As Starbucks Corp. (NASDAQ: SBUX) prepares to release its fourth-quarter fiscal 2025 earnings report, global investors are once again turning their attention to the Seattle-based coffee giant. The company finds itself at a critical turning point in its business transformation amid slowing U.S. consumer demand and fierce competition in China. With a valuation still considered premium, investors are eager to see tangible results from CEO Brian Niccol’s “Back to Starbucks” initiative — a turnaround plan focused on operational efficiency, menu simplification, and enhancing in-store customer experience.

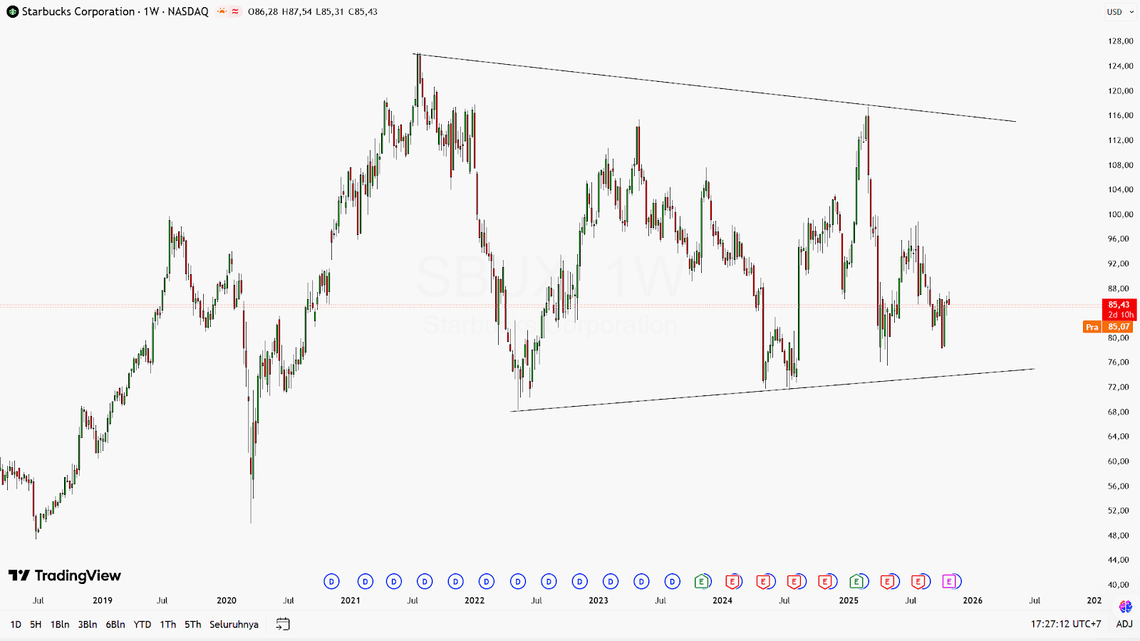

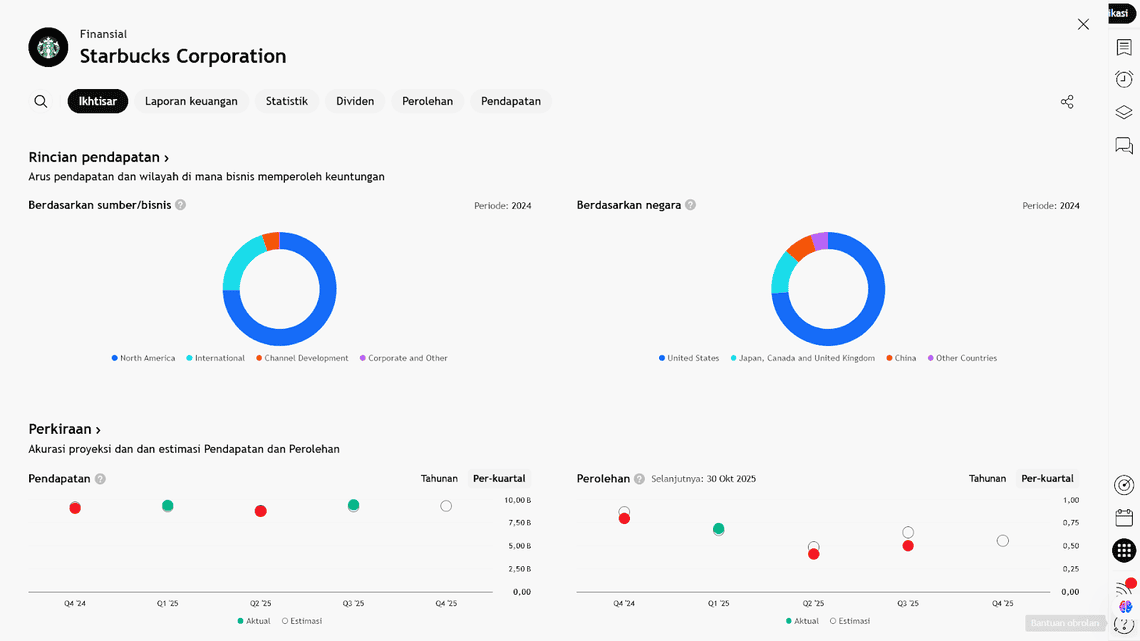

Throughout the year, Starbucks’ stock performance has mirrored the company’s challenges: pressured U.S. sales, narrowing margins due to higher labor and ingredient costs, and customer traffic that has yet to fully recover post-pandemic. On the other hand, signs of stabilization in international markets, particularly in China, offer a glimmer of optimism for the company’s medium-term outlook.

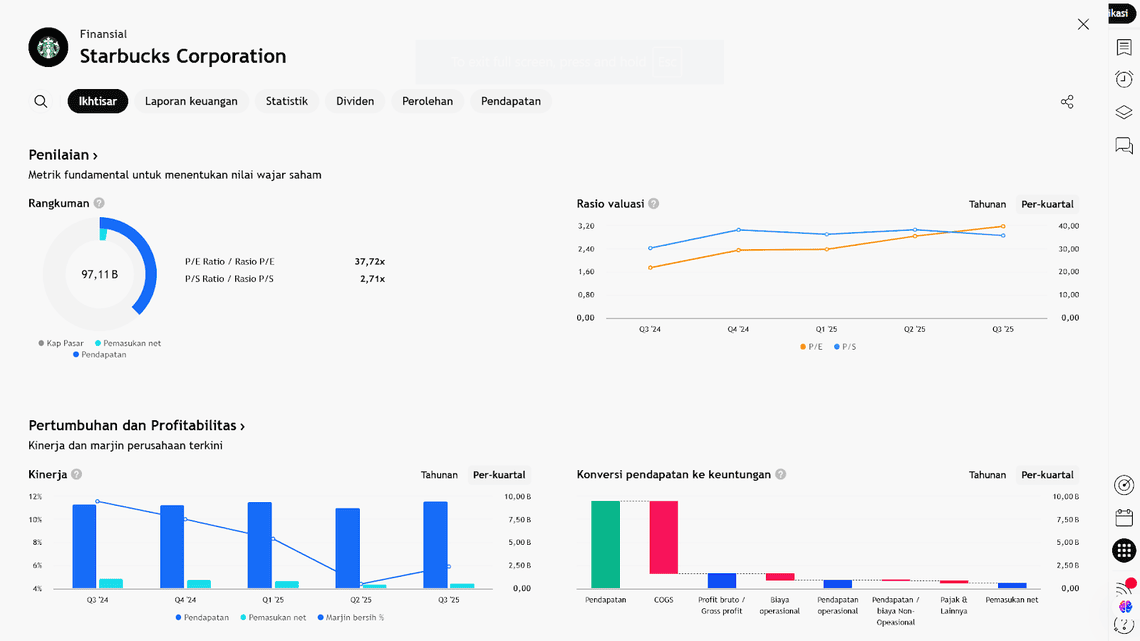

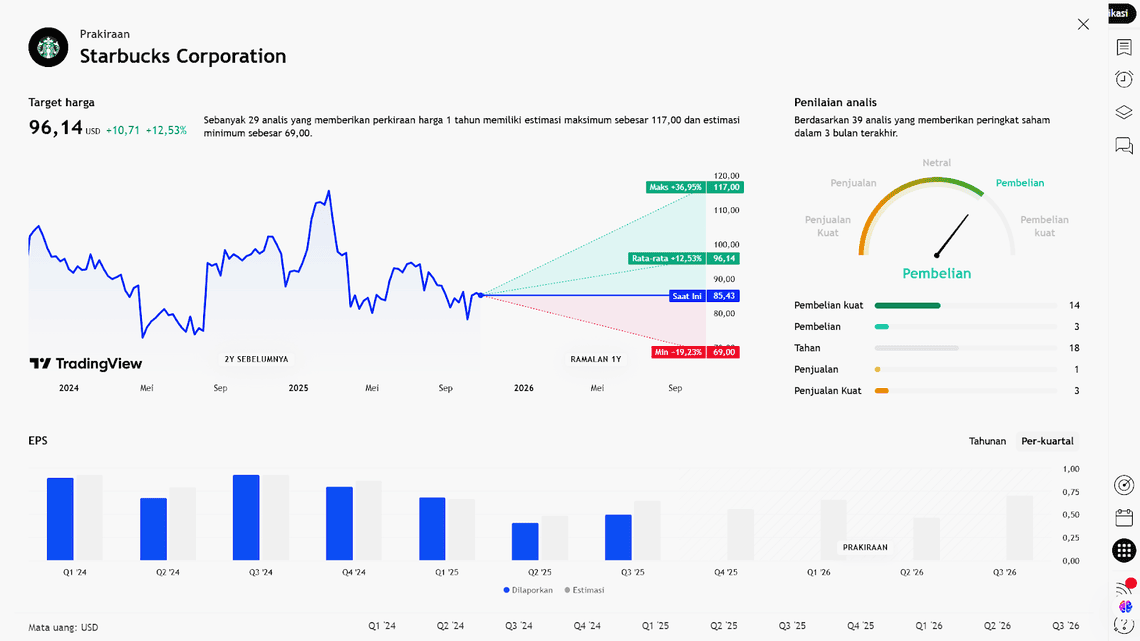

This upcoming earnings report will serve as a key test of the effectiveness of Starbucks’ restructuring efforts and the direction of its new leadership. Analysts expect moderate revenue growth, though earnings per share (EPS) are likely to decline year-over-year. Market attention will center on same-store sales growth, operating margins, and management’s forward guidance for the coming quarters.

With evolving consumer dynamics and intense competition from local brands and global quick-service chains, Starbucks’ quarterly results are more than just numbers — they are a reflection of how well this iconic brand can balance growth, profitability, and relevance in an increasingly complex global marketplace.

Key Highlights

- Starbucks is scheduled to report Q4 earnings after market close on Wednesday, October 29.

- Analysts forecast EPS of approximately US$0.55, down from US$0.80 in the same quarter last year.

- Consensus revenue estimate stands at US$9.35 billion, up from US$9.07 billion year-over-year.

Analyst Revisions & Ratings

Several major equity analysts have recently updated their price targets and ratings:

- Mizuho (Nick Setyan): Initiated coverage with a Neutral rating and a US$84 price target. Historical accuracy: 69%.

- Barclays (Jeffrey Bernstein): Maintains Overweight, but lowers target from US$115 → US$95. Accuracy: 63%.

- Wells Fargo (Zachary Fadem): Keeps Overweight, reduces target from US$105 → US$100. Highest accuracy on the list: 78%.

- Citigroup (Jon Tower): Retains Neutral, trims target from US$99 → US$84. Accuracy: 69%.

- Baird (David Tarantino): Upgrades from Neutral → Outperform, raises target from US$100 → US$115. Accuracy: 67%.

Insights & Implications

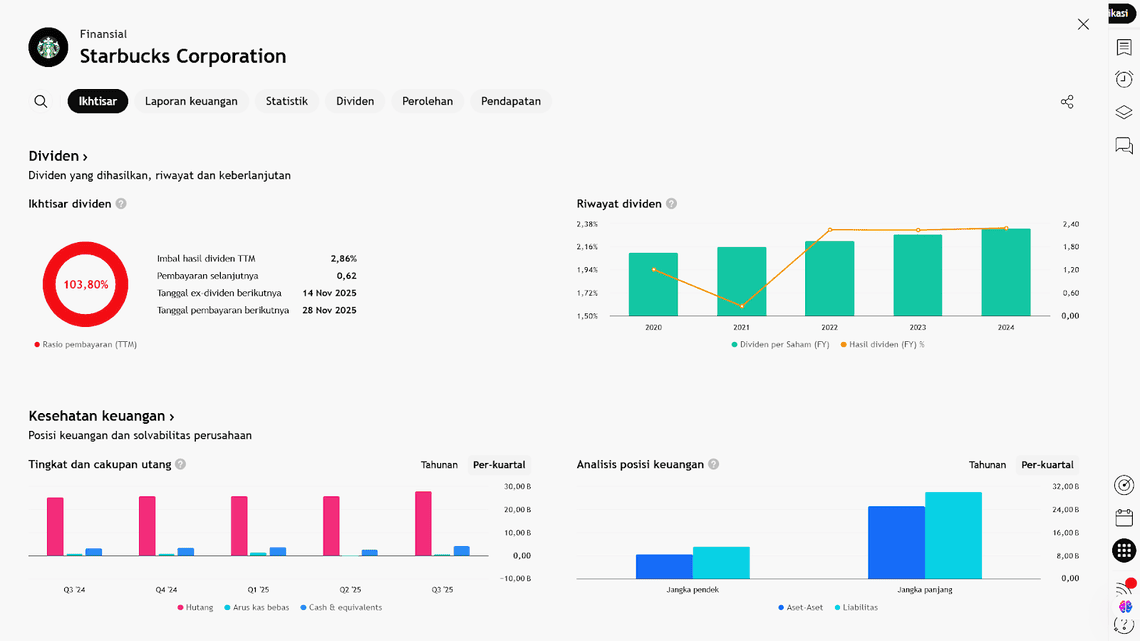

- The expected decline in EPS suggests ongoing margin pressure or rising operational costs compared to last year.

- While revenue growth (from US$9.07B to US$9.35B) indicates some resilience, the increase appears insufficient to offset profit compression.

- The downward target revisions from Barclays and Citigroup reflect a more cautious near-term market sentiment, signaling that expectations have been tempered.

- Baird’s upgrade implies a minority view — suggesting potential upside that may not yet be fully priced in by the market.

- For investors, the upcoming quarterly results and management guidance will be critical indicators of whether Starbucks can control costs, sustain consumer demand, and defend its market share amid rising competition.

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

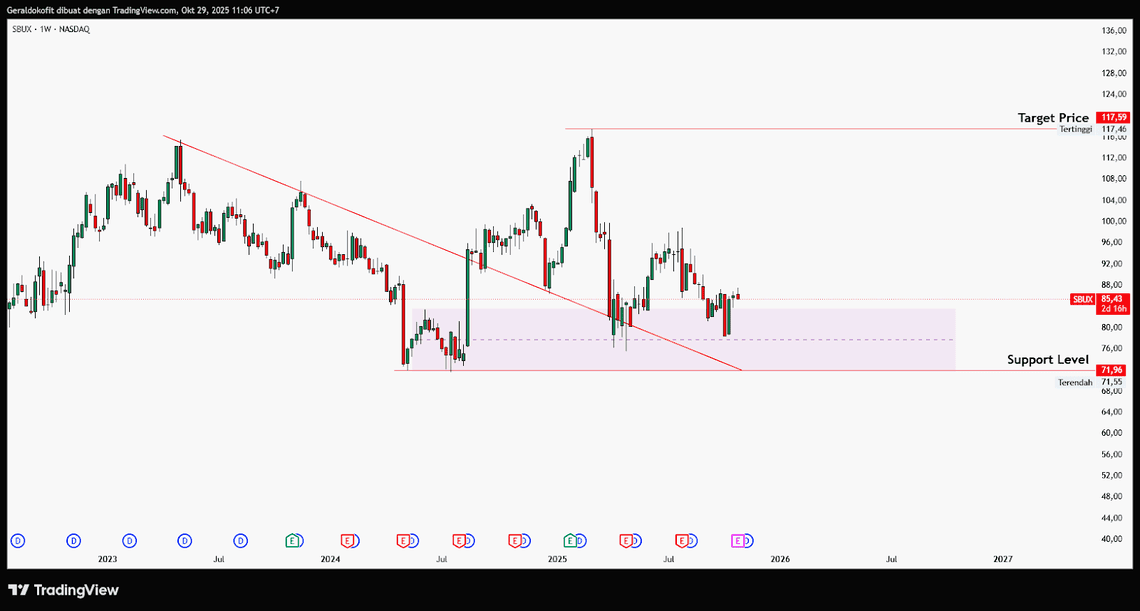

Strategi

| Buy Verizon | |

| Entry | 85,43 |

| Take Profit | 117,46 |

| Stoploss | 71,96 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst