Focus on Automotive & IoT Segments, Watch for Risks from Apple and US-China Tariffs

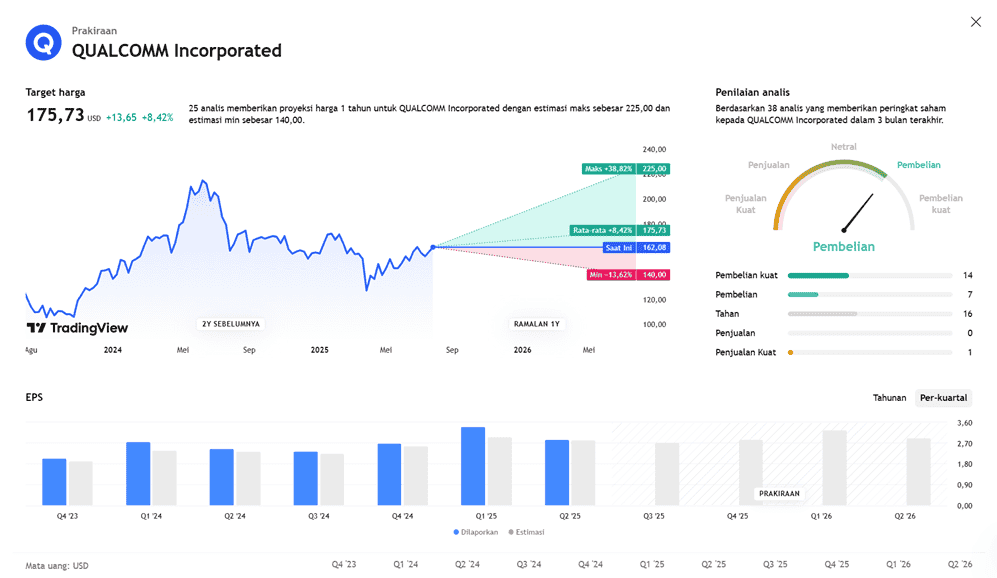

Qualcomm (QCOM) is scheduled to release its Q3 FY2025 financial performance on Tuesday evening, July 30, 2025. Analysts project earnings per share (EPS) of $2.71 and revenue of approximately $10.35 billion, reflecting growth of around 10–15% year over year.

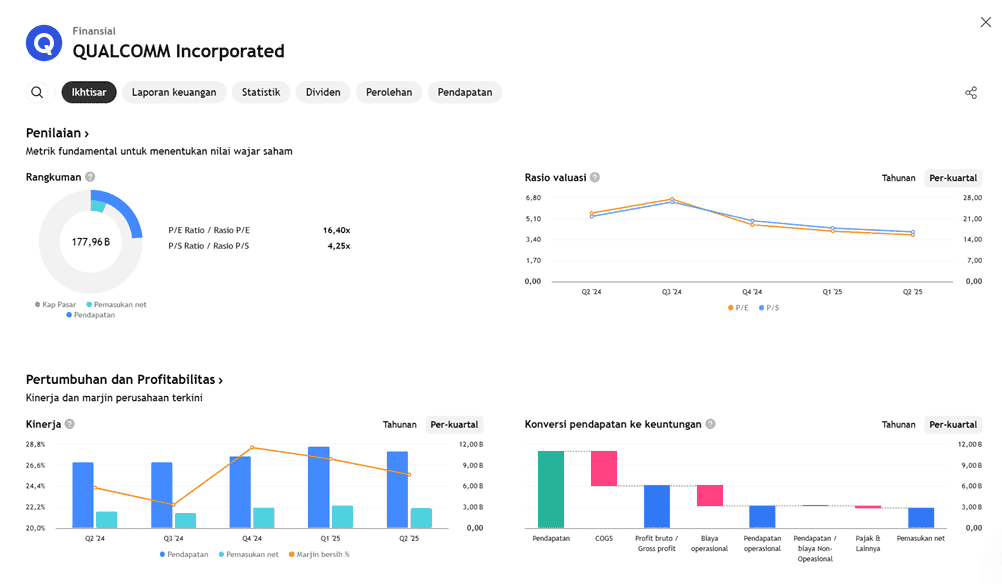

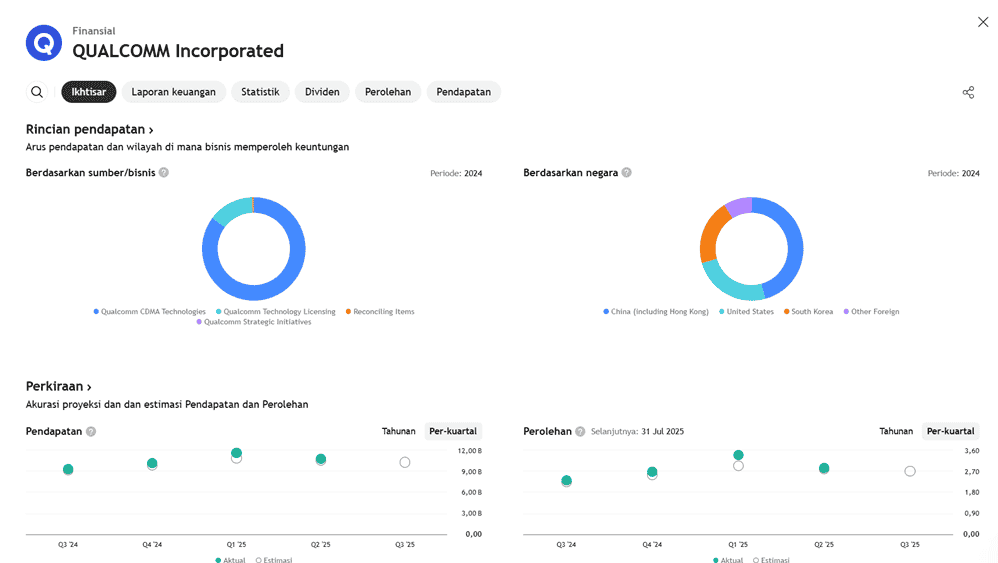

The automotive and Internet of Things (IoT) segments are expected to be the main drivers of growth, with estimated increases of nearly 19% and 16%, respectively. However, there may be pressure from declining licensing revenues (QTL) and Apple’s strategy to develop its own in-house modem chips, potentially reducing future reliance on Qualcomm’s components.

Another area of concern is the potential imposition of additional US import tariffs on goods from China, which could impact Qualcomm due to its significant market exposure in Asia.

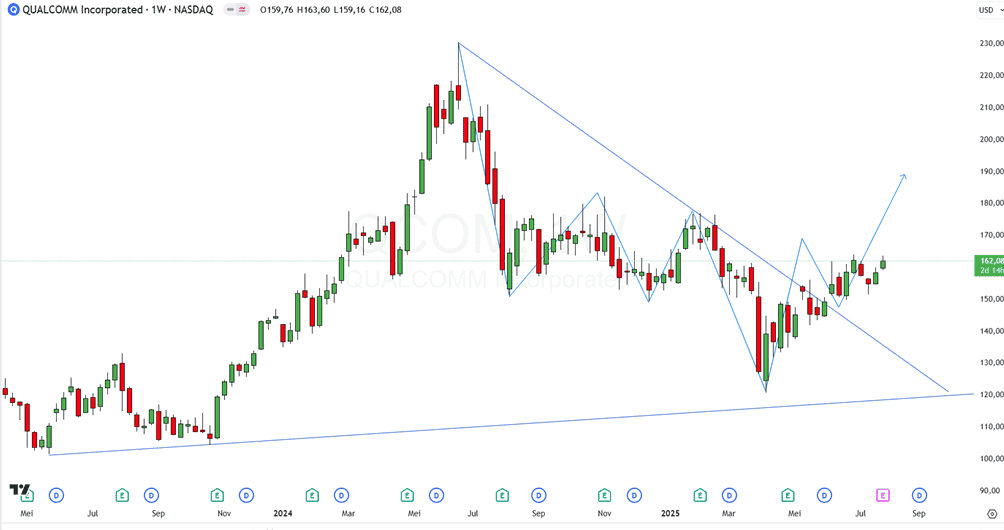

Despite exceeding expectations in the previous quarter, QCOM stock declined following a management outlook perceived as conservative. This time, investors will be watching to see whether Qualcomm can deliver a positive surprise or once again issue cautious guidance that might weigh on its stock.

Q3 2025 FINANCIAL PERFORMANCE PROJECTIONS

Analyst Estimates Before Official Release:

- Revenue is expected to reach US$10.64 billion (up ~13–14% YoY)

- Adjusted EPS is projected at around US$2.82 per share, up approximately 15% YoY (~US$2.44)

- The lower bound of EPS estimates has risen ~1.2% in the past 30 days, reflecting improving analyst sentiment

Projected Revenue by Segment:

- QCT Handsets: US$6.87 billion (+11.2% YoY)

- QCT Automotive: US$889 million (+47.5%)

- QCT IoT: US$1.45 billion (+16.5%)

- QTL (Licensing): US$1.35 billion (+2.3%)

Actual Results After Report Release:

- Revenue was reported at US$10.84 billion, beating consensus estimates of ~US$10.65 billion, with YoY growth of ~15%

- Non-GAAP EPS reached US$2.85, up ~17% YoY, surpassing analyst estimates (~US$2.81–2.82)

- Qualcomm has exceeded revenue estimates for eight consecutive quarters and EPS estimates for seven straight quarters

Key Factors to Watch:

- Exposure to China & Tariff Risks

- Investors are closely monitoring comments related to tariffs, particularly their impact on smartphone demand and Qualcomm’s supply chain mitigation strategies.

- Growth Momentum in QCT Segments

- Handsets: +12% YoY

- Automotive: US$959 million, up 59% YoY

- IoT: US$1.58 billion, up 27% YoY

- Engineering services revenue supports Qualcomm’s growing pipeline of digital car and advanced driver assistance systems (ADAS) designs

- Guidance & Forward Outlook

- Qualcomm expects Q4 FY2025 revenue to range between US$9.9 billion and US$10.7 billion (consensus: ~US$10.35 billion)

- EPS guidance: US$2.60 – US$2.80 (consensus: ~US$2.67)

- Corporate Strategy & Initiatives

- Focus on product diversification, operational efficiency, and long-term investment in AI-IoT technologies

- Strategic acquisitions such as Movian AI and Alphawave IP Group support long-term growth

- Competitive & Regulatory Risks

- Threats from Apple’s development of internal modem chips

- Potential handset sales slowdown due to new US–China trade tariffs

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED