Walmart Inc.’s performance in the third quarter of fiscal year 2026 will be a crucial indicator of the purchasing power of American consumers. The results will reflect more than just the company’s operational strength—they will also serve as a macroeconomic signal. Currently, the Federal Reserve has lowered the federal funds rate to the range of 3.75%–4.00% at its October 2025 meeting. This monetary easing suggests that the central bank sees rising risks of a slowdown in economic activity or consumer spending. As a result, Walmart’s earnings report will test whether consumers remain resilient amid relatively high borrowing costs, persistent inflation, and ongoing pressure from elevated import costs.

Walmart Inc. (NYSE: WMT) — Q3 FY2026 Earnings Preview

Date: November 20, 2025

Coverage: Consumer Staples & General Merchandise Retail

Rating: Neutral (Watchlist)

Risk Level: Medium

1. Investment Thesis

Walmart is set to report its Q3 FY2026 financial results, and the market views this release as a key gauge of U.S. consumer strength. With its broad customer base—from low-income to upper-middle-income households—Walmart’s results offer meaningful insight into how consumers are navigating inflation, high interest rates, and import tariff pressures.

Expectations remain positive yet moderate. Investors will pay close attention to:

- Same-store sales (SSS) growth

- Operating margins amid rising cost pressures

- Growth in e-commerce and retail media (digital advertising)

Market sentiment is neutral with a cautious bias.

2. Earnings Expectations

Consensus Estimates (Q3 FY2026)

| Metric | Estimate | YoY |

|---|---|---|

| Revenue | $177.5B | +4.7% |

| EPS (Diluted) | $0.60 | from $0.58 |

| U.S. Comparable Sales | +3.9% | Moderating from Q2 |

| E-commerce Growth | Double-digit | Positive momentum continues |

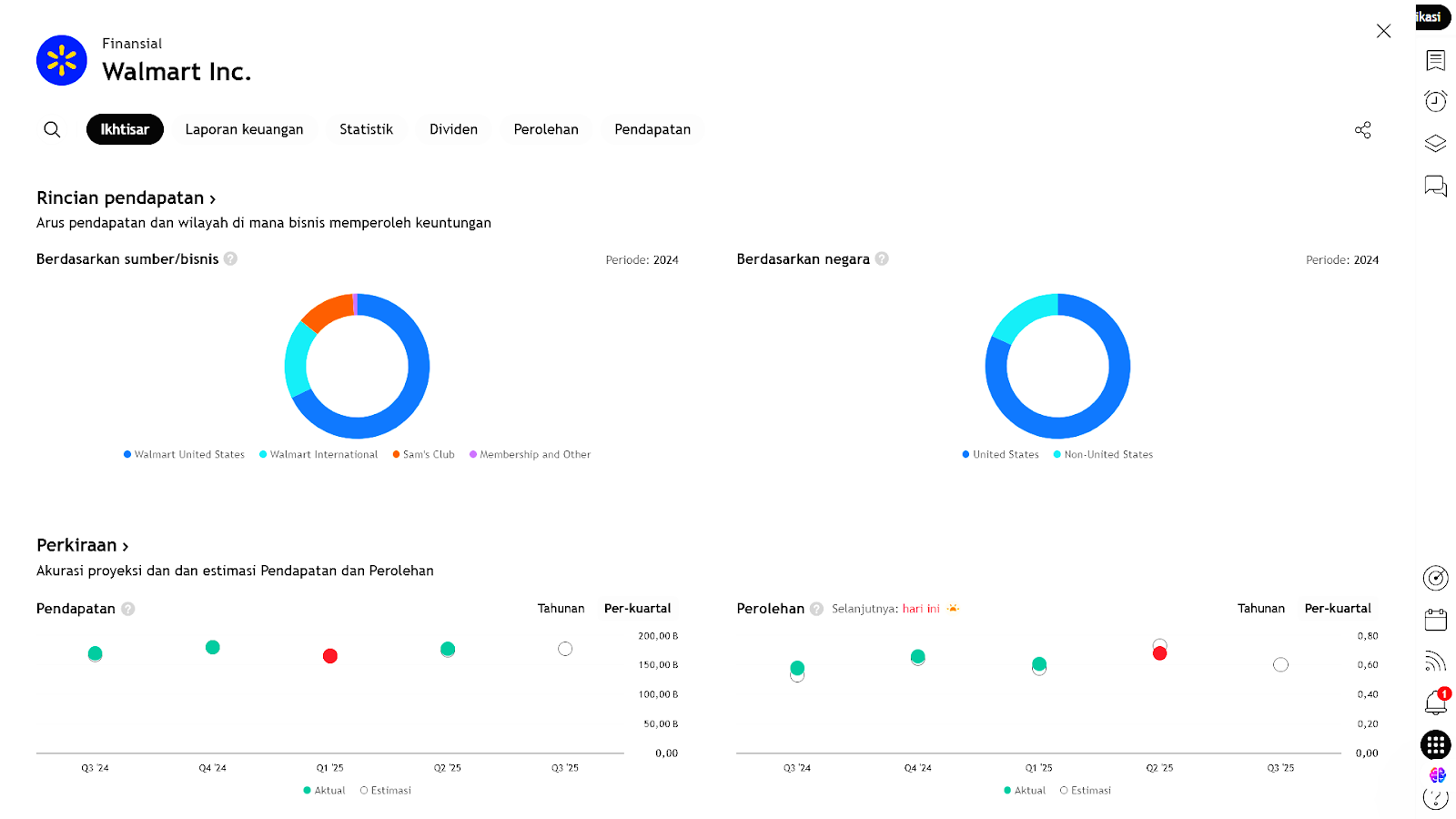

Revenue growth is expected to be driven by higher volumes in essential categories and increased contribution from higher-income customers, particularly in online grocery and non-discretionary goods.

3. Consumer Insight: Reading the Macro Through Walmart

Walmart serves as a macro proxy for the health of U.S. household consumption.

Key observations:

- Upper-middle-income consumer spending remains solid

- Lower-income consumers are showing signs of trade-down, including:

- shifting to private labels

- declining discretionary ticket sizes

- increased promotion-driven purchases

Growing expectations for deeper discounts highlight rising price sensitivity.

Segment Outlook

| Segment | Outlook | Notes |

|---|---|---|

| E-commerce | Positive (double-digit) | Supported by automated fulfillment |

| Retail Media (Walmart Connect) | Strong margin contributor | Mirrors growth trajectory of Amazon Ads |

| Grocery & Essentials | Stable demand | Core driver with high frequency |

| General Merchandise | Weak | Discretionary spending softens |

| Tariff & Supply Chain Pressures | Negative | Margin expansion constrained |

4. Operational Trends & Structural Catalysts

Retail media remains a long-term margin catalyst due to significantly higher profitability compared to physical goods sales.

5. Margin Outlook

Margin pressure from import tariffs and supply chain inflation remains a major risk. Walmart’s ability to raise prices is limited given heightened consumer sensitivity.

Key Watch: Gross Margin Direction — Improving or Compressing?

“If margins improve, the market is likely to react bullishly.”

6. Risks

| Risk | Description |

|---|---|

| Import tariffs & logistics costs | Potential margin compression |

| Discretionary slowdown | Weak performance in non-essential categories |

| Price elasticity risk | Consumers may reject further price increases |

| Economic uncertainty | Higher impact on low-income segments |

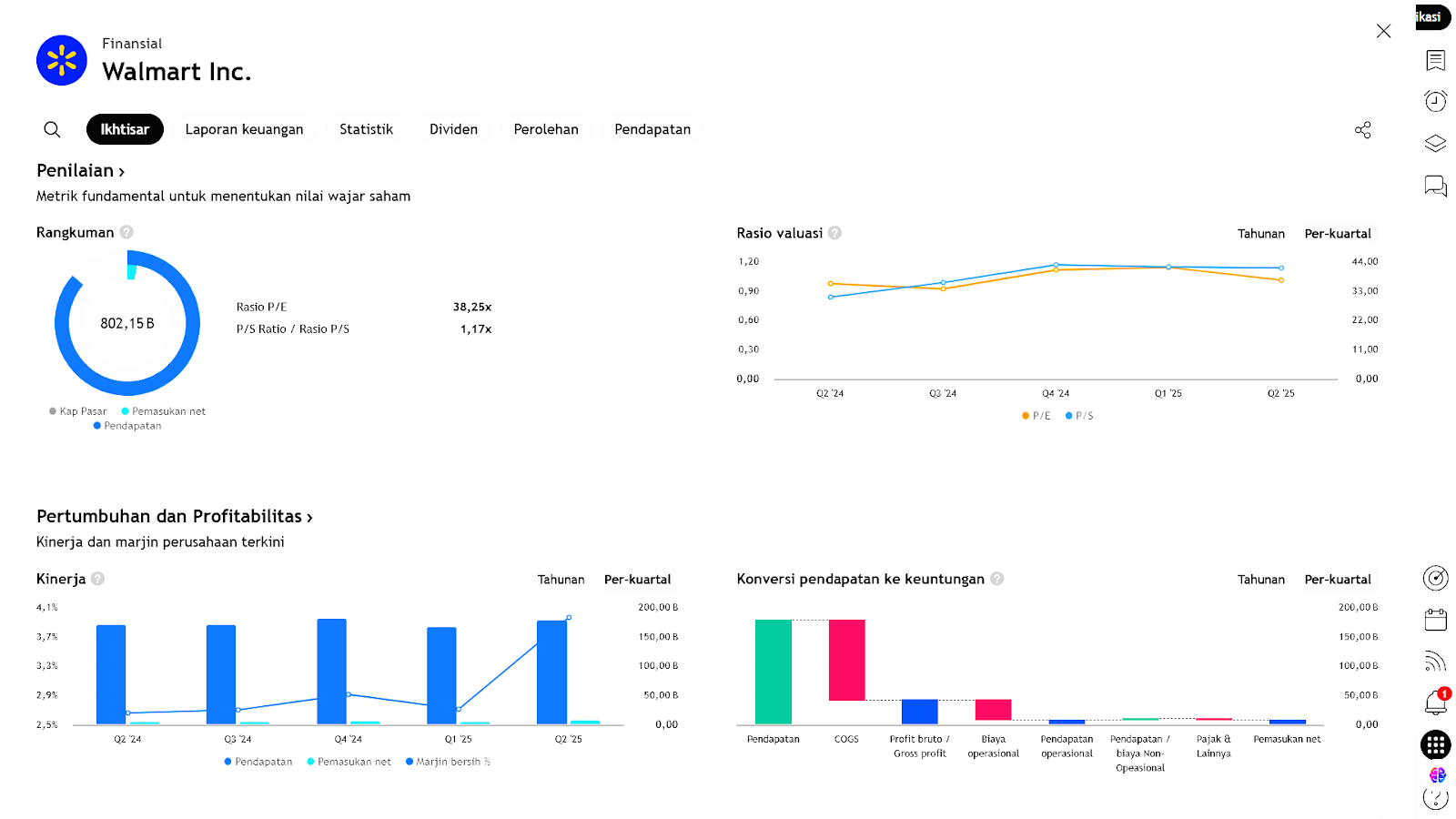

7. Valuation View

Walmart trades at a premium relative to traditional retailers due to its business stability and digital growth. However, valuation adjustments may occur if margins disappoint or if forward guidance is revised downward.

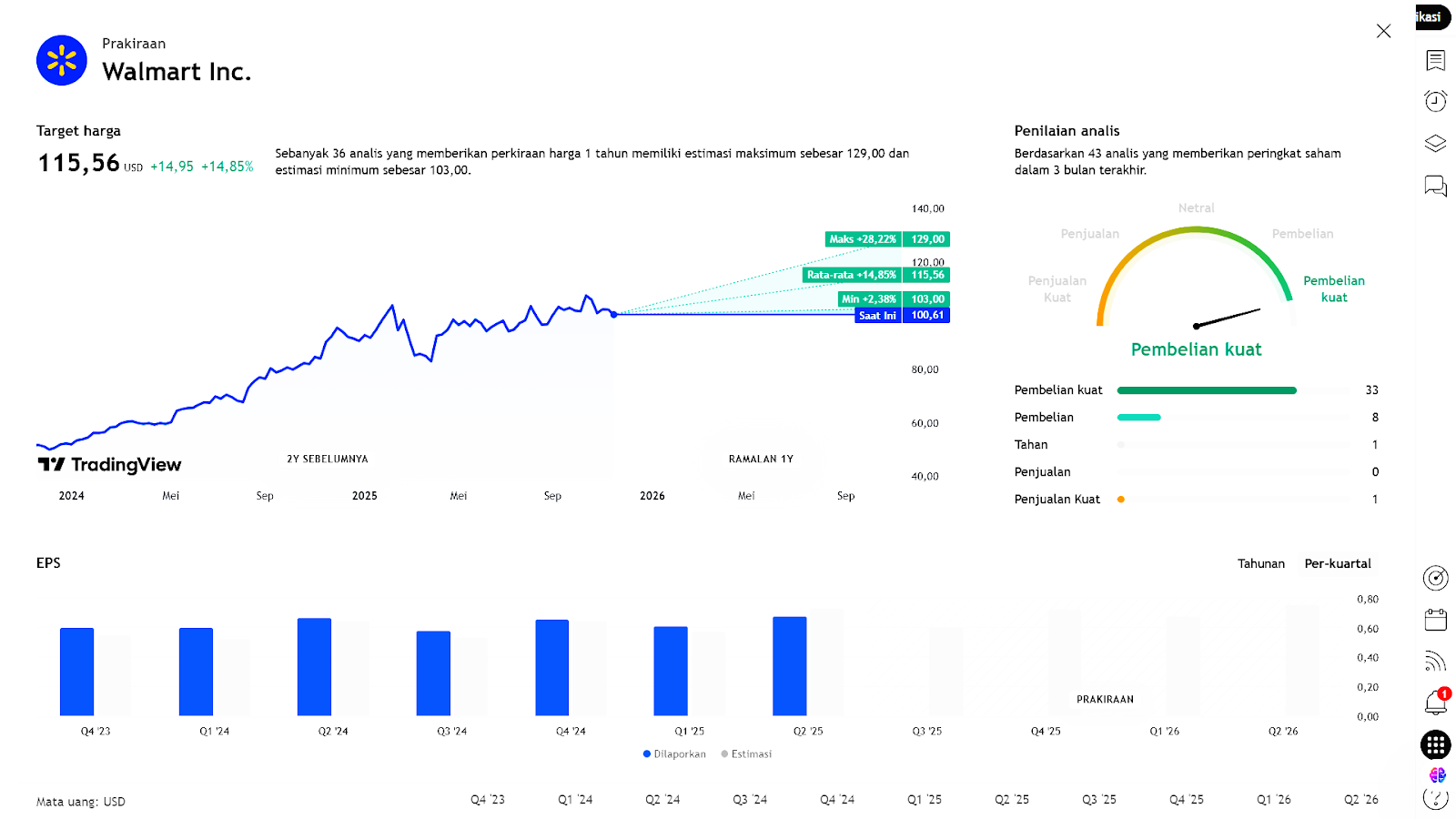

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

Strategi

| Sell WMT | |

| Entry | 100.19 |

| Take Profit | 95.49 |

| Stoploss | 104.32 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst