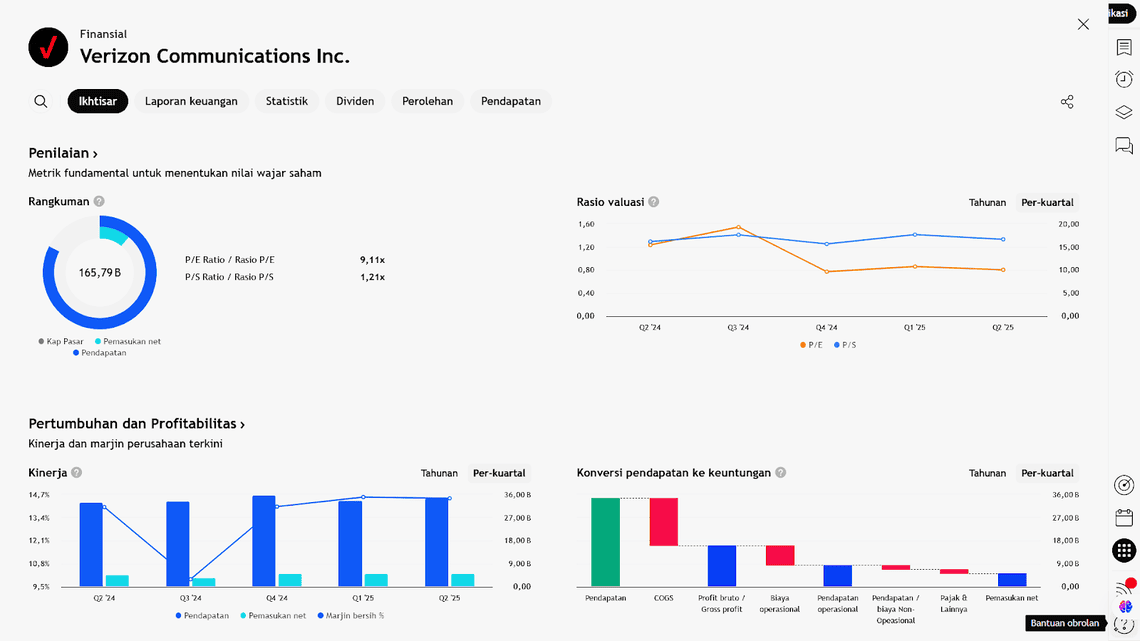

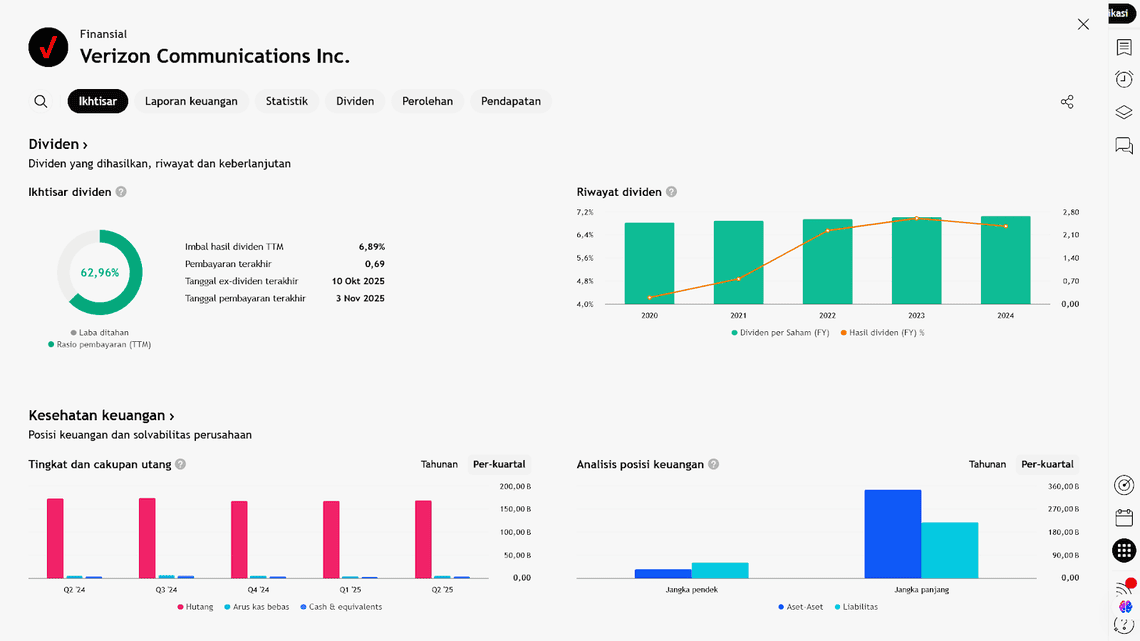

As Verizon Communications Inc. prepares to release its third-quarter earnings report, the company is once again in the spotlight amid an evolving telecommunications landscape. Following a period of volatility across the wireless and broadband sectors, investors are now watching closely to see how Verizon’s cost-efficiency strategies, 5G network expansion, and growing fixed wireless broadband subscriber base are supporting its overall performance.

Fierce competition from AT&T and T-Mobile has pushed Verizon to accelerate innovation while carefully balancing pricing strategies with value-added service improvements. At the same time, infrastructure costs and softening post-pandemic demand continue to pressure margins — forcing management to maintain profitability without compromising the company’s hallmark network quality.

This earnings report will serve as a key barometer for assessing the effectiveness of Verizon’s internal restructuring and its long-term direction within the U.S. communications market. Market participants will be looking beyond quarterly results, focusing instead on management’s guidance for the remainder of the fiscal year — specifically, whether Verizon can sustain its recovery momentum or will face renewed headwinds from intensifying competition and price pressure.

Market Expectations

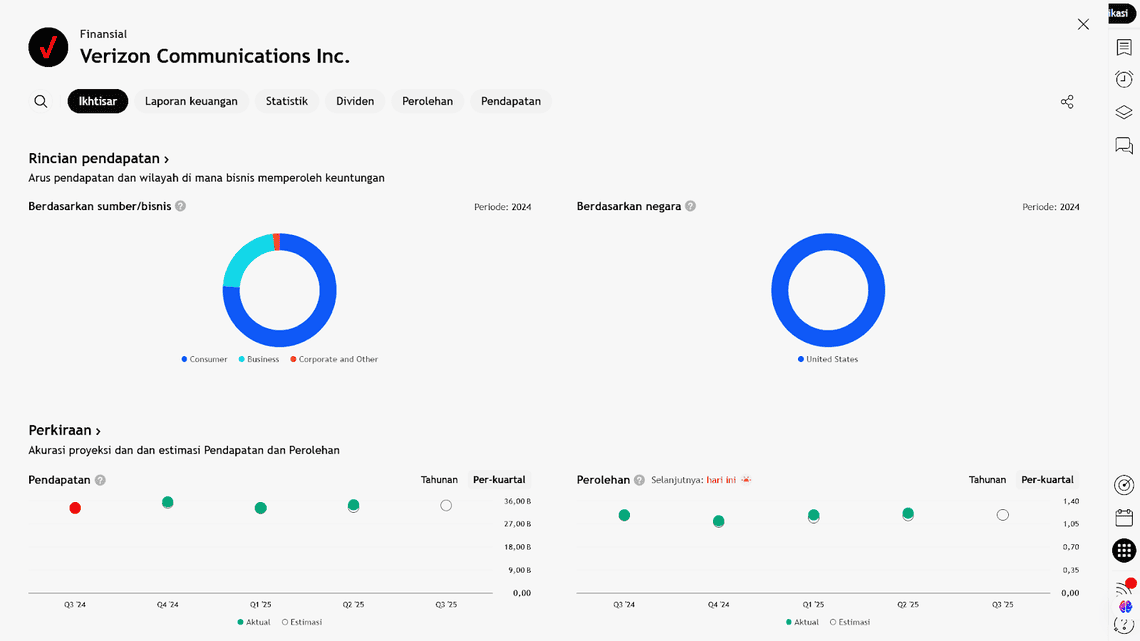

- Revenue is projected to grow around 10.3% year-over-year, reaching approximately US$10.61 billion.

- Adjusted EPS (Earnings Per Share) is expected to come in around US$2.97.

- For comparison, in the previous quarter Visa reported US$10.17 billion in revenue — up 14.3% year-over-year.

- Analyst estimates have remained stable over the past 30 days, suggesting consistent expectations ahead of the report.

Key Notes & Context

- The 10.3% growth rate represents a slowdown from the 11.7% growth recorded in the same period last year.

- Over the past two years, Visa (note: this data section likely refers to Visa Inc.) has missed Wall Street revenue expectations only once, typically exceeding forecasts by an average of 1.2%.

- Competitor performance in the credit and payment sector shows a mixed picture:

- Capital One Financial Corporation delivered 53.4% year-over-year growth, beating expectations.

- Synchrony Financial reported flat growth but still slightly exceeded analyst forecasts.

- The average analyst price target for Visa stock stands at US$392.59, compared to the market price of around US$347.50 at the time of writing.

Investor Implications

- Since Visa (likely an editorial mismatch with Verizon here) rarely misses expectations, this report could be crucial to gauge whether its growth trajectory can be sustained.

- The deceleration in growth from ~11.7% to ~10.3% signals potential pressure from macroeconomic conditions, consumer spending trends, or competitive dynamics — all factors that merit close attention.

- Despite slower growth, the optimistic analyst consensus and high price targets suggest that the market still expects the company to maintain or strengthen its momentum moving forward.

Earning Projection Prediction

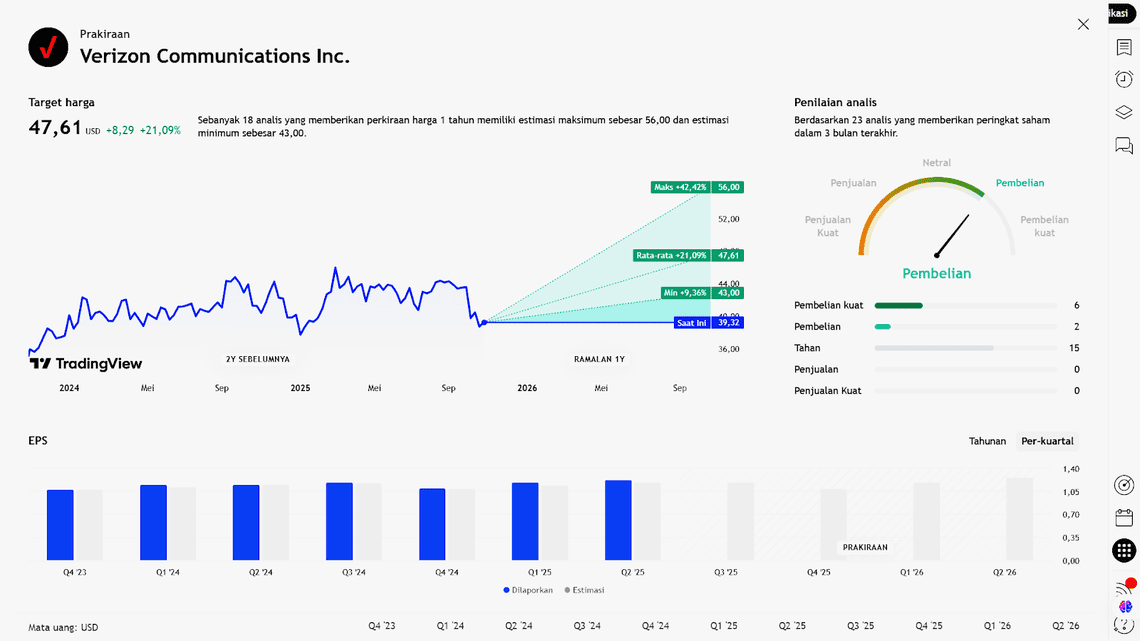

APA YANG DINYATAKAN ANALIS

Short – Medium Term Projection

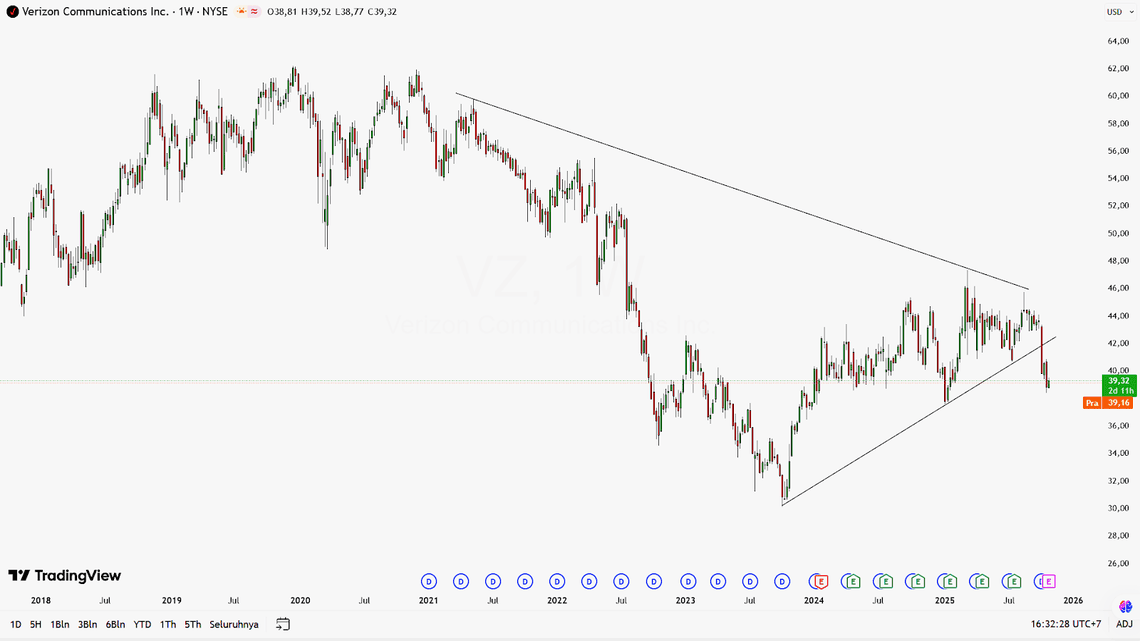

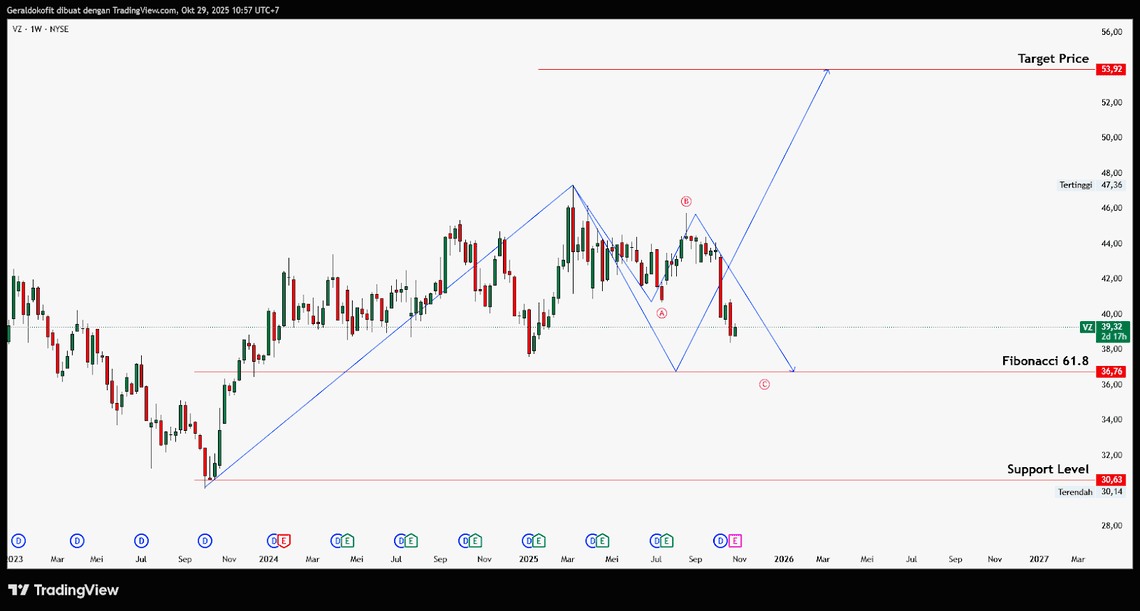

Strategi

| Buy Verizon | |

| Entry | 36,76 |

| Take Profit | 53,92 |

| Stoploss | 30,63 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst