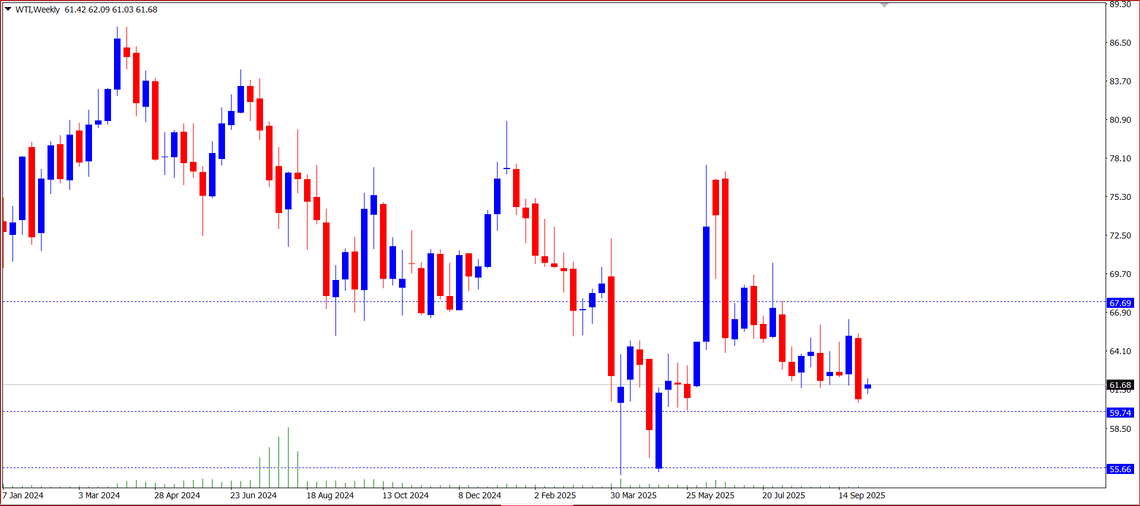

Global oil prices posted a slight rebound at the start of the week, offering a brief respite to the energy market still clouded by global uncertainty. West Texas Intermediate (WTI) crude rose to around US$61.90 per barrel, up approximately 0.34%, after being pressured by concerns over oversupply and slowing global economic growth.

The modest gain followed OPEC+’s decision to increase production moderately by 137,000 barrels per day for November. The move is seen as a compromise — enough to appease member countries pushing for expansion, yet not large enough to destabilize prices. For the market, this cautious approach signals that OPEC+ remains committed to maintaining price stability without tipping the balance toward oversupply.

However, despite this mild recovery, uncertainty continues to loom. Analysts warn that weakening global demand could once again weigh on oil prices. Economic growth in key regions such as China and Europe has shown clear signs of deceleration. Several research institutions have even projected that WTI prices could fall below US$60 per barrel by year-end, especially if supply continues to outpace demand.

From a fundamental perspective, U.S. oil production data has become a major focus. The steady rise in shale output over recent months has reignited concerns about additional oversupply. Meanwhile, a stronger U.S. dollar, fueled by expectations of prolonged high interest rates, has also pressured oil prices, as it makes dollar-denominated commodities more expensive for global buyers.

On the geopolitical front, no significant new disruptions have emerged to threaten global oil supply. While Middle East tensions remain a latent risk, their direct impact has so far been limited. Investors’ attention has now shifted toward global monetary policy, particularly the Federal Reserve’s next move heading into year-end. Should the Fed signal a rate cut, the U.S. dollar may weaken, potentially giving oil prices some upward momentum.

For market participants, WTI currently sits in a cautious zone. Its relatively stable price reflects a temporary balance between negative fundamentals (oversupply, slowing demand) and supportive sentiment (OPEC+ restraint, geopolitical stability).

However, this balance remains fragile. Even minor changes in demand expectations or the next OPEC+ production decision could quickly shift market direction.

From a technical standpoint, WTI still shows downside potential toward US$55 per barrel, with price movement expected to remain within the US$63–US$57 range.

— Ade Yunus

Global Market Strategies