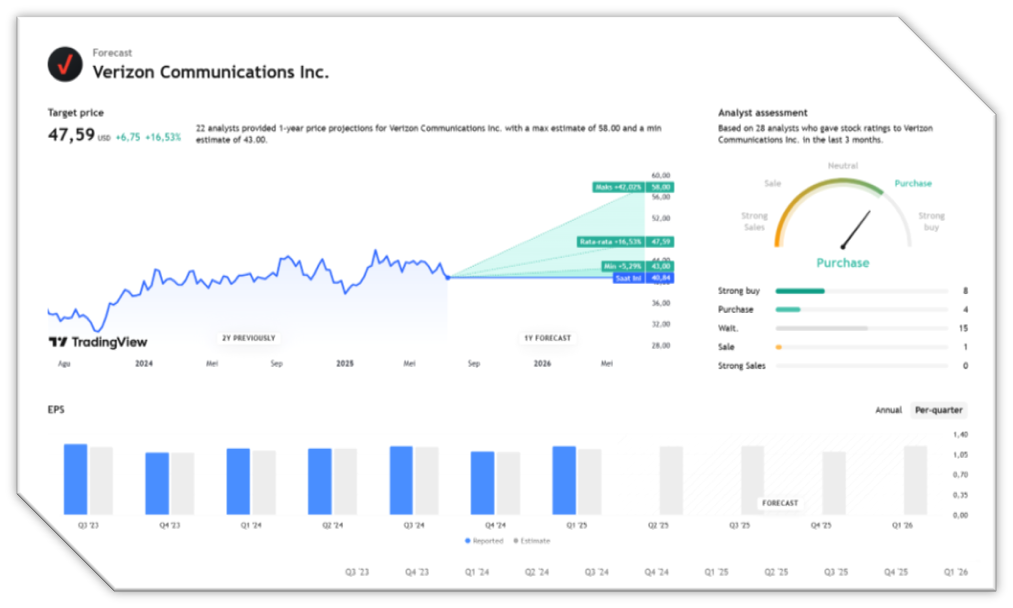

Verizon Communications is scheduled to release its second-quarter 2025 earnings report on Monday, July 21, before the market opens. The telecommunications giant is expected to report earnings per share (EPS) of $1.19—the same figure achieved in the previous quarter and slightly above analysts’ expectations at that time. Previously, Verizon outperformed market estimates with solid EBITDA growth and strong cash flow.

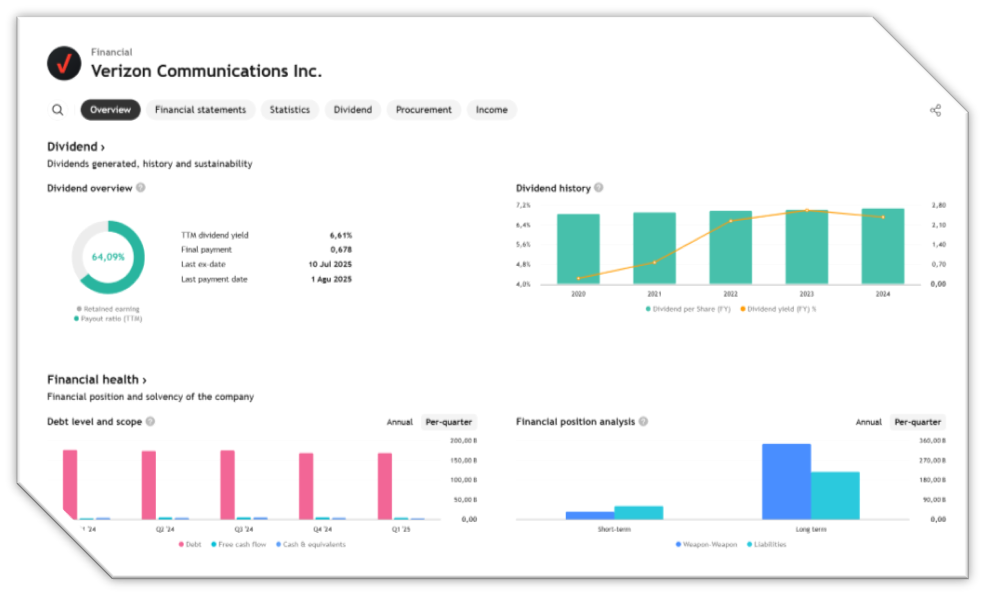

Investors and analysts are now anticipating more clarity on wireless service revenue growth, which rose 2.7% last quarter—hitting the upper range of market forecasts. Attention will also be focused on subscriber numbers, especially considering previous challenges related to price increases and churn rate (the rate of customer attrition).

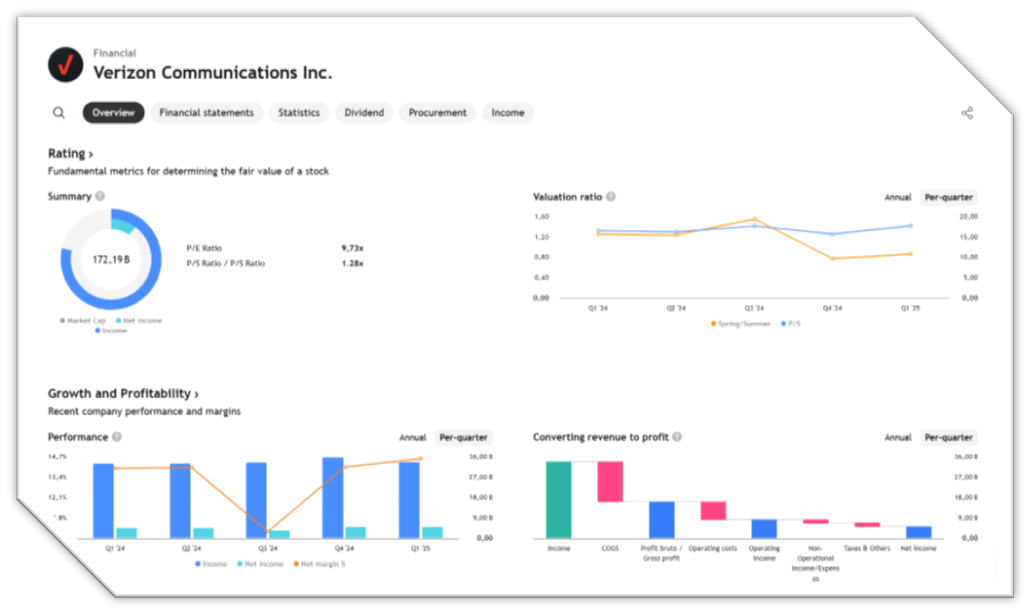

Financially, the prior quarter showed a 4% increase in EBITDA to $12.6 billion, while free cash flow rose by more than $900 million. The key question is whether this growth trend can be sustained amid tightening competition and shifting consumer preferences.

Equally important, analysts will examine Verizon’s efforts to develop its broadband infrastructure and 5G network—including the expansion of C-Band, growth in Fios subscribers, and pricing strategies through the Value Guarantee program.

This earnings report is one of several major corporate releases this week—including Tesla, Alphabet, and Coca-Cola—that could help determine overall market direction. Amid global economic uncertainty and close scrutiny of Federal Reserve policy, Verizon’s results could serve as a critical indicator of the strength of the communications sector and U.S. consumer purchasing power.

With high expectations and many external factors at play, Verizon’s earnings report is anticipated to be among the most closely watched by market participants and institutional investors.

Quarterly Performance Outlook

- Analysts forecast year-over-year earnings (EPS) growth for the most recent quarter.

- Revenue is expected to increase, driven by higher broadband and mobile subscriber numbers.

Supporting Factors

- Revenue growth is likely to be supported by increased use of 5G networks and data services.

- Consumer service segments such as Fios, mobile, and business offerings are expected to contribute to total revenue.

Macroeconomic Conditions & Strategy

- Verizon remains focused on expanding its network and improving service quality, particularly 5G.

- Broadband infrastructure development is aimed at maintaining revenue momentum and attracting more customers.

Earning Projection Prediction

WHAT THE ANALYST STATED