Qualcomm Set to Announce Q4 Earnings Amid Bold Move into AI Data Center Market

As the global semiconductor industry pivots toward artificial intelligence (AI), Qualcomm Inc. is preparing for its next major leap. The San Diego-based chipmaker will release its fourth-quarter earnings report after market close, with investor attention focused not only on its mobile chip business performance but also on its new ambitions to break into the AI data center market — an arena that has become the epicenter of the world’s technological evolution.

This move marks Qualcomm’s serious effort to reduce its reliance on the slowing smartphone market. By introducing two next-generation AI chips — AI200 and AI250 — slated for launch in 2026 and 2027, Qualcomm aims to position itself alongside giants such as Nvidia, AMD, and Intel in the high-stakes world of large-scale AI computing.

According to reports, Qualcomm has already secured an early customer for its new platform — Humain, which plans to deploy Qualcomm’s AI rack-scale solution with up to 200 megawatts of capacity starting in 2026. This early traction signals that Qualcomm is gaining a foothold in a new segment previously outside its core business scope.

The market has responded positively to this strategic shift. Qualcomm’s shares rose following the announcement of its AI-centered expansion plans, reflecting investor optimism toward the company’s revenue diversification potential. Analysts suggest that if this strategy succeeds, Qualcomm could unlock new, higher-margin growth opportunities beyond the now-saturated smartphone market.

However, challenges remain significant. The AI data center sector is characterized by high entry barriers and dominated by entrenched players with mature ecosystems. Moreover, with its new chips not arriving until 2026–2027, Qualcomm must maintain momentum and manage expectations to prevent market enthusiasm from turning into pressure.

For CEO Cristiano Amon, this initiative represents a strategic gamble to redefine Qualcomm’s identity — from a mobile chipmaker to a key player in global AI infrastructure. With the AI market expected to grow exponentially over the next decade, success in this segment could be pivotal to Qualcomm’s long-term transformation.

Key Points

- Qualcomm will report its Q4 earnings after market close while entering the AI data center (artificial intelligence) market.

- The company is launching two new AI chips — AI200 (2026) and AI250 (2027) — designed for rack-scale data center servers.

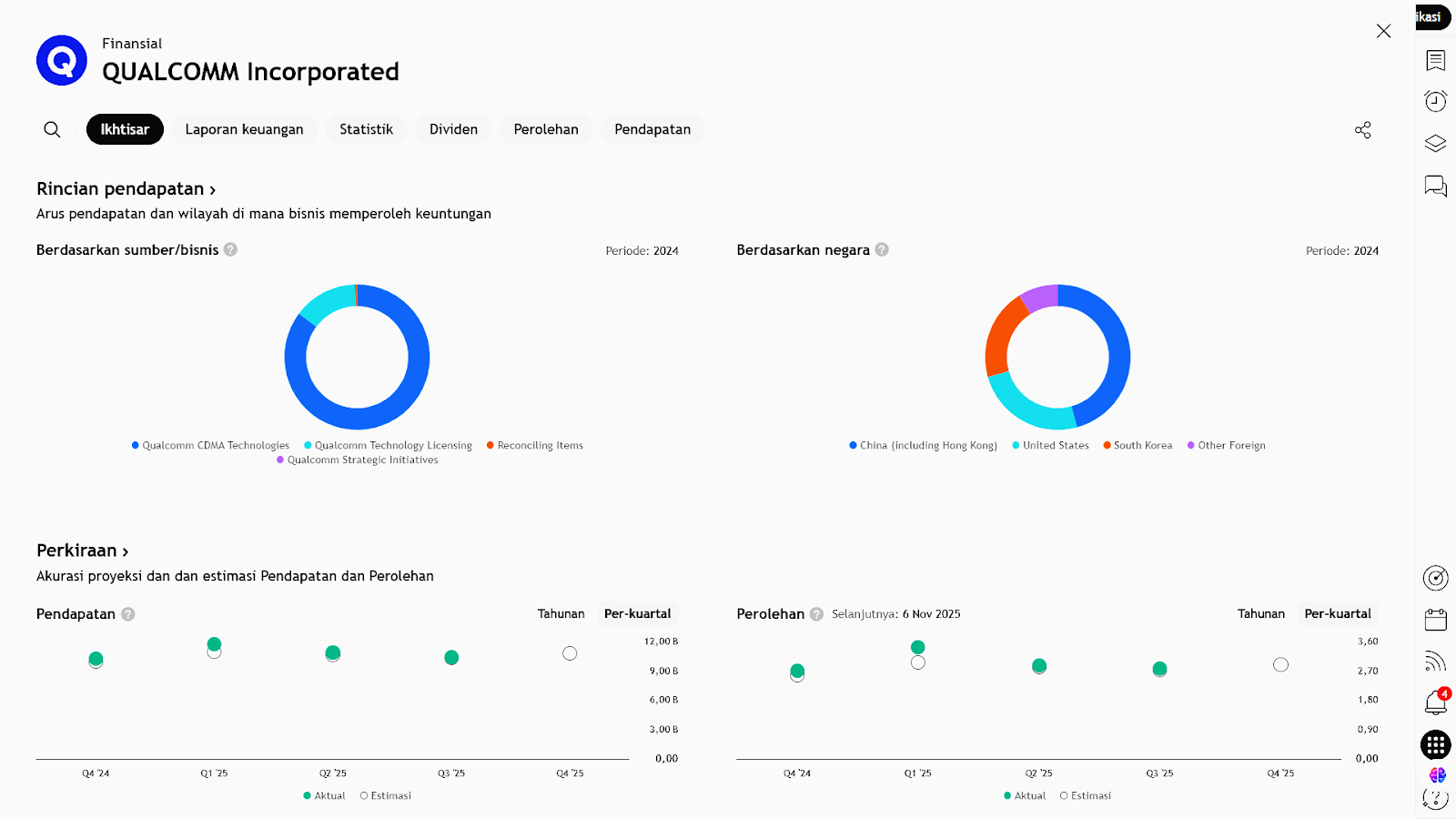

- This move marks a critical diversification as Qualcomm’s main business — smartphone chips and technology licensing — faces slowing growth.

- By entering the fast-growing AI data center market, Qualcomm aims to compete with major players like Nvidia and AMD.

- Reports indicate that Qualcomm has already secured an early customer, Humain, which plans to deploy a 200-megawatt AI rack system starting in 2026.

- Qualcomm shares rose significantly after the announcement, reflecting strong market anticipation of its new business direction.

Implications and Notes

- Entering the AI data center business means Qualcomm is stepping into a highly competitive arena with significant entry barriers and well-established players.

- The smartphone sector, once Qualcomm’s revenue backbone, has shown slower growth, making diversification essential.

- Long-term opportunity: If Qualcomm’s AI server chips succeed, they could open new, higher-margin revenue streams with faster growth potential than smartphones.

- Risks: Product launches are still years away (2026–2027), and gaining market share from existing giants will be a major challenge.

- For investors, this signals that Qualcomm is entering a strategic transformation phase — evolving from a mobile chipmaker into a key enabler of AI infrastructure ecosystems.

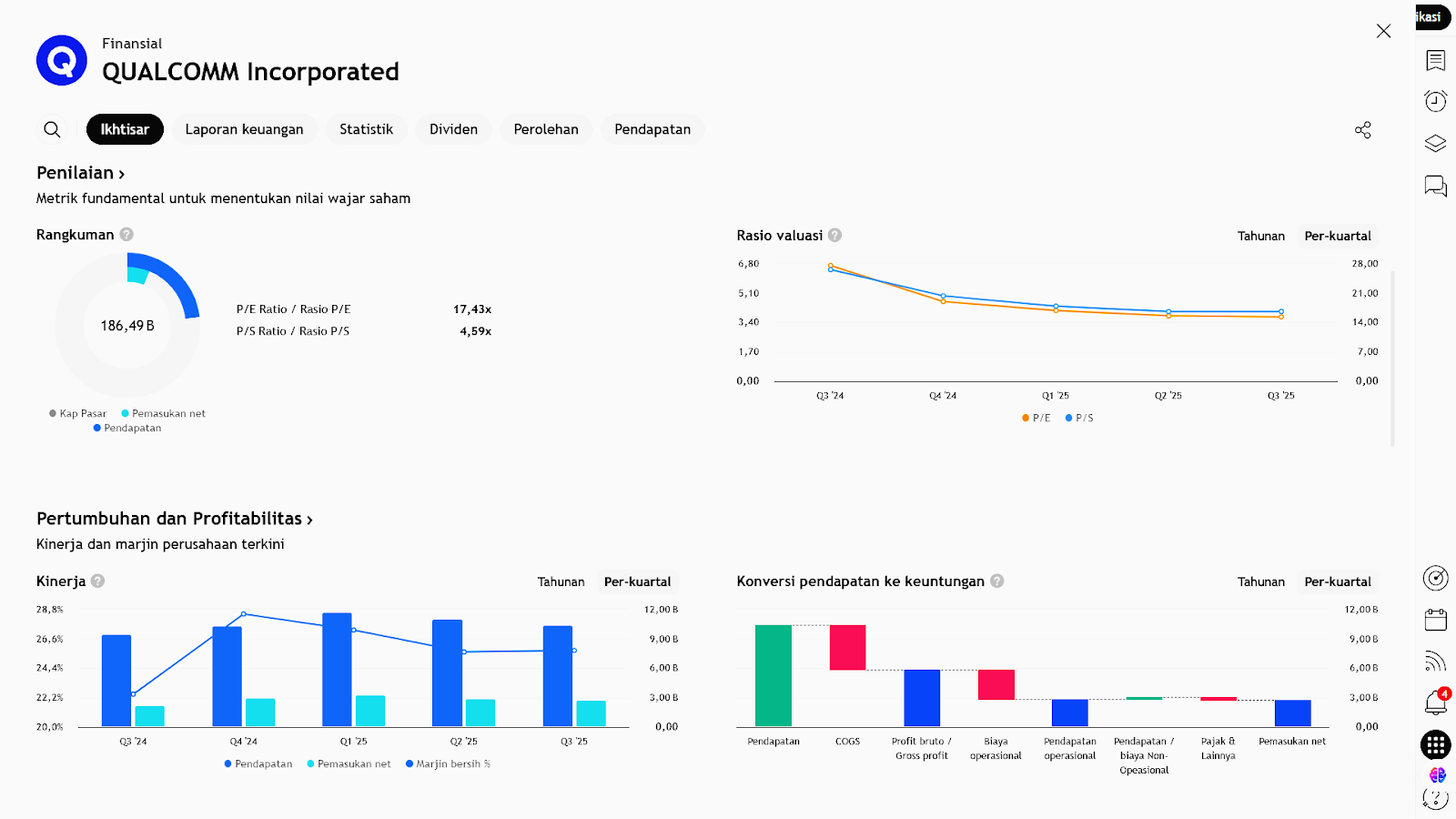

Earning Projection Prediction

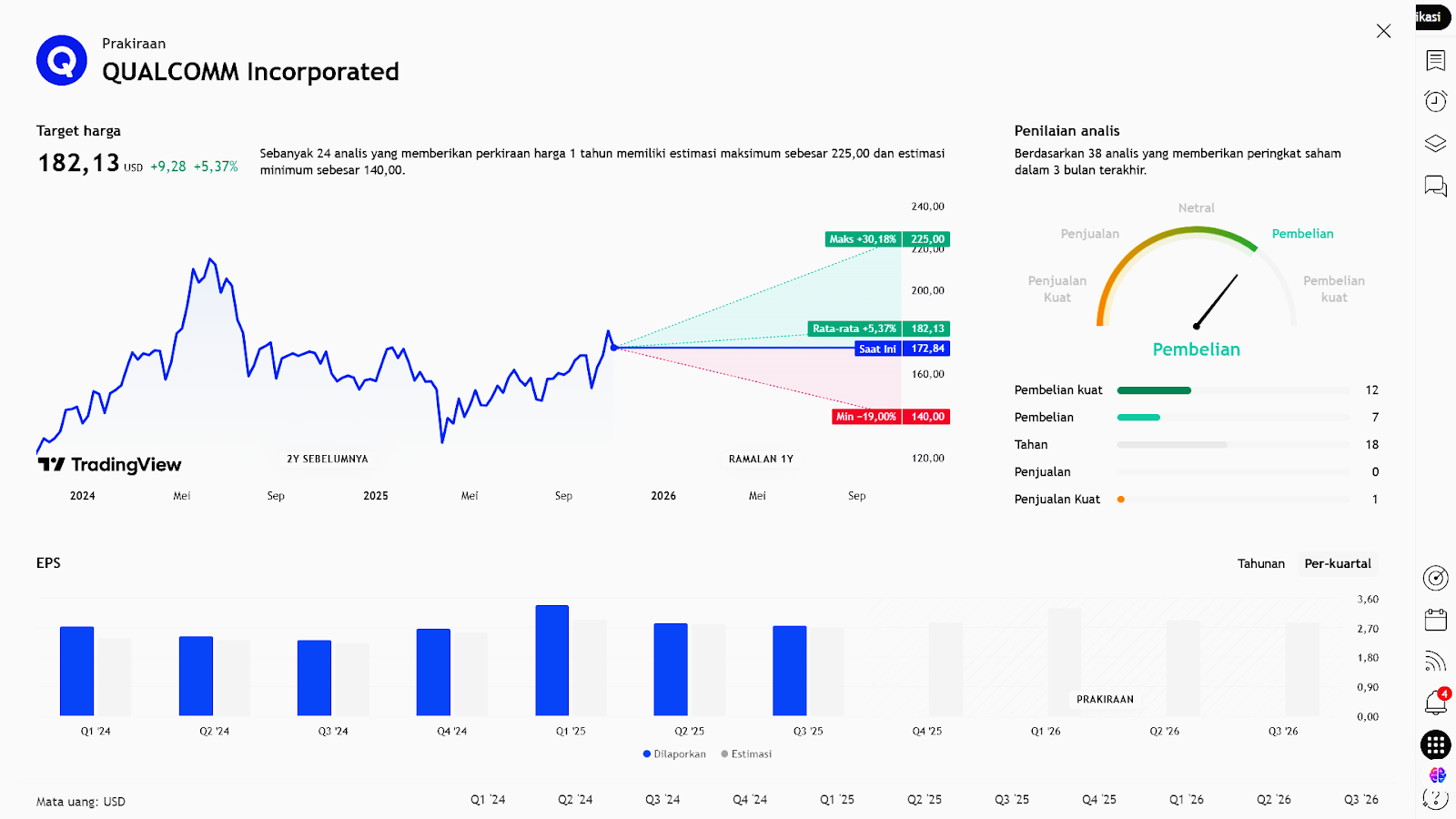

WHAT THE ANALYST SAYS

Short – Medium Term Projection

Strategy

| Sell Qualcomm | |

| Entry | 172.58 |

| Take Profit | 158.12 |

| Stoploss | 184.00 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst