PERDAGANGAN

PARTNER

PERUSAHAAN

ANALISA HARIAN

PIVOT

Prediksi Strategi untuk Perdagangan Jangka Pendek

EUR/USD

EUR/USD kembali berada di zona hijau di perdagangan New York tengah hari setelah berada di bawah air pada awal sesi ketika mendekati posisi terendah hari itu 1.0944. Pasangan ini telah bersemangat setelah melemahnya dolar AS dan telah naik ke sesi tertinggi 1.0999. EUR/USD telah menangkap tawaran beli menyusul data yang beragam dan imbal hasil AS yang lebih lemah yang mulai menurun di sesi Eropa dengan imbal hasil 2-tahun meluncur dari 2.414% ke terendah 2.292% pada awal perdagangan Amerika Utara.

Sementara itu, pasar akan waspada terhadap perkembangan pendorong utama adalah perkembangan invasi Rusia ke Ukraina selama sebulan terakhir, ini telah menjadi pusat perhatian dengan ketidakpastian geopolitik mencapai ketinggian baru. Akibatnya, harga komoditas yang lebih tinggi dan meningkatnya risiko resesi global jelas merupakan hal negatif bagi sebagian besar mata uang G10 yaitu EUR secara luas. Mata uang telah jatuh sekitar 6% sejak pertengahan Februari dan tertinggi 2022 mendekati angka 1.15.

USD/JPY

Pasangan USD/JPY akhirnya menyaksikan barikade di 125.10 di tengah program pembelian obligasi tak terbatas yang sedang berlangsung dari Bank of Japan (BOJ) selama empat hari pertama minggu ini, yang akan membantu mereka mempertahankan batas imbal hasil mereka. BOJ membeli 10-tahun Obligasi Pemerintah Jepang (JGB) pada hari Senin dan dimaksudkan untuk terus membelinya sampai Kamis untuk menjaga suku bunga dari mendapatkan taruhan elevasi.

Perlu dicatat bahwa mata uang utama telah reli tajam di bulan Maret dan telah bertambah 8.70% bulan ini. Gagal menaikkan suku bunga oleh BOJ di tengah angka inflasi yang dibatasi telah membawa perbedaan besar dalam siklus suku bunga BOJ dan bank sentral lainnya.

GBP/USD

GBP/USD telah memulai minggu baru di belakang dan turun ke terendah baru enam hari di 1.3130. Penguatan dolar berbasis luas membebani pasangan ini karena investor menunggu pidato Gubernur Bank of England (BOE) Andrew Bailey. Pekan lalu, komentar dari pembuat kebijakan Federal Reserve AS menghidupkan kembali ekspektasi untuk kenaikan suku bunga 50 basis poin di bulan Mei.

Mencerminkan sentimen ini, benchmark imbal hasil obligasi Treasury AS 10-tahun naik ke level tertinggi sejak Mei 2019 di atas 2.5% pada Senin pagi. Menurut CME Group Fed Watch Tool, pasar memperkirakan kemungkinan hamper 70% dari kenaikan tingkat dosis ganda pada pertemuan FOMC berikutnya. Didorong oleh kenaikan imbal hasil obligasi-T AS, Indeks Dolar AS terus mendorong lebih tinggi menuju puncak multi-tahun yang ditetapkan di 99.40 pada awal bulan.

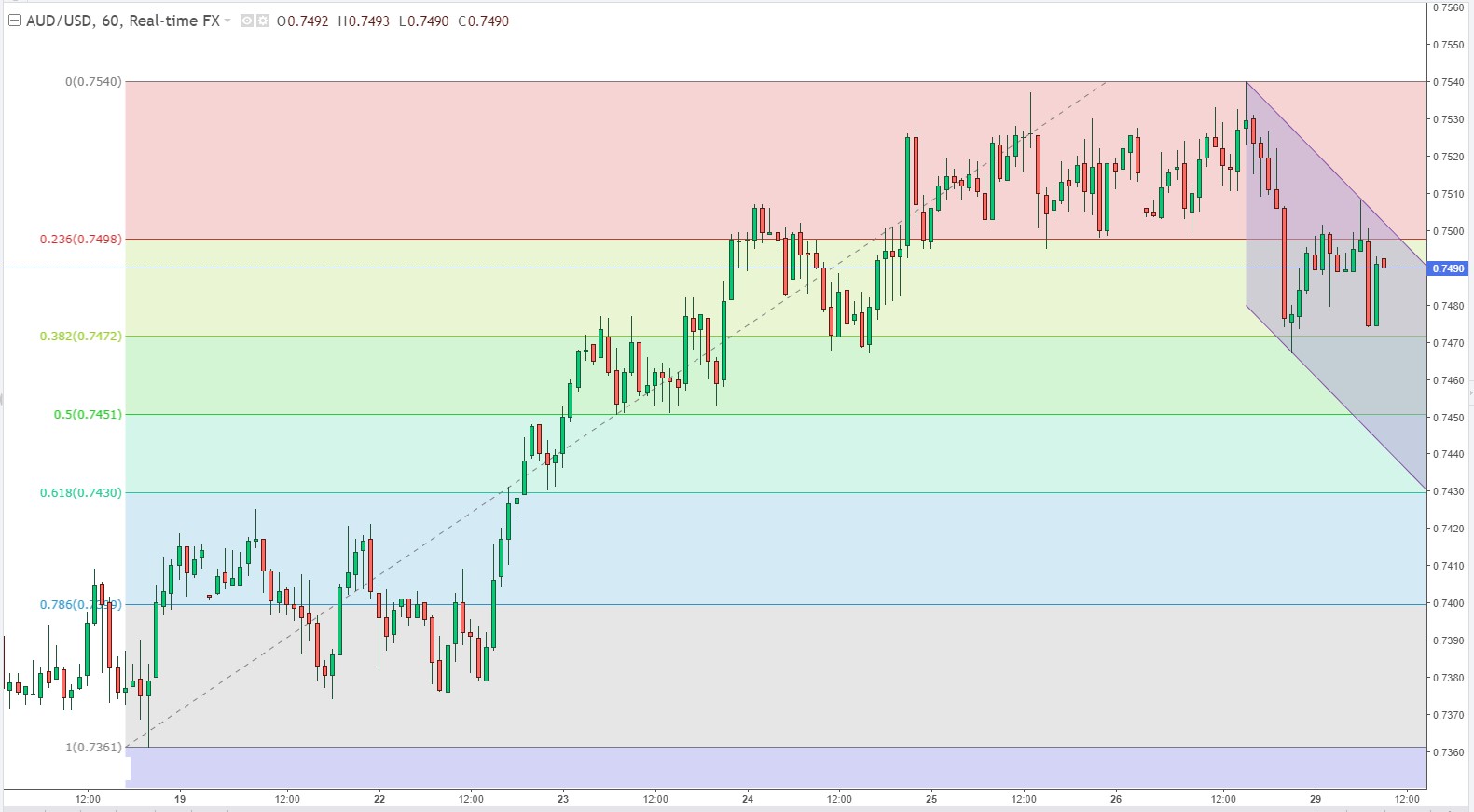

AUD/USD

Dolar Australia merosot dari tertinggi YTD di sekitar 0.7540 sebab sentimen pasar berfluktuasi karena Rusia - kemelut Ukraina, wabah Covid-19 China, dan inflasi yang lebih tinggi mendorong bank sentral global untuk memperketat kondisi kebijakan moneter. Pada saat penulisan, AUD/USD diperdagangkan di 0.7492.

Selera risiko terus dipengaruhi oleh kegelisahan geopolitik dan wabah Covid-19 akhir pekan di China, yang mempengaruhi Shanghai, salah satu kota terbesar, membebani sentimen pasar. Sementara itu, krisis Rusia – Ukraina terus menjadi berita utama. Di akhir sesi Amerika Utara, sumber terkait dengan Financial Times menyatakan bahwa Rusia siap untuk membiarkan Kyiv bergabung dengan Uni Eropa jika tetap militer non-blok sebagai bagian dari negosiasi gencatan senjata yang sedang berlangsung.

XAU/USD

Emas mundur pada hari Senin di tengah tekanan dari imbal hasil Treasury AS yang lebih tinggi dan dolar yang lebih kuat, sementara meredakan kekhawatiran pasokan menjelang pembicaraan damai Rusia-Ukraina mengirim paladium autocatalyst jatuh hampir 8%. Spot gold turun 1.2% menjadi $1.933.12 per ounce pada 14:08. ET (1808 GMT), sementara emas berjangka AS turun 0.7% pada $1.939.80.

Benchmark imbal hasil obligasi 10-tahun mencapai level tertinggi sejak April 2019 pada hari itu, didukung oleh taruhan kenaikan suku bunga agresif oleh Federal Reserve untuk melawan inflasi yang melonjak. Meskipun emas dianggap sebagai lindung nilai inflasi, kenaikan suku bunga AS meningkatkan biaya peluang memegang emas batangan yang tidak menghasilkan.

WTI

Minyak turun lebih dari 8% pada posisi terendah hari ini pada hari Senin karena kekhawatiran atas penguncian baru di China dan dampak potensial pada permintaan membuat harga jatuh. Minyak mentah berjangka West Texas Intermediate, patokan minyak AS, turun 8.25% menjadi diperdagangkan pada $104.50 per barel. Patokan internasional, minyak mentah Brent diperdagangkan 7.4% lebih rendah pada $ 111.61 per barel.

Namun, kedua kontrak memulihkan beberapa kerugian selama perdagangan sore di Wall Street. WTI mengakhiri hari di $105.96 dengan kerugian sekitar 7%. Brent menetap 6.77% lebih rendah pada $112.48 per barel. China adalah importir minyak terbesar di dunia, sehingga setiap penurunan permintaan akan membebani harga. Negara ini menggunakan sekitar 15 juta barel per hari, dan mengimpor 10.3 juta barel per hari pada tahun 2021, menurut Andy Lipow, presiden Lipow Oil Associates.

#AMZN

Saham Amazon.com Inc. rally pada hari Senin, dengan raksasa e-commerce menjadi yang pertama dari saham teknologi megacap yang menghapus kerugian untuk tahun ini. Saham naik 2.6% menjadi $3.379.81, ditutup pada level tertinggi sejak 3 Januari. Mereka sekarang naik 1.4% pada tahun ini, setelah turun lebih dari 18% awal bulan ini.

Amazon telah merebut kembali gelar lama sebagai pemimpin pasar setelah menjadi lamban pada tahun 2021. Pada awal Februari, ia melaporkan hasil kuartal keempat yang jauh lebih kuat dari yang diharapkan, mengurangi kekhawatiran tentang prospek pertumbuhan pasca-pandemi dan memicu pertumbuhan satu hari terbesar. keuntungan oleh saham AS dalam sejarah pasar. Sebulan kemudian, ia mengumumkan pemecahan saham 20-untuk-1, memacu keuntungan tambahan karena Wall Street bertaruh langkah itu dapat menyebabkan minat yang lebih tinggi dari investor ritel.

#AAPL

Apple AAPL menciptakan sejarah di Academy Awards ke-94 dengan memenangkan Oscar pertamanya untuk CODA. CODA Apple TV+ adalah film streaming pertama dengan jajaran pemeran utama tunarungu yang memenangkan penghargaan film terbaik.

Taruhan pembuat iPhone bahwa sebuah film yang berhubungan dengan sebuah pendengaran buatan dalam keluarga tuli adalah unik dan bisa menjadi pesaing Oscar telah terbayar. Apple membayar rekor $25 juta untuk memenangkan hak distribusi untuk film tersebut. Apple merilis film tersebut di sejumlah bioskop untuk jangka waktu terbatas sebelum streaming di Apple TV+. Saham AAPL lebih tinggi 0.88 (+0.50%) ditutup pada 175.60 pada hari Senin.

PERDAGANGAN

PARTNER

PERUSAHAAN

MEMBANTU

Disclaimer: Trading derivatif mengandung risiko kerugian tinggi dan belum tentu cocok untuk semua investor. TIDAK ADA JAMINAN KEUNTUNGAN dari investasi Anda.

ID

ID

-

English

-

Bahasa Indonesia