PERDAGANGAN

PARTNER

PERUSAHAAN

ANALISA HARIAN

PIVOT

Prediksi Strategi untuk Perdagangan Jangka Pendek

EUR/USD

Pasangan EUR/USD diperdagangkan di dekat terendah mingguan di 1.0873 setelah rilis Risalah Rapat FOMC. Dokumen tersebut mengingatkan pelaku pasar bahwa Federal Reserve AS bertekad untuk memindahkan kebijakan moneter ke netral "secepatnya."

Sebelumnya pada hari itu, Presiden AS Joe Biden mengumumkan perintah eksekutif untuk melarang investasi baru di Rusia. Para pemimpin Eropa, di sisi lain, tidak dapat mencapai kesepakatan tentang pelarangan batubara Rusia, meskipun mereka mengatakan itu karena masalah teknis dan mereka akan membahasnya lagi pada hari Kamis. Sementara itu, Presiden Komisi Eropa Ursula von der Leyen mengatakan bahwa sanksi baru terhadap Kremlin bukanlah yang terakhir.

USD/JPY

USD/JPY naik di sesi Amerika Utara di tengah suasana pasar risk-off, berkat pidato Fed, kelanjutan perang Rusia-Ukraina, dan ekonomi China akan melambat, seperti yang dilaporkan oleh IMP Manufaktur dan Jasa, yang turun di bawah tingkat ekspansi. Pada saat penulisan, USD/JPY diperdagangkan di 123.87. Ekuitas AS tetap diperdagangkan di zona merah, dengan kerugian antara 0.89% dan 2.66%.

Greenback tetap apung, seperti yang ditunjukkan oleh Indeks Dolar AS, ukuran nilai dolar vs mata uang utama lainnya, naik 0.25%, duduk di 99.742, didukung oleh imbal hasil Treasury AS 10-tahun hingga enam basis poin, saat itu di 2.622% . USD/JPY naik-turun di sekitar kisaran 123.50-124.00 menjelang rilis pertemuan FOMC Maret. Setelah diumumkan, USD/JPY merosot ke posisi terendah harian di 123.46 tetapi pulih kembali dan mengarah ke 124.00.

GBP/USD

GBP adalah mata uang terkuat segera setelah rilis risalah Komite Pasar Terbuka Federal, melonjak ke 1.3107 sebelum turun ke posisi terendah menit di 1.3056 ketika dolar AS akhirnya menembus ke atas. DXY, indeks yang mengukur greenback vs sekeranjang enam mata uang saingan, telah mencapai level tertinggi untuk 2022 di 99.769 setelah risalah yang menunjukkan bahwa pejabat Federal Reserve menyatakan kecemasan tentang inflasi.

Anggota FOMC telah menyelesaikan rencana untuk mengecilkan kepemilikan obligasi dalam upaya agresif untuk mengekang kenaikan harga. The Fed sedang bersiap untuk menyusutkan neraca $9tn dengan kecepatan sekitar $95bn per bulan. Banyak pejabat mengatakan satu atau lebih kenaikan suku bunga 50bps mungkin diperlukan dan banyak anggota mencari kenaikan 50bps Maret jika tidak ada perang Ukraina.

AUD/USD

Dolar AS meningkat setelah rilis risalah pertemuan The Fed terbaru dan ini telah mendorong AUD/USD ke terendah baru sesi kembali di bawah level 0.7500. Itu berarti pasangan ini sekarang diperdagangkan lebih rendah lebih dari 1.0% hari itu, telah berada di bawah tekanan sebelum rilis risalah The Fed, kemungkinan sebagai akibat dari kemunduran tajam yang terlihat di pasar ekuitas dan komoditas global. Aussie memiliki korelasi yang kuat untuk selera risiko dan harga komoditas seperti minyak, tembaga dan harga energi dan logam lainnya.

Dengan Aussie sekarang diperdagangkan kembali di area 0.7500, Aussie telah lebih dari membatalkan kenaikan pertemuan RBA pasca-hawkish Selasa yang melihatnya pada satu titik reli setinggi 0.7660-an pada hari Selasa. Itu penurunan sekitar 2.0% dari puncak mingguan. Sekarang AUD/USD diperdagangkan kembali dalam kisaran minggu lalu (ketika menghabiskan hampir sepanjang minggu dalam 40 pips dari level 0.7500).

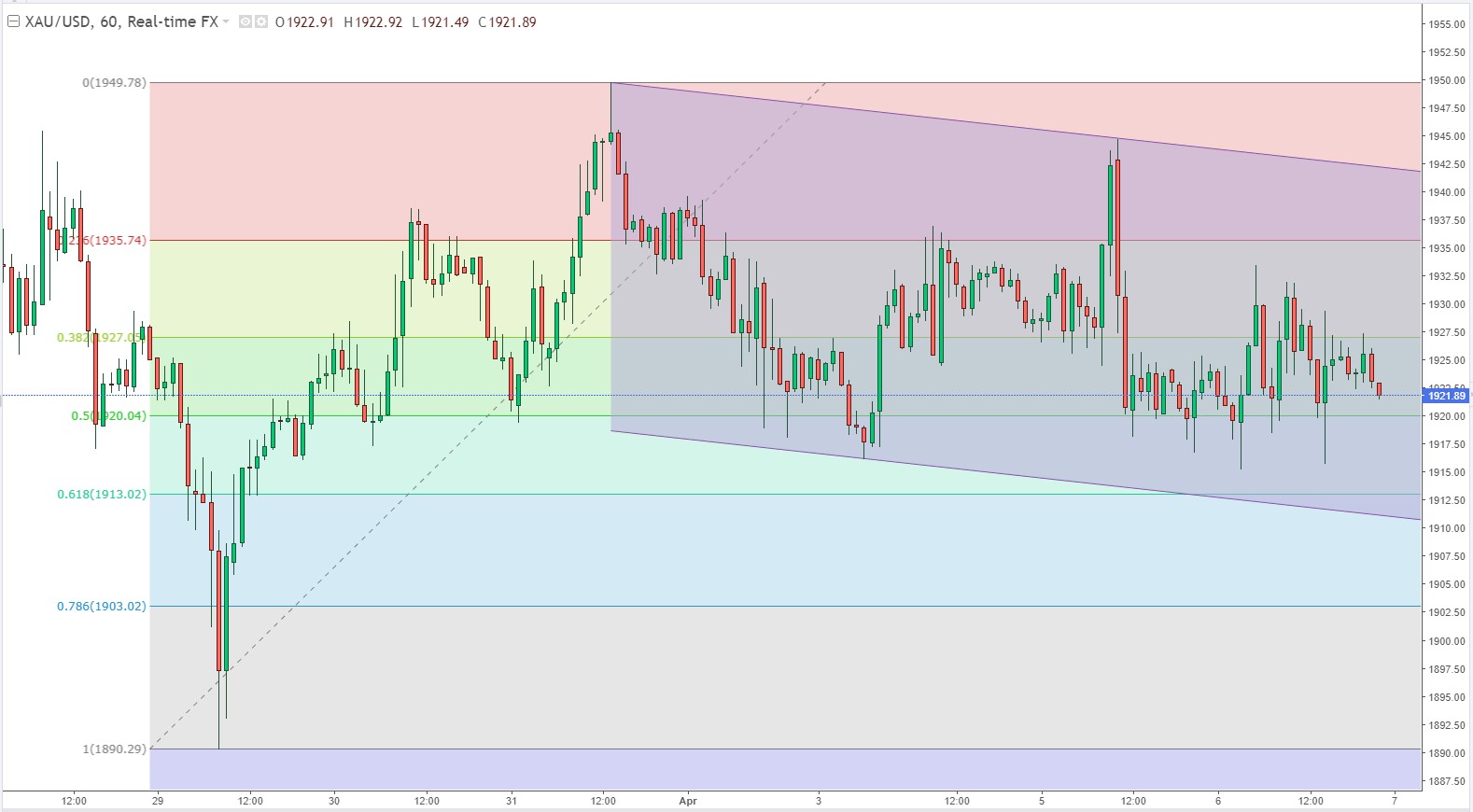

XAU/USD

Harga emas menguat dalam apa yang dianggap sebagai serangan spontan dari volatilitas kecil-kecilan setelah risalah Komite Pasar Terbuka Federal yang tiba dengan hawkish. DXY, indeks yang mengukur greenback vs sekeranjang enam mata uang saingan, melonjak ke level tertinggi untuk 2022 di 99.769 setelah risalah yang menunjukkan bahwa pejabat Federal Reserve menyatakan kecemasan tentang inflasi.

Harga emas berada di bawah tekanan pada hari Rabu tetapi tertahan dalam kisaran yang sudah dikenal karena terus diperdagangkan menyamping pada grafik harian. Pada saat penulisan, pada $1.922.10, XAU/USD turun 0.06% dan telah melakukan perjalanan antara tertinggi $1.933.58 dan terendah $1.915.08. Dampak dari dolar yang lebih kuat akan diredam karena geopolitik mendominasi pasar. Selanjutnya, harga emas diperkirakan akan tetap di atas level $1.900 sepanjang tahun.

WTI

Minyak berjangka turun pada hari Rabu menyusul kenaikan mengejutkan dalam stok minyak mentah AS dan setelah berita bahwa negara-negara konsumen besar juga akan melepaskan minyak dari cadangan dalam hubungannya dengan Amerika Serikat untuk melawan kekhawatiran pasokan. Negara-negara anggota Badan Energi Internasional (IEA) akan melepaskan 120 juta barel dari cadangan strategis, termasuk 60 juta dari Amerika Serikat, menurut dua sumber yang mengetahui masalah tersebut.

Minyak mentah berjangka Brent turun 5.22% menjadi $101.07 per barel. Minyak mentah AS menetap 5.6% lebih rendah pada $96.23 per barel. Pasar minyak mentah telah mengalami volatilitas selama berminggu-minggu, dengan harga melonjak karena kekhawatiran pasokan setelah invasi Rusia ke Ukraina dan sanksi berikutnya terhadap Moskow oleh Amerika Serikat dan sekutunya.

#KO

Jika sebuah perusahaan dapat mempertahankan pertumbuhan laba per saham (EPS) cukup lama, harga sahamnya pada akhirnya akan mengikuti. Itu berarti pertumbuhan EPS dianggap sangat positif oleh sebagian besar investor jangka panjang yang sukses. Dapat dilihat bahwa dalam tiga tahun terakhir Coca-Cola meningkatkan EPS-nya sebesar 14% per tahun. Itu tingkat pertumbuhan yang bagus, jika bisa dipertahankan. Coca-Cola mempertahankan marjin EBIT yang stabil selama setahun terakhir, sambil meningkatkan pendapatan 17% menjadi US$39 miliar.

Karena Coca-Cola memiliki kapitalisasi pasar sebesar US$273 miliar, tidak diharapkan orang dalam memiliki persentase saham yang besar. Tapi melihat dari kenyataan bahwa mereka adalah investor di perusahaan. Memang, mereka memiliki segunung kekayaan yang diinvestasikan di dalamnya, yang saat ini bernilai US$1.8 miliar. Ini menunjukkan bahwa kepemimpinan akan sangat memperhatikan kepentingan pemegang saham ketika membuat keputusan. Saham KO lebih tinggi 0.63 (+1.01%) ditutup pada 63.10 pada hari Rabu.

#DIS

Strategi Pemimpin Keberlanjutan ClearBridge mengungguli benchmark Indeks Russell 3000 selama kuartal keempat. Secara absolut, Strategi memiliki keuntungan di sembilan dari 10 sektor di mana ia diinvestasikan (dari total 11 sektor). Kontributor utama adalah IT, konsumen discretionary, dan sektor perawatan kesehatan.

Didirikan pada tahun 1923, The Walt Disney Company (NYSE:DIS) adalah perusahaan hiburan yang berbasis di Burbank, California dengan kapitalisasi pasar $252.3 miliar, dan saat ini dipelopori oleh CEO-nya, Bob Chapek. The Walt Disney Company (NYSE:DIS) memberikan pengembalian -10.53% sejak awal tahun, sementara pengembalian 12 bulannya turun -26.96%. Saham ditutup pada $138.58 per saham pada 04 April 2022. Saham DIS lebih rendah 3.05 (-2.25%) ditutup pada 132.57 pada hari Rabu.

PERDAGANGAN

PARTNER

PERUSAHAAN

MEMBANTU

Disclaimer: Trading derivatif mengandung risiko kerugian tinggi dan belum tentu cocok untuk semua investor. TIDAK ADA JAMINAN KEUNTUNGAN dari investasi Anda.

ID

ID

-

English

-

Bahasa Indonesia