Marriott International is scheduled to release its second-quarter (Q2) earnings report for 2025 on Monday, August 5, before the market opens. Investors and analysts will closely examine the results to determine whether the world’s largest hotel chain can withstand the global economic challenges currently affecting the travel and tourism sector.

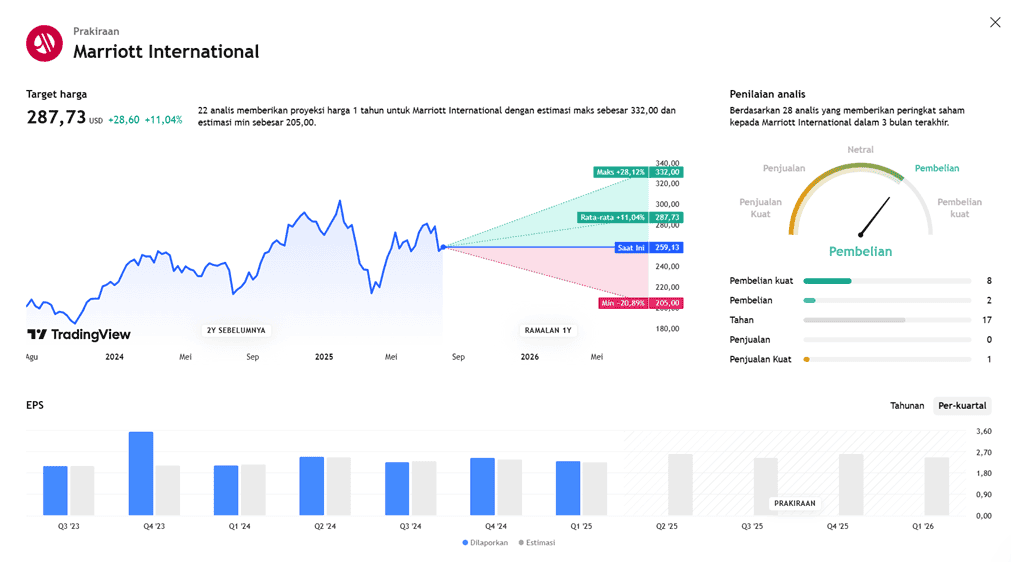

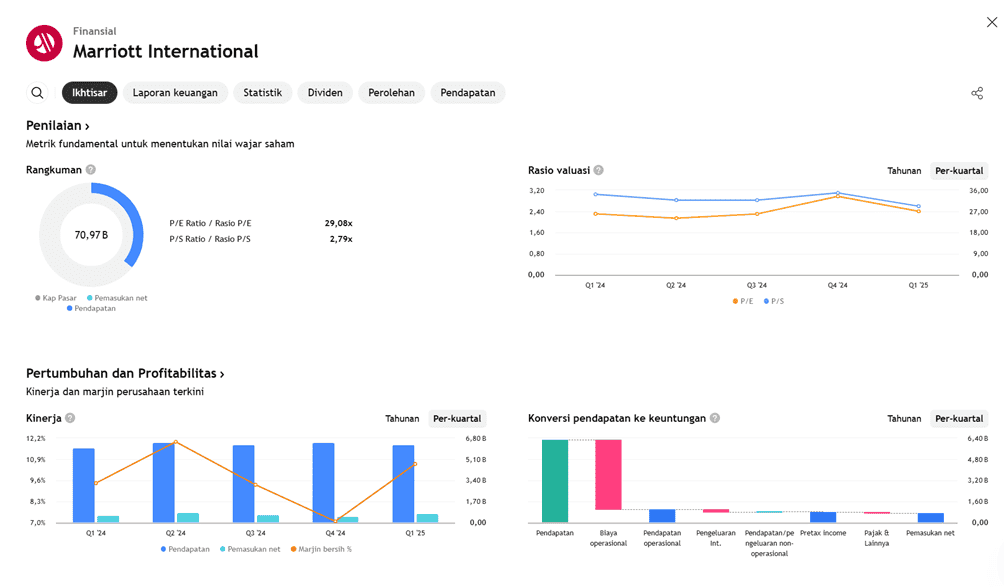

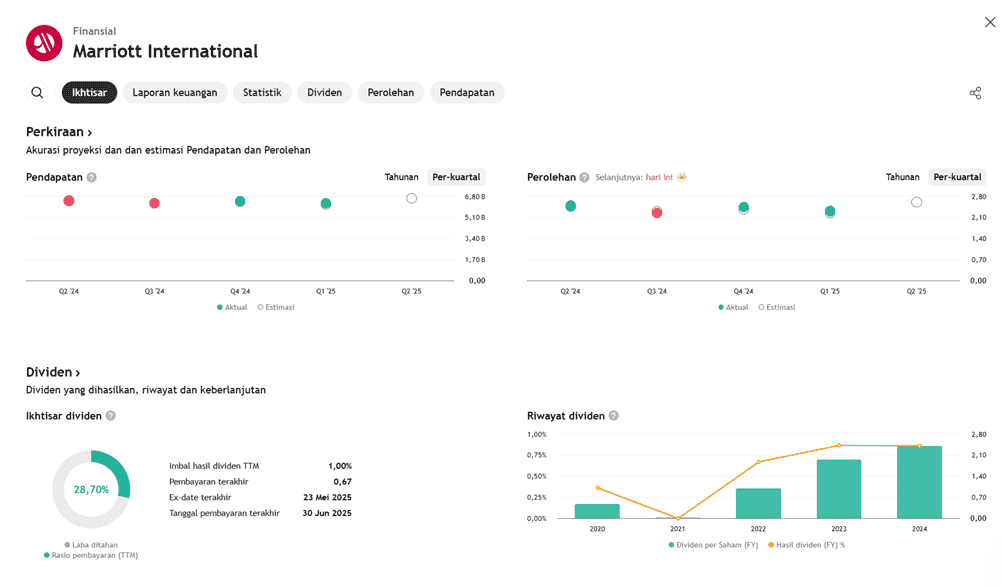

In its previous guidance, Marriott projected adjusted earnings per share (EPS) in the range of $2.57 to $2.62 for the quarter. However, this is slightly below analyst consensus estimates, which forecast an EPS of around $2.68, indicating potential margin pressure or a slowdown in demand. Meanwhile, revenue is expected to reach approximately $6.66 to $6.67 billion, a year-over-year increase of about 3.5%.

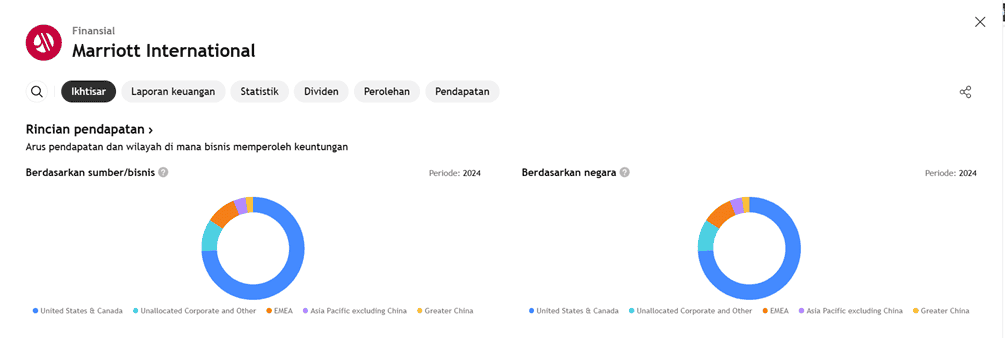

One key performance indicator, Revenue per Available Room (RevPAR), is also under scrutiny. The company has lowered its full-year 2025 global RevPAR growth outlook from 2–4% to 1.5–3.5%, signaling a slower pace of travel demand recovery—particularly in Asia and Europe.

That said, Marriott’s Q1 performance showed solid strength. In Q1 2025, the company reported revenue of $6.26 billion, beating analyst expectations and up about 5% year-over-year. Adjusted EPS also exceeded expectations at $2.32, compared to a consensus of $2.25.

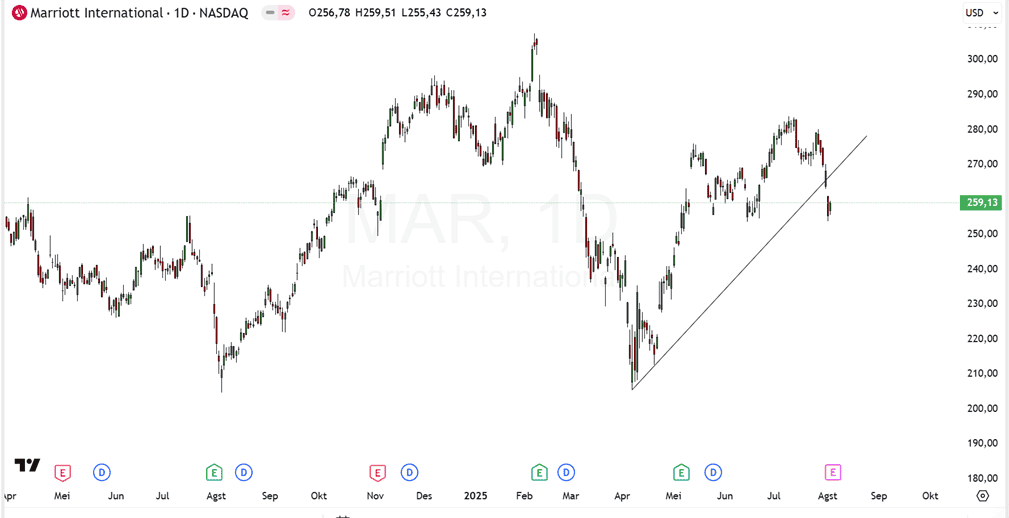

Against this backdrop, the upcoming Q2 report is crucial in confirming whether Marriott can maintain its momentum or if more evident signs of slowing growth are emerging. Amid rising global economic uncertainty and a cooling of international travel, markets will look for clear signals regarding Marriott’s forward strategy, and whether the company will revise its guidance again for the remainder of the year.

Financial Performance Outlook

Key Highlights:

- Release Date: August 5, 2025 (before market open, approx. 7:00 AM ET)

- Earnings Call: 8:30 AM ET

- Q2 EPS Guidance: $2.57–$2.62

- Analyst Consensus EPS: $2.68

- 2025 RevPAR Forecast: Revised to 1.5%–3.5% (from 2%–4%)

Q1 2025 Performance:

- Revenue: $6.26 billion (+5% YoY)

- Adjusted EPS: $2.32 (vs. consensus $2.25)

Outlook & Market Sentiment

Analyst expectations:

- Q2 EPS: Approximately $2.63–$2.64

- Revenue: $6.66–$6.67 billion

- Estimated year-over-year growth: ~3.5%

The downward revision in expectations reflects concern over slowing global demand, though Q1 data indicated relatively strong fundamentals.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED