Gold Approaches Critical Zone as Markets Await Jerome Powell’s Remarks

Washington, D.C. — Amid rising political pressure and heightened scrutiny over the Federal Reserve, Fed Chair Jerome Powell delivered a formal address at a banking conference hosted by the Board of Governors of the Federal Reserve on Monday evening (Tuesday morning WIB). While the content of his remarks was relatively neutral, the political backdrop added weight to the occasion.

Powell refrained from commenting explicitly on interest rates, inflation, or economic outlook. Instead, he focused on the importance of supervision and stability in the banking sector. The tone of his speech remained formal and measured, suggesting that this was not intended as a policy signal to the markets.

However, beneath the calm delivery, the atmosphere was far from serene. Just hours before the speech, Republican Congresswoman Anna Paulina Luna formally referred Powell to the Department of Justice for investigation over alleged perjury related to a $2.5 billion renovation project at the Fed’s headquarters. Powell has strongly denied the accusations, but the issue adds to the political headwinds he currently faces.

In financial markets, reactions were relatively muted. The 10-year U.S. Treasury yield pulled back after a four-day rally, though Powell’s remarks offered no major surprises. Investors continue to see the Fed as being in a “wait-and-see” mode, with attention now shifting toward the next FOMC meeting, which is expected to provide clearer guidance on future rate decisions.

Powell appeared calm and diplomatic. Amid mounting pressure from Congress and public scrutiny, he reaffirmed that the independence of the Federal Reserve remains a cornerstone of U.S. financial stability. While avoiding direct references to interest rates, Powell stressed that banking supervision remains a top priority—especially after this year’s turbulence in the regional banking sector.

Although this particular speech may not have moved markets significantly, it underscored a crucial point: the Federal Reserve is walking a tightrope—balancing its economic credibility while navigating increasing political turbulence. In the coming days, markets are likely to focus more intensely on comments from FOMC members and upcoming economic data ahead of the next policy decision.

Powell may not have shifted the tide that evening, but it’s clear that the pressure around him is mounting. Investors, analysts, and lawmakers alike are closely watching for the Fed’s next move—both behind closed doors and in the public eye.

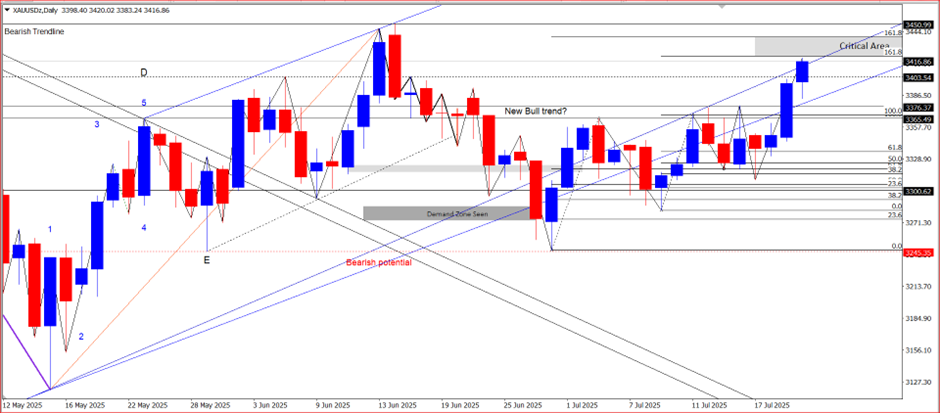

Gold Movement

Gold prices rose and reached a daily high of $3,420, approaching key daily resistance levels at $3,435 and $3,452. It appears that traders and institutions are closely monitoring gold’s fluctuations. Should gold break and sustain above these critical levels, it could potentially retest the 2025 high of $3,500. However, if it fails to maintain above this area, a price correction is likely to occur.