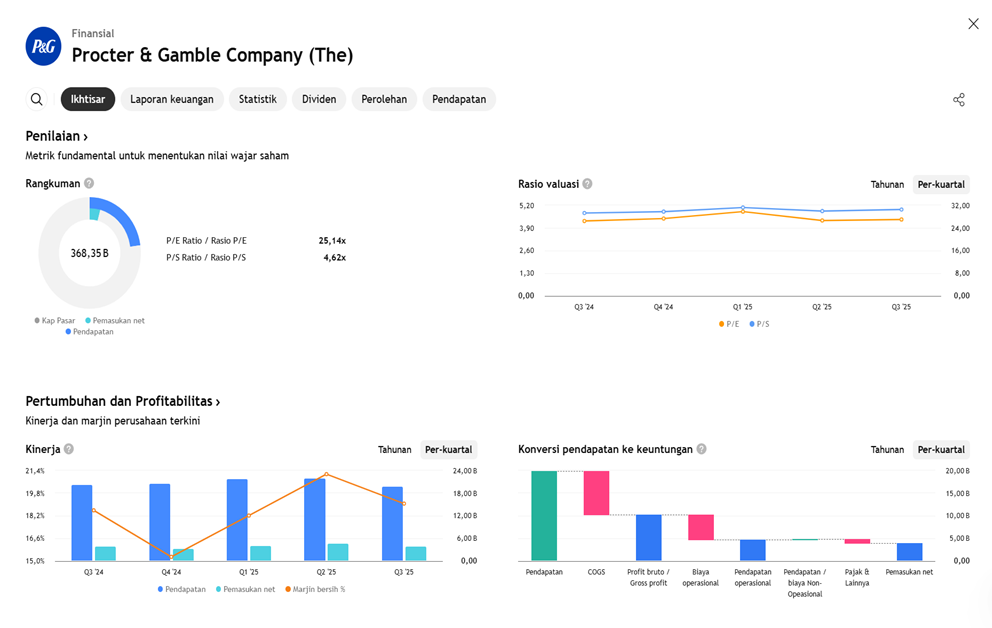

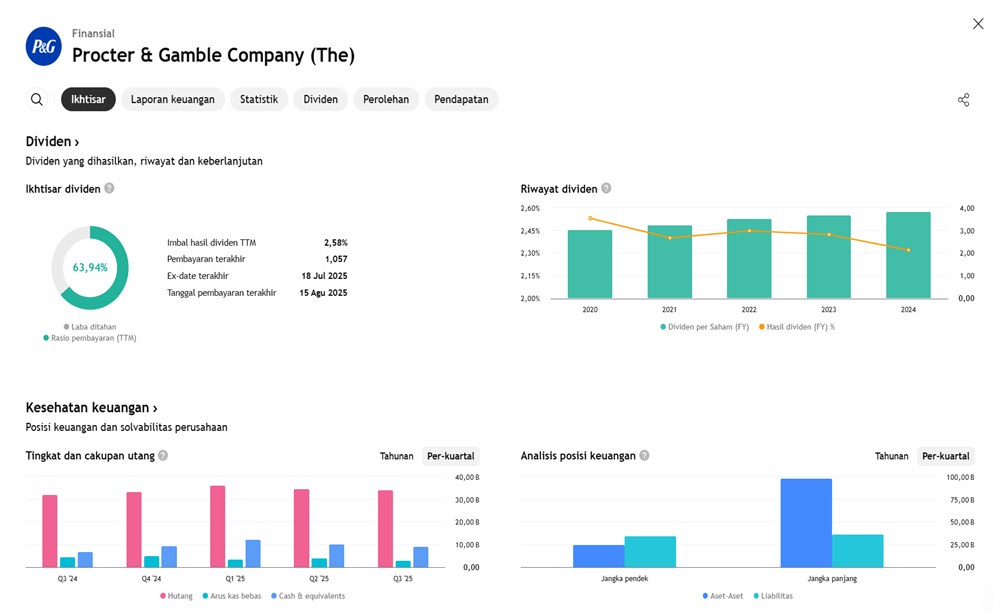

Ahead of the Q4 2025 earnings report, Procter & Gamble (P&G) shares are under pressure due to market concerns over slowing revenue and cost pressures stemming from import tariffs. While EPS is projected to rise slightly to $1.42, revenue is expected to grow modestly to around $20.9 billion. Previously, P&G has consistently exceeded earnings expectations but often missed on revenue.

The new import tariffs from China are projected to have a negative impact of $1–$1.5 billion annually. In response, P&G has launched an efficiency program including 7,000 layoffs, process digitalization, and a focus on core brands.

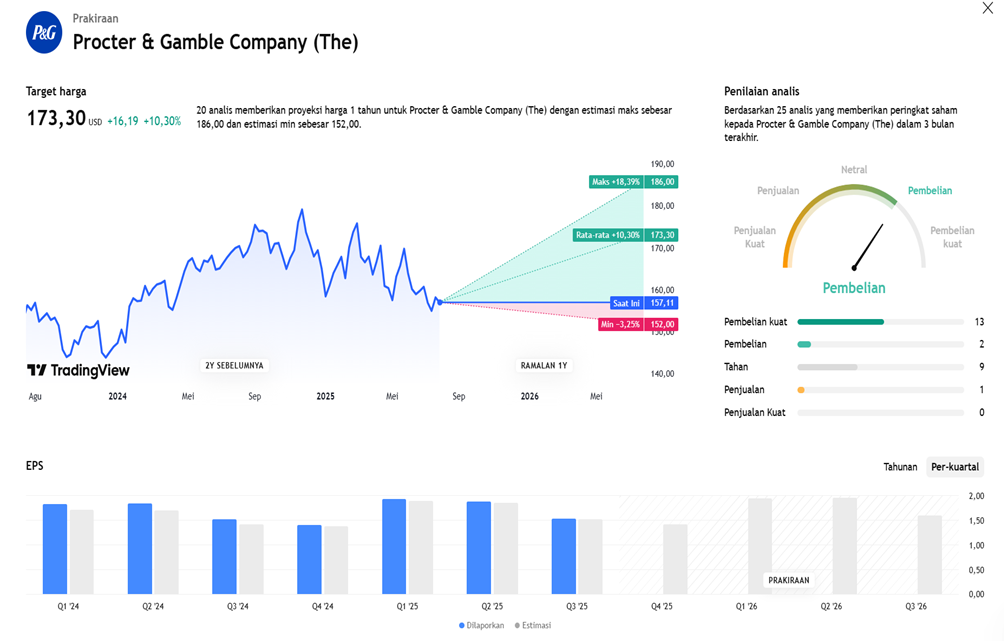

Technically, the stock has fallen below its 200-day moving average, signaling short-term weakness. However, analysts still maintain a “Moderate Buy” rating with a price target of $172–$178, awaiting confirmation of the company’s new strategic direction ahead of the CEO transition to Shailesh Jejurikar in early 2026.

Key Highlights

Release Schedule and Market Expectations

- P&G is scheduled to release its Q4 2025 earnings report before market open on Tuesday, July 29, 2025.

- EPS is expected at $1.42–$1.43 per share, representing a YoY increase of approximately 1.4–2.1% from $1.40 last year.

- Revenue is estimated at around $20.9 billion, with YoY growth of +2% and a possible range of $20.82 billion in line with consensus estimates.

Trends and Historical Performance Notes

- In the past four quarters, P&G has consistently beaten EPS expectations, although revenue has occasionally fallen short.

- Q3 2025: EPS of $1.54 (above the $1.53 consensus), but revenue declined 2.1% YoY to $19.78 billion.

- Management lowered its full-year FY2025 EPS guidance to $6.72–$6.82 due to tariff impacts and weakening consumer demand.

Key Points to Watch

- FY26 EPS and Revenue Guidance: A primary investor focus after the earnings release, as a key determinant of future stock direction.

- Import Tariff Risks: Particularly on Chinese components, could add $1–$1.5 billion in costs, equating to about 3–4 cents per share over FY26.

- Internal Restructuring and Efficiency: The company plans to cut up to 7,000 non-manufacturing employees (~15%) over a two-year program aimed at improving productivity and adopting digital/automated systems.

Division Breakdown – EPS and Revenue Estimates

- Consensus EPS: Approx. $1.43 per share, up ~2.1% YoY.

- Estimated Net Sales by Division:

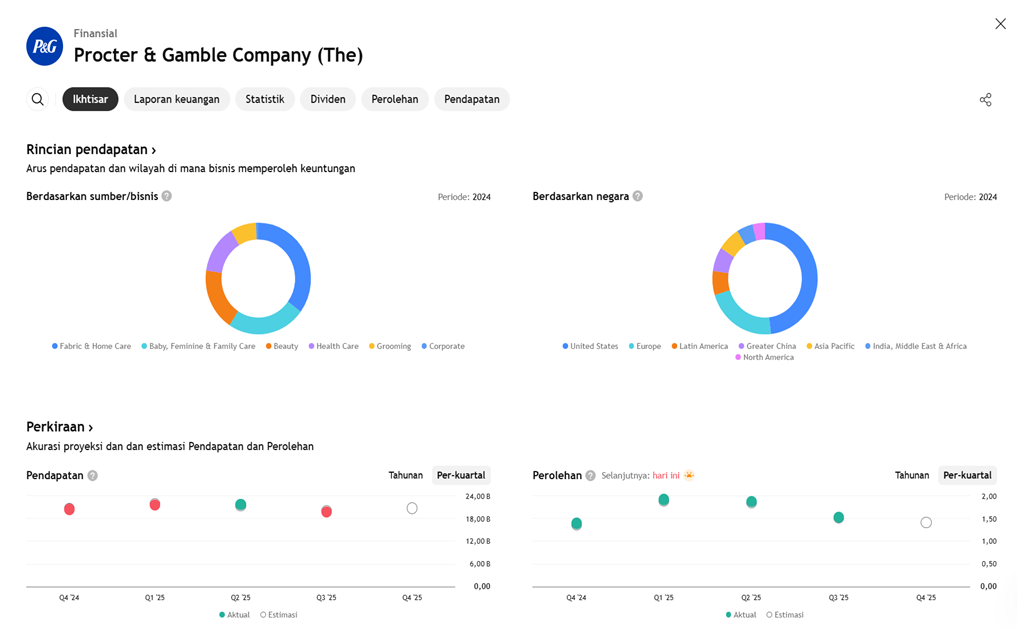

- Beauty: $3.77 billion (+1.1% YoY)

- Grooming: $1.69 billion (+2%)

- Fabric & Home Care: $7.37 billion (+1.4%)

- Baby, Feminine & Family Care: $5.02 billion (+0.1%)

- Health Care: $2.74 billion (+2.7%)

- Organic Growth:

- Beauty: 1.8% (down from 3.0% last year)

- Grooming: 3.2% (down from 7.0%)

- Health Care: 3.2% (down from 4.0%)

| Aspect | Estimate / Notes |

|---|---|

| Q4 2025 EPS | $1.42–$1.43 (YoY increase of ~1.4–2.1%) |

| Q4 Revenue | ~$20.8–$20.9 billion (up ~1–2%) |

| Last Report | Q3 EPS beat, but revenue fell -2.1% YoY |

| Investor Focus | FY26 guidance, tariffs, and cost efficiency |

| Restructuring | 7,000 non-production staff cuts for optimization |

| Product Segments | Limited growth in most core segments |

Earning Projection Prediction

WHAT THE ANALYST STATED