U.S. benchmark crude oil, West Texas Intermediate (WTI), has shown volatile moves in the first week of September 2025. After briefly touching a monthly high, prices have retreated under the weight of geopolitical tensions, supply dynamics, and expectations ahead of OPEC+’s upcoming production policy decision.

Latest Market Developments

On Thursday, September 4, 2025, WTI slipped about 0.7% to around $63.50 per barrel. The day before, prices had climbed as high as $65.43 per barrel following U.S. sanctions on an Iranian oil-smuggling network. The move briefly raised concerns over potential disruptions to global supply, pushing prices near their monthly peak.

However, this support quickly faded as fresh data revealed U.S. crude inventories increased by 622,000 barrels, defying expectations of a 2 million barrel drawdown. The surprise stock build weighed on sentiment, signaling weaker domestic demand amid a slowdown in industrial activity.

Key Factors Driving Prices

OPEC+ Meeting on September 7

The upcoming meeting of major oil producers is the market’s key focus. Speculation is growing that OPEC+ could raise output in response to recent price stability. Such a move could exacerbate oversupply risks and pressure WTI lower.

U.S. Energy Inventories

While crude stockpiles rose, gasoline and distillate inventories fell sharply by 3.4 million barrels. This indicates ongoing demand for refined fuels, especially in transportation and industry, partially offsetting the bearish sentiment.

Geopolitics and U.S. Sanctions

Fresh U.S. sanctions on Iran remain a pivotal factor. Although the measures may not immediately cut global supply, they add geopolitical risk that often supports oil prices as traders price in uncertainty.

Global Macroeconomic Conditions

Sluggish global growth continues to cast a shadow over energy demand. Recent data from the U.S. and Europe point to weakening manufacturing activity, while Asia—particularly China—shows only a slow recovery. This backdrop limits the upside potential for oil despite geopolitical tensions.

Price Outlook Into the Weekend

Market estimates suggest WTI will likely trade between $63.5 and $70.2 per barrel through Friday, September 5, averaging near $66.9. This reflects a fragile balance between supply-side pressures (OPEC+ and U.S. inventories) and geopolitical support (Iran sanctions).

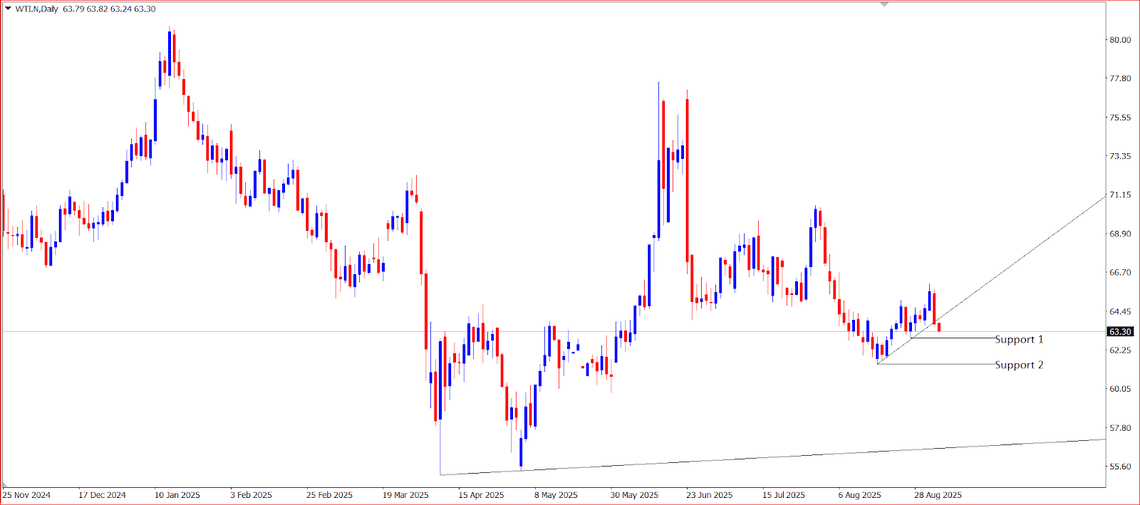

Technically, the $63.00–$63.50 range is seen as near-term support, while resistance lies at $67.50–$70.00. A breakout above $70 could open the door for further gains, but failure to hold above $63 risks a decline toward the psychological $60 level.

Chart: WTI Technicals

WTI has broken below its daily uptrend line, signaling potential downside toward key support levels at $62.95 and $61.44. This technical setup reinforces the short-term bearish outlook.

Medium-Term Outlook

According to projections from the Energy Information Administration (EIA), WTI is expected to weaken further over the coming quarters. Estimates point to WTI averaging around $60 per barrel in September 2025, falling below $50 by early 2026, before gradually recovering toward the end of 2026.

This outlook is based on expectations of global oversupply driven by rising output from OPEC+, the U.S., and independent producers, while energy demand growth slows amid the global transition to renewables and efficiency gains.

Ade Yunus

Global Market Strategies