Focus on AI and Cloud Growth

Microsoft (MSFT) is scheduled to release its fiscal fourth-quarter earnings after the market closes on Wednesday. Investors and analysts are focusing on the performance of its AI and cloud segments, particularly as customer interest in AI applications continues to rise.

Market Expectations:

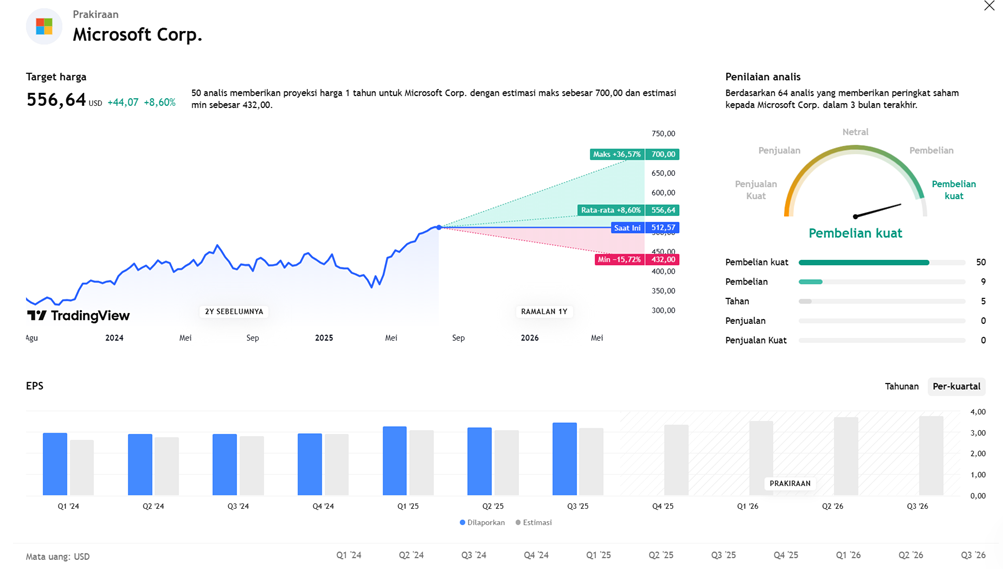

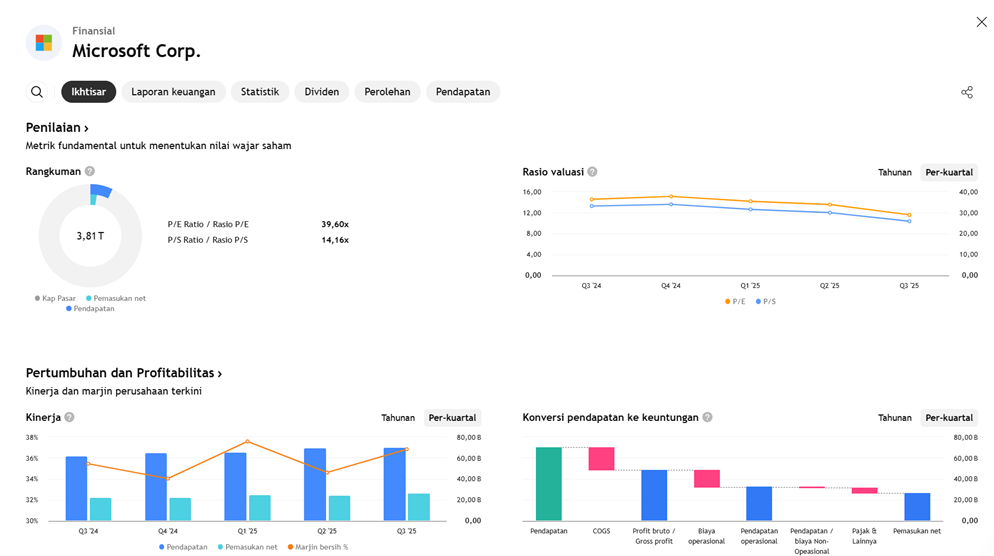

- Adjusted EPS: $3.37

- Revenue: $73.89 billion

(Compared to last year: EPS $2.95 and revenue $64.72 billion)

Key Segments:

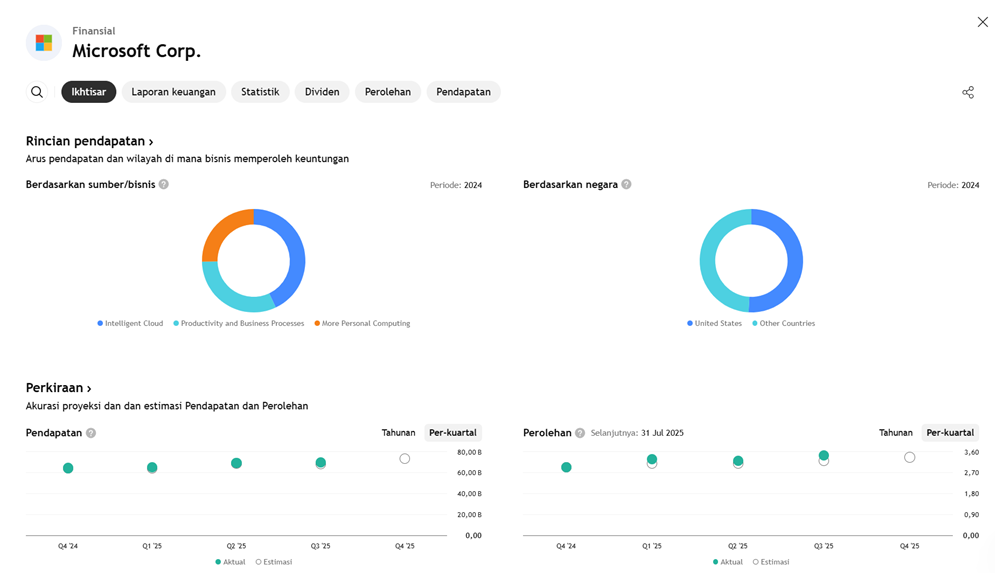

- Intelligent Cloud Revenue (including Azure): Expected to reach $29.09 billion, up 22% from $23.78 billion the previous year.

- AI-Driven Azure Growth: Projected to contribute 17.25 percentage points, up from 11 points in Q4 of the prior year.

- AI Demand: Continues to outpace supply capacity, although additional servers are being brought online more rapidly.

Major Catalysts:

- AI Investment: Wedbush analyst Dan Ives stated that Microsoft’s AI boom will likely peak in fiscal year 2026.

- Copilot (AI-powered software): According to BofA, Copilot could be a key growth driver, though its short-term impact may still be limited.

Market Position & Competition:

- Microsoft stock has risen over 21% year-to-date (YTD), compared to Google (13%) and Amazon (27%).

- AI Advantage: Microsoft retains a competitive edge thanks to its investment in OpenAI. However, that relationship is under scrutiny as OpenAI plans to restructure its organization, which could affect Microsoft’s stake and its potential $20 billion investment.

Q3 2025 FINANCIAL PERFORMANCE OUTLOOK

Key Highlights:

- Cloud & AI Business Growth

Corporate demand for AI is fueling Azure’s expansion, making it a core growth driver in Q4 FY2025.

Intelligent Cloud revenue is expected to grow by approximately 21–22% YoY, with Azure accounting for about 33–35% annual growth. - High Capital Expenditure (CapEx)

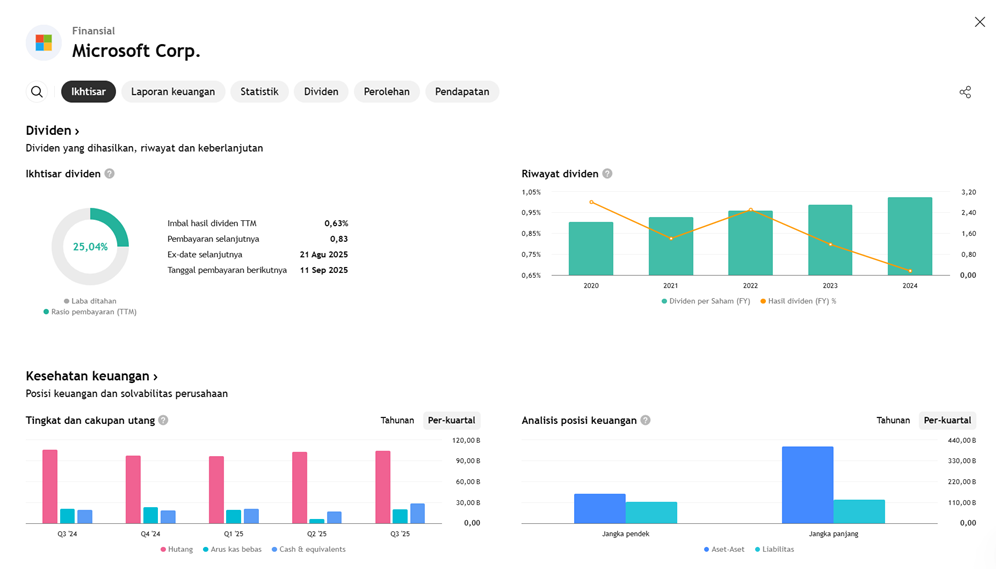

Microsoft is expected to allocate around US$80 billion in FY2025 to expand its AI and Azure data center infrastructure.

However, investors are beginning to question the sustainability of this spending if cheaper AI alternatives emerge. - Restructuring and Workforce Reduction

Despite earning about US$75 billion in net income over the past three quarters, Microsoft has laid off approximately 17,000 employees to align its structure with AI-driven transformation.

CEO Satya Nadella stated the layoffs reflect a culture of constant adaptation amid fast-paced industry shifts. - Investor Focus and Strategic Challenges

Key Q4 focus areas include:- Whether AI (especially Copilot and Azure) is translating into tangible monetization;

- Azure’s competitiveness amid pressure from AWS and Google Cloud;

- Potential shifts in OpenAI’s cloud partnerships and implications for Microsoft’s exclusivity extension.

- Market Sentiment Ahead of the Earnings Report

- Analysts estimate revenue of around US$73.8 billion (~14% YoY growth);

- EPS expected at approximately US$3.38;

- Sentiment remains positive: all major analysts maintain buy ratings, with price targets ranging between US$578–600+.

- However, analysts warn that much of the market’s optimism may already be priced in, and 4–5% post-earnings volatility is common.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED