Over the past two years, gold has experienced an extraordinary rally that has surprised many investors. At the beginning of January 2024, gold prices were around $2,063 per troy ounce. However, by August 27, 2025, prices had surged to $3,395 per troy ounce — an increase of more than 64% in just 20 months. This surge reflects a global environment filled with uncertainty, ranging from high inflation and geopolitical tensions to shifting monetary policies.

For investors, this rally presents a dilemma. On one hand, gold has proven itself as a safe-haven asset, protecting against inflation and stock market volatility. On the other hand, prices are already at elevated levels, leaving many potential investors hesitant to enter, fearing they might be buying at the peak.

The question is: will gold prices correct in the near term, creating an opportunity to enter at lower levels? Or even present a chance to sell now? While it is difficult to predict precisely, several factors may drive short-term weakness in gold prices.

1. Cooling Inflation

Gold is often seen as a “mirror” of inflation. When inflation runs high, investors turn to gold for protection, driving prices higher. Conversely, when inflation cools, demand for gold tends to decline.

Currently, U.S. inflation stands at around 2.7%, much lower than the multi-decade highs of three years ago. This figure is already close to the Federal Reserve’s 2% target. If this downward trend continues, the Fed may further cut interest rates. Ironically, lower inflation could actually weigh on gold, as the need for protection against dollar purchasing power erosion diminishes.

A lower CPI reading provides a strong signal of potential for looser monetary policy.

2. Calmer Geopolitics

The surge in gold prices in recent years has also been fueled by escalating geopolitical tensions — from conflicts in Eastern Europe and instability in the Middle East to the U.S.–China trade rivalry. These conditions made gold an attractive flight-to-safety asset.

However, if diplomatic progress is achieved or peace agreements are reached in key conflict zones, tensions could ease. Should this occur, gold may lose part of its appeal as a risk hedge. Historically, whenever global tensions ease — even temporarily — gold prices have tended to correct sharply.

3. Declining Investor Demand

The recent rally in gold prices was also supported by strong demand from both institutional and retail investors. Many global fund managers increased their gold allocations as part of portfolio diversification.

But if inflation continues to moderate and equity markets recover, the need for safe-haven assets may diminish. This could dampen demand for gold, ultimately triggering a price correction. History shows that gold corrections are not always dramatic, but often significant enough to create attractive entry points for long-term investors.

Technical Outlook

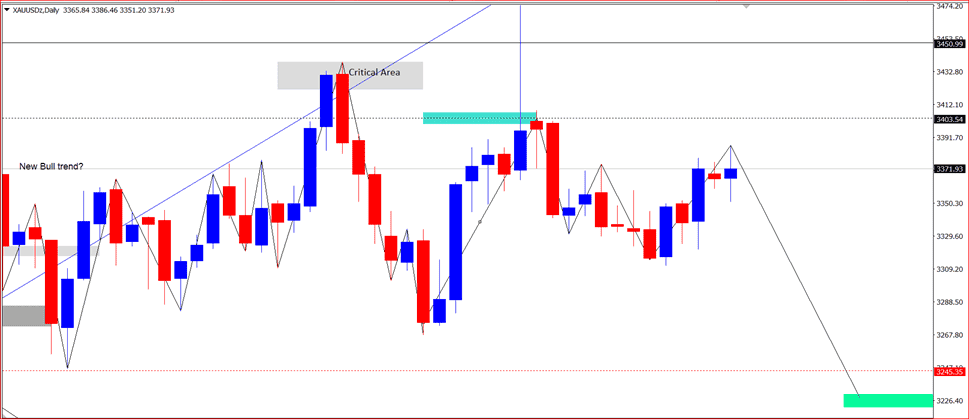

Technically, gold failed to register new highs above 3,390 and 3,409, which serve as minor bullish areas, signaling limited upside potential toward 3,437 and 3,447.

With gold currently trading at historically elevated levels, signs of a potential correction are emerging. Factors such as easing inflation, calmer geopolitics, and weakening investor demand may all contribute to near-term downside pressure on gold prices.

Disclaimer ON

— Ade Yunus