The US Dollar Index (DXY) heads into the weekend with a positive tone, supported by US economic data released throughout the week that bolstered the Federal Reserve’s interest rate outlook. Today, Friday (September 26), market focus shifts to the Fed’s preferred inflation gauge, the PCE Price Index, along with US personal income and personal spending data.

Key Data Highlights

The August report underscores several important points:

- Core PCE Price Index (MoM): Expected to hold steady at 0.3%, matching the previous month and above the 0.2% consensus, signaling persistent underlying inflationary pressures.

- Personal Income (MoM): Projected to rise 0.3%, slightly below July’s 0.4% but still supportive of purchasing power.

- Personal Spending (MoM): Forecast to ease to 0.3% from 0.5%. While indicating softer consumption, it still points to growth.

- Headline PCE Price Index (MoM): Anticipated to climb to 0.3% from 0.2%.

- PCE Price Index (YoY): Expected to accelerate to 2.8% from 2.6%, reaffirming that annual inflation remains above target.

Implications for the US Dollar

If the data meets or exceeds expectations—particularly Core PCE and YoY PCE—the market will likely interpret this as inflation remaining “sticky.” This would reinforce the Fed’s cautious stance, making it less inclined to cut rates prematurely. Consequently, the US dollar could gain additional momentum, as investors anticipate higher-for-longer interest rates.

Conversely, if the data undershoots forecasts—say, Core PCE slips to 0.2% or YoY PCE stays at 2.6%—markets may interpret this as easing inflationary pressure, opening the door for a technical pullback in the DXY.

Technical Outlook for DXY

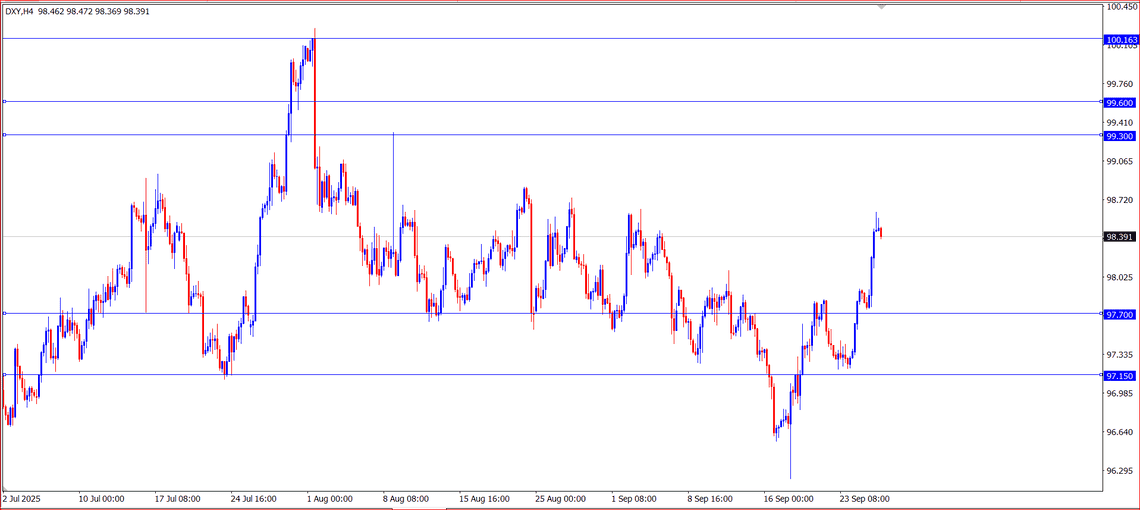

From a technical standpoint, DXY remains in a short-term bullish channel after breaking above 98.60. If inflation data supports the move, the index could test resistance around 99.30, 99.60, and 100.15. However, weaker data could trigger a decline toward nearby support levels at 97.70 and 97.15.

Conclusion

Overall, upcoming PCE and consumption data will serve as key drivers for DXY’s direction into the week’s close. With inflation still showing resilience, the short-term bias leans bullish. Investors will be watching closely to see whether the Fed has room to delay rate cuts—a move that could extend the dollar’s rally.

Ade Yunus

Global Market Strategies