Meta Earnings Report: AI Investments Under Spotlight as Q3 Results Loom

Maxco Futures — October 2025

Meta Platforms Inc. is set to release its third-quarter earnings, as market focus intensifies on Mark Zuckerberg’s ambitious strategy to strengthen the company’s position in the age of artificial intelligence (AI). With revenue expectations nearing US$50 billion and profit growth projected in double digits, investors are eager to find out whether Meta’s massive spending on AI infrastructure and advertising capabilities is beginning to pay off — or if it is weighing on profit margins. As Wall Street assesses the outlook for an increasingly capital-intensive tech sector, Meta’s forward guidance will serve as a key barometer for digital market direction and sentiment toward megacap AI stocks in the second half of the year.

Summary

Performance Expectations

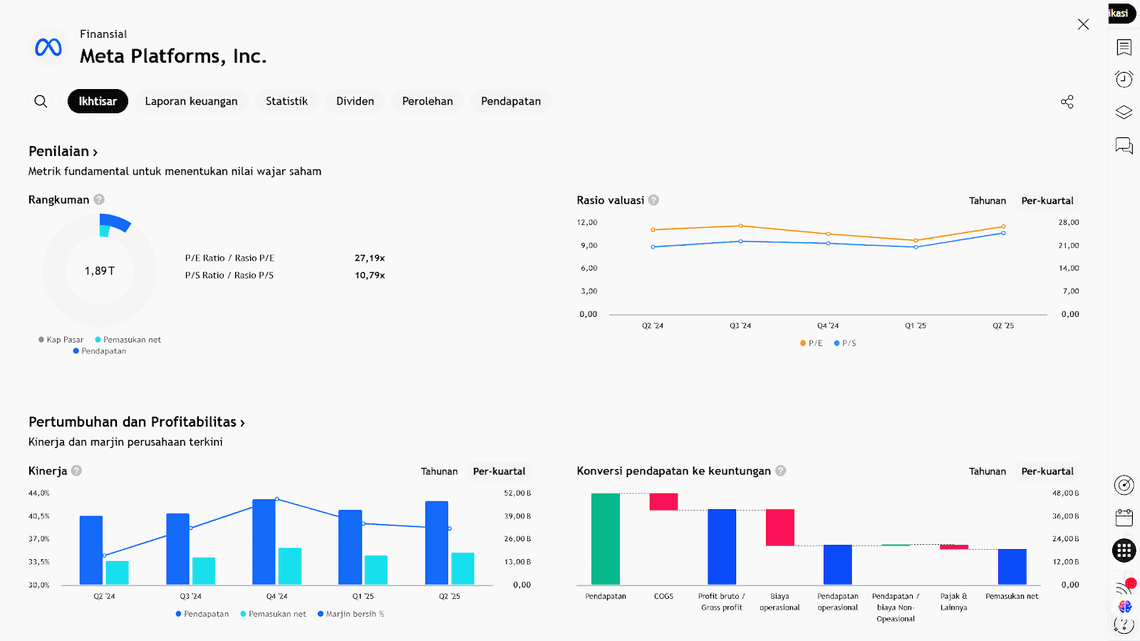

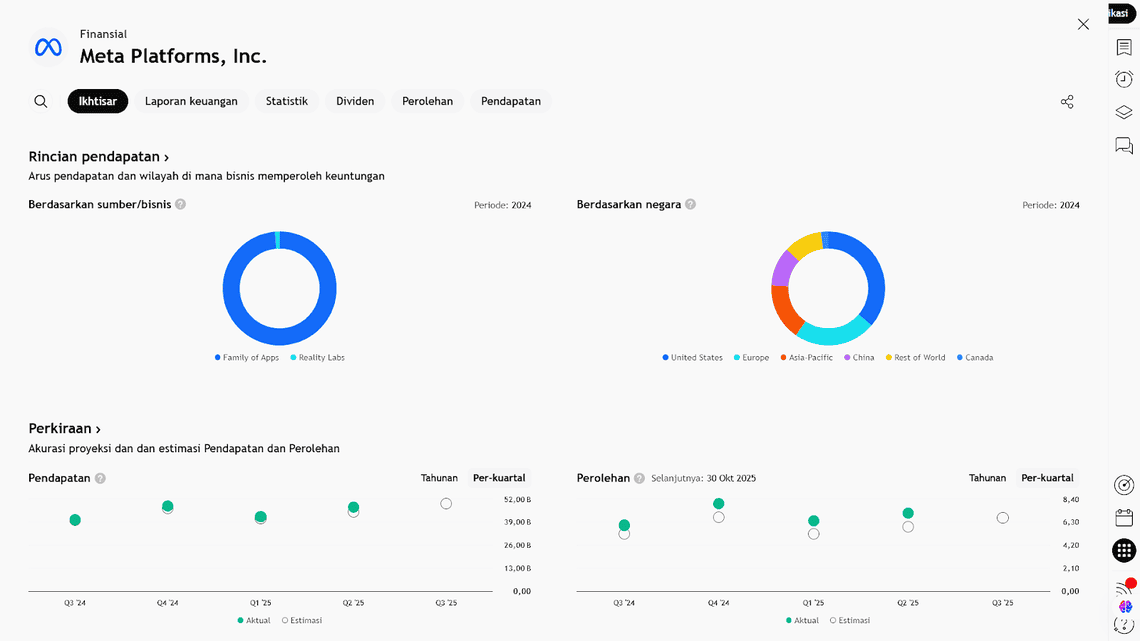

- Analysts forecast Meta’s revenue at around US$49.5 billion, representing approximately 22% year-on-year growth.

- Adjusted earnings per share (EPS) are expected to range between US$6.67 and US$6.72.

- Revenue growth is likely to be driven by strong digital advertising demand and continued high user engagement across Meta’s platforms.

Key Focus Areas & Risks

- Meta remains heavily focused on AI investments, including infrastructure, hardware, and generative tools.

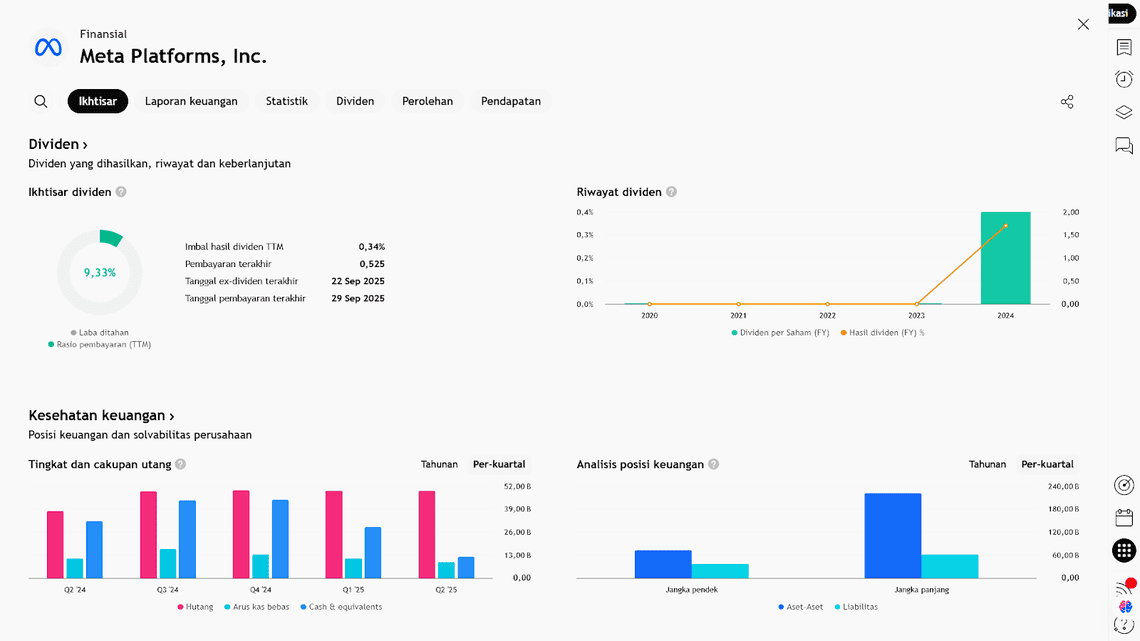

- Capital expenditures (CapEx) are expected to stay elevated — some analysts project up to US$70 billion or more for 2025.

- The market’s main questions:

- How effectively can Meta monetize AI capabilities?

- What will management’s guidance reveal about spending and profit margins, especially compared to rivals like Alphabet Inc. (Google)?

Why It Matters

Meta has demonstrated strong momentum, with advertising growth rebounding and platforms such as Instagram and Reels driving engagement and revenue.

However, with massive AI-related spending, this quarter’s results will be crucial in determining whether the company’s long-term strategy is beginning to deliver tangible returns — or whether high costs will become a drag on profitability.

Upcoming CapEx plans and forward guidance are expected to be the “make-or-break” factors for investors who now view Meta not merely as a social media company, but as a major AI infrastructure player.

What to Watch

- Whether Meta provides forward guidance signaling stronger or slower growth in revenue and margins.

- Potential AI-related announcements, such as new generative tools, creative products, or strategic partnerships.

- The impact of heavy capital spending on profitability and how investors assess the associated risks.

- Comparative performance against competitors like Google in terms of advertising growth and AI adoption.

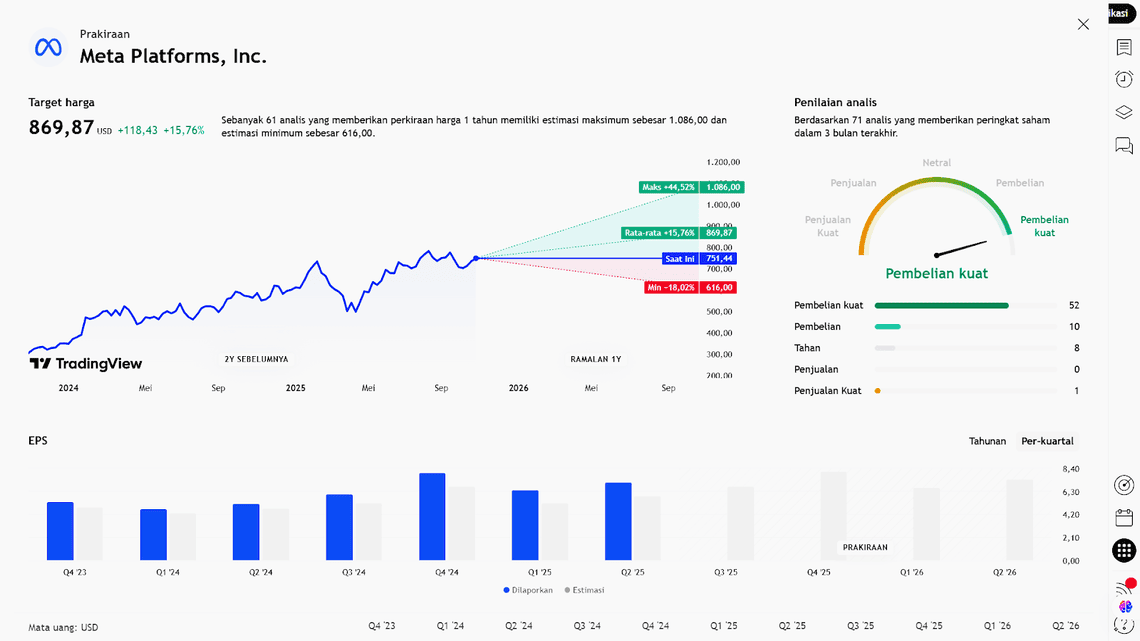

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

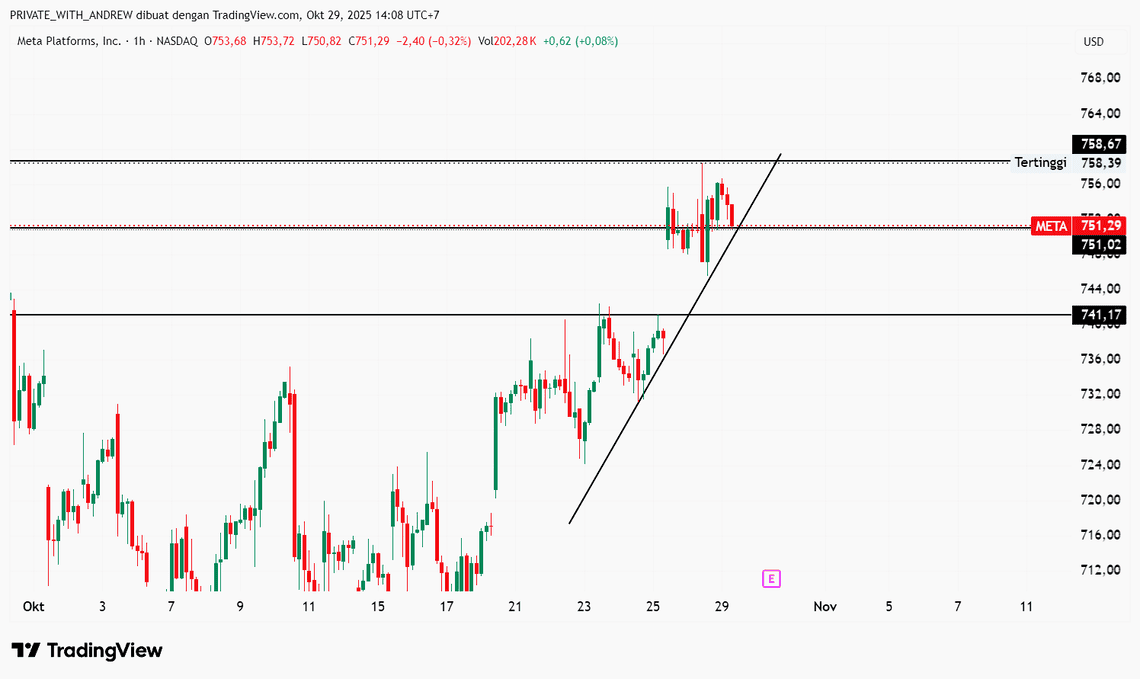

Strategy

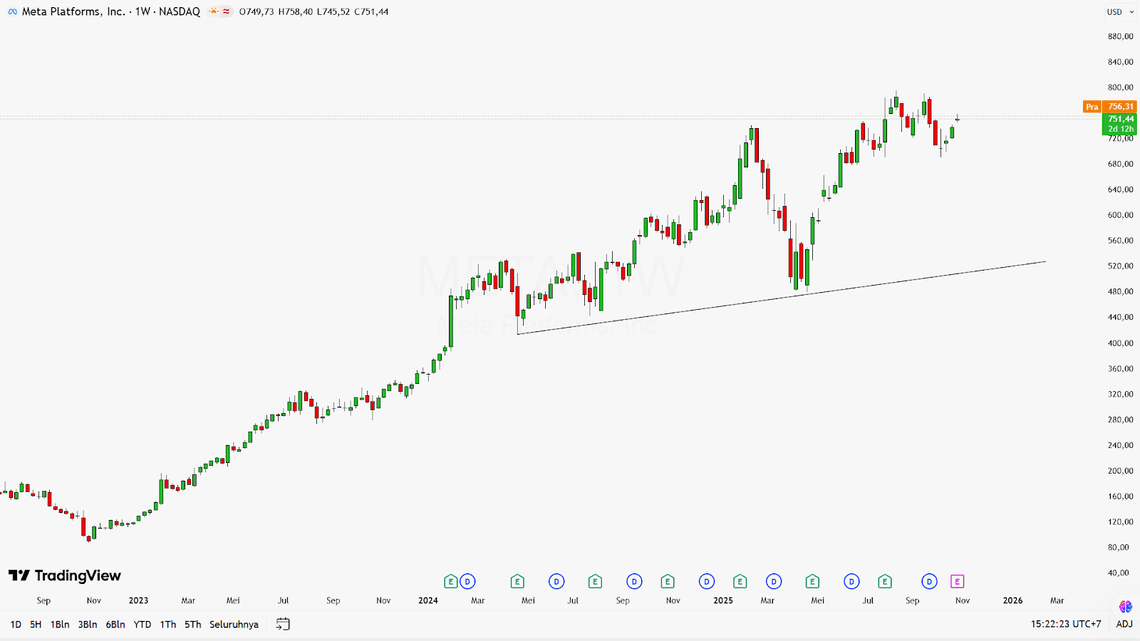

| Sell META | |

| Entry | 751.44 |

| Take Profit | 741.17 |

| Stoploss | 758.67 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst