Investors Await Signals of Stability from the US Banking Sector

Citigroup Prepares to Release Third Quarter Results

Citigroup Inc. is set to be one of the first major US banks to kick off the third-quarter earnings season, with results scheduled to be released Tuesday morning, New York time.

Investors are paying close attention to this report as the global banking sector faces growing pressure from higher funding costs, slowing loan activity, and the recent weakness in bank stock performance.

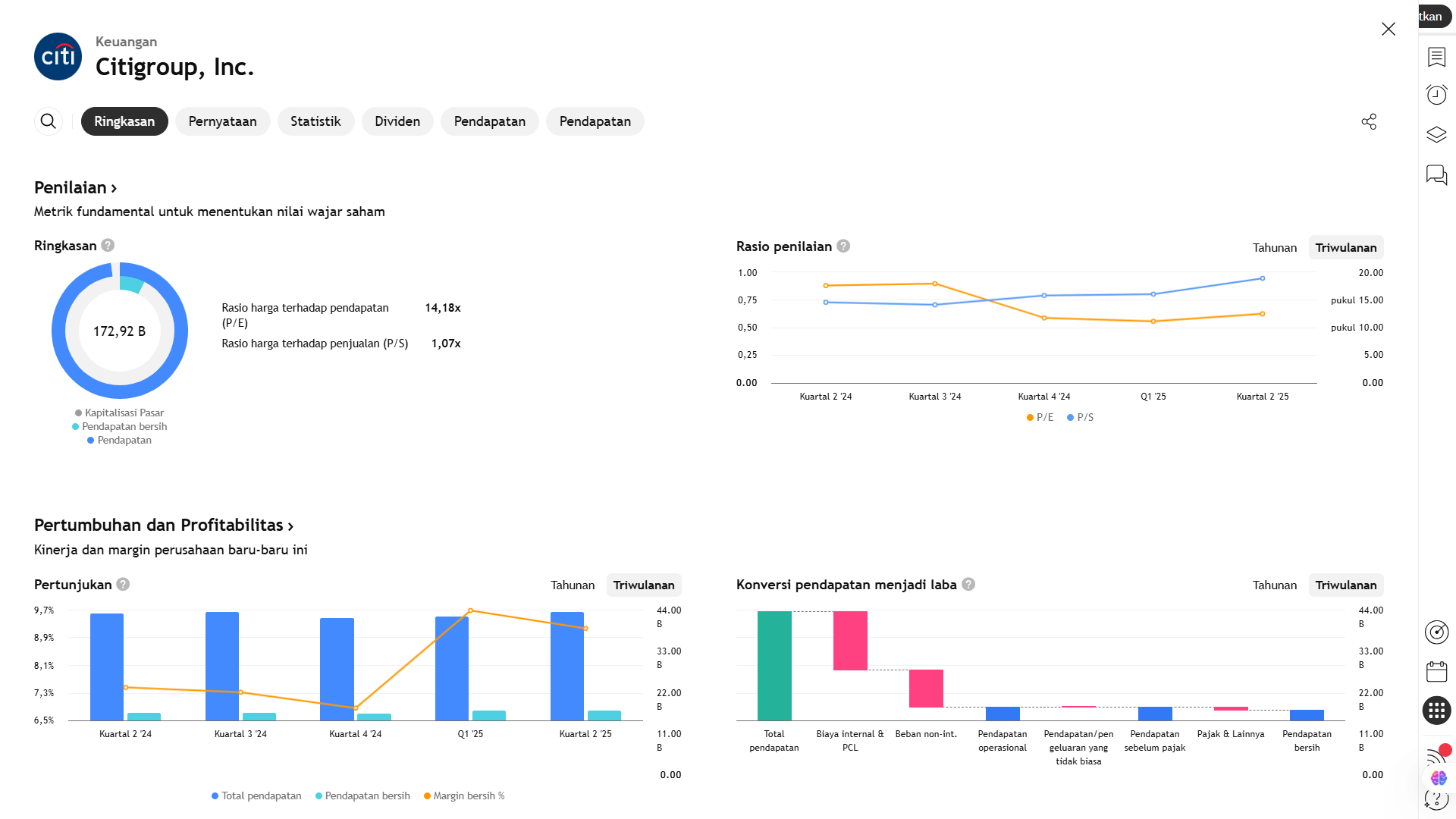

In the previous quarter, Citigroup delivered solid results, posting revenue of US$21.67 billion, up 8.2% year-over-year (YoY).

Both earnings per share (EPS) and net interest income (NII) exceeded analyst expectations, signaling that the operational transformation led by CEO Jane Fraser is starting to show tangible results.

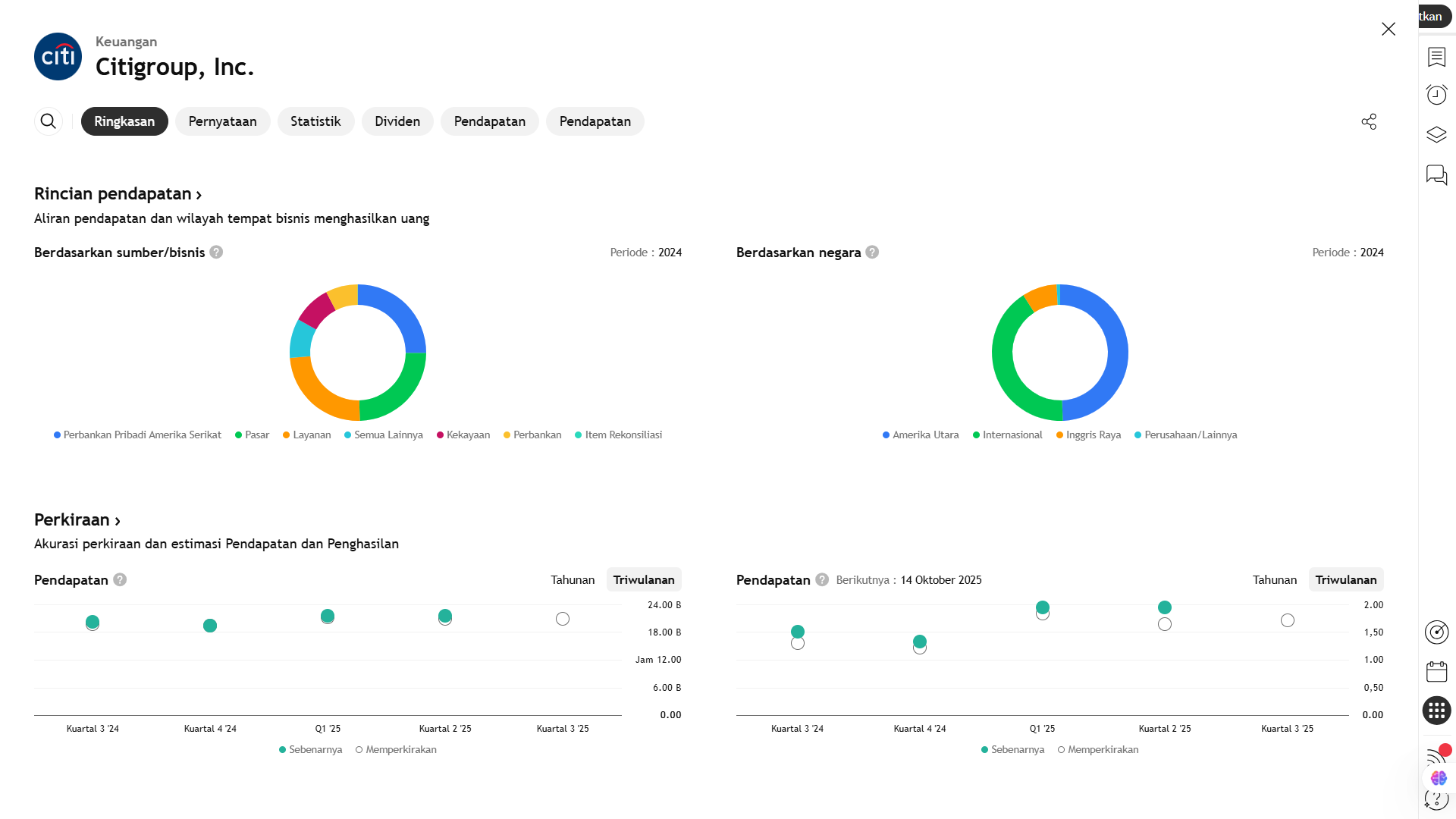

For Q3 2025, analyst consensus projects that Citigroup’s revenue will continue to grow by around 4.5% YoY to US$21.11 billion, with adjusted earnings per share expected to be approximately US$1.93.

The relatively stable estimates over the past 30 days suggest that market participants view risks around this report as contained, even though volatility remains high within the financial sector.

Over the past two years, Citigroup has missed Wall Street revenue expectations only twice, while management has demonstrated significant improvements in cost discipline and capital efficiency — key factors that have kept analysts constructively optimistic about the bank’s performance outlook.

From a technical perspective, Citigroup shares have fallen about 6% over the past month, in line with the broader decline in US banking stocks.

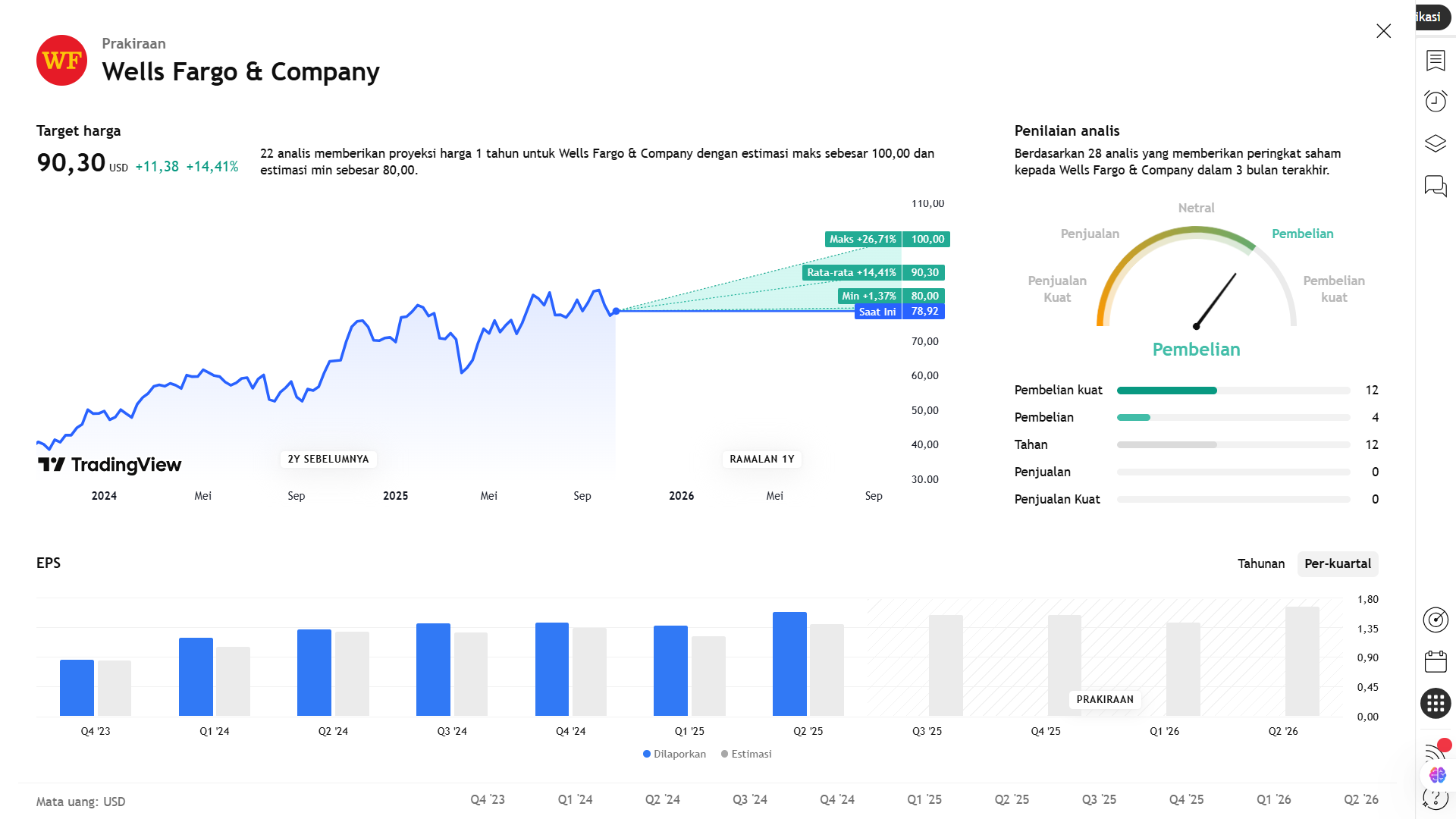

Nevertheless, the medium-term outlook remains positive, with the average analyst price target set at US$110.64, well above the recent trading level of around US$93.75, implying an upside potential of nearly 18%.

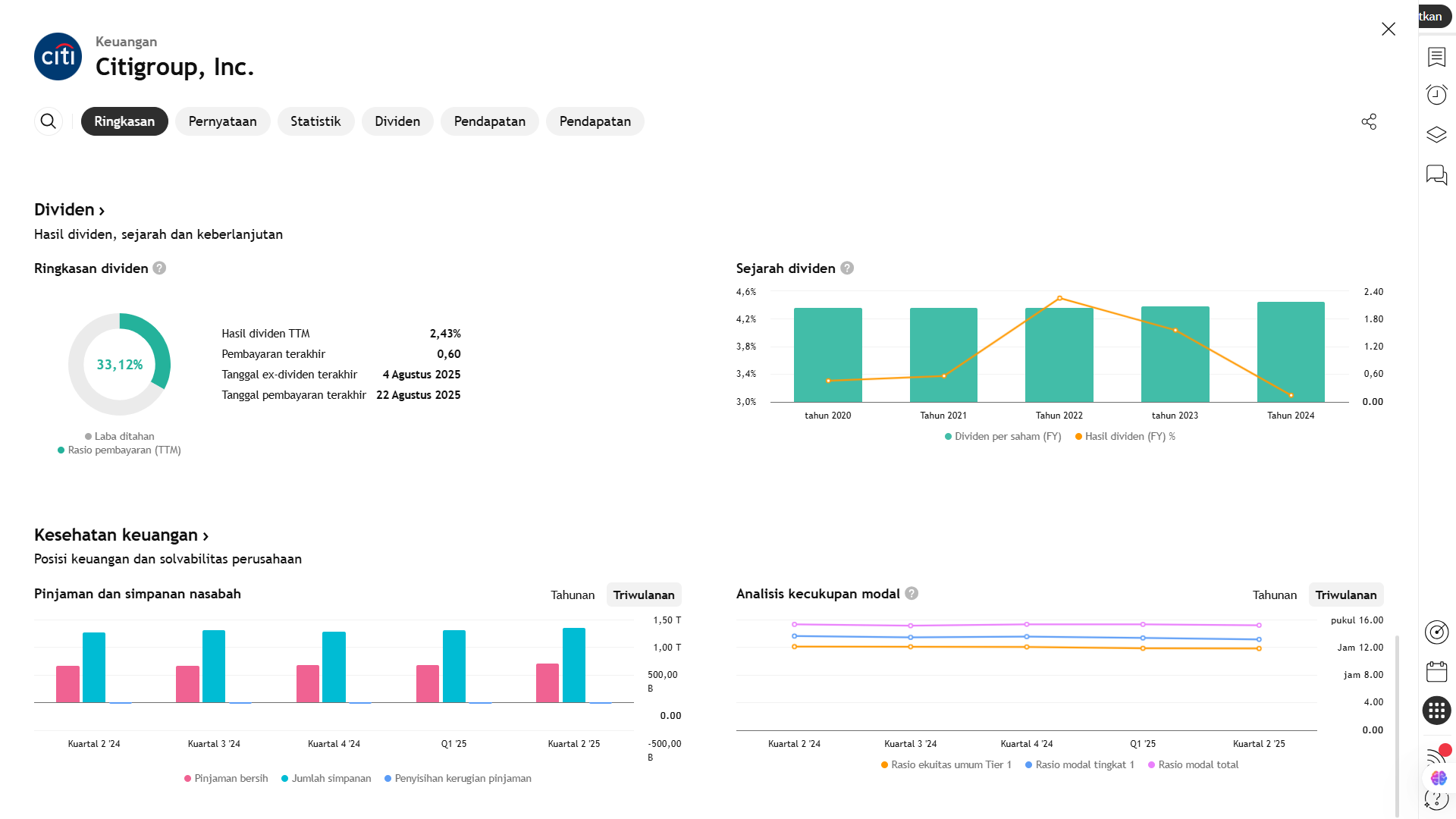

In addition to its financial performance, investors will also be watching management’s strategy regarding share buybacks, particularly if Citigroup continues to generate strong cash flow.

In the current macroeconomic environment, a continued buyback program would signal management’s confidence in the bank’s valuation and balance sheet resilience.

As the first major US bank to report this quarter, Citigroup’s results will serve as an early benchmark for investor expectations across the US financial sector in the second half of 2025.

The report’s outcome is also expected to influence trading sentiment in other major banks such as JPMorgan, Bank of America, and Wells Fargo in the days that follow.

Key Consensus Estimates

- Earnings per Share (EPS): Approximately US$1.61, with more optimistic forecasts reaching US$1.67.

- Revenue: Around US$20.9 billion, with minor variations among analyst estimates.

Key Factors to Watch

| Factor | Importance / Potential Impact |

|---|---|

| Investment Banking & Markets Revenue | Citigroup’s CFO stated that investment banking fees and markets revenue are expected to grow in the mid-single-digit range YoY. Stronger-than-expected growth in this segment could deliver a positive surprise for investors. |

| Margins & Operating Expenses | Maintaining cost control and demonstrating positive operating leverage would strengthen profit margins. |

| Asset Quality / Credit Loss Reserves | Since the banking sector is highly sensitive to rising credit losses, particularly in consumer and credit card portfolios, markets will be closely monitoring any increase in provisions or defaults. |

| Capital Return (Dividends / Buybacks) | Citigroup has a strong history of returning capital to shareholders. Any new or expanded buyback or dividend announcement could boost investor sentiment. |

| Management Commentary (Guidance & Outlook) | Forward guidance on the macroeconomic outlook, interest rates, loan demand, and cost pressures will be a key determinant of market reaction. |

Strengths and Risks

Strengths / Tailwinds

- A strong track record of beating analyst estimates in recent quarters.

- Expanding Markets & Investment Banking segments that may outpace other business lines.

- Ongoing commitment to shareholder returns through buybacks and dividends.

Risks / Headwinds

- Rising credit losses or higher loan-loss provisions could weigh on profitability.

- Net interest margin (NIM) compression from rate pressures could limit earnings growth.

- Macroeconomic uncertainty — including global recession risks, inflation, and high interest rates — may dampen loan demand and investment activity.

- If management delivers a cautious or weaker forward outlook, markets could react negatively even if current-quarter results are solid.

Outlook and Possible Scenarios

- Citigroup has the potential to beat the EPS estimate of US$1.61, particularly if markets and investment banking segments outperform expectations while costs remain contained.

- However, since moderate expectations may already be priced in, any upside surprise will need to be meaningful to trigger a strong stock rally.

- Conversely, if the report includes rising provisions or a softer outlook, the market could respond sharply to the downside.

Earning Projection Prediction

WHAT THE ANALYSIS STATES

Short Term Projection