Jakarta — Tesla Inc. (TSLA) is expected to post the highest quarterly revenue in its history in the upcoming Q3 2025 earnings report, scheduled for release after the U.S. market close on Wednesday. However, behind the record figures, analysts caution that net profit may not be as strong as revenue growth, as Tesla continues its price-cutting strategy amid intensifying competition in the global electric vehicle (EV) market.

Tesla reported vehicle deliveries of 497,099 units in the third quarter, up 2% from the previous period, while production reached 447,450 units. The increase was primarily driven by robust demand in North America, as buyers rushed to take advantage of expiring U.S. EV tax incentives, pulling forward purchases into the current quarter.

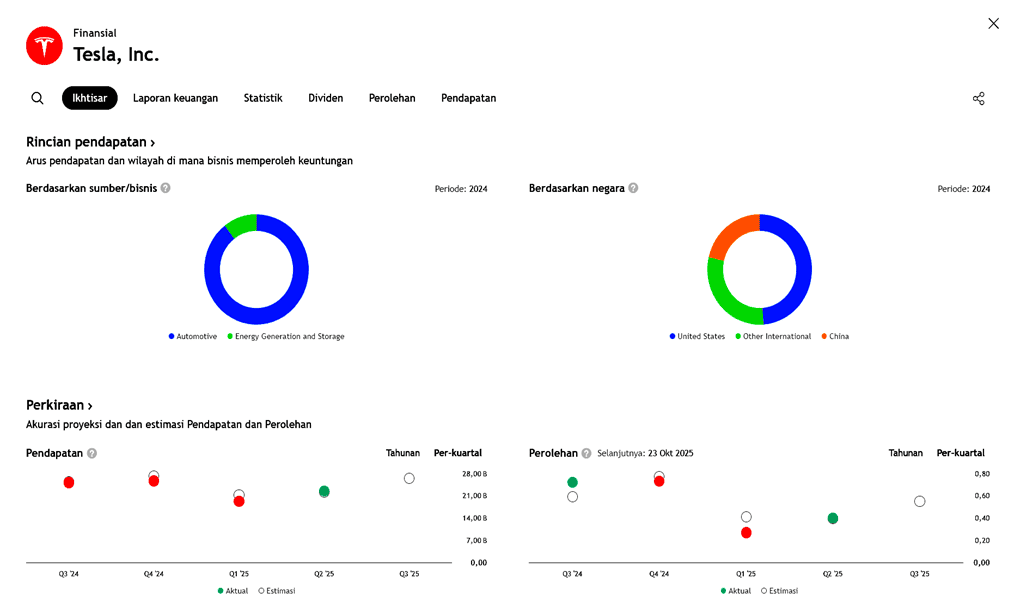

In addition, Tesla Energy achieved a new record with 12.5 GWh of energy storage capacity deployed during the quarter — underscoring the growing importance of Tesla’s non-automotive business as a strategic driver of long-term growth.

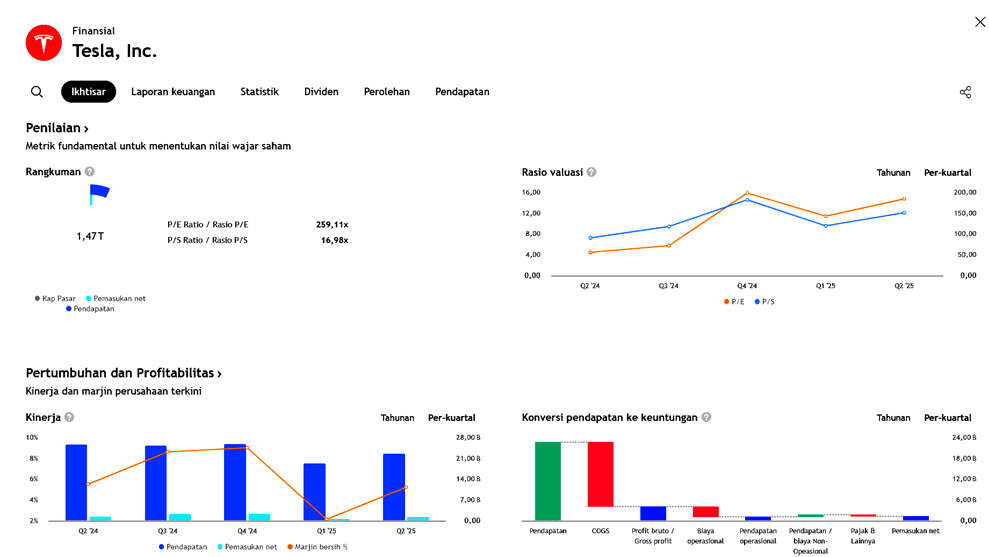

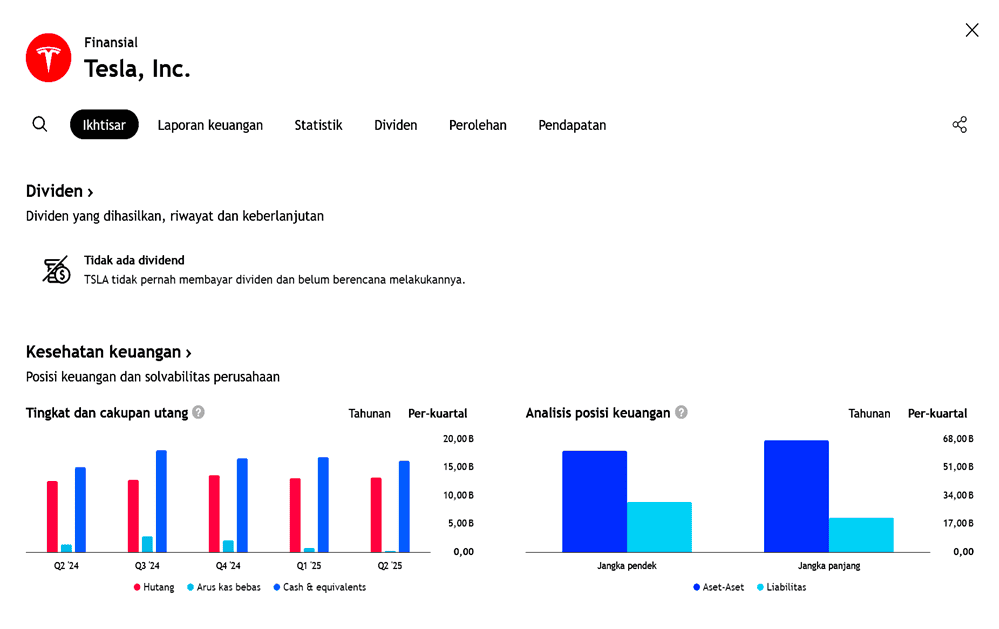

While sales volume and revenue are expected to surge, profit margins remain under pressure. Tesla’s aggressive price cuts — particularly on the Model Y and Model 3 — have helped sustain market share amid fierce competition from Chinese EV makers such as BYD and NIO, but have also eroded overall profitability.

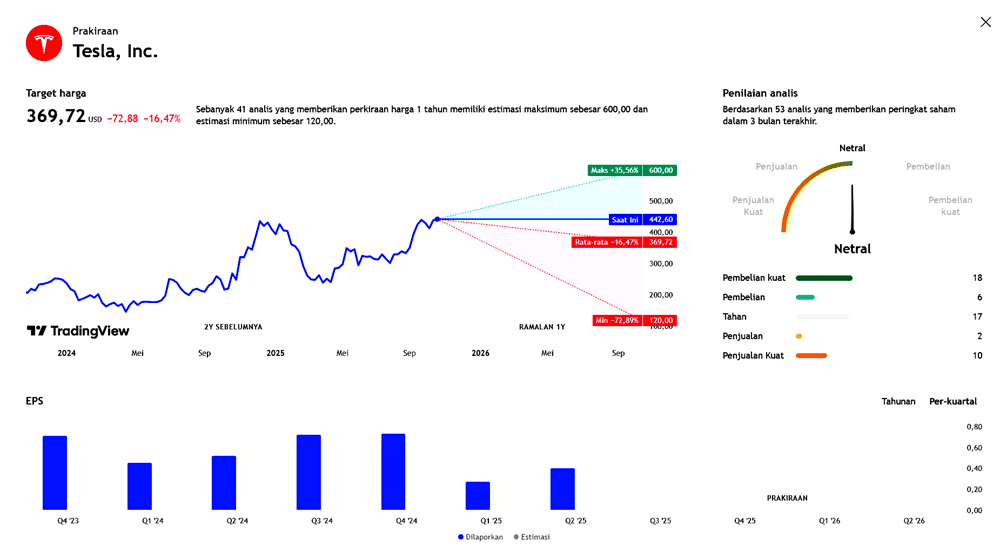

Market consensus estimates Tesla’s revenue at around US$26.4 billion, up from US$25.5 billion in the previous quarter, with earnings per share (EPS) projected in the range of US$0.55–0.57. If realized, this would represent solid year-over-year revenue growth, albeit with relatively flat operating margins.

Investors will be closely watching Elon Musk’s comments on several key topics, including the timeline for the robotaxi rollout, progress on the Optimus humanoid robot project, and updates on Full Self-Driving (FSD) as it moves toward unsupervised driving capability. Questions are also expected about the company’s product roadmap — particularly its compact car and Cybertruck-based pickup variants — as well as factory expansion plans in Mexico and India.

Although this could be one of Tesla’s strongest quarters in terms of revenue, analysts warn of potential short-term demand risks due to the “pull-forward effect” from tax credit–driven purchases. This could result in a softer Q4 performance unless Tesla sustains momentum through technology innovation and continued battery cost reduction.

Key Highlights

- Earnings release date: October 22, 2025 (after U.S. market close)

- Vehicle production and deliveries (Q3 2025):

- Production: ~447,450 units

- Deliveries: ~497,099 units (+2% QoQ)

- Energy segment: Record 12.5 GWh of energy storage deployed in the quarter.

- Revenue: Market consensus at ~US$26.45 billion, slightly above Estimize’s estimate of ~US$26.27 billion.

- Earnings per share (EPS): Around US$0.55 (market consensus) to US$0.57 (Estimize).

- Despite the record revenue projection, profit is unlikely to hit a record due to ongoing price reductions amid intensifying competition.

What to Watch in the Investor Call & Shareholder Letter

Tesla is expected to strike a confident tone in this quarter’s presentation. Reports indicate that the shareholder meeting has been moved to early November, partly due to the pull-forward impact of U.S. EV tax incentives, which boosted Q3 demand.

Key questions likely to arise from investors include:

- Updates on robotaxi and Full Self-Driving (FSD): When will fully unsupervised driving become reality?

- Demand and backlog for energy products such as Megapack, Powerwall, and Solar Roof — and Tesla’s plans to support hyperscale AI and data center operators.

- New vehicle pipeline: Compact car, SUV/pickup based on Cybertruck, and next-generation platform developments.

- Progress on the Optimus humanoid robot: supply chain challenges, mobility systems, and software integration.

- Timeline for legal, wide-scale FSD deployment without human supervision.

Additional Notes

While Tesla’s core automotive business remains the backbone of its financial performance, profitability has been pressured by price cuts and intensifying global competition, potentially leading to a declining earnings trend despite revenue growth.

Moreover, analysts note that the strength of this quarter was partly fueled by accelerated purchases ahead of expiring tax incentives — which could dampen momentum in subsequent quarters if not offset by technological innovation and sustained cost efficiencies.

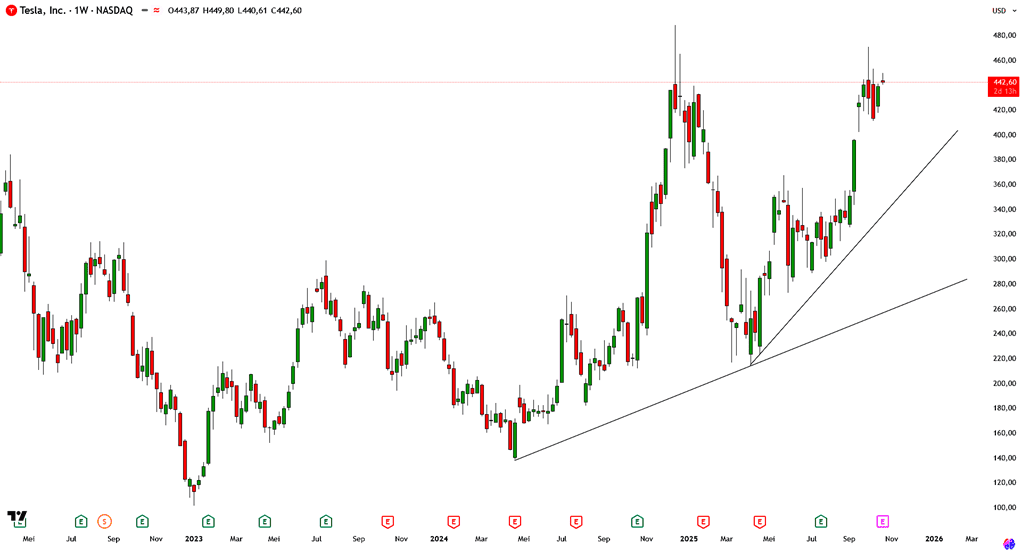

Earning Projection Prediction

WHAT THE ANALYST SAYS

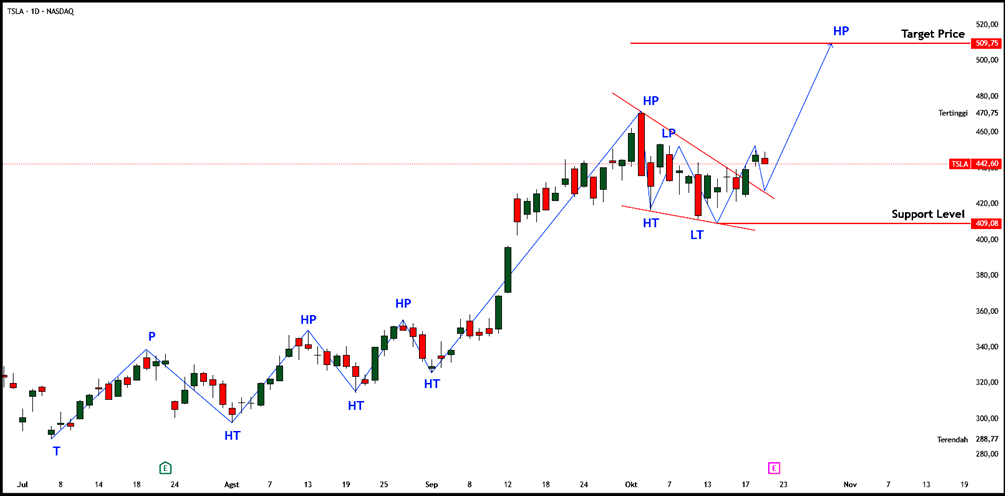

Short – Medium Term Projection

Strategy

| Buy 3M | |

| Entry | 442.60 |

| Take Profit | 509.75 |

| Stoploss | 409.08 |

Disclaimer On