MAXCO FUTURES – Marriott International is preparing to release its quarterly earnings report, closely watched by the market, with earnings per share (EPS) expected to reach $2.41, marking an improvement from the previous year. However, behind this positive projection, the company’s short-term outlook faces pressure from weaker domestic demand and slowing growth in Asia. Investors are now waiting to see how the world’s largest hotel chain will balance post-pandemic momentum amid global economic uncertainty and rising operational costs.

Marriott International, Inc.

Key Points

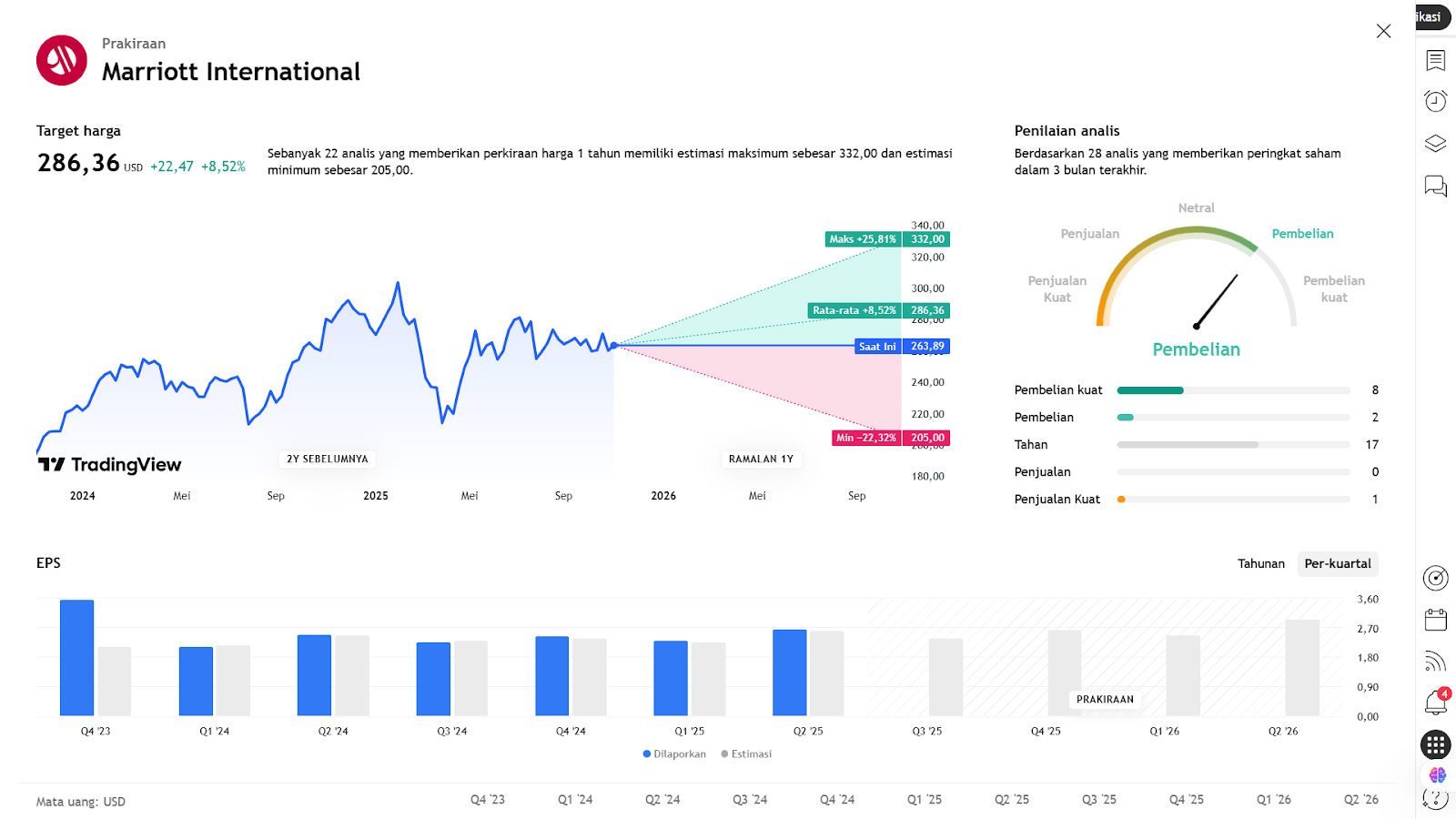

- Marriott is expected to report earnings per share (EPS) of around US$2.41 for the upcoming quarter.

- This projection signals potential growth compared to the same period last year.

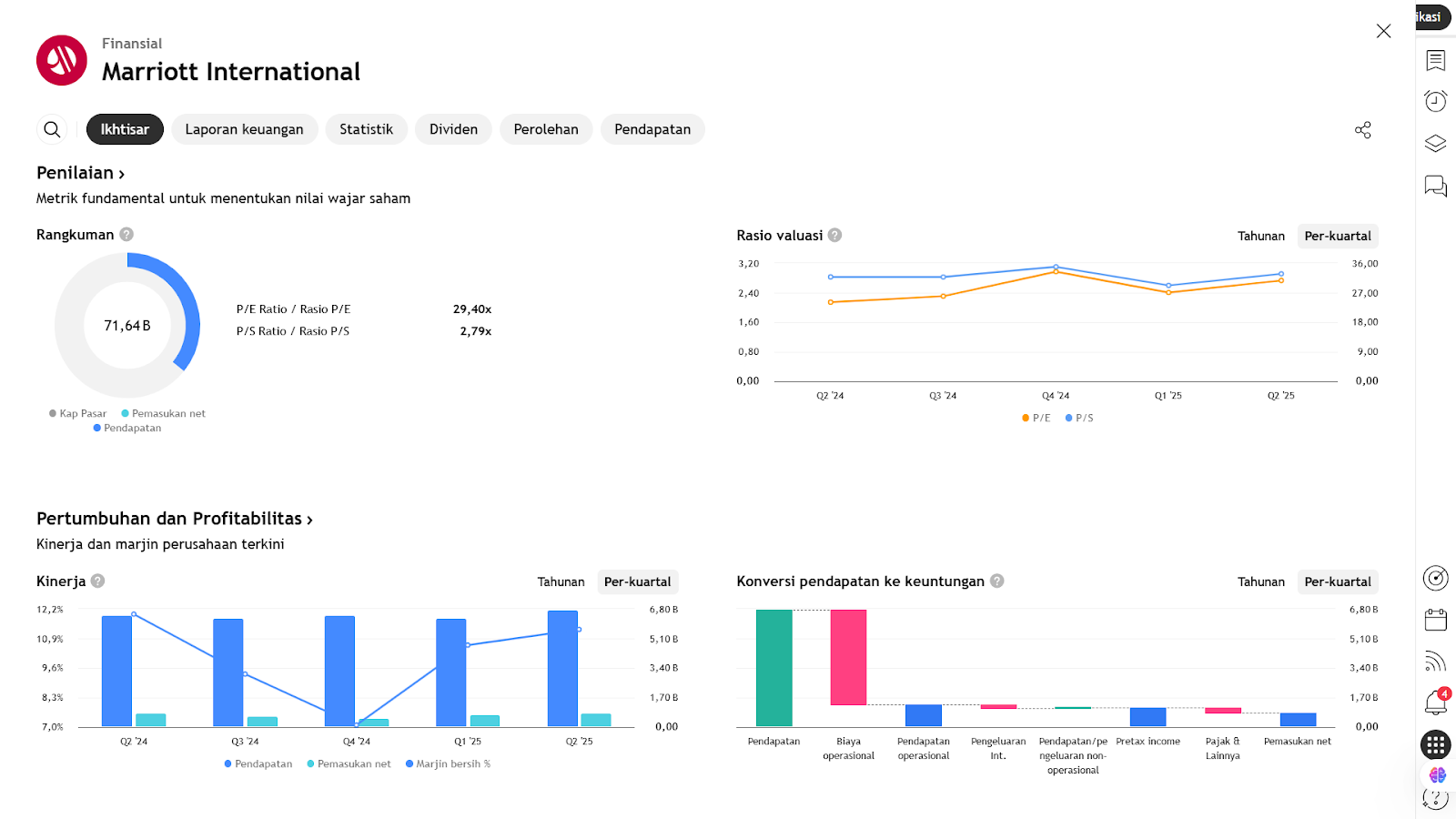

- Analysts highlight that although operational performance remains solid in several areas, there are increasing pressures, particularly from weaker demand in certain market segments.

- For instance, demand from the U.S. government sector for hotel room services has declined, potentially hindering a full recovery.

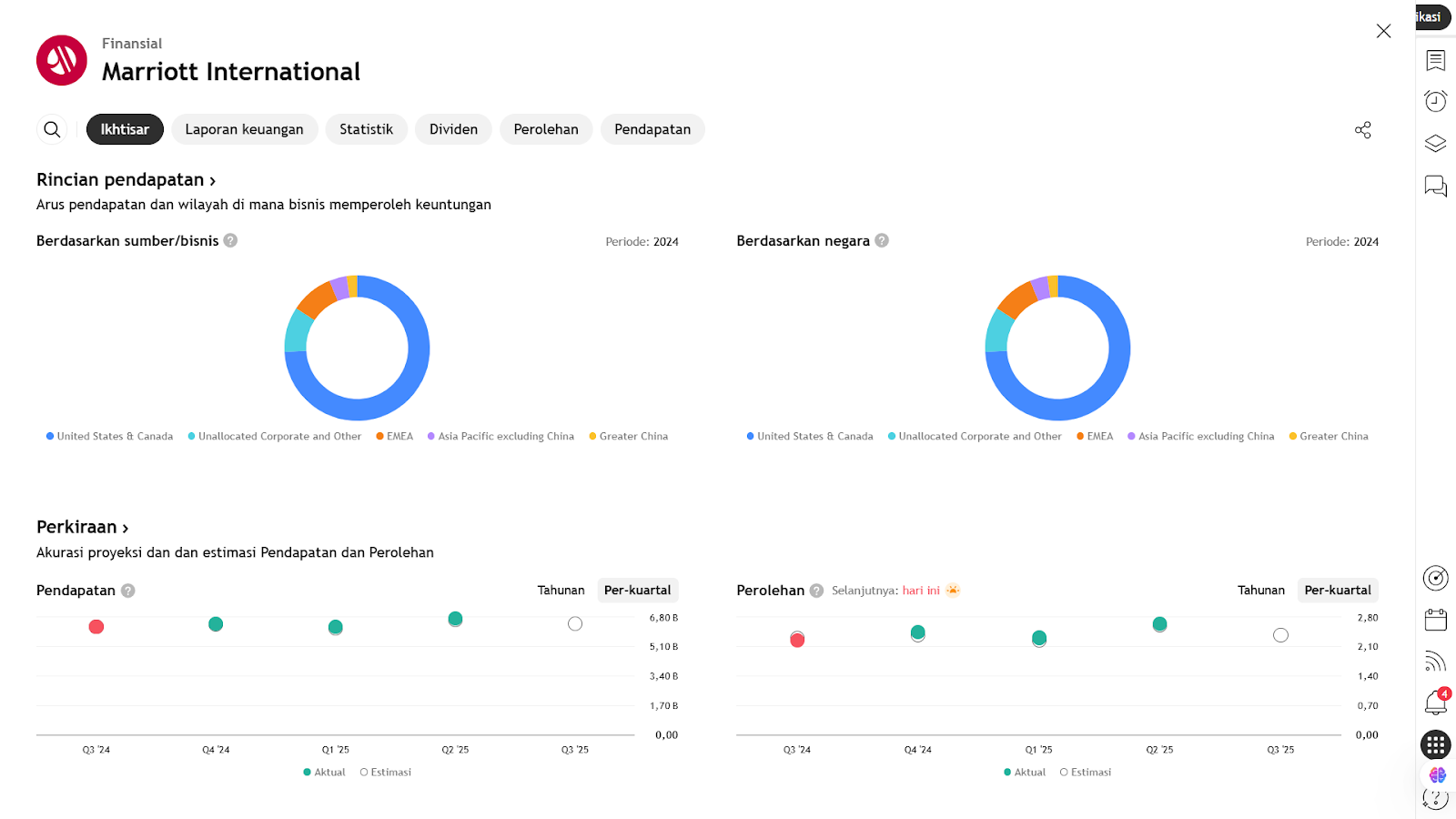

- In addition, Marriott has lowered its guidance for both net room growth and annual profit, citing weaker performance in regions such as China and North America.

Analysis & Implications

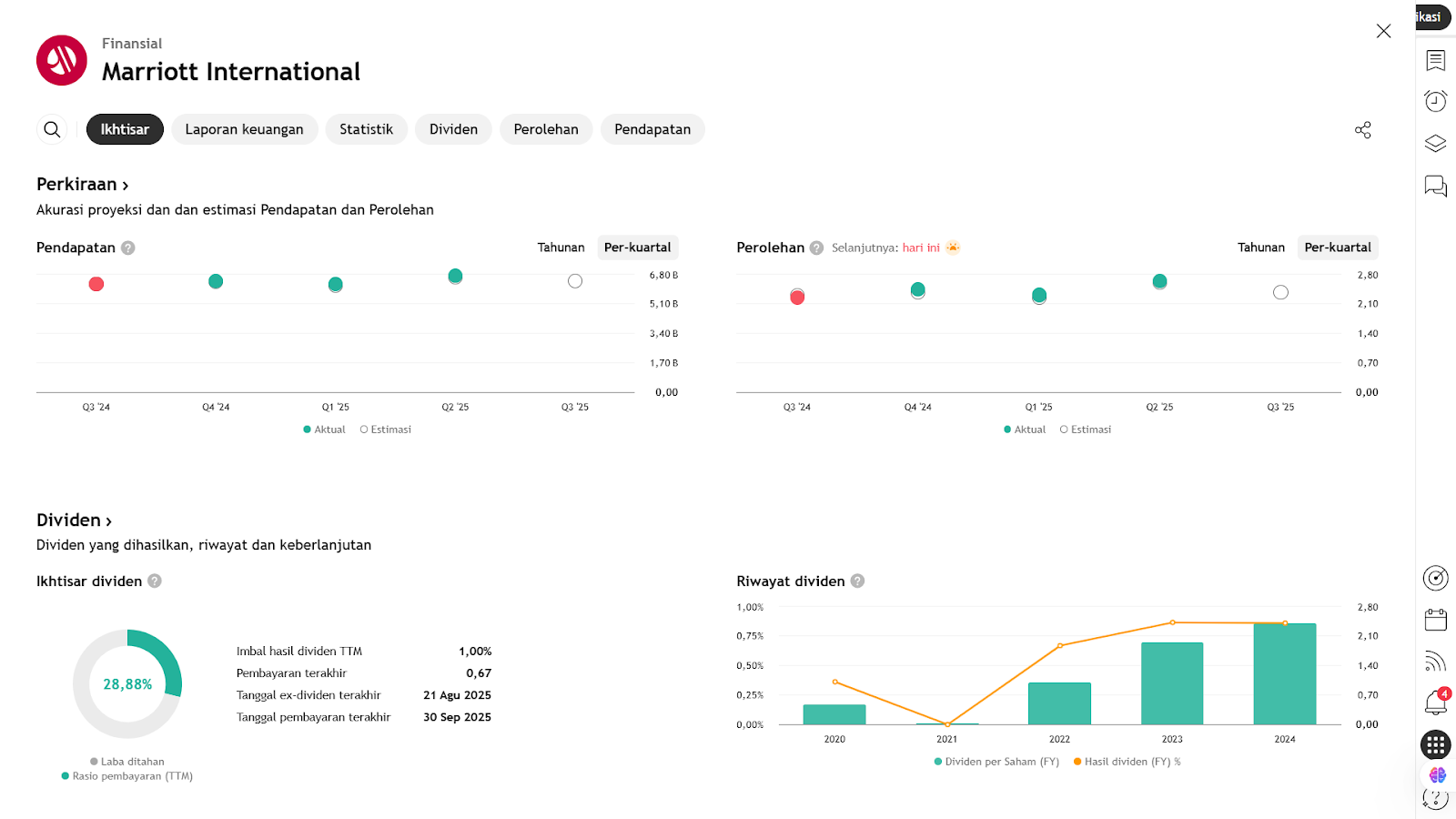

- The expected EPS rise to US$2.41 shows that Marriott continues to deliver strong profitability — a positive sign for investors.

- However, the more conservative guidance and indications of slowing demand, especially from the government sector and amid rising overall costs, could act as headwinds for future growth.

- For investors, this means quarterly results may still deliver a positive surprise, but risk areas — such as cost-sensitive segments, slower regions, and evolving travel patterns — warrant close attention.

- In the broader market context (inflation, interest rates, global economy), hotel companies like Marriott remain highly sensitive to shifts in consumer behavior and external factors.

Conclusion

Marriott remains well-positioned in the short term, backed by solid EPS expectations. However, macroeconomic headwinds and slower performance in certain business segments could limit its forward momentum. For shareholders or potential investors, the key focus will be on how effectively Marriott navigates these challenges — whether through operational efficiency, cost management, or adaptation to changing market demand.

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

Strategy

| Buy Marriot | |

| Entry | 260 |

| Take Profit | 307 |

| Stoploss | 231 |

Disclaimer On