Maxco Futures – The global oil market entered early 2026 with fragile sentiment. West Texas Intermediate (WTI) prices remain anchored in the mid-USD 50s, extending the bearish pressure that has been in place since late 2025. This level reflects a structural imbalance in the global market, where persistent supply surplus and softening demand continue to cap upside potential.

In early January trading, WTI briefly moved within the USD 56–57 per barrel range, trading below last year’s closing levels. This price action reinforces the view that the weakness in oil prices is not merely seasonal, but rather a continuation of a well-established downtrend that has developed over recent months.

Geopolitical tensions between the United States and Venezuela briefly became a catalyst for volatility. A U.S. military operation that resulted in the detention of President Nicolás Maduro, along with threats of a blockade on Venezuelan oil exports, triggered a short-term surge in risk premium. In several sessions, WTI recorded daily gains of more than 2% amid concerns over potential supply disruptions.

However, the rally quickly lost momentum. Market participants assessed that the actual impact on global physical supply remains limited. Venezuela currently accounts for less than 1% of global oil supply, with production long constrained by sanctions and deteriorating infrastructure. Under these conditions, the risk of supply disruption has not been sufficient to materially alter the fundamental balance of the market.

Overall, recent WTI price movements have reflected headline-driven geopolitical reactions rather than meaningful changes in fundamentals. Institutions such as the International Energy Agency (IEA) continue to highlight a global oversupply of several million barrels per day, which remains the primary factor weighing on oil prices.

In this context, the U.S.–Venezuela conflict acts more as a short-term volatility trigger than a catalyst for a trend reversal. As long as global supply remains ample and demand growth shows no meaningful acceleration, WTI prices are likely to stay subdued despite elevated geopolitical risks.

Outlook & Post U.S.–Venezuela Conflict Scenarios

WTI’s trajectory will largely depend on whether the conflict escalates into a tangible supply disruption or remains confined to geopolitical risk. The market currently frames three key scenarios:

1. Escalation & Physical Supply Disruption (Bullish Risk Scenario)

If tensions escalate into real disruptions—such as port blockades or tighter sanctions—risk premium could re-enter the market. WTI may test levels above USD 59–60 per barrel, particularly if accompanied by declining U.S. crude inventories or disruptions in other major producing regions.

However, any rally is expected to be limited, given the overall loose global supply backdrop.

Implication: High volatility; gains likely tactical and short-lived.

2. Controlled Conflict & Status Quo (Base Case – Neutral)

Tensions persist without materially affecting global oil flows. Market focus returns to oversupply dynamics, OPEC+ policy, and U.S. shale production. WTI trades sideways in the mid-USD 57 to low-USD 59 range, with brief spikes following escalation headlines.

Implication: The conflict remains a volatility trigger, not a trend changer.

3. De-escalation & Normalization of Venezuelan Production (Structural Bearish Scenario)

A relaxation of sanctions and gradual normalization of Venezuelan output would reinforce the global surplus narrative. In this scenario, WTI risks renewed downside pressure toward the low-USD 50s, especially if global economic growth slows.

Implication: Sustained price pressure; rallies likely become sell-on-rally opportunities.

Technical View

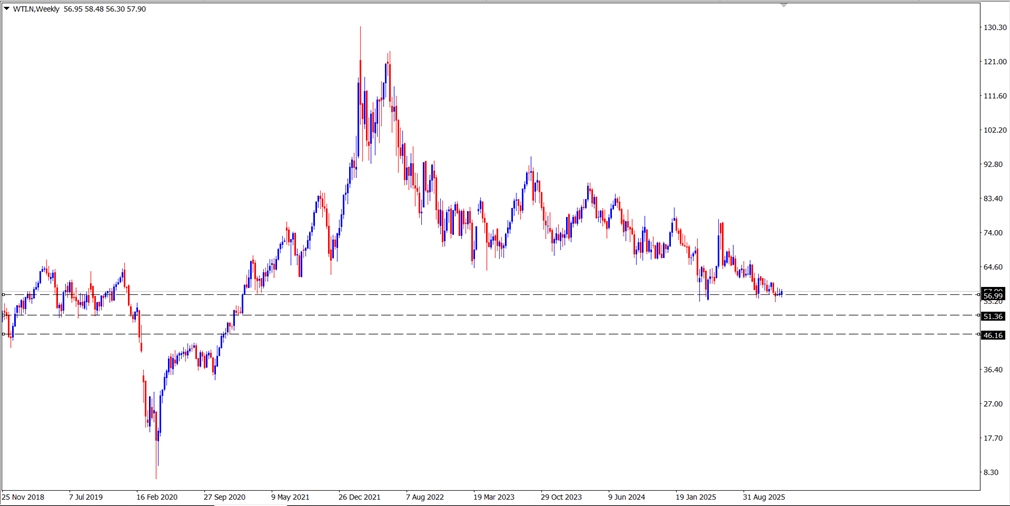

The weekly WTI chart continues to signal a bearish bias, with prices approaching a key support area around 54.8. A decisive break below this level would open the door for further downside, with subsequent support levels at 51.3 and 46.2.

Ade Yunus, ST, WPA

Global Market Strategies