Over the past month, the U.S. stock market—particularly the S&P 500 index—has seen steady gains without any daily volatility exceeding 1%. In the last 30 days, the S&P 500 has recorded 11 new all-time highs, driven by a combination of factors:

- Optimism over potential global trade deals

- Strong corporate earnings reports

- Easing of economic policy uncertainties

This Week’s Economic Agenda Could Spark Volatility

Despite low market volatility recently, several key events this week have the potential to trigger significant market moves:

- Earnings reports from major tech companies

- The U.S. government’s trade policy deadline (August 1st)

- The Federal Reserve’s meeting

- The U.S. Non-Farm Payroll report

Investors should be aware of potential short-term turbulence even as economic fundamentals remain relatively solid.

Positive Developments in Trade Policy

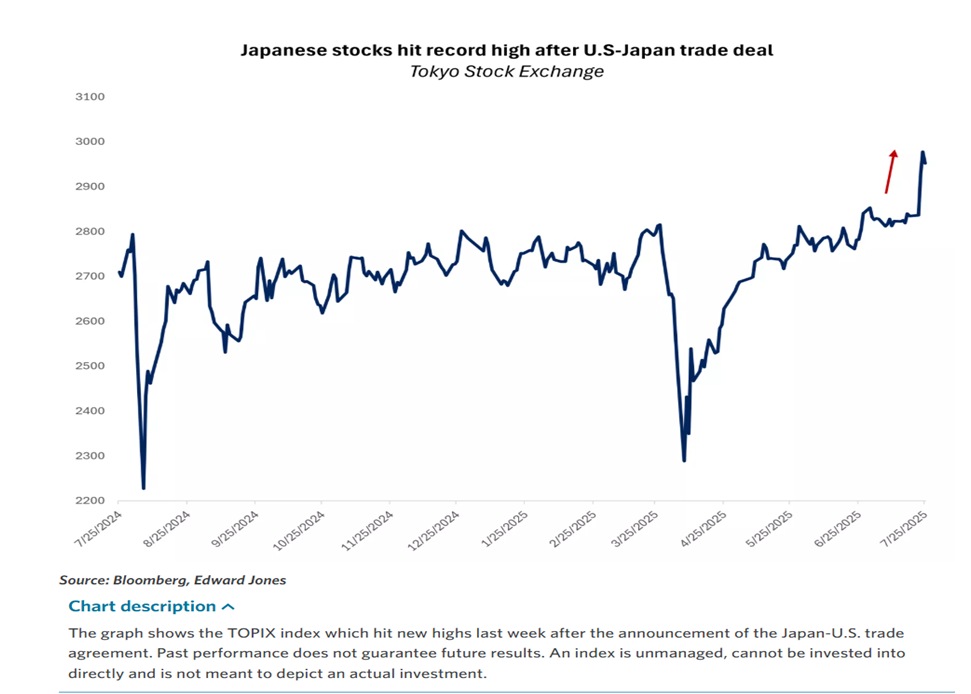

The trade uncertainty that triggered a nearly 20% correction back in April has begun to ease. The U.S. government has signed several new trade agreements, including with:

- Japan (tariffs lowered from 25% to 15%, plus a $550 billion U.S. investment commitment)

- The UK, Vietnam, Indonesia, and partially with China

Other countries like the EU, Canada, South Korea, and India remain in active negotiations. This clarity allows businesses to reassess their investment and expansion plans.

Monetary Policy: Market Awaits Dovish Signals

There is mounting pressure on the Federal Reserve to begin lowering interest rates, given slowing global growth and moderating inflation. The market is now anticipating rate cuts starting in September. The Fed’s remarks this week could have a major impact on market direction.

Market Sentiment & Speculative Risk

The resurgence of speculative stocks—commonly referred to as “meme stocks”—indicates pockets of euphoria in the market, though overall sentiment remains balanced. With equity valuations relatively high, the market now relies heavily on earnings growth to sustain its upward momentum.

U.S. Economy in a Sweet Spot—At Least for Now

Despite slower economic growth in the first half of the year, recent data suggests that fears of stagflation—a combination of high inflation and low growth—may still be premature.

- The labor market remains stable, as evidenced by declining initial jobless claims, indicating limited layoffs.

- Retail sales in June exceeded expectations, showing that consumers are still spending.

- Inflation appears under control. While goods prices have not surged, the services sector—making up 75% of the inflation index—has seen price declines.

However, over the coming months, trade tariffs are expected to negatively impact growth, especially in manufacturing and exports.

Fiscal Stimulus: Hope from the Government

There is good news on the fiscal side. A newly passed tax bill has provided clarity for investors. The government is also expected to introduce stimulus measures through:

- Tax cuts

- Business investment incentives

- Deregulation

These efforts are expected to gradually support economic recovery.

The Fed Under Pressure: Navigating Politics and Data

The Federal Reserve is under increasing political pressure. The White House has been pushing for interest rate cuts, following the example of the European Central Bank, which has slashed rates by 2% over the past year. In contrast, the Fed has cut only 1%.

The situation is further complicated by the nearing end of Jerome Powell’s term as Fed Chair. Reports suggest the President may soon nominate a replacement, raising concerns over the Fed’s independence.

However, the U.S. system of checks and balances ensures that:

- Any Fed Chair nominee must be approved by the Senate

- Interest rate decisions are made by a majority vote in the FOMC (12 members), not solely by the Chair

Fed Policy: Hold Now, Cut Later?

Based on the latest economic data, the Fed is likely to hold rates steady in this week’s meeting. However, if trade policy becomes clearer after August 1st, a rate cut in September is possible.

Further clarity is expected at the annual Jackson Hole Symposium on August 21–23.

Fed Interest Rate Outlook

- 2H 2025: 1–2 rate cuts anticipated

- 2026: Additional gradual easing

- Medium-term target: Neutral rate of 3%–3.5%

Earnings Reports Calendar (July 21–24, 2025)

| Date | Company | EPS | Revenue | Market Cap | Time |

|---|---|---|---|---|---|

| July 21 | Verizon (VZ) | 1.22 | $34.5B | $180.49B | AM |

| July 22 | Coca-Cola (KO) | 0.87 | $12.5B | $297.04B | AM |

| July 23 | Alphabet (GOOG) | 2.31 | $96.43B | $1.1T | PM |

| July 23 | Tesla (TSLA) | 0.40 | $22.5B | $1.01T | PM |

| July 23 | IBM | 2.80 | $17B | $235.52B | PM |

| July 24 | Intel (INTC) | -0.10 | $12.9B | $87.44B | PM |