Markets Brace for Signals of the End of the Tightening Cycle

Global financial markets are once again turning their attention to the United States this week, with the economic calendar filled with speeches from several Federal Reserve officials. At a time when the direction of monetary policy stands at a crucial juncture, investors are closely monitoring every statement from the Fed to determine whether the central bank is truly ready to begin a new chapter — transitioning from tightening to easing.

The dovish tone that began emerging in late September is expected to grow stronger, particularly after key officials such as Waller and Musalem voiced support last week for additional rate cuts. Market reactions were swift: Treasury yields declined, the U.S. dollar weakened, and gold prices rose back toward the USD 2,650 level.

However, will this trend continue? Or will Powell and his colleagues attempt to temper the market’s easing euphoria with a more cautious stance?

Monday, October 13 – A Calm Start from Paulson

The week begins with a speech by Fed official Paulson, which is not expected to bring any major surprises. Known for his focus on financial stability, Paulson tends to speak cautiously. Should he highlight the risks of an economic slowdown or strains in credit markets, investors will likely interpret this as dovish, reinforcing expectations that the Fed is ready to cut rates further.

Early in the week, markets are likely to experience a calm session with a dovish tone, allowing for a rebound in risk assets and modest gains in gold.

Tuesday, October 14 – Spotlight on Bowman and Powell

Tuesday will be the main event of the week.

Michelle Bowman, one of the Fed’s most hawkish members, will speak first. She has consistently warned of persistent inflation in the services sector and the need to keep policy restrictive. Her remarks will likely serve as a counterbalance to the dovish tone dominating recent weeks.

The spotlight, however, will be on Federal Reserve Chair Jerome Powell. After several members hinted at potential easing, markets are eager to hear whether Powell will confirm or push back on that narrative. If he emphasizes progress on inflation and indicates room for policy adjustment, a stronger dovish response may follow, pushing yields lower.

Conversely, if Powell stresses a “data-dependent” approach and highlights lingering inflation risks, the dollar could regain strength.

Tuesday’s session will likely set the tone for the rest of the week — especially for the DXY, Treasury yields, and gold.

Wednesday, October 15 – Unified Dovish Voices

Four Fed officials are scheduled to speak: Waller, Collins, Bostic, and Miran.

All four have shown varying degrees of dovish leanings:

- Waller, previously hawkish, has recently shifted tone, backing additional rate cuts.

- Collins often highlights regional economic risks, signaling concern about the impact of prolonged tightening.

- Bostic stresses the importance of stability and gradualism, while

- Miran remains cautious and balanced.

Their combined remarks could reinforce a dovish consensus, pressuring the U.S. dollar and boosting demand for gold and equities.

Thursday, October 16 – A Volatile Day Ahead

Thursday will be the busiest and most volatile day of the week, with seven speeches from various FOMC members.

The day will open with dovish remarks from Waller but will later feature a series of hawkish tones from Barkin, Barr, and Bowman.

- Barkin, known for his tough stance on inflation, is expected to highlight labor market resilience that could sustain price pressures.

- Barr will likely emphasize the importance of maintaining financial stability amid easing expectations.

- Bowman, speaking again that evening, is almost certain to repeat her warning that “premature easing is a risk.”

The combination of dovish sentiment in the morning and hawkish remarks later in the day could lead to sharp volatility across the DXY, bond yields, and gold.

Friday, October 17 – A Mixed but Dovish Finish

Toward the end of the week, three officials — Miran, Kashkari, and Musalem — will deliver remarks.

- Miran is expected to open with a soft, cautious tone.

- Kashkari, one of the Fed’s most hawkish voices, will likely caution markets against expecting aggressive rate cuts too soon.

- Musalem, now among the leading dovish figures, is expected to close the week by emphasizing the Fed’s readiness to cut rates further if inflation continues to ease without significant labor market strain.

The week is likely to end on a dovish note, providing support for risk assets ahead of the weekend.

Conclusion and Market Implications

Overall, this week’s schedule reflects a collective dovish shift, though hawkish voices from Bowman, Barkin, and Kashkari may add volatility.

Key Market Implications:

- U.S. Dollar (DXY): Likely to weaken if most speeches reinforce the easing narrative.

- Treasury Yields: Expected to decline, supporting gold and equities.

- Gold (XAUUSD): Supported by dovish tones and a softer dollar.

- U.S. Stocks: Dovish remarks could extend the current risk-on rally, particularly in technology and real estate sectors.

This week could mark a turning point for the Fed’s monetary policy direction toward an easing phase.

If dovish sentiment dominates, markets will likely conclude that the high-rate era has peaked, paving the way for further cuts before year-end.

With inflation easing and growth moderating, the Fed now walks a fine line — balancing price stability with economic momentum.

And judging by this week’s lineup of speeches, markets appear increasingly convinced: the era of high interest rates in the U.S. is drawing to a close.

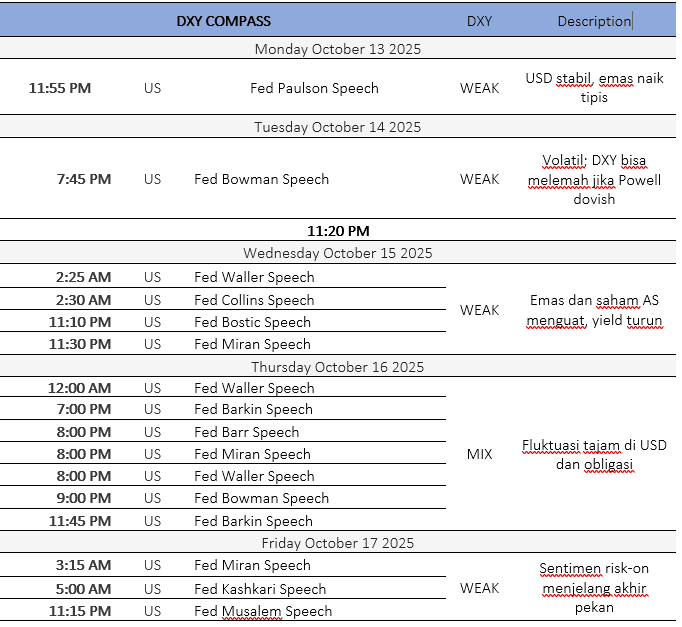

DXY Compass Schedule Summary

By Ade Yunus – Global Market Strategist