- Release date: Friday, July 18, 2025

- EPS expectation: $2.01 per share

- Investors look forward to not only EPS results that exceed expectations, but also positive guidance for the next quarter – an important factor that can influence stock price movements.

Historical Performance

| Kuartal | Estimasi EPS | Realisasi EPS | Perubahan Harga Saham |

| Q1 2025 | $1.77 | $1.88 | -0.0% |

| Q4 2024 | $1.66 | $1.68 | +2.0% |

| Q3 2024 | $1.90 | $1.98 | -3.0% |

| Q2 2024 | $1.68 | $1.93 | +23.0% |

Stock Performance

- Price as of July 16, 2025: $157.56

- Last 52-week return: +51.69%

- Signaling positive sentiment for long-term investors.

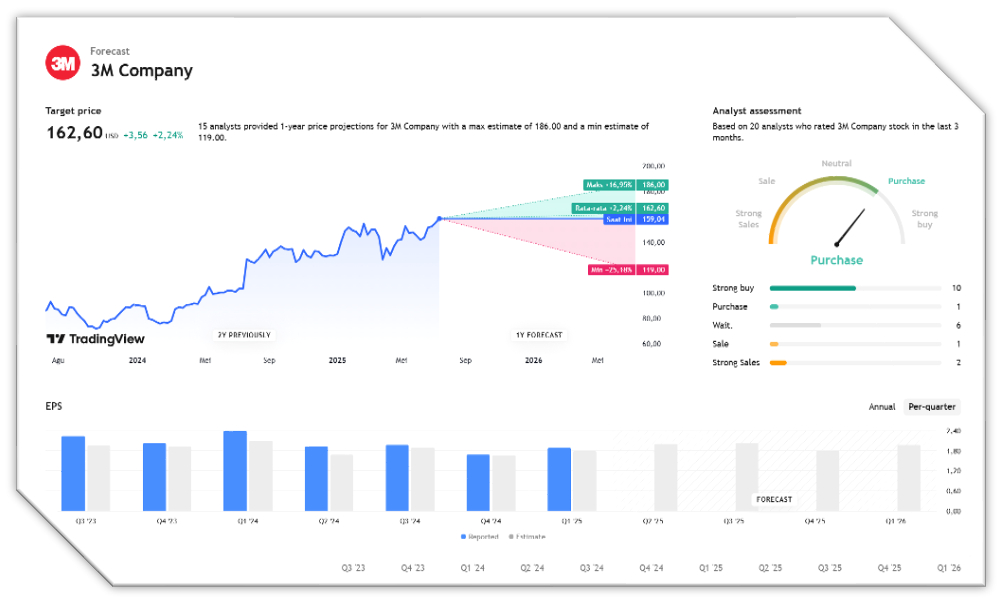

Analyst View

- Consensus rating: Outperform

- 1-year price target: $153.14 → downside potential -2.81%

About 3M

- Founded in 1902, it manufactures thousands of products such as medical devices, electronics, and consumer goods.

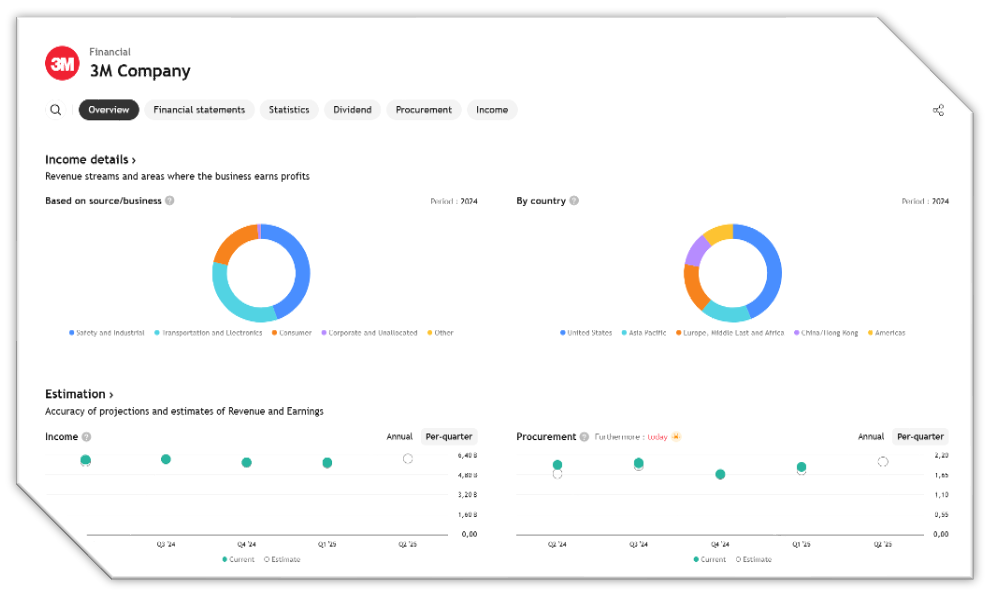

- Consists of 3 main segments:

- Safety & Industrial: 44% of revenue

- Transportation & Electronics: 36%

- Consumer: 20%

- Recently separated the healthcare business unit into Solventum.

- About 50% of revenue comes from outside the US.

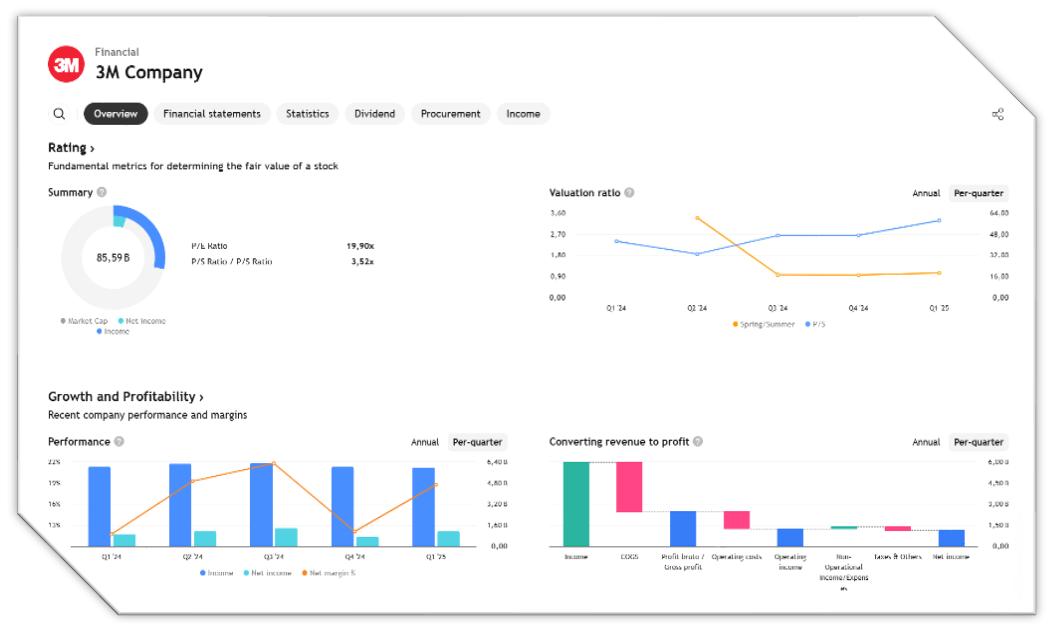

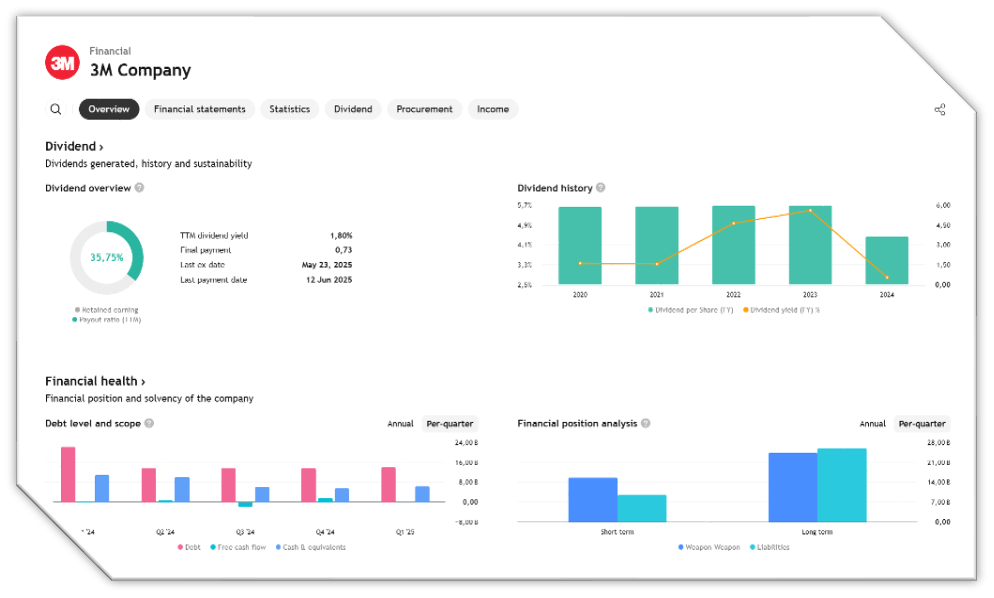

Financial Health

- Net Margin: 18.74% (above industry average)

- ROE: 26.87% (high, good capital efficiency)

- ROA: 2.8% (high asset utilization effectiveness)

- Debt-to-equity ratio: 3.15 (below industry average)

Conclusion

3M will be of interest to investors in the Q2 report due to:

- Despite low revenue growth, profitability and financial efficiency remain solid.

- EPS expectations and forward guidance.

- Stable historical performance but mixed share price reaction.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED