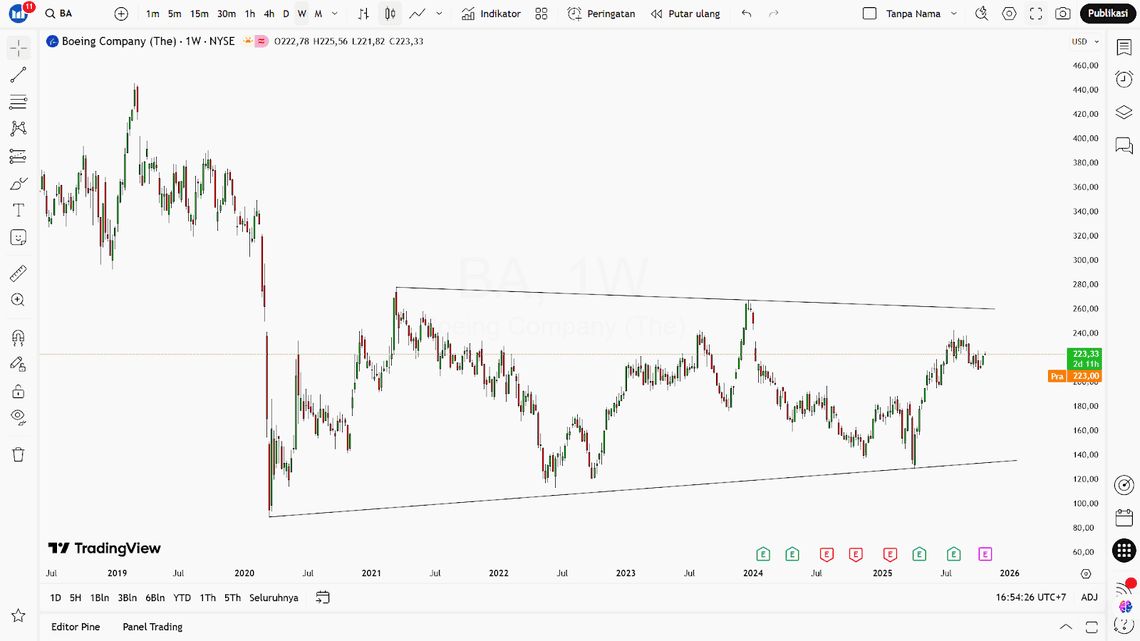

Boeing Co. once again finds itself under Wall Street’s microscope as the company grapples with a delicate balance between operational recovery and financial pressure. The aerospace giant’s third-quarter report reflects a determined effort by its new management team to stabilize production lines and rebuild its reputation following a series of technical and delivery setbacks that have slowed its comeback.

Despite a surging global demand for commercial aircraft and a backlog exceeding US$600 billion, Boeing continues to struggle with losses that weigh heavily on its cash flow and balance sheet. Investors are now focusing on two critical questions — whether Boeing can accelerate aircraft deliveries without compromising quality, and whether CEO Kelly Ortberg’s efficiency measures are strong enough to restore market confidence.

With Boeing shares down more than 30% year-to-date, this earnings report is seen as a crucial test of the company’s “turnaround strategy” amid rising production costs and fierce competition from Airbus.

Key Highlights

- Boeing is facing two major investor concerns ahead of its Q3 results:

(1) the pace of aircraft deliveries, and

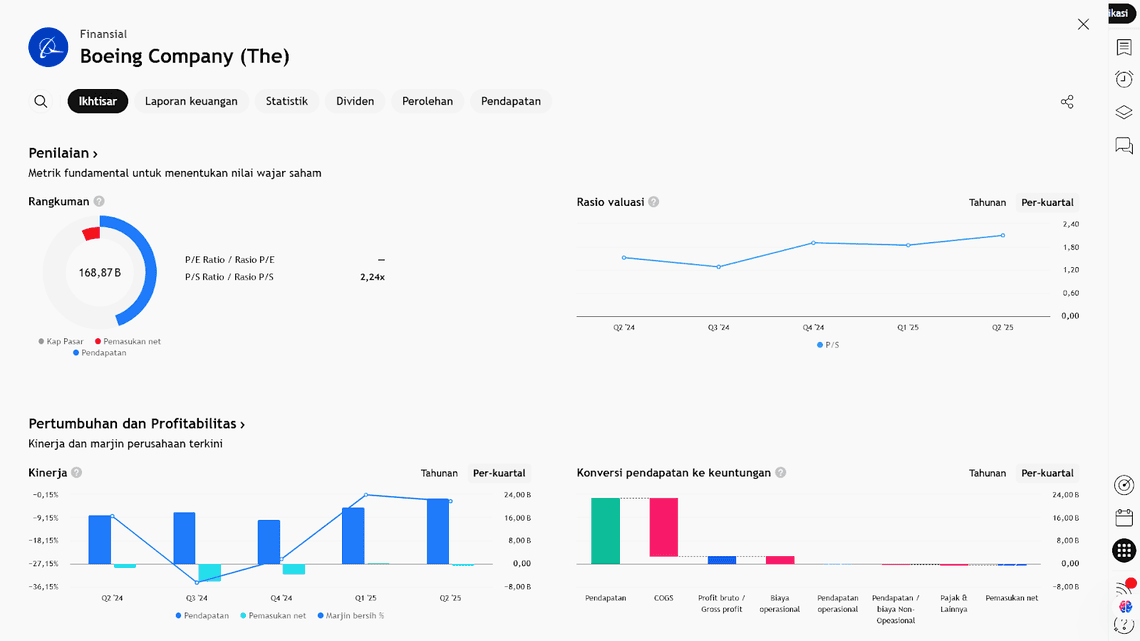

(2) the reduction of cash-flow burn. - A year ago, the company reported a net loss of about US$6.17 billion and a cash-flow burn of roughly US$1.34 billion over a specific period.

- For Q3, investors are closely watching:

- Whether Boeing can increase aircraft deliveries to customers (as low deliveries directly impact revenue).

- Whether the company can slow its cash burn, a critical factor since production delays could worsen liquidity needs.

- Although Boeing has made progress in several areas — including production stabilization and quality improvements — risks remain if deliveries stagnate and cash burn persists.

Why It Matters

- Delivery rates are central to Boeing’s recovery story. The company’s revenue and cash flow rely heavily on the number of aircraft handed over to customers. Any delay in production or certification could directly weaken earnings.

- Sustained negative cash flow signals potential financing pressures, which might force Boeing to rely on external funding or cut back on investment — both of which could affect valuation and credit outlook.

- As one of the world’s largest aerospace manufacturers operating in a highly regulated, capital-intensive industry, Boeing’s progress in these two areas serves as a key indicator for both investors and industry analysts.

Risks and Watchpoints

- If aircraft deliveries fail to rise meaningfully, Boeing could face continued revenue and margin pressure in the near term.

- With elevated cash burn, the company’s financial burden may intensify — limiting its flexibility to invest and raising concerns about balance sheet health.

- External risks remain significant, including regulatory hurdles, aircraft certification delays, supply-chain disruptions, and macroeconomic uncertainty (such as global demand shifts).

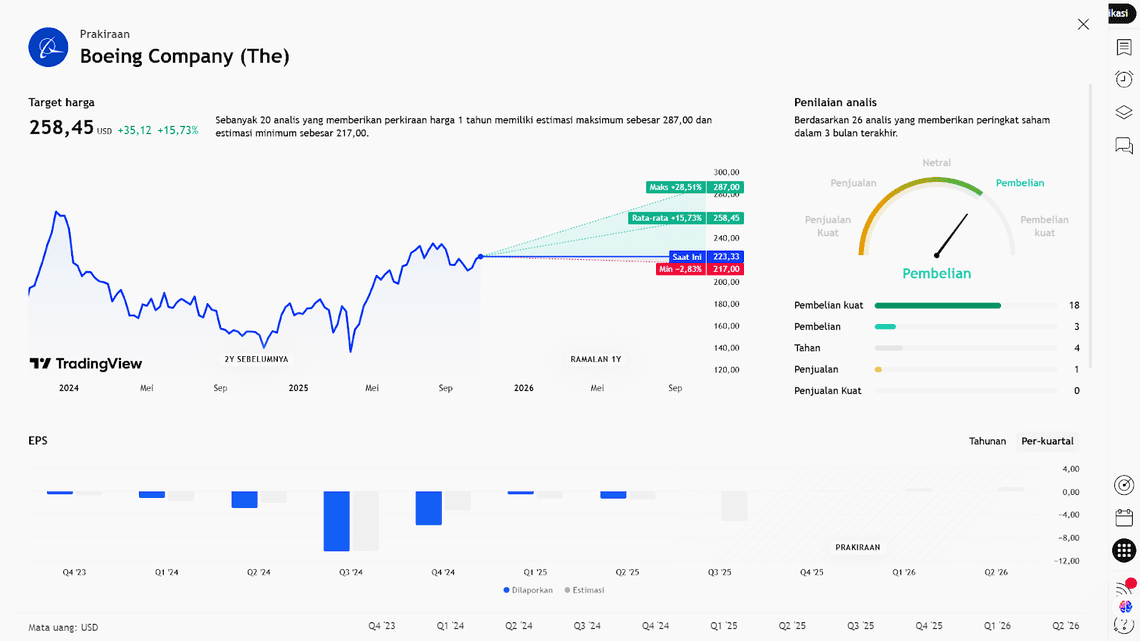

Earning Projection Prediction

APA YANG DINYATAKAN ANALIS

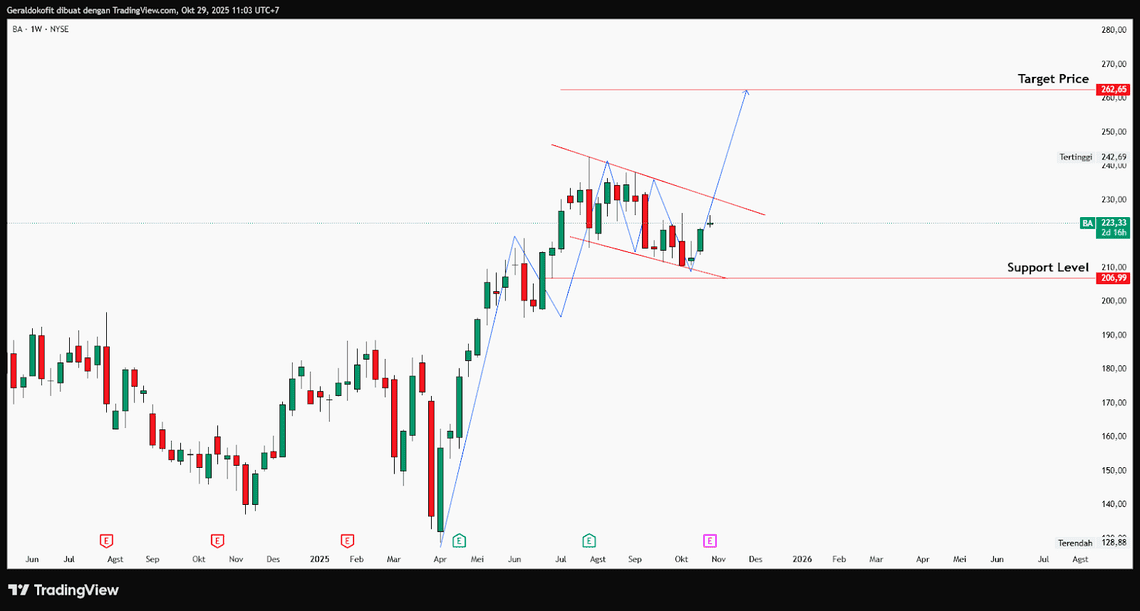

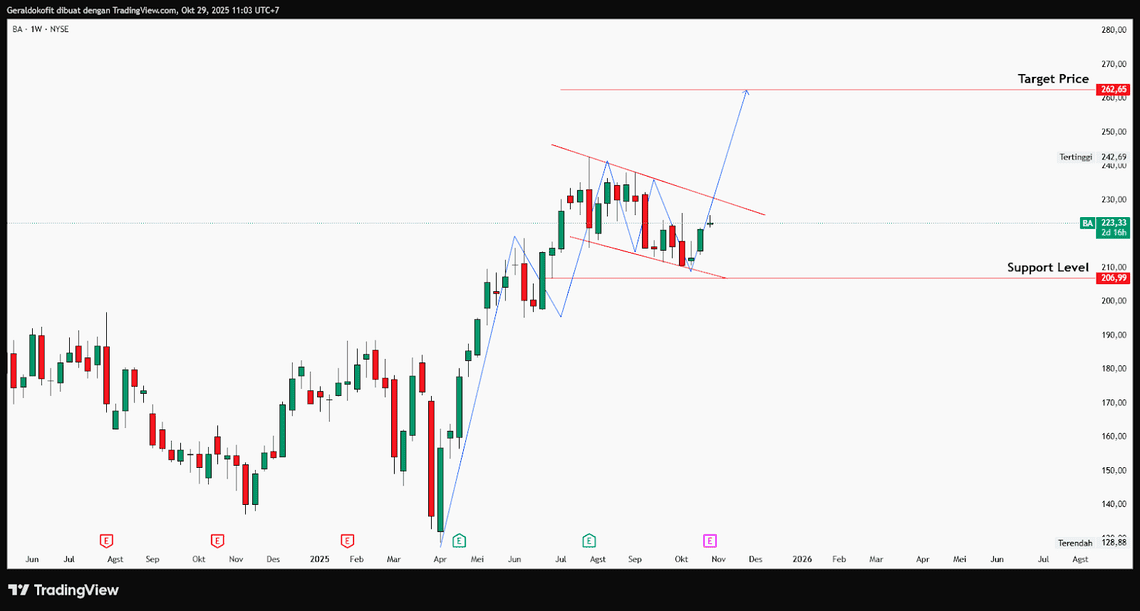

Short – Medium Term Projection

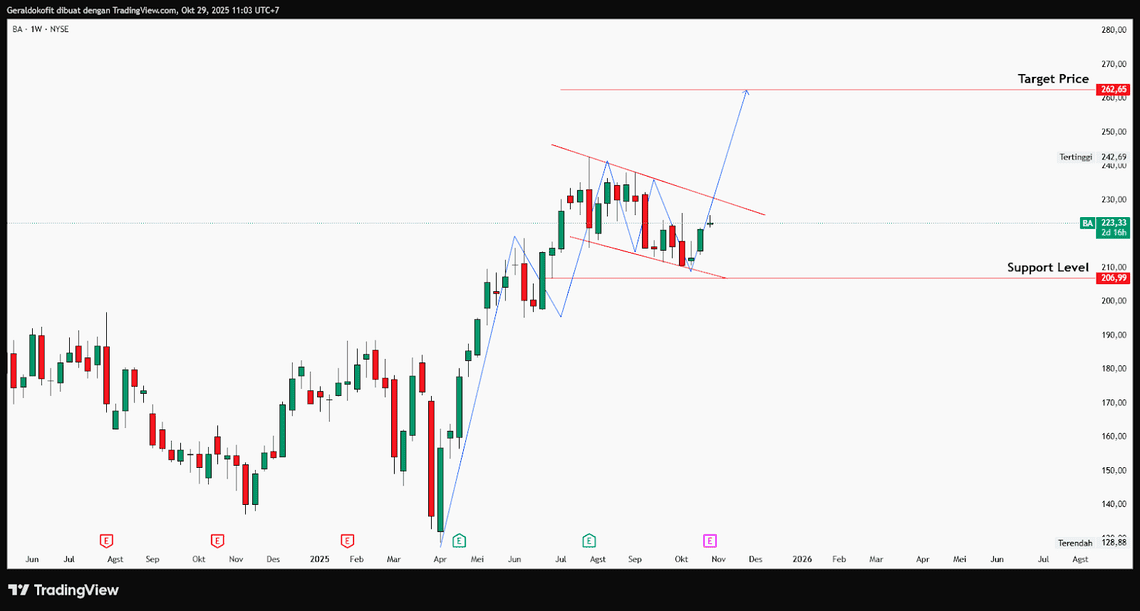

Strategi

| Buy Verizon | |

| Entry | 223,33 |

| Take Profit | 262,65 |

| Stoploss | 206,99 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst