Merck is scheduled to release its second quarter (Q2 2025) earnings report on Tuesday, July 29, 2025. Investor attention is not solely focused on the company’s short-term financial performance, but also on its long-term strategy in the face of looming challenges.

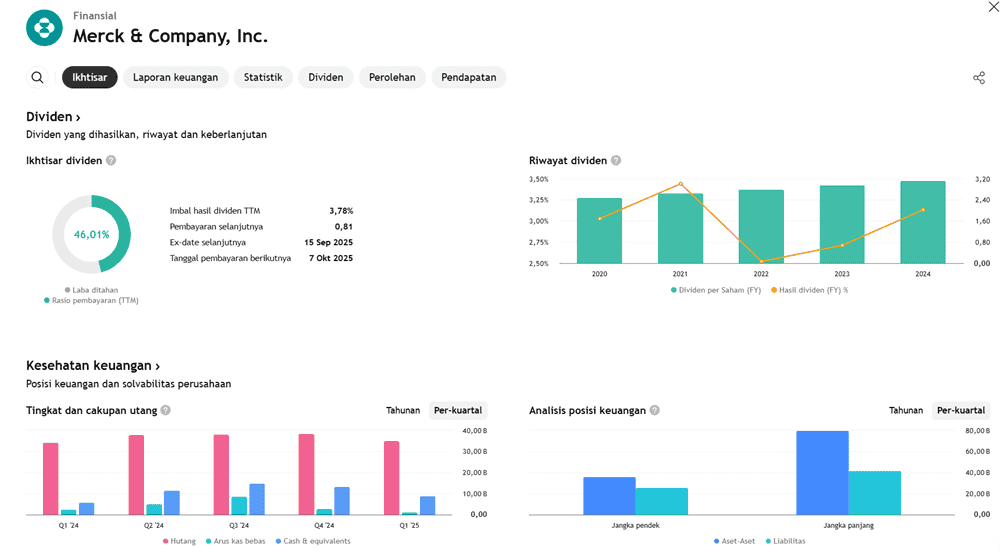

Its flagship drug, Keytruda, currently contributes around 46% of Merck’s total revenue, but its U.S. patent is set to expire in 2028. This raises serious concerns about biosimilar competition and the potential impact of Medicare price negotiation policies.

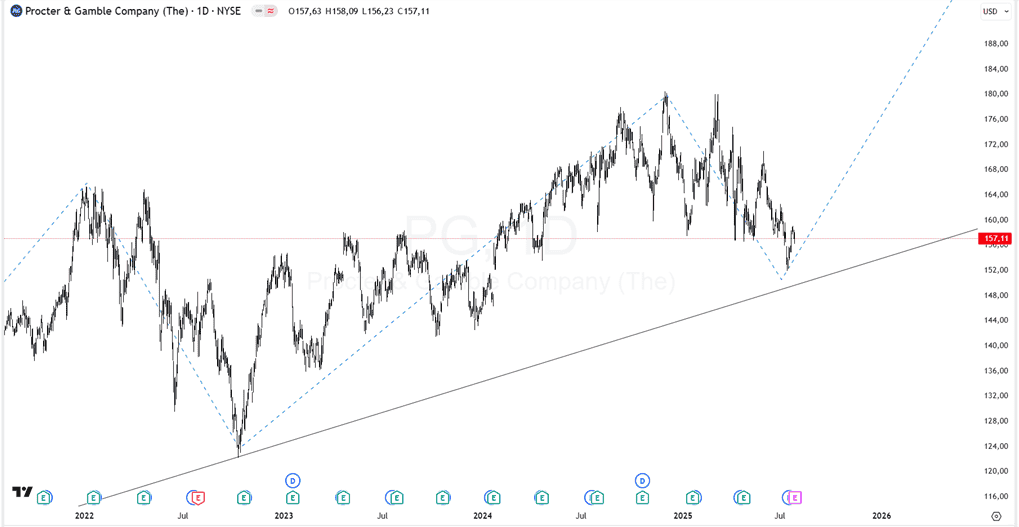

Over the past 12 months, Merck’s stock has declined by 33%, including a 15% drop so far in 2025 alone.

Gardasil, Merck’s HPV vaccine, is also under pressure: demand in China has softened, and potential CDC dosage adjustments in the U.S. could negatively impact sales volumes.

To reduce its dependence on Keytruda, Merck acquired Verona Pharma in a US$10 billion deal. Verona’s drug, Ohtuvayre, developed for respiratory diseases, is expected to support future growth.

However, concerns remain that the new intradermal formulation of Keytruda could fall under Medicare price negotiation starting in 2028—limiting its effectiveness as a strategic defense against rising competition.

While analysts acknowledge Merck’s efforts to diversify into cardiopulmonary and infectious diseases, regulatory and commercial pressures on Keytruda and Gardasil continue to weigh on investor sentiment in the short term.

Key Highlights:

- Merck’s stock price target (MRK) has been lowered by Leerink Partners from US$136 to US$119, though the rating remains Outperform.

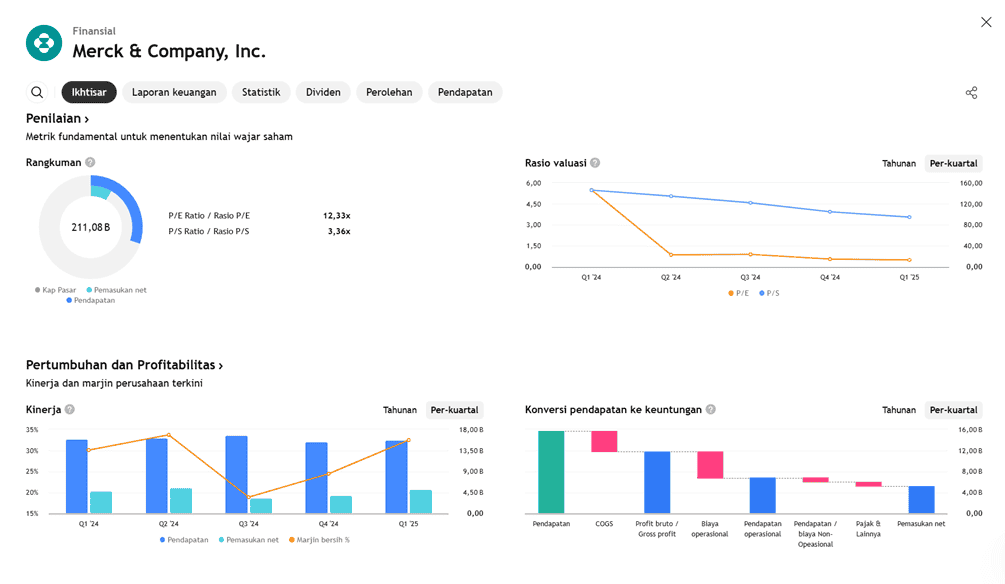

- The downgrade is largely due to a downward revision in projected Q2 2025 earnings per share (EPS), now expected to be US$1.96, compared to the earlier estimate of US$2.13. For reference, Merck’s Q1 EPS stood at US$2.22, slightly above expectations.

- Q2 revenue is projected to fall by approximately 1.6% year-over-year to US$15.53 billion, raising concerns over Merck’s mid-term outlook.

Market Consensus:

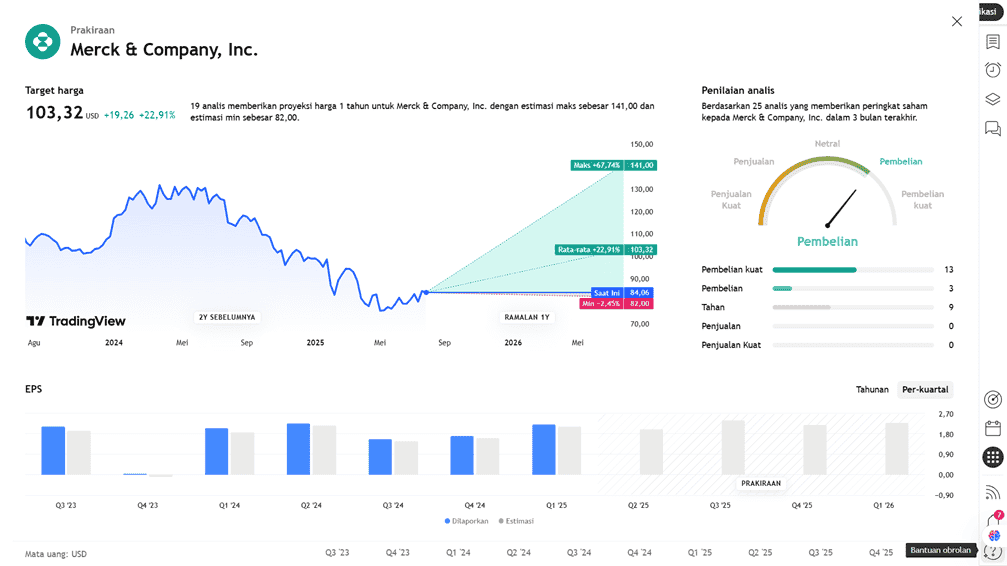

- Average price target: US$108.69 (MarketBeat), with a Hold recommendation and an estimated upside potential of ~37% from the current price (~US$80).

- Highest target: US$140

- Lowest target: US$84

- Zacks reports an average target of US$103.68, with a range of US$82–141

Other Financial Institution Revisions:

- Citigroup: Target revised down to US$84, rating changed to “Neutral” from “Buy”.

- Cantor Fitzgerald: Downgraded to “Cautious”, target around US$83–84

- Guggenheim: Target at US$115, rated “Buy”

- Other institutions including HSBC, Goldman Sachs, BMO Capital, Deutsche Bank, and Morgan Stanley have revised targets to the US$99–115 range and updated their respective ratings.

Interpretation:

- Leerink Partners’ downgrade stands out, as it previously held one of the most optimistic targets for MRK.

- The downward revision in Q2 EPS highlights concern over Merck’s revenue momentum, despite its Q1 performance exceeding estimates.

- Market consensus still sees 30–37% upside potential for MRK stock, though many analysts have adopted a more cautious stance, shifting to “Hold” or “Neutral” ratings.

Earning Projection Prediction

WHAT THE ANALYST STATED