Marriott International is a company engaged in the hospitality industry.

More specifically, Marriott is a multinational company that:

- Operates, manages and franchises a worldwide network of hotels and resorts.

- Provides accommodation, conference, culinary and other customer services in the hospitality sector.

- Includes various hotel brands from economy to luxury, such as Ritz-Carlton, JW Marriott, Sheraton, and Courtyard by Marriott.

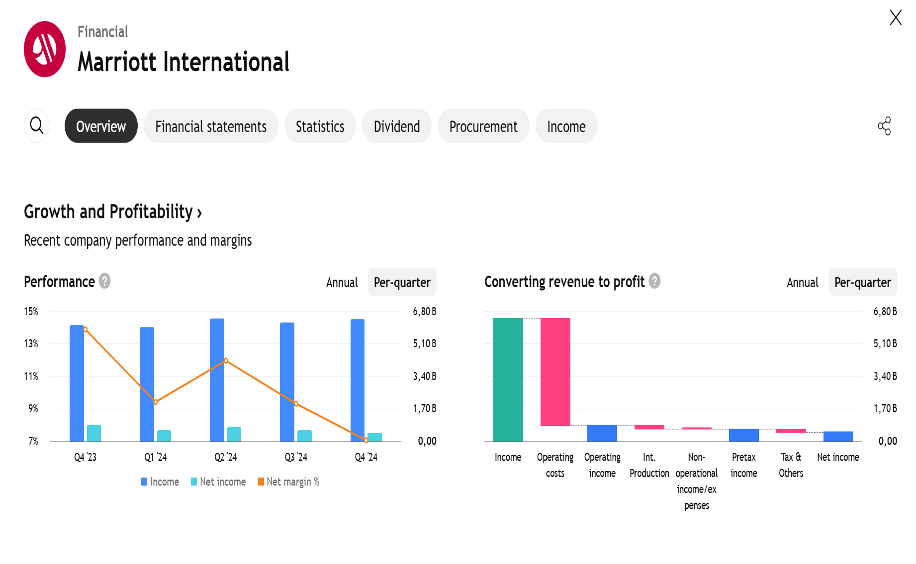

Marriott International Inc (MAR) estimates a 5.6% increase in EPS in the first quarter, indicating a strong growth path.

With projected revenue of $6.18 billion, Marriott continues to demonstrate fiscal resilience and steady improvement.

Analysts estimate a potential upside of 9.40%, reflecting an optimistic growth outlook for this hospitality industry giant.

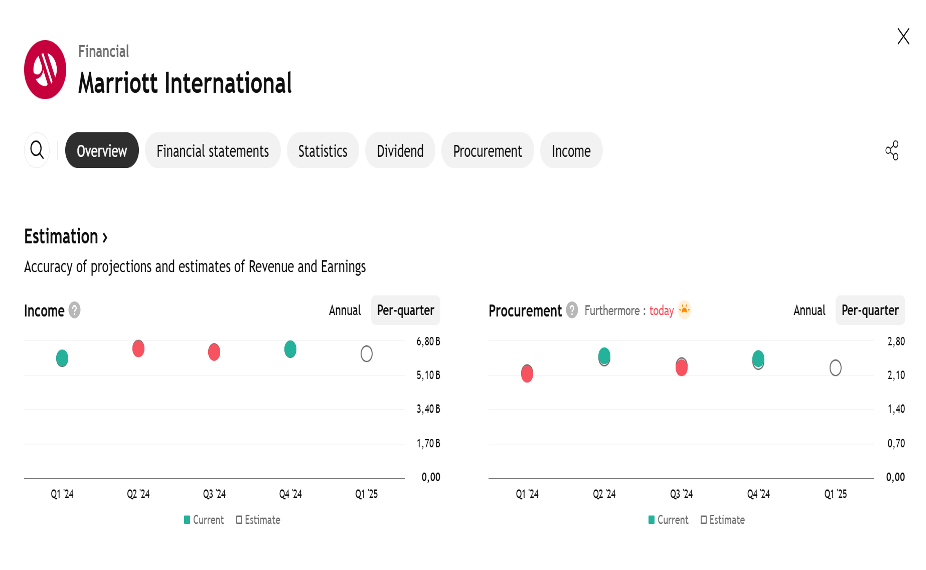

Marriott International Inc (MAR) is preparing to announce its first quarter earnings report on May 6. Analysts expect earnings per share (EPS) of $2.25, reflecting a promising 5.6% increase over the same period last year. The company’s revenue is expected to reach $6.18 billion, which translates to a 3.4% year-on-year increase. Notably, Marriott has exceeded EPS estimates on 75% of occasions over the past two years, demonstrating a strong track record.

Wall Street Analyst Forecasts

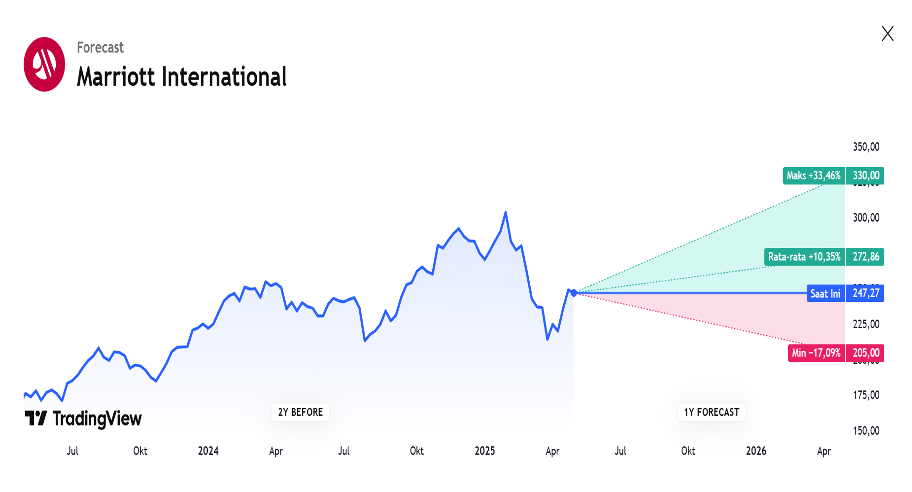

According to the one-year price targets provided by 23 analysts, the average target price for Marriott International Inc (MAR) is set at $272.69. Price estimates range from a high of $330.00 to a low of $205.00. This average target implies a potential upside of 9.40% from the current price of $249.27. For a more complete forecast, you can visit Marriott International Inc (MAR)’s Forecast page.

The consensus recommendation, taken from 28 brokerage firms, puts Marriott International Inc (MAR) at an average recommendation of 2.6, which indicates a “Hold” status. The recommendation scale ranges from 1 to 5, where 1 indicates a “Strong Buy” and 5 indicates a “Sell”.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED