Stable Consumer Spending Provides Support Amid Tariff Uncertainty

Visa Inc. is scheduled to release its quarterly earnings report on Tuesday evening (U.S. time), with analysts projecting a rise in profit supported by resilient consumer spending. Analysts believe Visa remains strong amid macroeconomic uncertainties, thanks to its global reach and broad exposure to various types of expenditures.

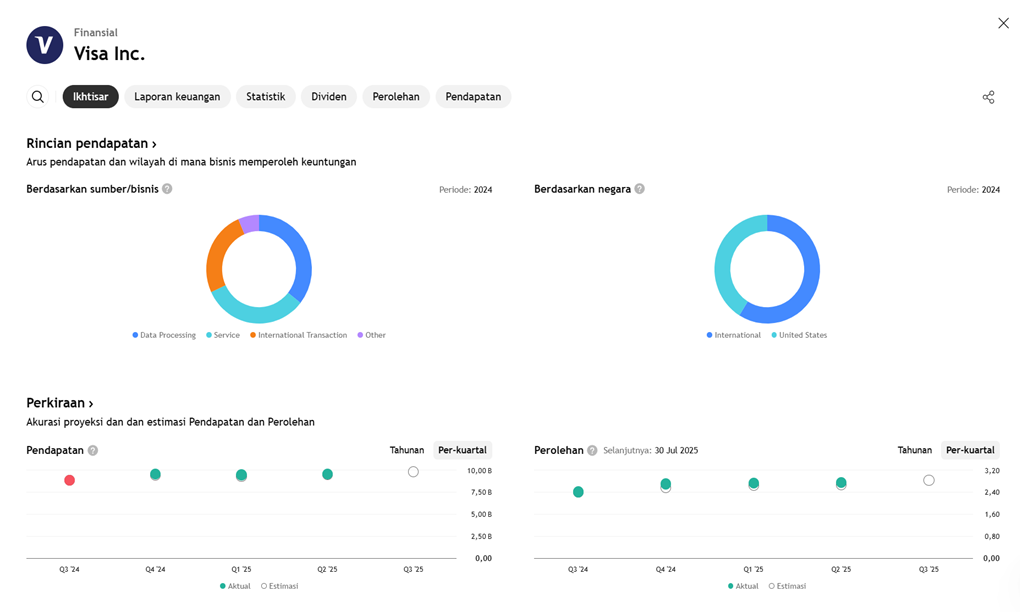

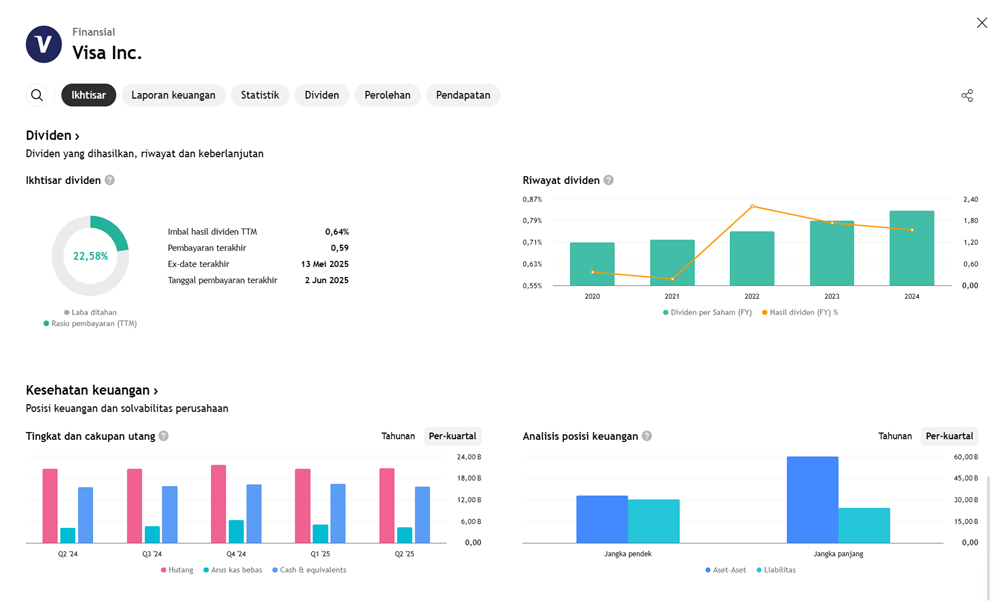

The company has also expanded its business through value-added services such as transaction security and fraud prevention. However, potential slowdowns in international travel and concerns about the impact of new tariffs pose challenges, particularly for the cross-border business segment, which contributes significantly to Visa’s revenues.

Investors are also watching Visa’s strategic steps in the stablecoin space, following new regulations that could reshape the digital payment system landscape in the future.

Key Highlights

- Earnings Release Date: Visa will report its Q3 2025 financial results after market close on July 29, 2025.

- Analyst Estimates:

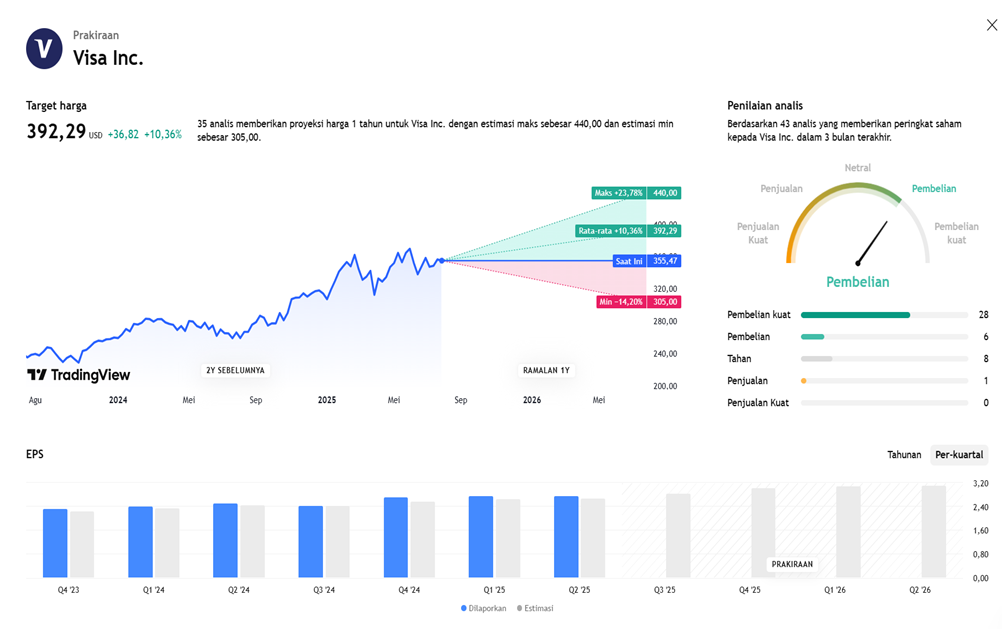

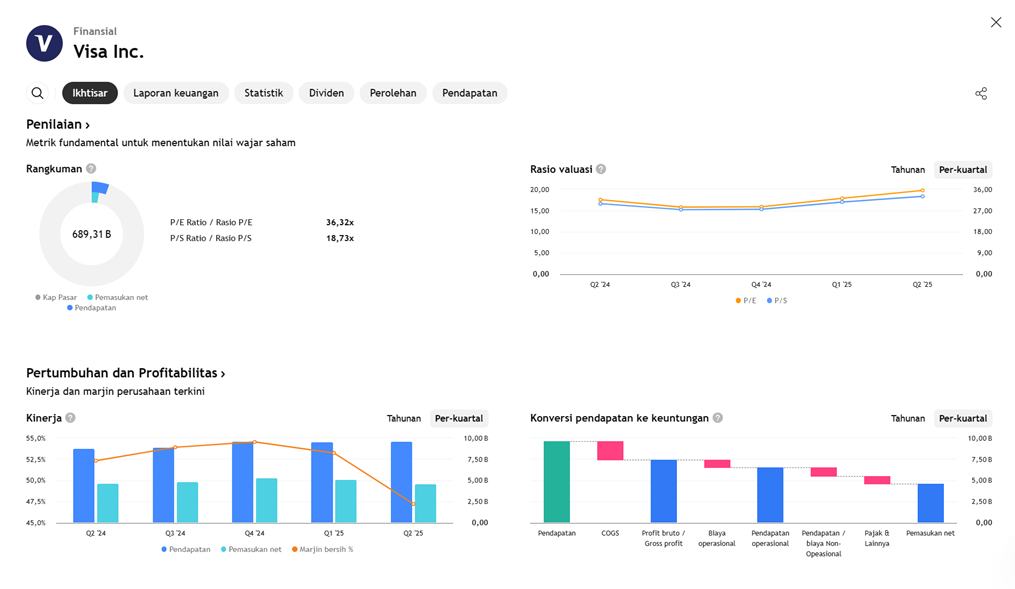

- Revenue is expected to reach approximately $9.82 billion, reflecting a year-over-year growth of ±10%.

- Adjusted EPS (Earnings Per Share) is projected to be in the range of $2.83–2.86, representing an annual increase of around ±17–18%.

- Growth Drivers:

- A surge in transaction volume, particularly cross-border transactions which typically carry higher margins.

- Expansion of high-margin value-added services such as fraud protection, consulting, and merchant solutions.

- Risks & Challenges:

- Macroeconomic uncertainties due to rising tariffs and geopolitical risks could reduce international travel and consumer spending—two major revenue drivers for Visa’s cross-border business.

- Increasing operating expenses, including client incentives expected to exceed $4 billion, could offset some of the gains from growing transaction volume.

- Historical Performance & Market Sentiment:

- In Q2 2025, Visa posted an EPS of $2.76 and revenue of $9.59 billion, both exceeding analysts’ expectations of $2.68 EPS and $9.57 billion in revenue.

- Historical data shows that Visa shares have a 55% likelihood of rising on the day following earnings release over the past five years.

Despite global uncertainties, analysts at Oppenheimer maintain a bullish outlook on Visa shares due to its geographical diversification, effective cost management, and growing contribution from high-margin service segments.

Earning Projection Prediction

WHAT THE ANALYST STATED