Wall Street fell sharply on Thursday as investors braced for potential delays in key economic data releases due to the government shutdown. Concerns that the delayed data would confirm economic weakness—potentially influencing future monetary policy—triggered broad-based selling, particularly in technology and semiconductor stocks.

The S&P 500 slid 1.66%, the Dow Jones fell 1.65%, and the Nasdaq 100 plunged 2.05%.

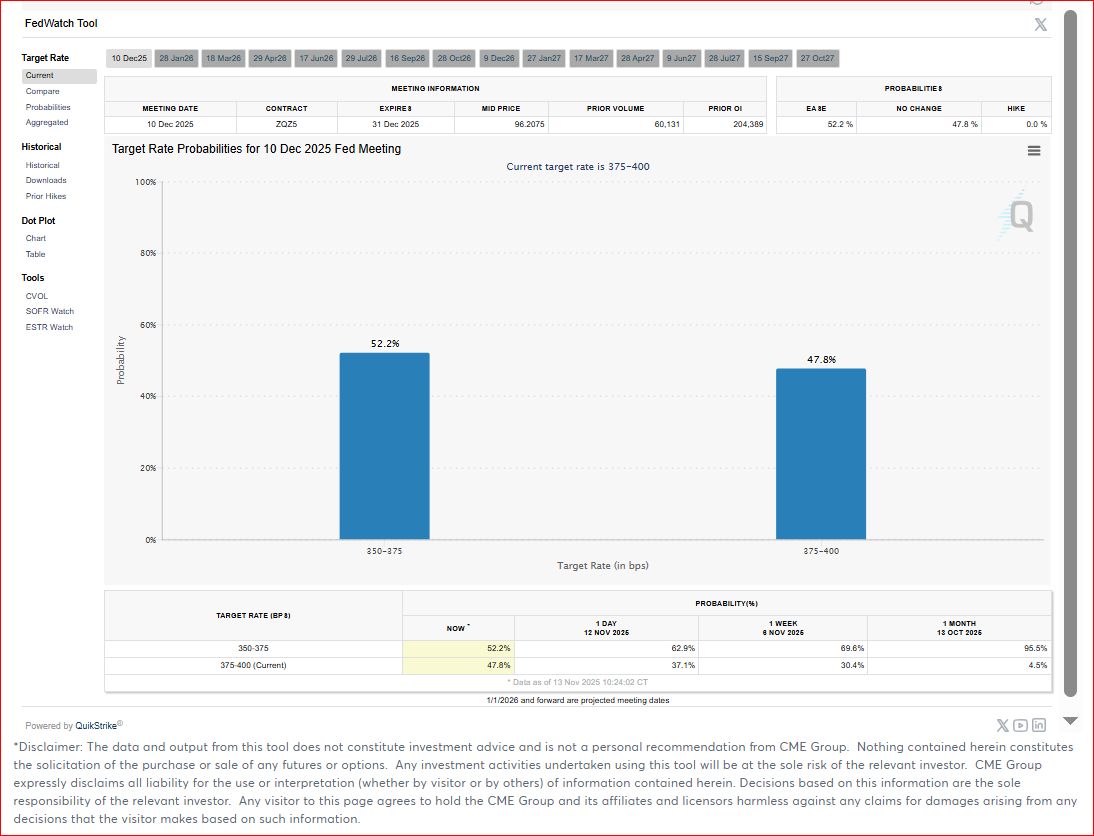

Market pressure intensified after a series of hawkish remarks from Federal Reserve officials—Collins, Hammack, and Musalem—who signaled that interest rates may remain higher for longer. This pushed the 10-year Treasury yield up to 4.11%, while expectations for a December rate cut dropped to 51% from 70%.

President Trump signed legislation to end the longest government shutdown in U.S. history. Although the CBO projects a 1.5% GDP contraction for the current quarter, most of the losses are expected to be recovered early next year as federal payments resume.

Meanwhile, the Q3 earnings season shows robust strength:

82% of S&P 500 companies have beaten expectations, with earnings growth reaching +14.6%, far above initial projections.

However, negative sentiment continues to dominate, with the semiconductor sector leading the sell-off. Intel plunged more than 5%, while Tesla and Amazon dragged the broader tech sector lower.

On the other hand, several stocks surged following strong earnings and positive outlook revisions: Cisco gained 4%.

In global markets, sentiment was mixed: the Euro Stoxx 50 declined, while the Shanghai Composite jumped to its highest level in 10 years and the Nikkei also strengthened.

As markets await the rescheduled release of key economic data such as payrolls and CPI, investors are shifting their focus to upcoming Fed policy signals and the market’s resilience amid strong earnings yet persistent macroeconomic uncertainty.

Gold experienced strong selling pressure on Thursday as traders closed long positions following hawkish comments from Federal Reserve officials, who emphasized that the Fed remains focused on fighting inflation. This caused analysts to lower their expectations for a potential Fed rate cut in December. According to FedWatch, probability estimates dropped from 70% to 52.3%.

A hawkish stance means central bank officials are prioritizing inflation control and are not in a hurry to move toward a rate cut in December.

Ade Yunus, ST WPA

Global Market Strategies