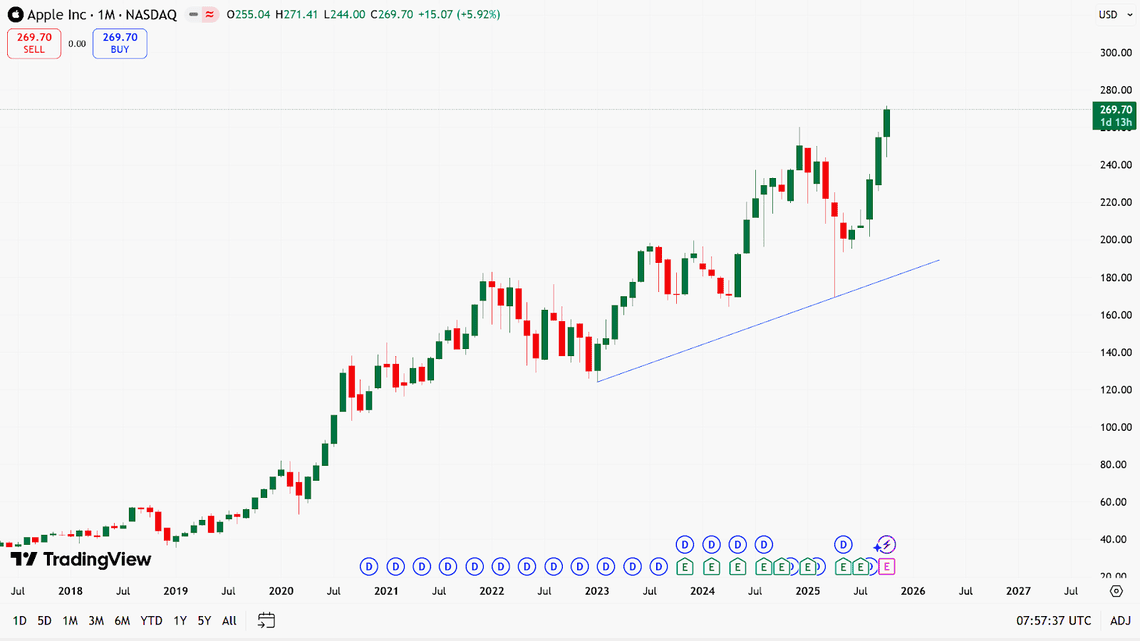

Apple Inc. once again takes center stage on Wall Street after its market capitalization briefly touched a record US$4 trillion, reaffirming its position as one of the most influential companies in global financial markets. Investor sentiment has strengthened ahead of the company’s upcoming fourth-quarter earnings report, scheduled for release after market close, amid expectations of rising iPhone demand and continued growth in its digital services segment.

However, behind the excitement over its record-breaking valuation, investors remain cautious about how long Apple can sustain its momentum amid fierce industry competition and the global transition toward the artificial intelligence (AI) era. Market attention now focuses on whether this quarter’s results will reinforce Apple’s long-term growth narrative — balancing between confidence in its ecosystem strength and concerns over a slowdown in product innovation.

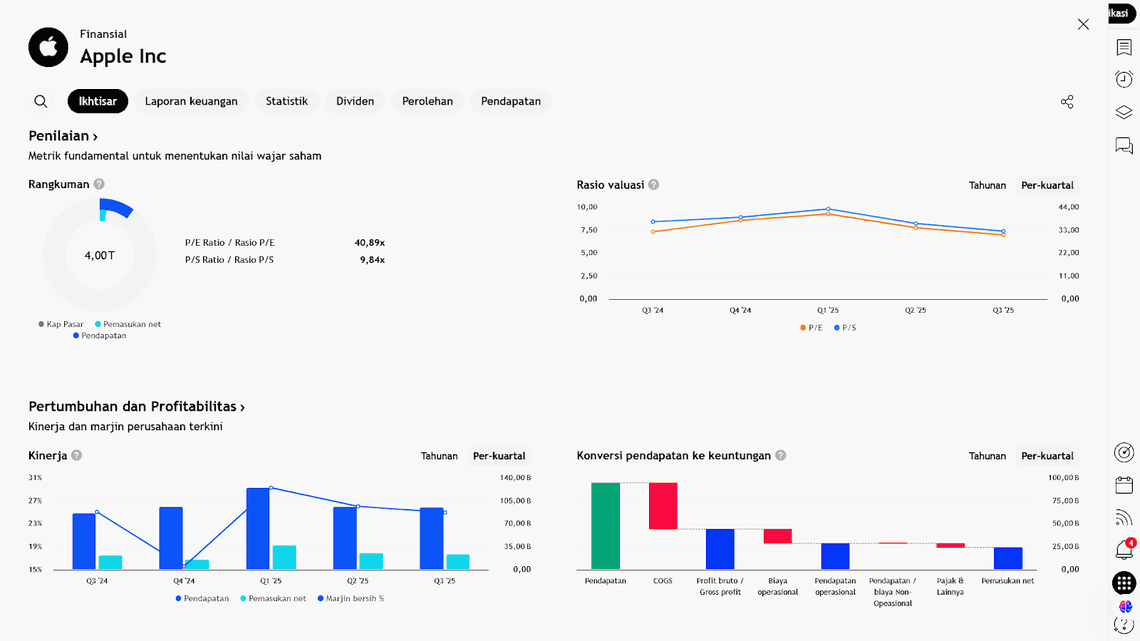

1. Market Valuation & Context

Apple briefly reached a US$4 trillion market capitalization, making it one of the few publicly traded companies ever to hit that milestone.

The primary driver behind this surge has been strong demand for the latest iPhone models, which have outperformed previous generations in several key markets.

Nevertheless, investors continue to monitor how Apple will navigate an increasingly competitive landscape — particularly in AI technology and smart devices.

2. Upcoming Q4 Earnings Report

Apple is set to release its fiscal fourth-quarter earnings after the market closes.

For the iPhone segment, analysts project revenue of approximately US$49.3 billion, up from US$46.2 billion in the same period last year — representing a 6.7% year-over-year increase.

This suggests that device upgrade cycles remain a critical driver of Apple’s core business, even as concerns linger about product innovation and competitive pressures.

3. Implications & Key Points to Watch

If Apple delivers strong results or provides an optimistic forward guidance, the company’s US$4 trillion valuation could be seen as more than symbolic — serving instead as a reflection of market confidence in Apple’s medium-term growth potential.

Still, investors are focusing on two key themes:

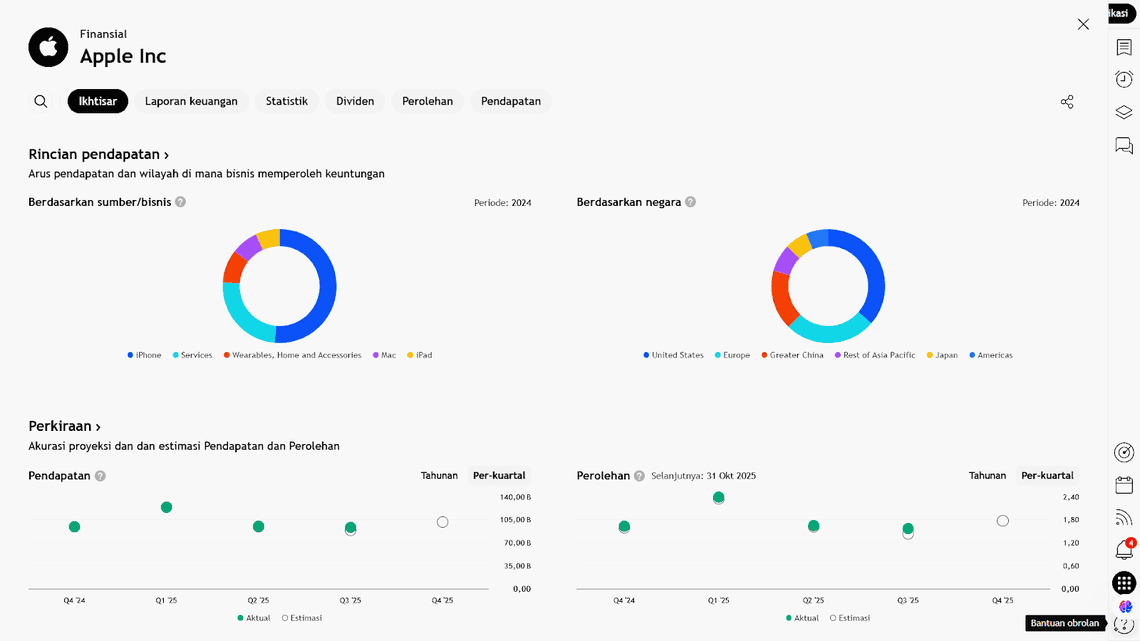

- Innovation & Competition: How effectively Apple can maintain its leadership in AI, develop new devices, and strengthen its integrated digital ecosystem.

- Revenue Diversification Beyond iPhone: Performance in services, hardware ecosystem integration, and new growth markets will be crucial to reduce reliance on a single flagship product.

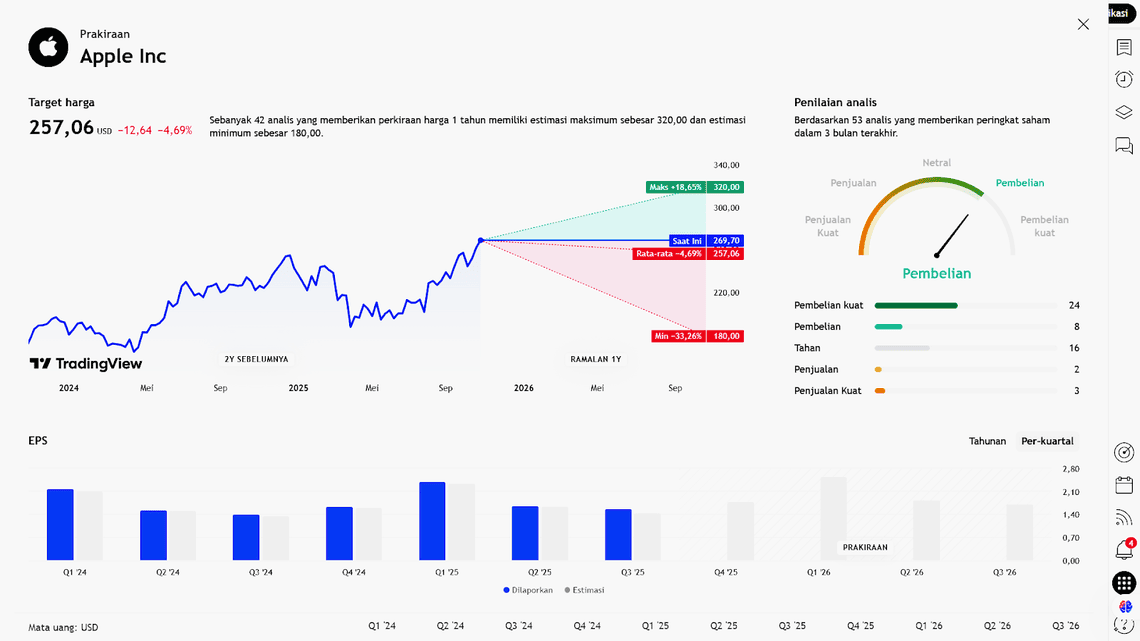

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

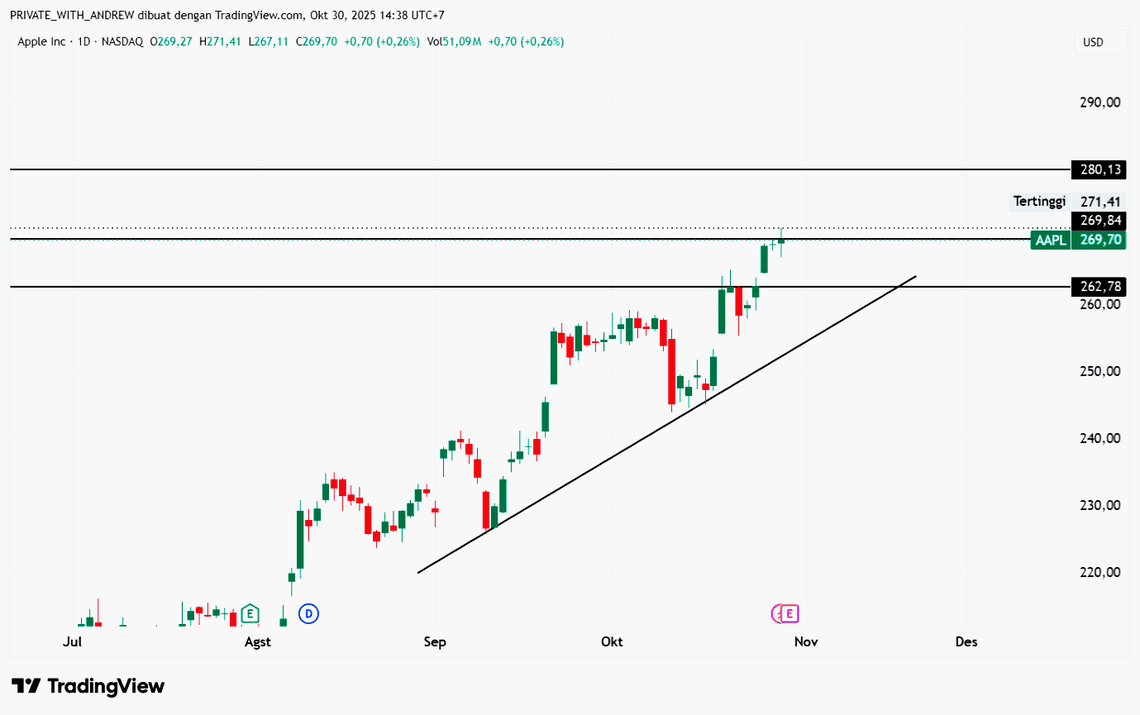

Strategi

| Buy APPLE | |

| Entry | 269,84 |

| Take Profit | 280,13 |

| Stoploss | 262,78 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst