Investors Focus on Recovery Amid Lingering Challenges

Boeing is scheduled to release its second-quarter 2025 earnings report on Tuesday, July 29, before the U.S. market opens. This report is highly anticipated by the market as it will provide the latest update on the company’s operational recovery after several years of headwinds that weighed on its business.

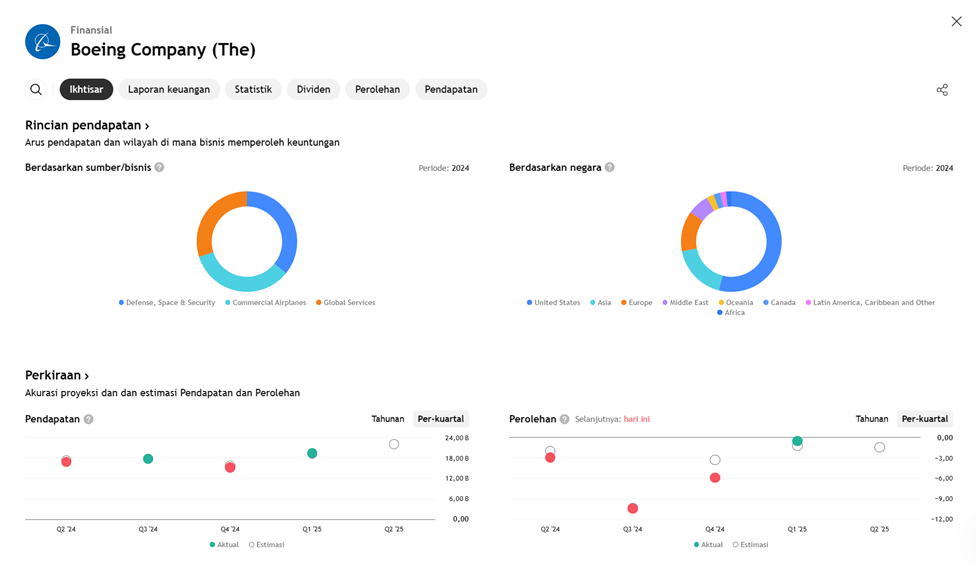

Analyst consensus expects Boeing to still report a loss this quarter, with estimated earnings per share (EPS) ranging from −US$0.92 to −US$1.48. However, this is a significant improvement from the same period last year, when Boeing reported a negative EPS of −US$2.90. Meanwhile, the company’s revenue is projected to grow substantially, increasing by approximately 30% year-over-year to around US$21.7–21.9 billion.

A key driver of revenue growth is the surge in aircraft deliveries. In this quarter, Boeing is estimated to deliver about 150 aircraft, a sharp increase from 92 units in Q2 last year. The resumption of 787 deliveries to the Chinese market and higher production of the 737 series have been major contributors to the recovery of the commercial aviation segment.

Nonetheless, challenges remain. One major risk is potential labor strikes, following the rejection of a new contract by over 3,200 union members. If no agreement is reached during the seven-day grace period, a strike could commence and potentially disrupt the production schedule.

On the regulatory front, Boeing continues to face scrutiny following the Air India crash involving one of its aircraft. Although preliminary findings did not reveal any design flaws, increased oversight from aviation authorities could delay the certification of new models such as the 777X.

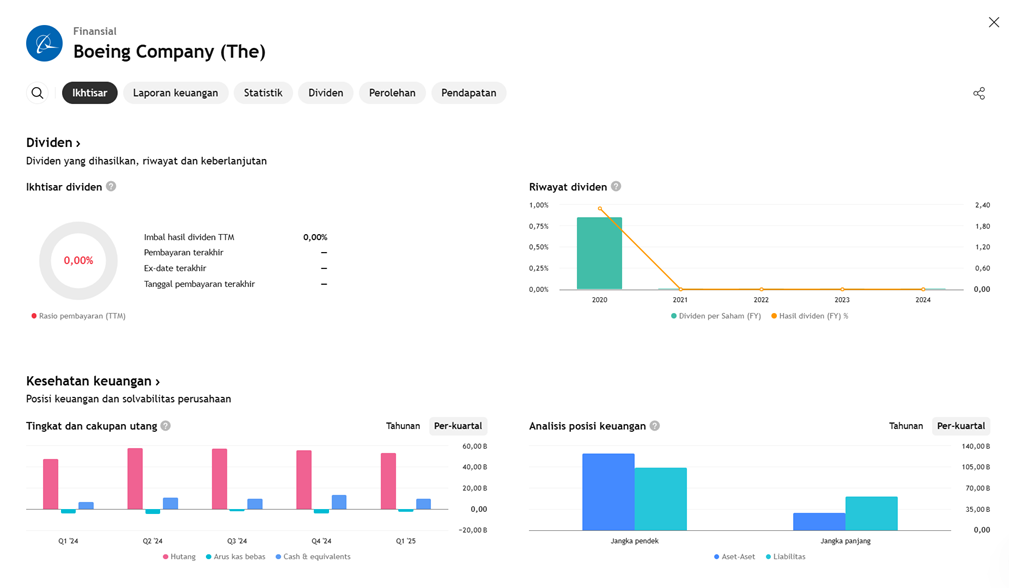

Financially, Boeing’s debt structure remains a market concern. The company is not expected to generate positive free cash flow until 2026, at which point management is targeting an EPS of US$3.50 and free cash flow of US$5.6 billion.

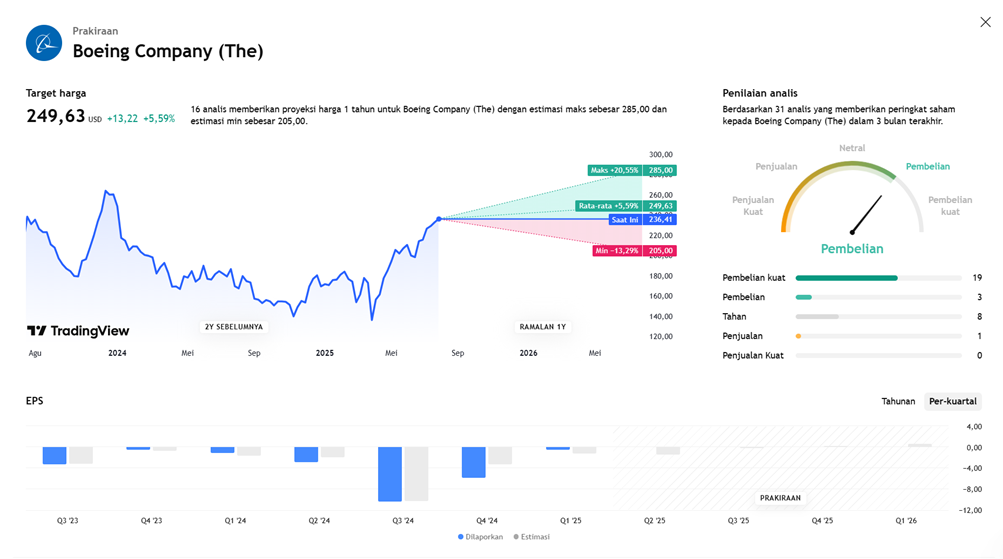

While these risks are yet to be fully resolved, the market remains optimistic about Boeing’s ongoing recovery. Some analysts even recommend the stock as a “Buy,” with target prices as high as US$285, reflecting mid-term optimism.

With high market expectations accompanied by uncertainty, Boeing’s Q2 report is set to be a crucial moment that could determine the trajectory of its stock performance in the coming months.

Performance Estimates: EPS, Revenue & Segment Breakdown

- Analysts expect Q2 losses to narrow to around −US$1.40, compared to −US$2.90 in Q2 2024.

- Consensus revenue is projected to reach US$21.7–21.9 billion (Zacks: US$21.93 billion), marking ~30% YoY growth.

Segment Revenue Estimates:

- Commercial:

US$9.95 billion (+65%) - Defense:

US$6.40 billion (+6%) - Global Services: ~US$5.16 billion (Revenue +5.6%, Earnings +8.3%)

Aircraft Deliveries and Production Progress

- Boeing delivered ~150 aircraft in Q2, up from 92 units a year ago.

- Eased export regulations to China and progress in 787 certification have positively impacted the commercial segment recovery.

Policy Support & Macro Sentiment

- The U.S.–EU trade deal lifting tariffs for the aerospace sector is a positive development, especially for fixed-price overseas contracts such as with European carriers.

- Adjustments to Boeing’s export policies and large orders (e.g., Qatar) bolster analyst confidence in medium-term stability.

Ongoing Risks

- Labor Strike Risk: High if union contract (~3,200 members) is not approved within the seven-day window, potentially disrupting production after last year’s strike.

- FAA Oversight & Safety Issues: Post-Air India Dreamliner crash, despite no design flaws, 777X and 737 MAX certifications remain under strict FAA and industry supervision.

- Financial Structure & Cash Flow: Boeing holds a large debt (~US$60 billion backlog). Free cash flow is expected to turn positive in 2026 when EPS and FCF rebound (target EPS: US$3.50; FCF: US$5.6 billion).

Analyst Sentiment & Stock Valuation

- Around 71% of analysts rate the stock as “Buy”; average price target is around US$274–285.

- Goldman, BofA, Citi, Bernstein, and J.P. Morgan have adjusted targets to US$230–282—reflecting expectations for better deliveries, efficiency, and regulatory clarity.

- Boeing’s valuation remains lower than Airbus, with a forward P/S ratio below the industry average (~1.88× vs 2.28×).

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED