This Week’s Focus:

TECH EARNINGS, INFLATION, AND THE FUTURE OF INTEREST RATES

Tech Giants Earnings Surge

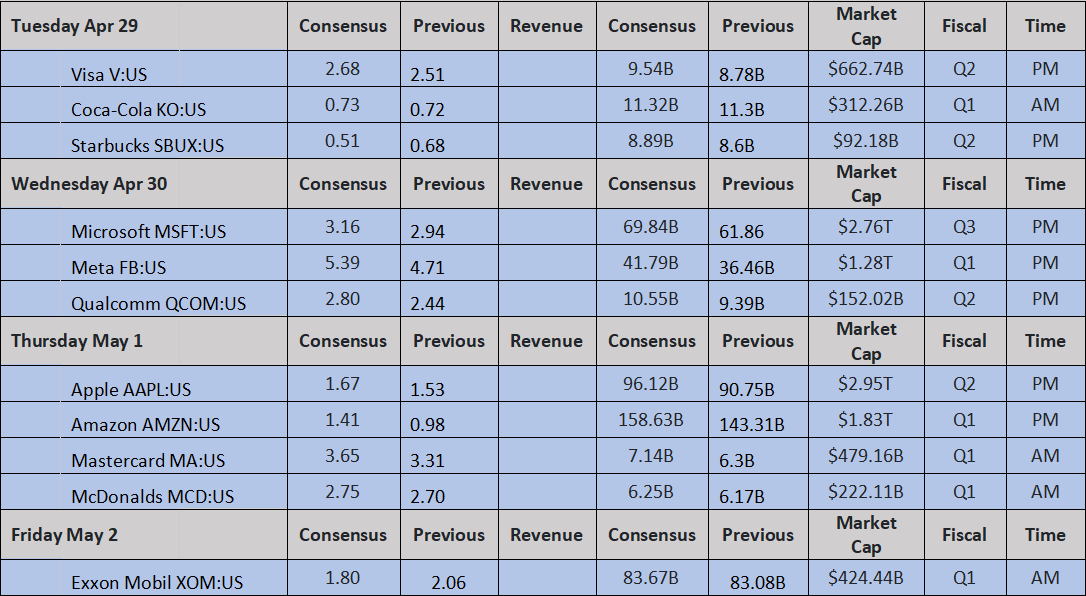

This week will be packed with crucial earnings reports from tech giants that could shape market momentum. Meta Platforms (META) and Microsoft (MSFT) are set to report on Wednesday, followed by Amazon (AMZN) and Apple (AAPL) on Thursday.

Together, these companies represent a significant portion of the S&P 500’s market cap and have recently driven overall market performance. Investors will focus on insights into digital advertising trends, cloud growth, AI investment returns, consumer spending behavior, and supply chain conditions.

Forward guidance will be critical, especially given the market’s heightened sensitivity to future growth expectations. These earnings could either reinforce or challenge the prevailing AI-driven growth narrative.

April Jobs Report

The April Nonfarm Payrolls report, due Friday at 8:30 AM, is this week’s key economic event. Amid mixed labor market signals, this report will be crucial in assessing whether job growth remains robust or is weakening.

Markets will closely watch job creation numbers, the unemployment rate, and especially average hourly earnings as an inflation gauge. With the Fed’s next policy meeting looming, any sign of labor market cooling could reignite hopes for rate cuts — while strong data could delay such moves.

Key Inflation Gauge

The Personal Consumption Expenditures (PCE) Price Index — the Fed’s preferred inflation measure — will be released Wednesday at 10:00 AM. Following hotter-than-expected CPI data, this report will be critical to confirm whether inflationary pressures are cooling or persisting.

Markets will focus particularly on Core PCE (excluding food and energy).

This release coincides with the Q1 GDP preliminary report at 8:30 AM the same day, offering a broad view of economic growth and price pressures. Expect significant volatility across rate-sensitive sectors like technology, utilities, and real estate.

Consumer Sentiment Snapshot

The Conference Board’s Consumer Confidence report, due Tuesday at 10:00 AM, will provide valuable insights into household sentiment and spending intentions.

Following mixed retail sales data, this update will help assess consumer resilience amid persistent inflation and trade policy uncertainty.

Detailed readings on home, auto, and major appliance purchase plans will be closely watched, especially with earnings reports from Starbucks (SBUX) on Tuesday and McDonald’s (MCD) on Thursday offering additional perspectives on consumer behavior.

Manufacturing Sector Momentum

Thursday brings key manufacturing data releases: the Manufacturing PMI at 9:45 AM, followed by the ISM Manufacturing PMI at 10:00 AM.

Ahead of that, Wednesday’s Chicago PMI at 9:45 AM will offer a regional snapshot.

Manufacturing has shown tentative stabilization after prolonged contraction. These reports are critical to confirm ongoing recovery or emerging challenges, especially amid tariff uncertainties and supply chain risks.

Industrial stocks, material suppliers, and transport companies could experience heightened volatility based on these outcomes. Earnings from Caterpillar (CAT) on Wednesday and Exxon Mobil (XOM) and Chevron (CVX) on Friday will offer additional industrial sector insights.