Key Highlights

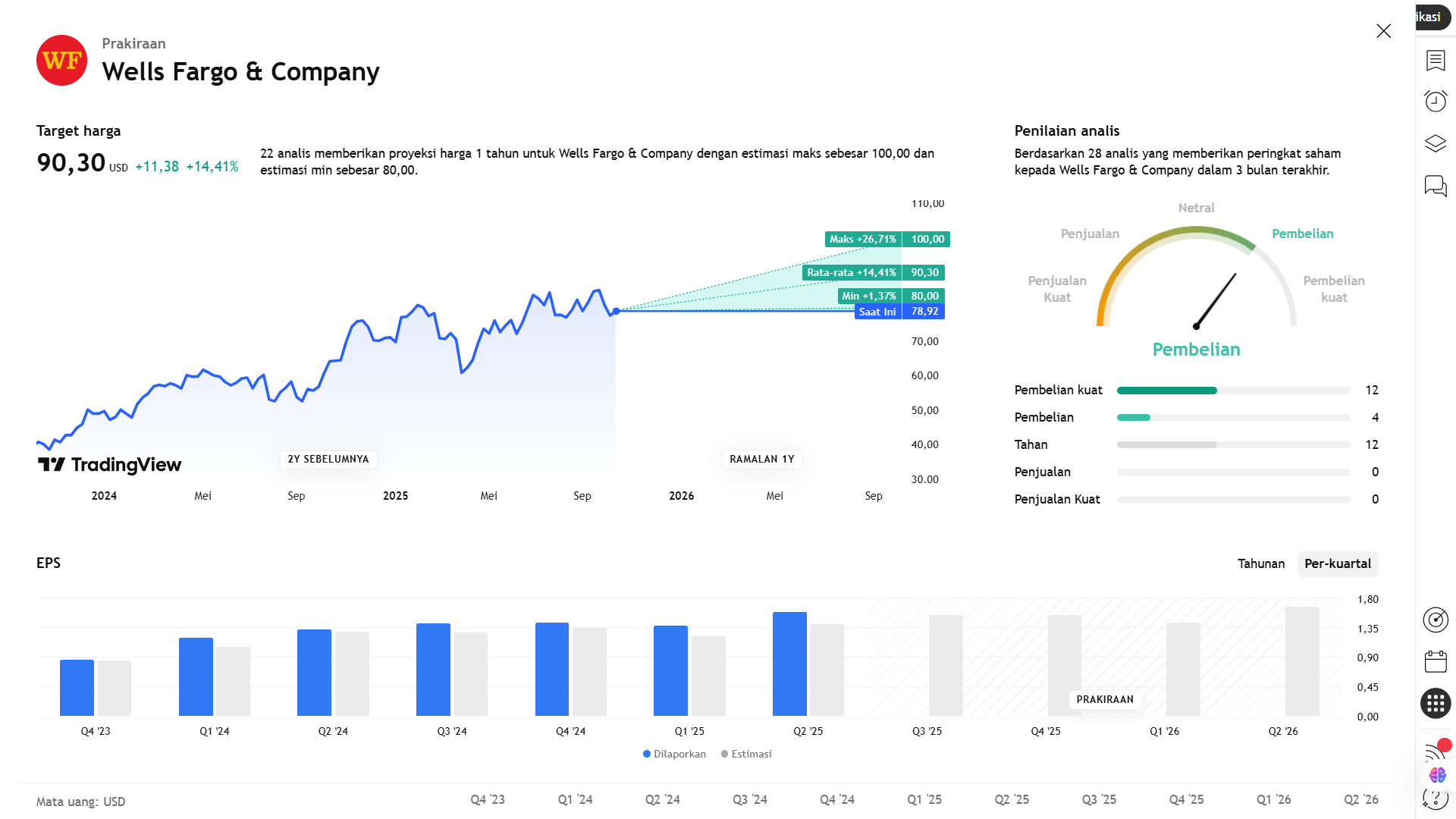

- Since late September, Wells Fargo (WFC) shares have declined by around 7.5%, ahead of its third-quarter 2025 financial report.

- Analysts forecast earnings per share (EPS) of US$1.54 for Q3 2025, reflecting an increase of approximately 1.32% year-over-year (YoY).

Supporting Factors and Opportunities

- Removal of Asset Cap

In June, the Federal Reserve lifted the US$1.95 trillion asset cap that had restricted Wells Fargo’s growth since the fake accounts scandal.

This development opens the door for renewed business expansion and loan growth. - Outlook Upgrade by S&P Global

S&P Global revised Wells Fargo’s outlook from “Stable” to “Positive”, citing improvements in governance, risk management, and internal controls.

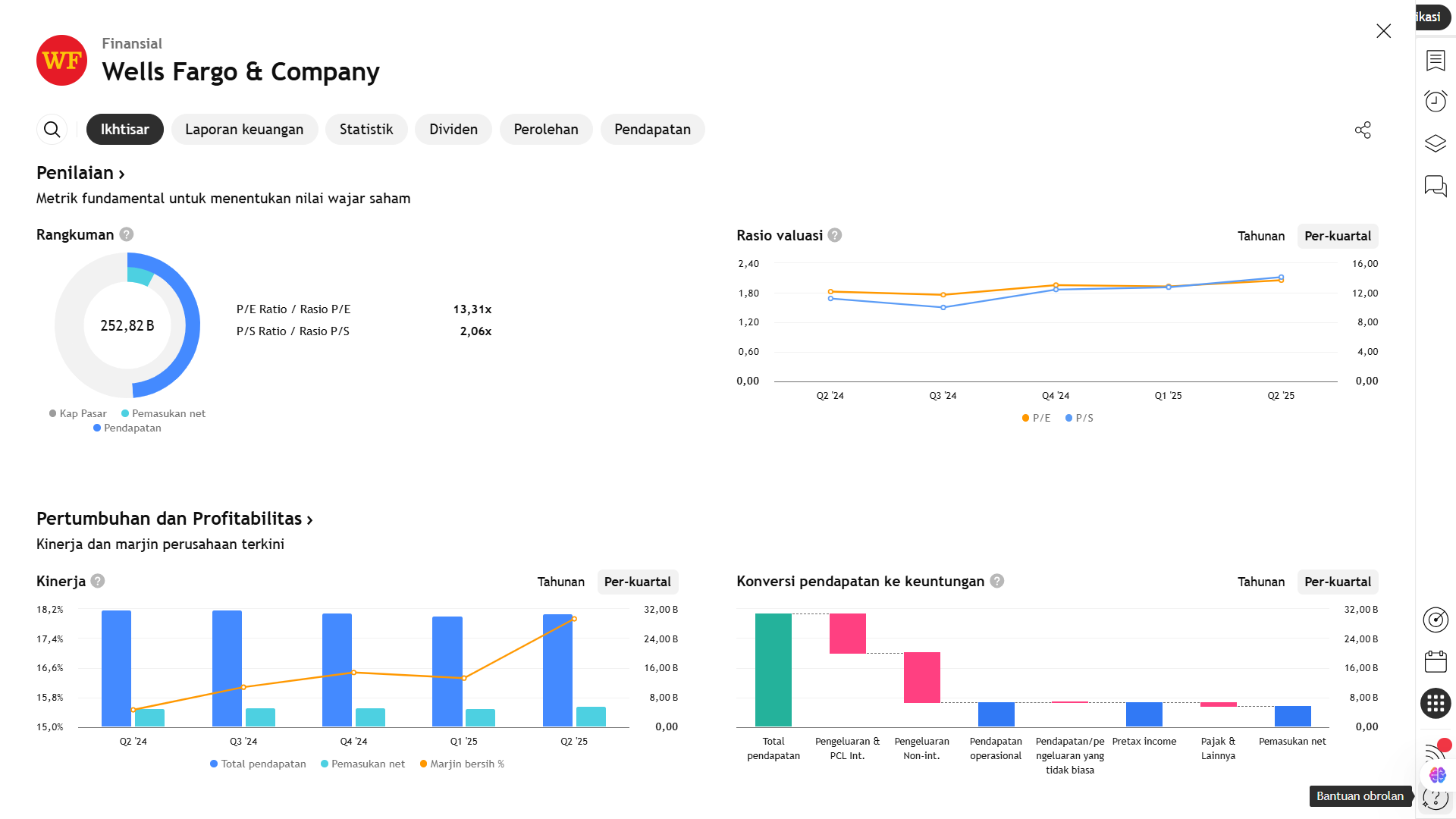

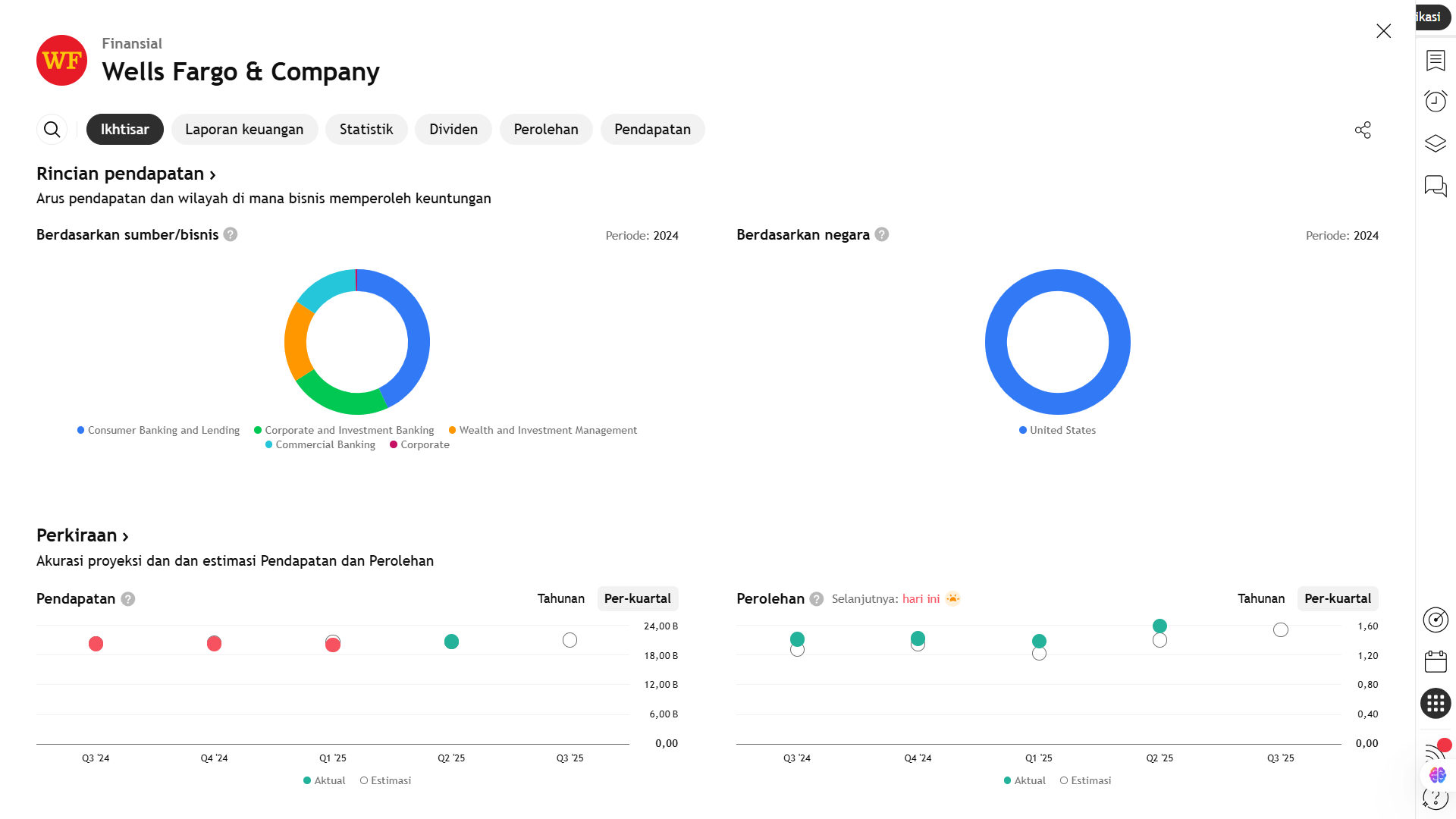

The upgrade signals increasing investor confidence in the bank’s structural recovery. - Growth in Non-Interest Income

In the previous quarter, non-interest income—particularly from investment banking activities—showed notable improvement.

For example, investment banking fees rose by about 9% to US$696 million, contributing to stronger overall revenue diversification.

Challenges and Risks

- Decline in Net Interest Income (NII)

Wells Fargo revised its 2025 NII forecast to remain near 2024 levels (~US$47.7 billion) due to weaker performance in the capital markets division.

In Q1 2025, NII fell by around 6% YoY to US$11.50 billion. - Reputation and Public Trust

Despite the asset cap removal, the legacy of the fake accounts scandal still affects the bank’s reputation.

Rebuilding regulatory, client, and market trust requires consistent ethical practices and disciplined risk management. - Economic and Interest Rate Uncertainty

If interest rates decline or economic growth slows, pressure on interest income could intensify.

Although Wells Fargo has diversified its revenue streams, NII remains a core component of its profitability.

Q3 2025 Report — A Critical Test for WFC

The upcoming Q3 2025 earnings report will serve as an important benchmark for the bank’s recovery and strategic progress.

Markets will closely watch how Wells Fargo:

- Manages pressure on interest income (NII),

- Capitalizes on post-asset-cap growth opportunities, and

- Demonstrates strong risk management and compliance discipline.

Depending on the results and tone of management commentary, the report could act as either a positive catalyst for the stock or lead to further selling pressure.

Earnings Expectations

Wells Fargo (WFC) is scheduled to release its Q3 2025 earnings report on October 14, 2025, before the market opens.

Market Forecasts

- Revenue: US$21.19 billion → up 4% YoY

- EPS: US$1.54 → up 1.3% YoY

- Consensus: Unchanged over the past week

- Earnings Track Record: WFC has beaten estimates for four consecutive quarters, averaging a +9.5% surprise

Key Drivers for Q3 Performance

- Loans and Net Interest Income (NII)

- The Federal Reserve cut interest rates by 25 bps to 4.00–4.25% in September.

- Stable rates throughout the quarter helped contain funding and deposit costs.

- Growth in commercial, property, and consumer lending supported NII expansion.

- Zacks estimates NII at US$12.03 billion, up 2.9% YoY.

- Non-Interest Income

- The mortgage banking business remained weak due to fluctuating interest rates and limited refinancing volume.

→ Estimated mortgage income: US$242.5 million, down 13.4% YoY. - Advisory and asset-based fees likely increased thanks to higher transaction and investment activity.

→ Estimated: US$2.6 billion, up 7.3% YoY.

- The mortgage banking business remained weak due to fluctuating interest rates and limited refinancing volume.

Conclusion

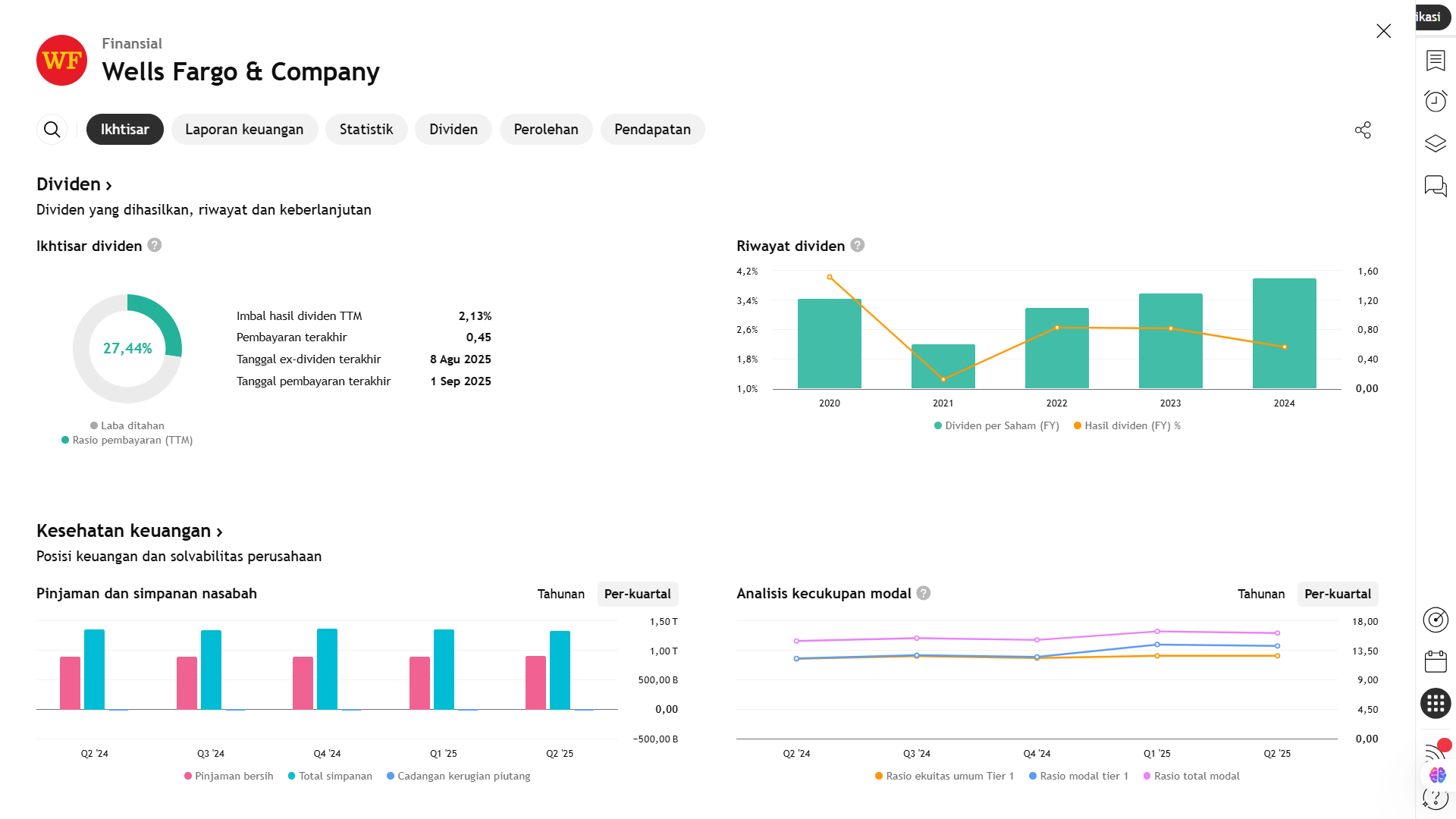

Wells Fargo is expected to deliver a stable Q3 performance, supported by:

- Improving asset quality.

- Steady growth in interest and fee income,

- Well-managed operating costs, and

Earning Projection Prediction

WHAT THE ANALYSIS STATES

Short Term Projection