“Merck Set to Report Q3 Performance Amid Keytruda Patent Cliff Concerns”

The “Patent Cliff” Shadow Looms Over Merck’s Financial Results

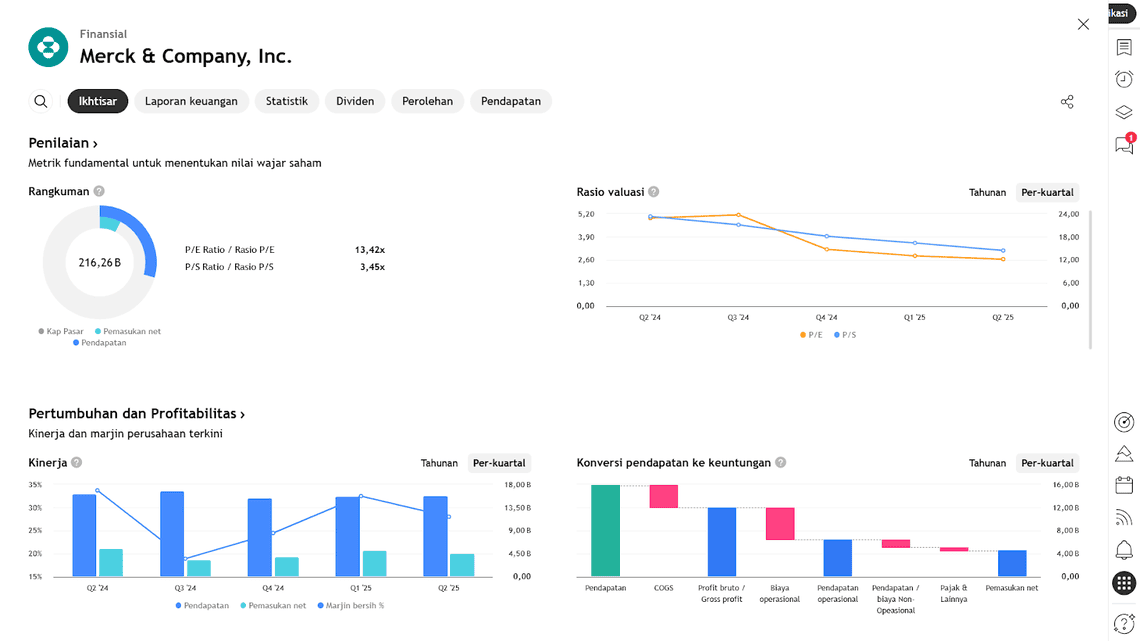

Ahead of its third-quarter earnings report set to be released tomorrow, global investors are closely watching Merck & Co. (MRK) — the U.S. pharmaceutical giant facing a major test of its heavy reliance on its blockbuster cancer therapy, Keytruda. With market expectations pointing to an earnings per share (EPS) of around US$2.35, investors are weighing two sides: Merck’s still-solid growth momentum versus the looming end of its patent protection, which could shake the foundation of its core business.

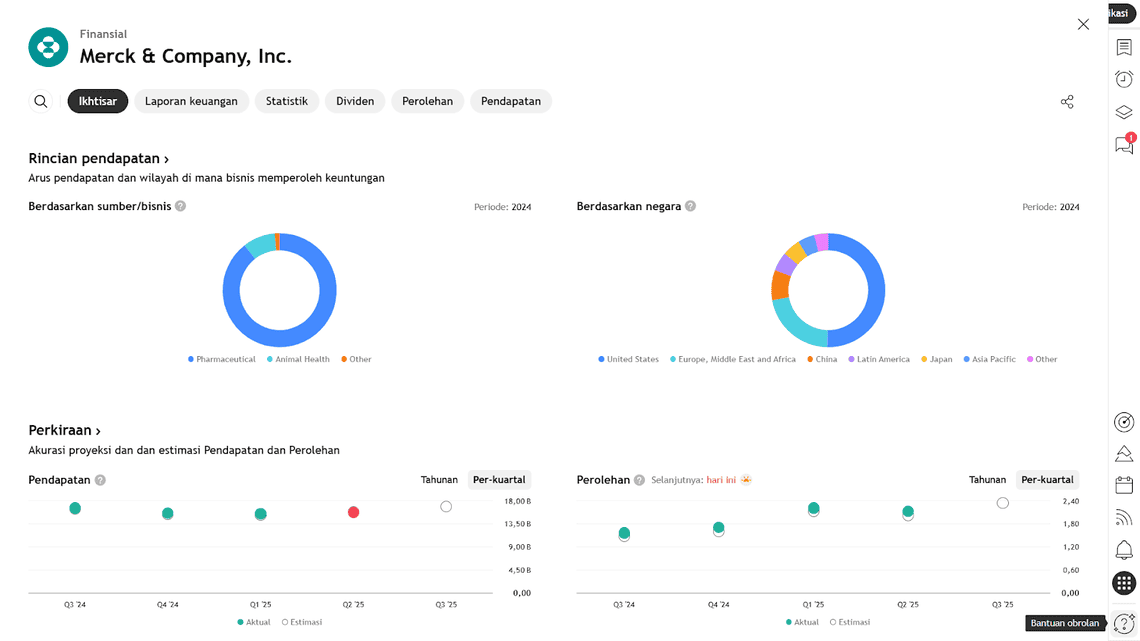

As sales of its HPV vaccine Gardasil begin to slow in key markets such as China and pricing regulations tighten in the U.S., this quarter’s results will serve as a key indicator of how well Merck can sustain growth before the “biosimilar era” starts to bite. For Wall Street, these numbers are more than financial data — they represent a signal of how Merck plans to navigate an increasingly competitive global pharmaceutical landscape.

Key Highlights

- Merck is scheduled to release its quarterly earnings tomorrow morning before the market opens.

- Analyst consensus expects EPS of approximately US$2.35, marking a significant year-over-year increase.

- The main focus for investors: how Merck will tackle future challenges, including biosimilar competition, regulatory pressure, and shifts in its product portfolio.

Context & Challenges

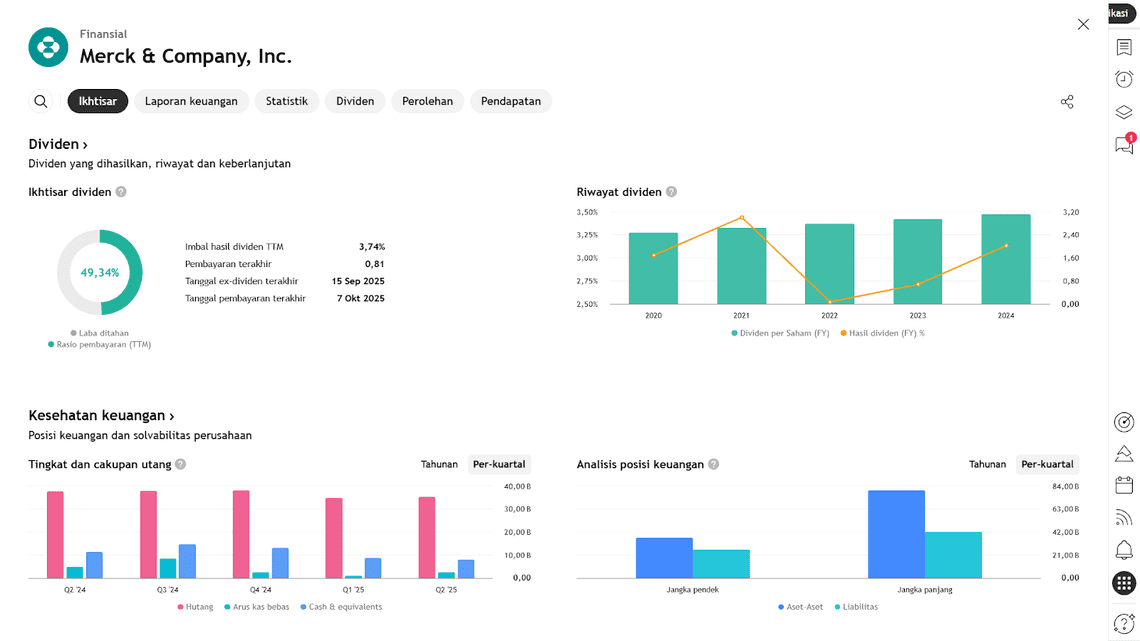

- Keytruda, Merck’s flagship cancer therapy, remains the backbone of the company’s revenue but is approaching a “patent cliff”, after which it will face biosimilar competition.

- Meanwhile, Gardasil, its HPV vaccine, is seeing declining demand, particularly in China, adding pressure to its vaccine segment.

- Despite these headwinds, Merck has pursued strategic acquisitions (such as Acceleron Pharma and Verona Pharma) to diversify its product pipeline and mitigate future risks.

What to Watch in the Report

- Earnings performance: Will EPS and revenue meet or exceed expectations (~US$2.35 EPS)? A miss could negatively impact the stock.

- Forward guidance: Updates on how Merck plans to handle the Keytruda patent expiration and insights into new product pipelines or diversification strategies.

- External factors: The impact of biosimilar competition, drug pricing regulations (particularly in the U.S.), and international market dynamics (including China).

Earning Projection Prediction

APA YANG DINYATAKAN ANALIS

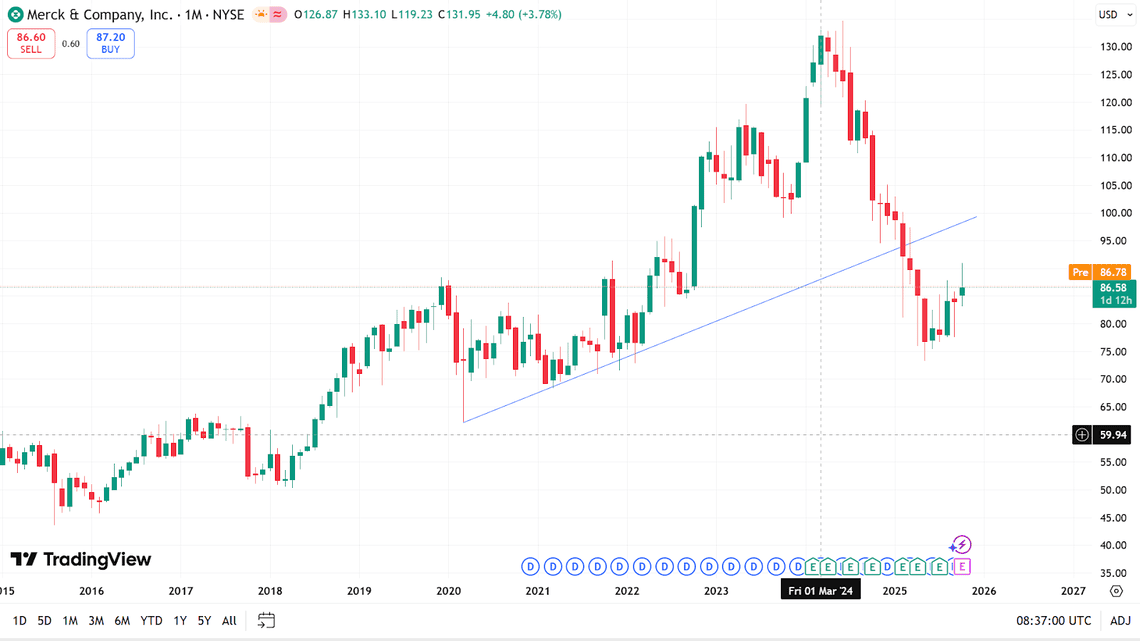

Short – Medium Term Projection

Strategy

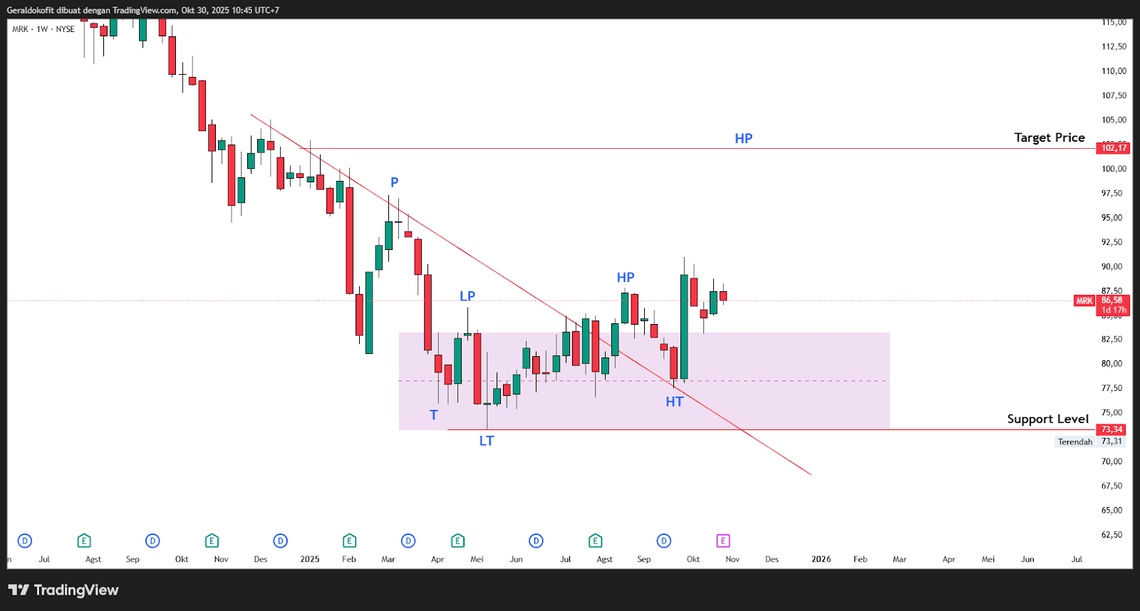

| Buy MERCK | |

| Entry | 86,58 |

| Take Profit | 102,17 |

| Stoploss | 73,34 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst