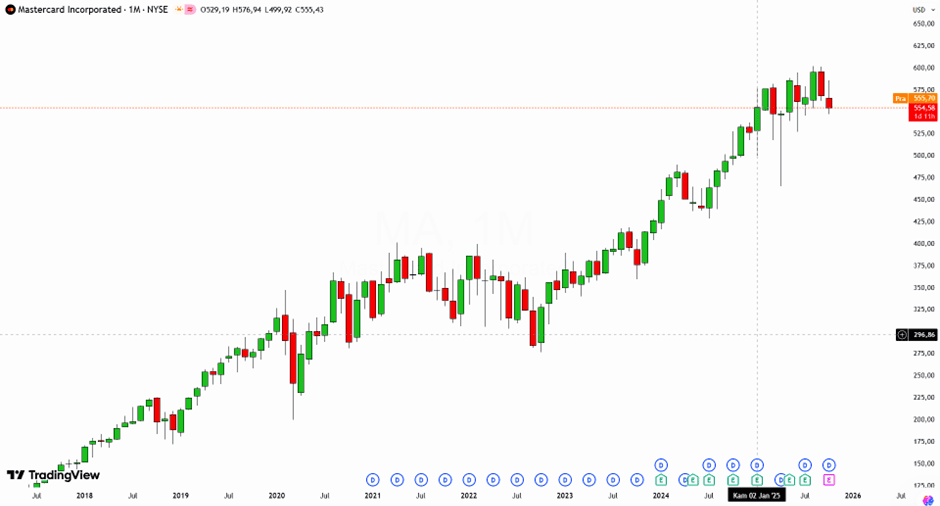

Mastercard Inc. (MA) appears set to deliver solid quarterly profit growth despite ongoing market volatility and global economic uncertainty. Strong momentum in cross-border transactions and the continued expansion of digital payment adoption signal resilient consumer demand, reinforcing Mastercard’s leading position in the competitive global payments industry.

However, behind the optimism, its elevated stock valuation and high market expectations leave little room for error. Investors are now watching closely to see whether the upcoming Q3 results will reaffirm Mastercard’s reputation as a high-profitability leader—or trigger a correction amid growing saturation in the digital payments sector.

Key Highlights

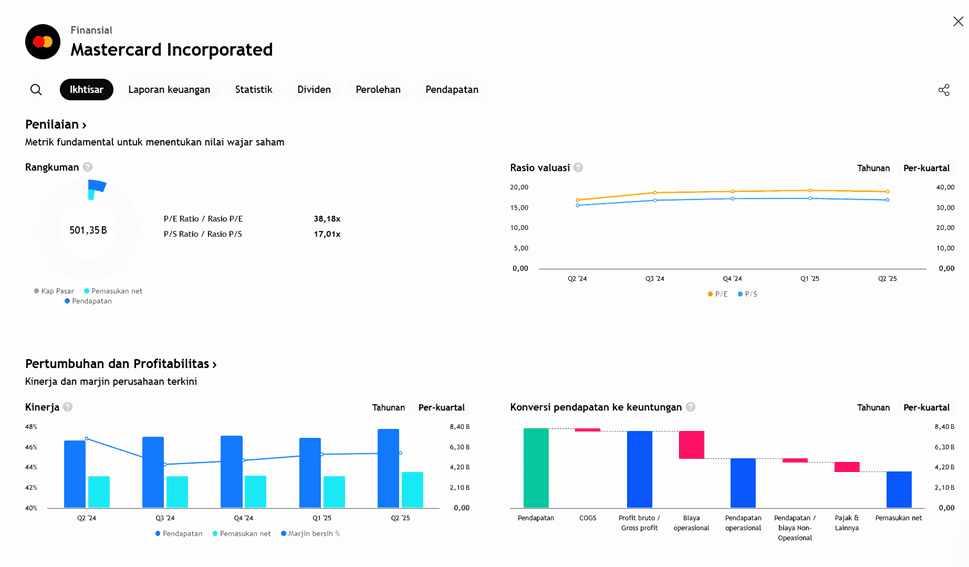

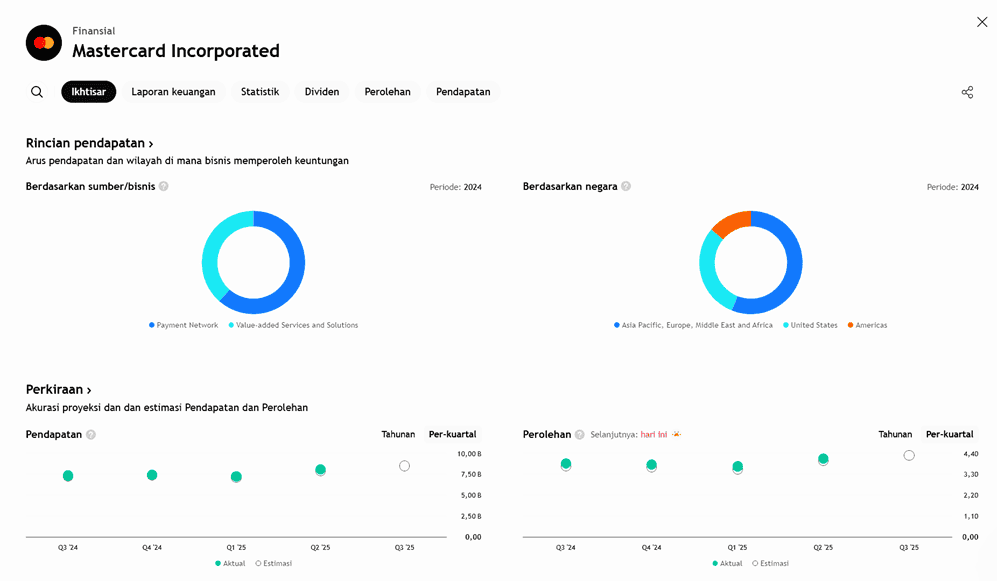

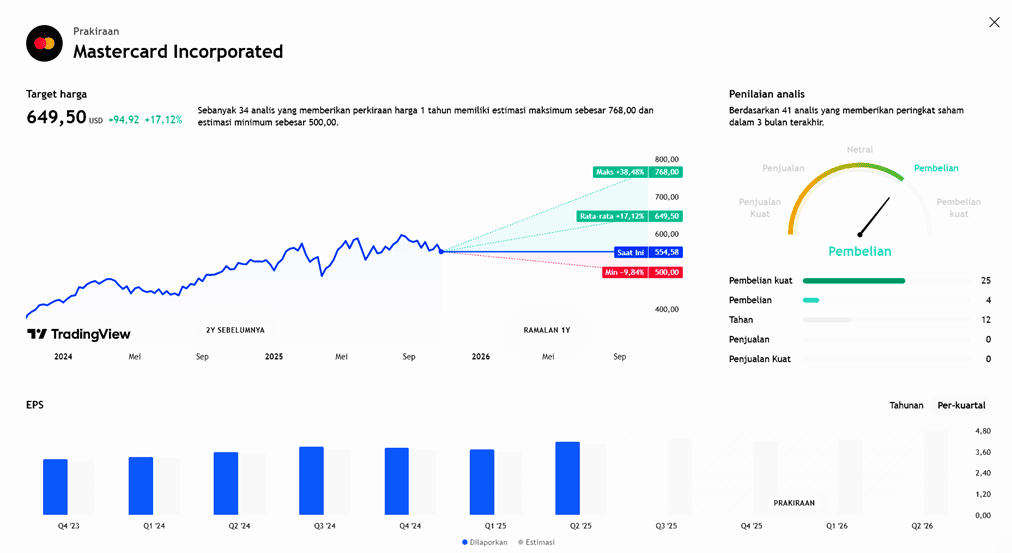

- Mastercard is expected to post a notable increase in both EPS and revenue in Q3.

- Projected key figures: EPS around US$4.31 (+~10.8%) and revenue around US$8.53 billion (+~15.7%).

- Growth is driven by higher consumer spending and rising adoption of contactless payments.

- Cross-border transactions are anticipated to rise by ~14–15%, and switched transaction volumes by ~7.2–9.3%.

- From a fundamentals perspective: operating margin ~58%, net margin ~44.9%, and 3-year revenue CAGR ~16.9%.

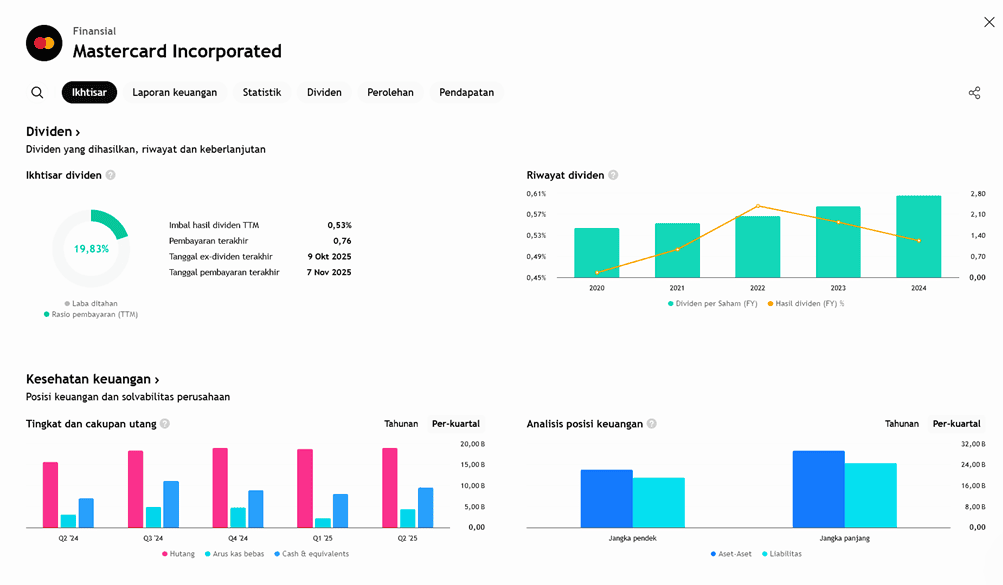

- However, valuation remains steep — P/E ~37.6x, P/S ~16.9x, P/B ~64.4x — indicating that the “price for growth” is already high.

- Slight increase in insider selling activity noted, though overall financial condition remains strong.

Implications & Why It Matters

- If projections hold true, it would show that Mastercard continues to demonstrate strong growth despite macroeconomic headwinds — suggesting the payments sector remains dynamic.

- For investors tracking this stock, Q3 results could be a key checkpoint — to see whether growth is reflected in actual numbers or remains largely expectation-driven.

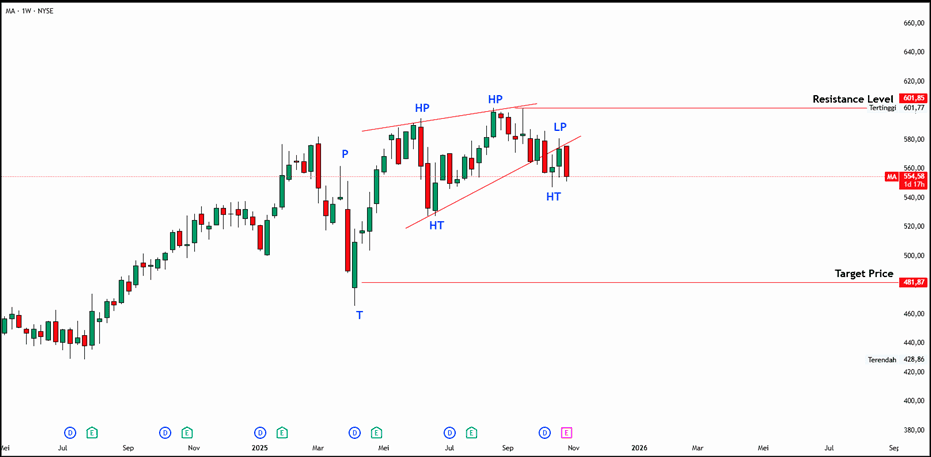

- Given the high valuation, potential upside may be limited unless Mastercard can significantly outperform expectations.

- Rising cross-border and digital payment volumes highlight favorable external tailwinds such as travel recovery and ongoing digitalization trends.

Risks & Watchpoints

- While prospects are positive, expectations are already high — meaning if results are “good” but not exceptional, the market reaction may be muted.

- A premium valuation leaves little margin for error — any macro slowdown (e.g., weaker consumer spending, tighter digital payment regulations, or rising operational costs) could increase downside risk.

- Although margins remain strong, operating expenses are rising due to tech investments and global expansion.

- Increased insider selling could be a cautionary signal, though not necessarily alarming on its own.

Earnings Projection Prediction

What analyst said

Short–Medium Term Outlook

Mastercard’s near-term performance will hinge on its ability to sustain transaction growth and defend its profit margins amid rising competition and cost pressures. The company’s strong fundamentals offer stability, but valuation sensitivity remains a key risk factor.

Ade Yunus ST, WPA

Global Market Strategist

Geraldo Kofit CSA,CTA,CDMP

Market Analyst