Persistent Pressure, Markets Await The Fed Decision

The US Dollar Index (DXY) enters a critical week with selling pressure still dominant. The latest economic data from the United States indicate weakening fundamentals, particularly on the employment front. Weekly unemployment claims have surged to their highest level in more than three years, while consumer confidence and monthly inflation indicators have not been strong enough to dampen market expectations of a rate cut. These conditions reinforce the view that the Federal Reserve is almost certain to lower interest rates by 25 basis points at the FOMC meeting on September 17–18.

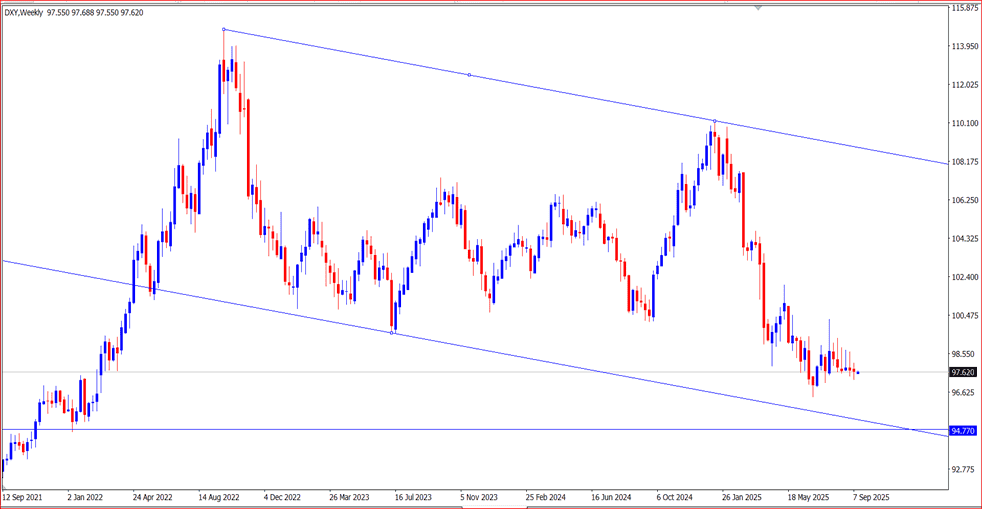

Growing confidence in a rate cut has diminished some of the appeal of the dollar. Although the dollar briefly gained limited strength due to safe-haven demand following geopolitical tensions, the bearish pin bar formation on the weekly chart confirms that the dollar is now in a corrective trend.

Impact on Major Currencies

Euro (EUR/USD)

The euro has gained momentum against the dollar throughout this week. The most recent remarks from ECB President Christine Lagarde, affirming that the disinflation process has ended, signal that the European central bank may not loosen policy too aggressively. The combination of a weakening dollar and steady ECB policy has pushed EUR/USD higher, although investors remain cautious regarding the Eurozone’s economic slowdown.

British Pound (GBP/USD)

The pound has also been supported by the weakening dollar, although persistent inflationary pressure in the UK poses a dilemma for the Bank of England. The market expects the BoE to remain cautious in cutting interest rates, meaning that the policy gap with the Fed could further bolster GBP/USD.

Japanese Yen (USD/JPY)

The yen has taken advantage of the dollar’s weakness to strengthen slightly, though its movement remains limited. The Bank of Japan continues to maintain very low interest rates, so the yield differential with the US remains wide. However, if the Fed does cut rates, the pressure on the yen could ease. For now, USD/JPY is likely to correct, but there are no signs yet of a significant trend reversal.

Australian Dollar (AUD/USD)

The Australian dollar has also strengthened against the greenback, supported by risk-on sentiment as expectations for a Fed rate cut rise. However, the outlook for the AUD still hinges on Chinese economic data—Australia’s major trading partner—as well as policy from the Reserve Bank of Australia. So long as global sentiment favors risk assets, AUD/USD has the potential to continue its upward trend.

Impact on Gold

Gold prices (XAU/USD) have held steady to somewhat higher over the week, driven by a weaker dollar and expectations of Fed easing. A softer dollar makes gold cheaper for holders of other currencies, boosting demand both physically and for investment.

However, gold’s gains are partially constrained by temporary dollar strength driven by safe-haven inflows amid rising geopolitical tensions. Nonetheless, the medium-term outlook remains positive: if the Fed indeed enters a rate-cutting cycle, gold could receive strong support to break through important resistance levels.

Outlook Going Forward

Markets are currently awaiting two key determinants:

- Fed Decision: Jerome Powell’s remarks at the post-meeting press conference will be pivotal in determining the next direction for the dollar. A clearly dovish tone may accelerate the dollar’s weakening, while a more cautious stance could allow it some room to rebound.

- Upcoming US Economic Data: Employment, inflation, and business activity figures in the coming weeks will shape how aggressive Fed will be with monetary easing.

Overall, the short-term outlook for the dollar index is negative, with room for strengthening in the euro, pound, and aussie, and the potential for gold to rebound. The yen may remain rangebound, but could stabilize if the monetary policy differential with the US begins to narrow.

The DXY chart above shows that DXY is currently moving close to a channel support line, making this area a possible limit for its downward movement before further confirmation or correction occurs. Resistance is observed around 100.36 and 101.98, while support lies in the regions of 96.30 and 94.62.

Disclaimer ON

Ade Yunus WPA

Global Market Strategies