Key Points:

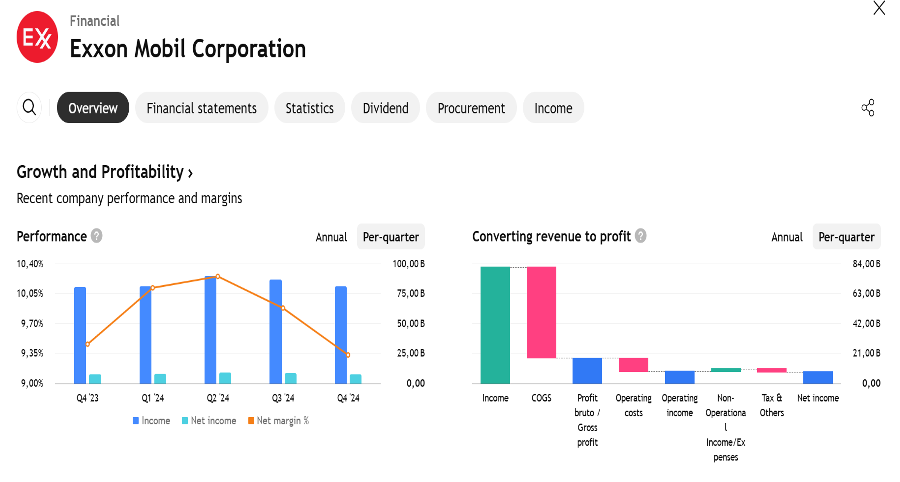

- Exxon Mobil (XOM, Financials) expects a 16% drop in profit in the first quarter, with estimated earnings per share (EPS) of $1.73, despite revenue rising 3.6% to $86.09 billion.

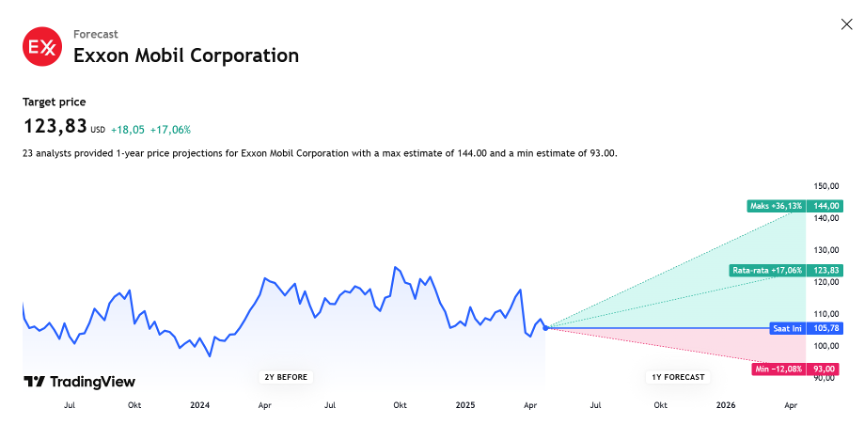

- Analysts estimate an average price target of $123.86, giving a potential upside of 17.41% from the current price.

- The stock has a consensus rating of “Outperform” (outperforming the market), although the GF Value indicates downside potential.

Exxon Mobil Financial Outlook

Exxon Mobil (XOM) is expected to report a 16% decline in first quarter earnings, with a predicted earnings per share (EPS) of $1.73. However, the company remains on a growth path, with a projected 3.6% increase in revenue to $86.09 billion. In a bid to stay ahead of its competitors, Exxon Mobil is significantly investing in clean energy initiatives, leading the way in spending on low-carbon technologies.

Insights from Wall Street Analysts

Analysts have set one-year price targets for Exxon Mobil Corp (XOM, Financials), with 25 experts forecasting an average target price of $123.86. Projections range from a low of $93.00 to a high of $144.00. This average target indicates a potential upside of 17.41% from the current share price of $105.50. For a more detailed look at these estimates, you can visit the Exxon Mobil Corp (XOM) Forecast page.

In addition, according to 28 brokerage firms, Exxon Mobil Corp (XOM, Financials) has an average recommendation of 2.3, which classifies it as “Outperform”. This rating is based on a scale where 1 is a Strong Buy, and 5 is a Sell.

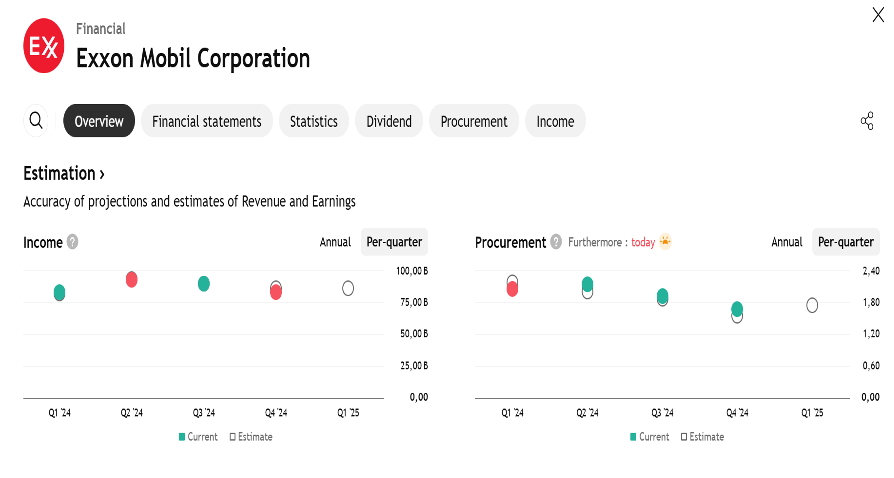

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED