1. Steady But Underwhelming Stock Performance:

This year, American Express stock has performed relatively steadily and moved in the same direction as the general market. Although not spectacular, AXP stock has received support from consumer spending trends and increased domestic travel.

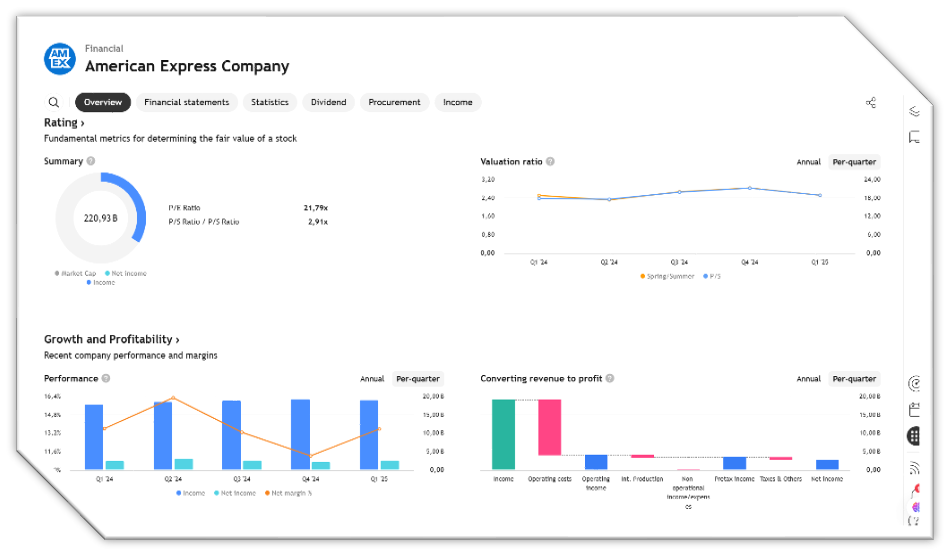

2. Valuation is Still Reasonable:

Ahead of the Q2 report, AXP stock is still considered to be at a reasonable valuation (not cheap). However, with rising revenue and profit estimates, and annual guidance remaining strong, the stock is considered to still have upside potential.

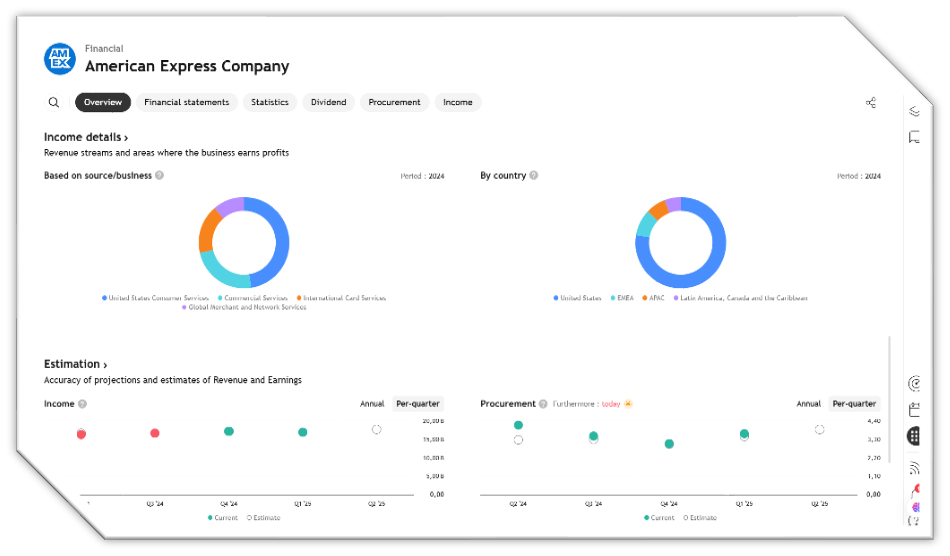

3. Unique and Defensive Business Model:

Amex targets a premium customer segment, unlike players like Visa, Mastercard, or flexible credit providers like SoFi and Affirm. Its revenue sources are more diversified, including from interest and card service fees, not just from transaction volume.

4. Superior Credit Quality:

Dengan basis pelanggan yang loyal dan daya beli tinggi, risiko gagal bayar Amex relatif rendah. Hanya sekitar 23,5% pendapatan tergantung pada kualitas kredit, menjadikannya lebih tahan terhadap siklus ekonomi.

5. Superior Credit Quality:

With a loyal customer base and high purchasing power, Amex’s default risk is relatively low. Only about 23.5% of revenue is dependent on credit quality, making it more resilient to economic cycles.

6. The Market Has Not Fully Appreciated Its Potential:

Despite rising performance expectations (revenue CAGR of 7.2% and EPS of 9.2%), stock valuations have not expanded significantly. This shows that the market is still cautious (wait and see).

7. Q2 Performance Drivers:

Target EPS for the quarter is $3.86 (up 10.5% YoY) on revenue of $17.7 billion (up 8.3% YoY). Growth was mainly driven by:

- Goods & Services (G&S) segment: Consumption remained stable, expected to grow 7% like the previous quarter.

- Travel & Entertainment (T&E) segment: Domestic travel showed recovery, although international travel remained depressed.

American Express (AXP)

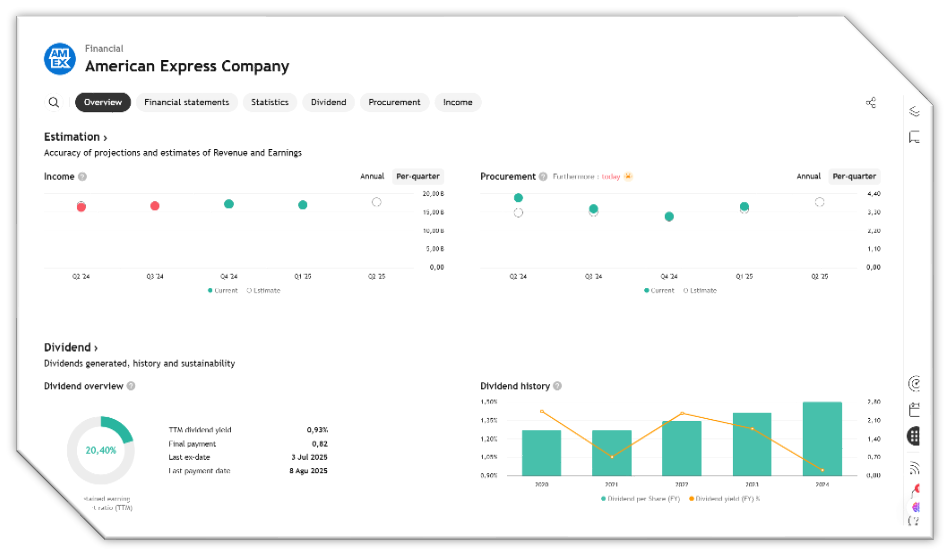

1. Change in Ownership by Institutional Investors

- Winslow Asset Management Inc. reduced its stake in American Express by 3.4% in the first quarter of 2025.

- They now own 32,566 shares worth about $8.76 million, making AXP the 17th largest in their portfolio.

- Several new institutional investors also bought AXP shares in late 2024 and early 2025, such as:

- Investment Management Corp VA ADV

- MorganRosel Wealth Management

- Sellwood Investment Partners

- Murphy & Mullick Capital Management

- Nexus Investment Management

2. Institutional Ownership

- A total of 84.33% of AXP shares are owned by institutional investors and hedge funds.

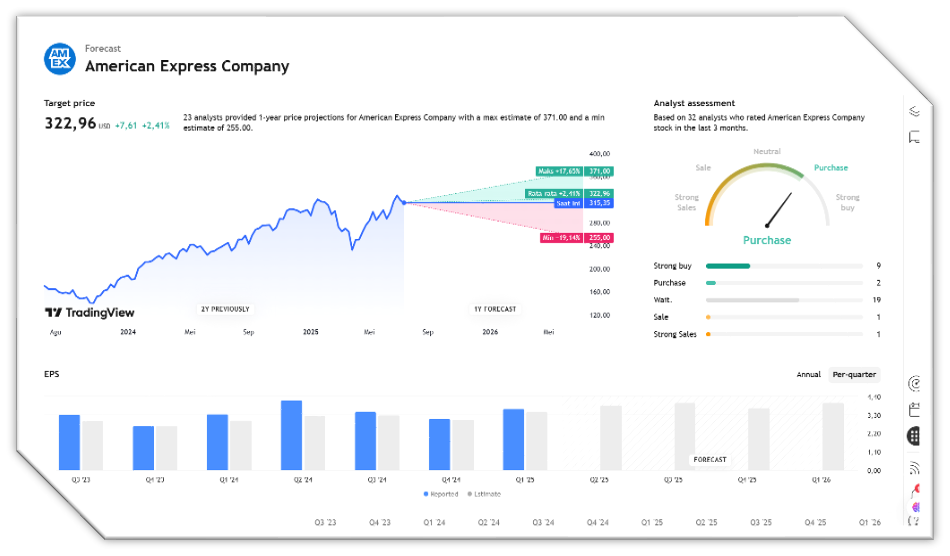

3. Analyst Ratings and Price Targets

- Analyst recommendations split:

- 1 sell

- 16 hold

- 7 buy

- Average price target: $307.68

Some recent price target changes:

- Barclays: Up to $297 (Equal Weight)

- Citigroup: Up to $327 (Netral)

- Redburn Atlantic: Down to $255 (from Sell to Neutral)

4. Share Price Performance

- Last price: $316.26 (up $4.36)

- 52-week range: $220.43 – $329.14

- Market capitalization: $221.57 billion

- PE Ratio: 22.09 | PEG: 1.51 | Beta: 1.25

- Liquidity position: Quick ratio 1.57 and current ratio 1.58

- Moving average:

- 50 days: $303.06

- 200 days: $290.92

5. Quarterly Performance Report (Q1 2025)

- EPS: $3.64, beating estimates ($3.47)

- Revenue: $16.97 billion, slightly below estimates ($17.04 billion)

- Net profit margin: 15.31%

- ROE: 32.48%

- Full year 2025 EPS projection: $15.33

Earning Projection Prediction

WHAT THE ANALYST STATED