Nike reported a mixed performance. On the positive side, the company slightly beat EPS expectations, executed its restructuring strategy (“Win Now,” “sport offense”), and maintained shareholder commitments through buybacks and dividends. However, several challenges remain: revenue fell about 12% YoY, gross margin contracted (-440 bps) due to discounts and channel mix, marketing expenses rose, and the effective tax rate was higher. External factors such as U.S. import tariffs on Chinese products (≈US$1 billion) and weaker discretionary consumer spending added further pressure. Nike also had to clear older inventory, which weighed on margins.

Facts & Expectations for the Upcoming Report (Q1 FY2026 / period ending ~ late Sept 2025)

Key Parameters & Market Expectations

| Parameter | Consensus / Estimate | Key Notes |

|---|---|---|

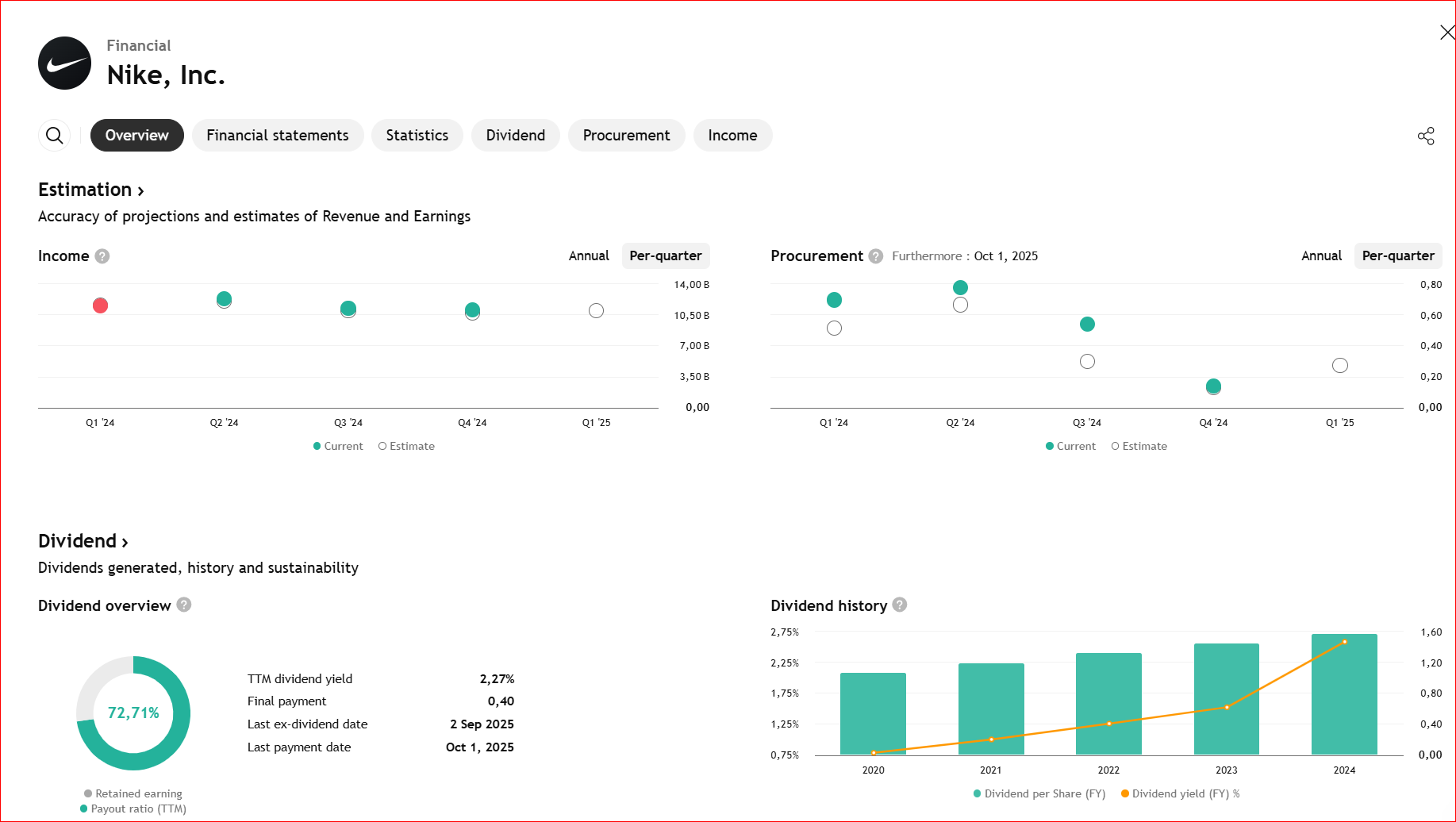

| EPS (Earnings per Share) | ~US$0.27 | Estimated to drop about 61% YoY compared with the same period last year. |

| Revenue | ~US$10.97 billion (≈ -5%) | Expected decline is more moderate than prior sharper drops. |

| Gross Margin | Decline of 350–425 bps | Due to tariff pressures, discounting, and a higher-cost sales mix. |

| Operating Expenses | Stable / slightly higher | Marketing spend likely to remain elevated for brand visibility, though efficiency measures will be pursued. |

| Guidance / Outlook | Critical | Investors will closely watch management tone on recovery, margin trends, tariff impacts, and supply chain strategy. |

| Risk Level | High | Weak consumer demand, tariffs, intense competition (including emerging niche brands), FX volatility, and high expectations for a turnaround. |

Signals to Watch:

- Nike stated in its Q4 report that the negative effects of restructuring (“Win Now actions”) likely peaked during that quarter, and headwinds are expected to moderate going forward.

- Management mentioned “surgical price increases” in the U.S. to offset tariff burdens.

- Wholesale order books reportedly began improving in certain regions, potentially signaling renewed confidence from retail partners.

- Investor attention remains heavily focused on management’s guidance — often influencing share price more than the earnings results themselves.

Predictions & Scenarios

Base Case

- EPS ≈ US$0.27

- Revenue ≈ US$10.9–11.0 billion (~ -5%)

- Margins and net income likely remain under pressure

- Market reaction will largely depend on management’s forward guidance

Optimistic Scenario

- If management demonstrates improvement in wholesale orders, margin control, and clear tariff mitigation, shares could rally after the report.

- A medium-term rebound to the US$80–90 range is possible if the turnaround appears credible (some analysts, such as Jefferies, have already raised targets aggressively).

Pessimistic Scenario

- If consumer weakness persists and tariffs/margin pressures intensify, EPS could come in below estimates.

- Cautious or negative guidance may trigger a sharp decline in the stock.

Earnings Projection Prediction

What Analysts Are Saying