Ahead of Home Depot’s (HD) upcoming earnings release, the market is entering a heightened phase of anticipation.

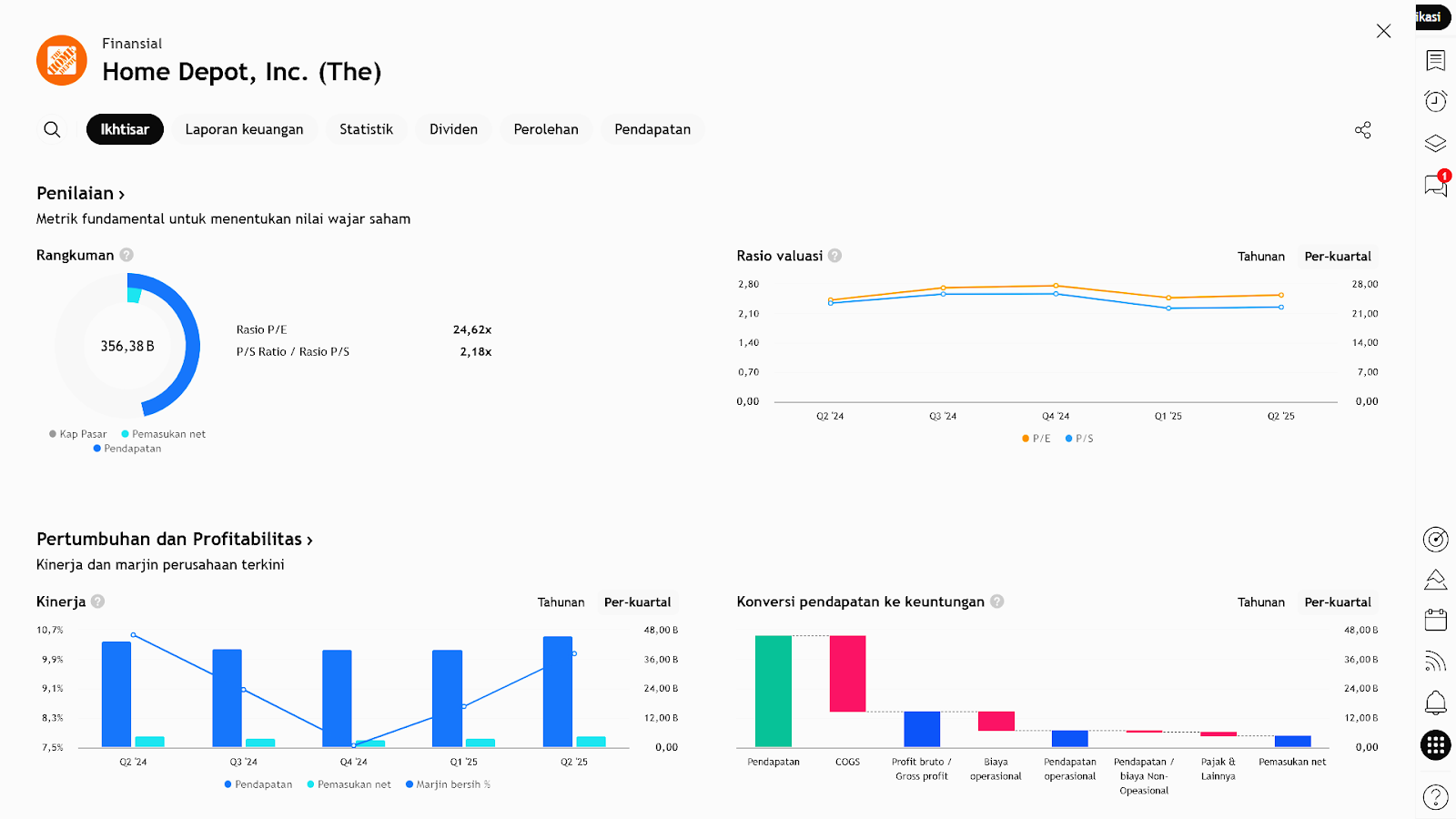

This is not only because the company serves as a key barometer for home renovation spending in the United States, but also because this quarter’s results may reflect consumer sentiment amid high interest rates and a slowing property sector. With consensus projecting modest EPS growth, investors are now seeking answers: Can Home Depot maintain its resilience — or is it beginning to show signs of structural pressure?

Market sentiment is currently in a “wait and see” zone. Many investors believe that this earnings report is not just about numbers but about the narrative: how management views forward demand, margin dynamics, and pricing strategy in a landscape where renovation activity is shifting from large-scale projects to short-term maintenance. In other words, this report could become a potential turning point — will Home Depot remain firmly positioned as the industry leader, or is the momentum beginning to shift?

Ticker: HD (Home Depot, Inc.)

Sector: Consumer Discretionary / Home Improvement Retail

Source: Earnings Preview

Date: 18 November 2025

1. Executive Summary

Home Depot is scheduled to release its latest quarterly earnings before the market opens. Analyst consensus expects:

- EPS: US$ 3.84 → +1.6% YoY

This relatively modest expectation reflects still-weak demand in large-scale renovation segments, while showing stability in the company’s core business despite macroeconomic pressures.

The market will focus on the outlook and management’s commentary, particularly on consumer spending trends, margins, and demand direction under high interest rates.

2. Market Context

Relevant Macro Conditions

| Factor | Impact | Status |

|---|---|---|

| High interest rates | Suppress large renovation decisions | Negative |

| Rising building material inflation | Pressures margins & demand | Moderate |

| Shift toward small DIY projects | Supports stable sales | Positive |

| Slowing U.S. property market | Reduces structural demand | Negative |

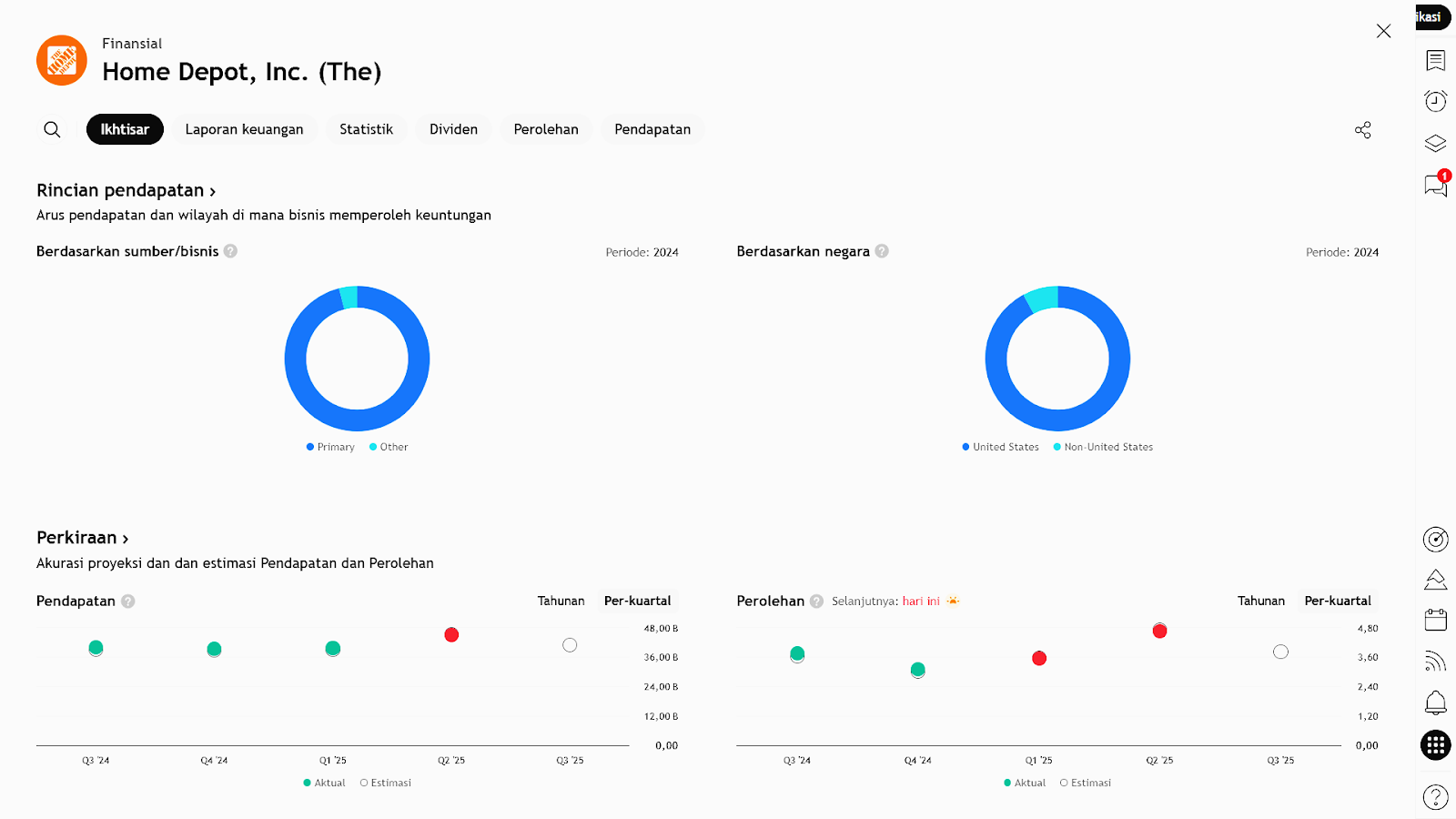

The earnings report will serve as an important indicator of whether consumers are still delaying major spending or beginning to return to long-term renovation plans.

3. Earnings Preview & Consensus

| Metric | Estimate |

|---|---|

| Expected EPS | $3.84 |

| YoY Trend | +1.6% |

| Revenue Outlook | Stable to slightly lower YoY |

| Margin Outlook | Under pressure from material costs & promotions |

4. Key Risks to Monitor

| Risk | Implication |

|---|---|

| Large renovation projects remain stagnant | Professional segment sales decline |

| Price competition (Lowe’s, online retailers) | Margin compression |

| High cost of capital | Lower capex & reduced property-linked demand |

5. Catalysts & Drivers

| Catalyst | Potential Impact |

|---|---|

| Fed rate cuts (2025–2026) | Recovery in renovation demand |

| DIY & small-maintenance trends | Stable volume in weak economic conditions |

| Strong brand & distribution network | Pricing power & customer loyalty |

6. Investor Sentiment & Market Positioning

Current sentiment: Muted but cautiously optimistic.

Investors are awaiting confirmation on whether Home Depot can:

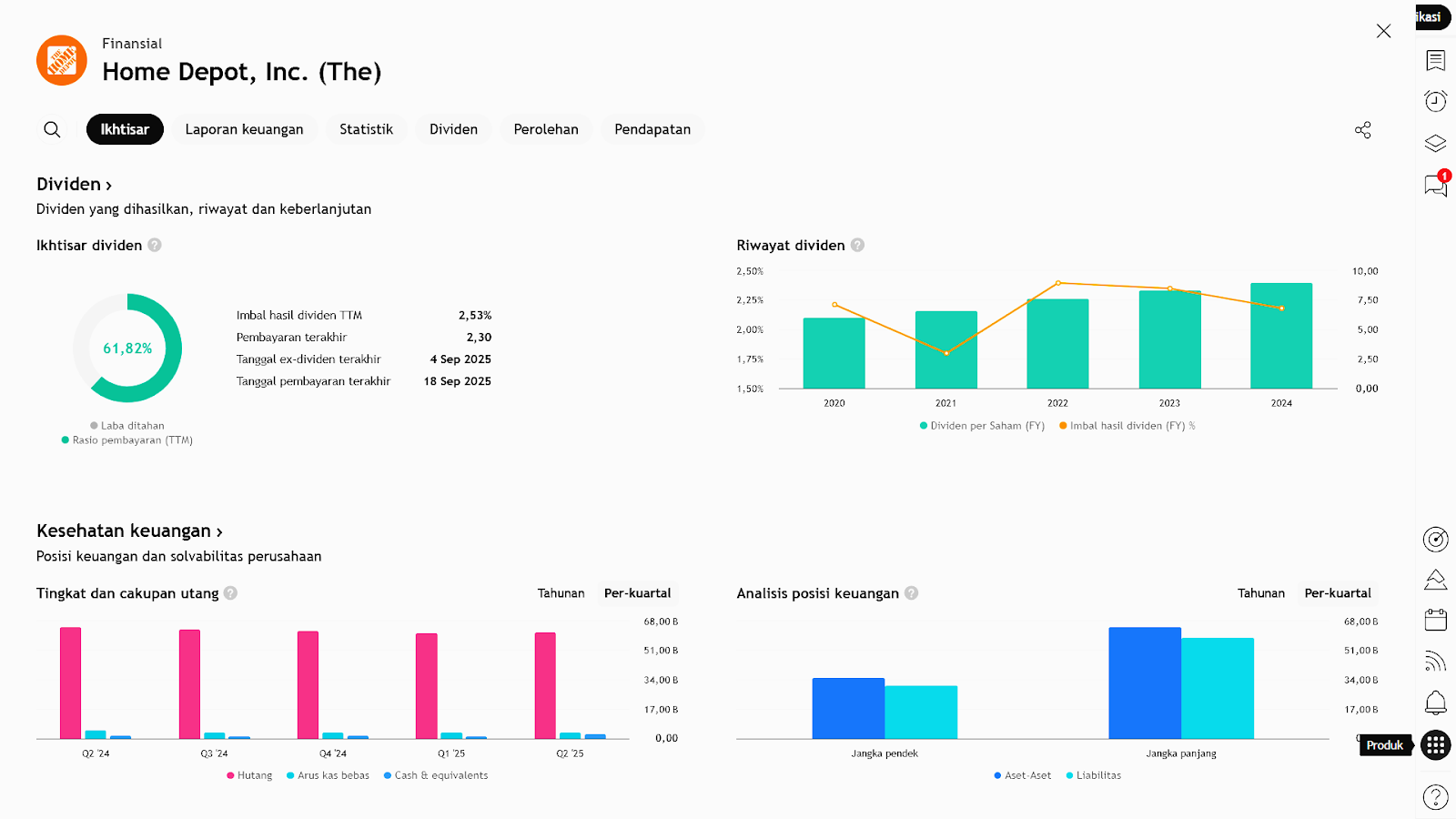

- Maintain margins despite discounts and cost pressures

- Reverse slowing momentum in renovation demand

- Provide an encouraging 2026 outlook

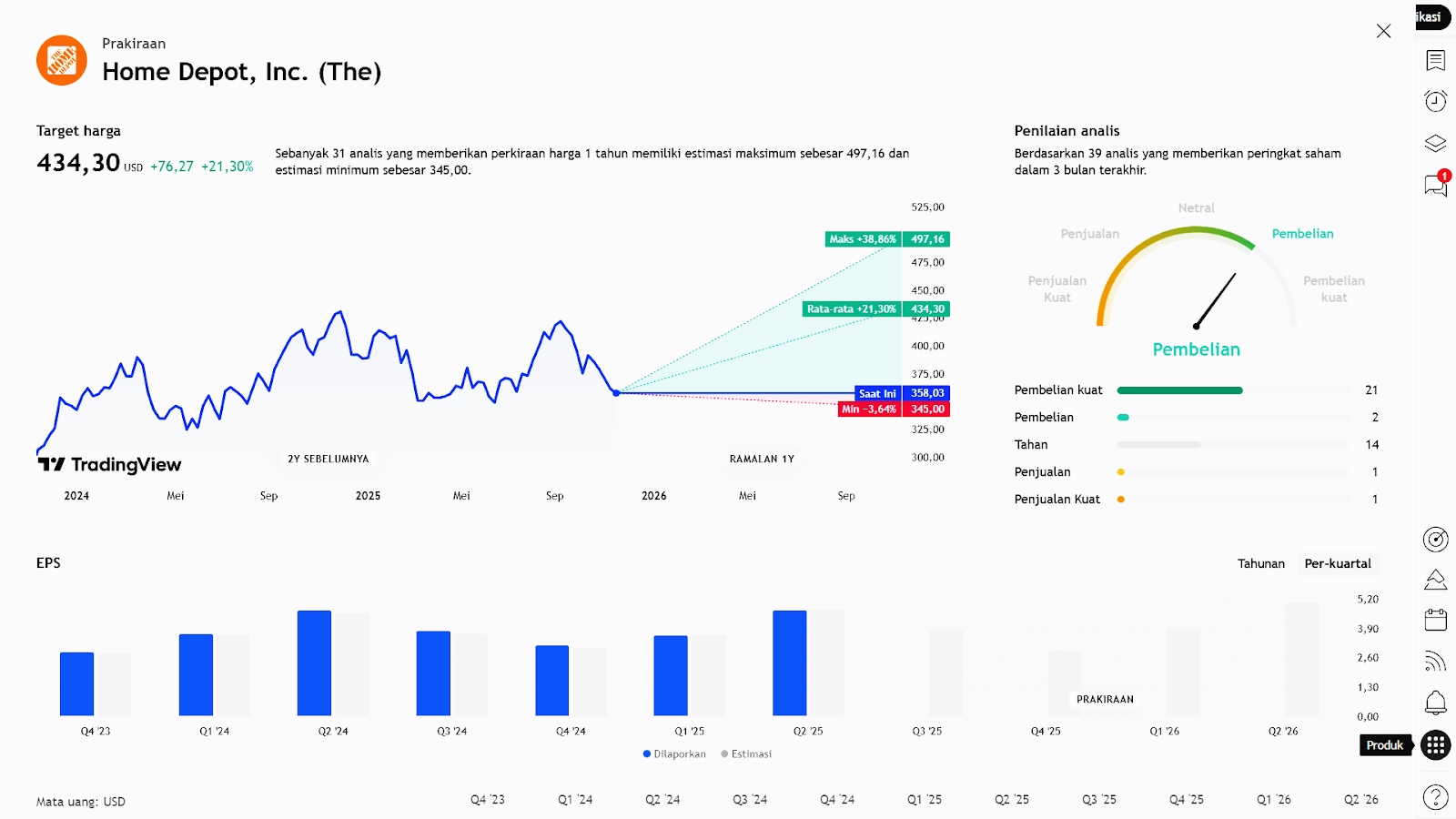

Price action is likely to be driven more by forward guidance than by the current EPS figures alone.

7. View & Conclusion

Expected Earnings Tone: Neutral → Slightly Positive

Interpretation: While growth remains modest and macro pressures persist, Home Depot continues to demonstrate profitability and a strong market position.

The market will focus on:

- Updates on new-home demand & large renovation projects

- Pricing strategy versus competitors

- Signals on when cyclical demand may recover

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

Strategy

| Sell Home Depot | |

| Entry | 362.36 |

| Take Profit | 422.57 |

| Stoploss | 277.39 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst