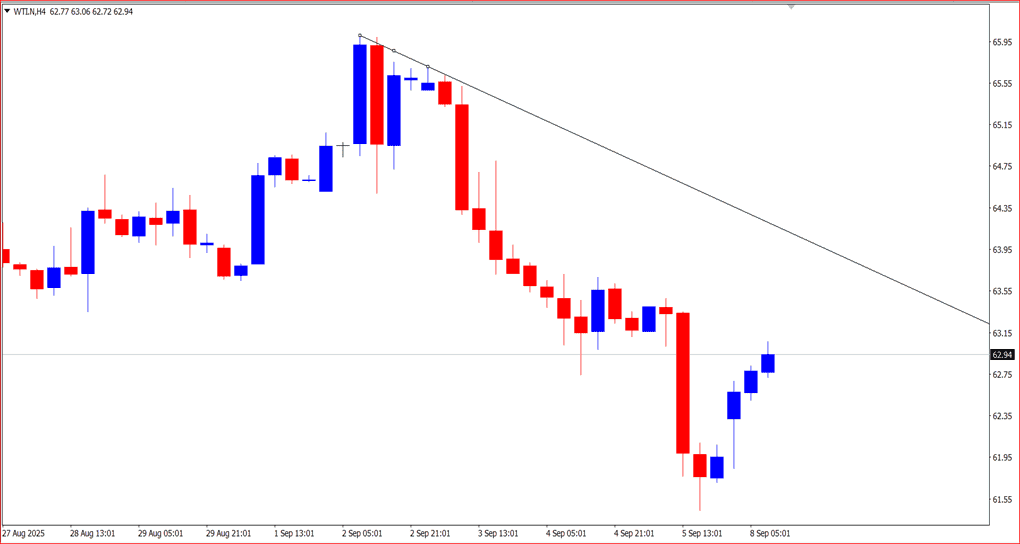

WTI observed strengthening after touching the target level at 61.44.

Global traders are now monitoring the sell-interest area around 64.

Medium-term price projection remains bearish.

Global Oil Prices

On Monday (September 8), global oil prices rose more than 1%, rebounding from last week’s sharp decline. Market sentiment was driven by the potential for new sanctions on Russian oil exports following a large-scale attack on Ukraine, which could tighten global supply. This price increase came despite OPEC+ recently deciding to raise production starting in October.

Price Movements

- Brent crude rose 80 cents, or about 1.2%, to $66.30 per barrel.

- WTI (West Texas Intermediate) gained 75 cents, or 1.2%, to $62.62 per barrel.

Both benchmarks had previously plunged more than 2% on Friday after a weak U.S. jobs report, raising concerns over energy demand. Over the past week, oil prices lost more than 3%.

OPEC+ Decision

In its Sunday meeting, the OPEC+ alliance — consisting of OPEC members, Russia, and other partners — agreed to increase oil production starting in October. However, the increase will be only 137,000 barrels per day from eight member countries, significantly smaller than prior months:

- September & August: about 555,000 bpd

- July & June: about 411,000 bpd

This move signals Saudi Arabia’s effort to balance market interests — aiming to secure market share while avoiding oversupply risks during the coming winter. Analysts noted this was a surprise, as markets expected a larger increase. The smaller-than-expected rise provided support for oil prices.

Geopolitical Factors: Russia–Ukraine

Geopolitics were the main driver of price gains. Russia launched its largest airstrike since the start of the invasion, hitting Kyiv’s government center and killing at least four people. This heightened the likelihood of new U.S. sanctions on Russian oil, potentially tightening global supply.

U.S. President Donald Trump expressed frustration over the prolonged war and announced that several European leaders would visit Washington in the coming days to discuss conflict resolution. While he remained optimistic about ending the war soon, the tension continues to inject significant uncertainty.

Market Analysis

According to Rakuten Securities analyst Satoru Yoshida, the buying momentum was triggered by the smaller-than-expected OPEC+ output and confidence that Russian oil will not flood the market.

Toshitaka Tazawa of Fujitomi Securities added that prices were also supported by a technical rebound following last week’s steep losses.

Other factors, such as weaker wind speeds in July–August and delays in some alternative energy projects, further intensified concerns over tight energy supply.

Outlook

Goldman Sachs projected a slight oil surplus in 2026 due to increased U.S. production capacity, even as Russian supply is expected to decline and global demand remains firm.

Forecast average prices for 2026:

- Brent: $56 per barrel

- WTI: $52 per barrel

However, Goldman emphasized that oil price risks for 2025–2026 remain two-sided, though tilted toward the upside due to geopolitical and supply uncertainties.

Technical Outlook

Oil prices still have room for a limited rebound toward the 64 level, with the favored selling zone seen around 63.7–64.

For further downside, support levels are projected at 61.44 and 58.5.

Ade Yunus

Global Market Strategies