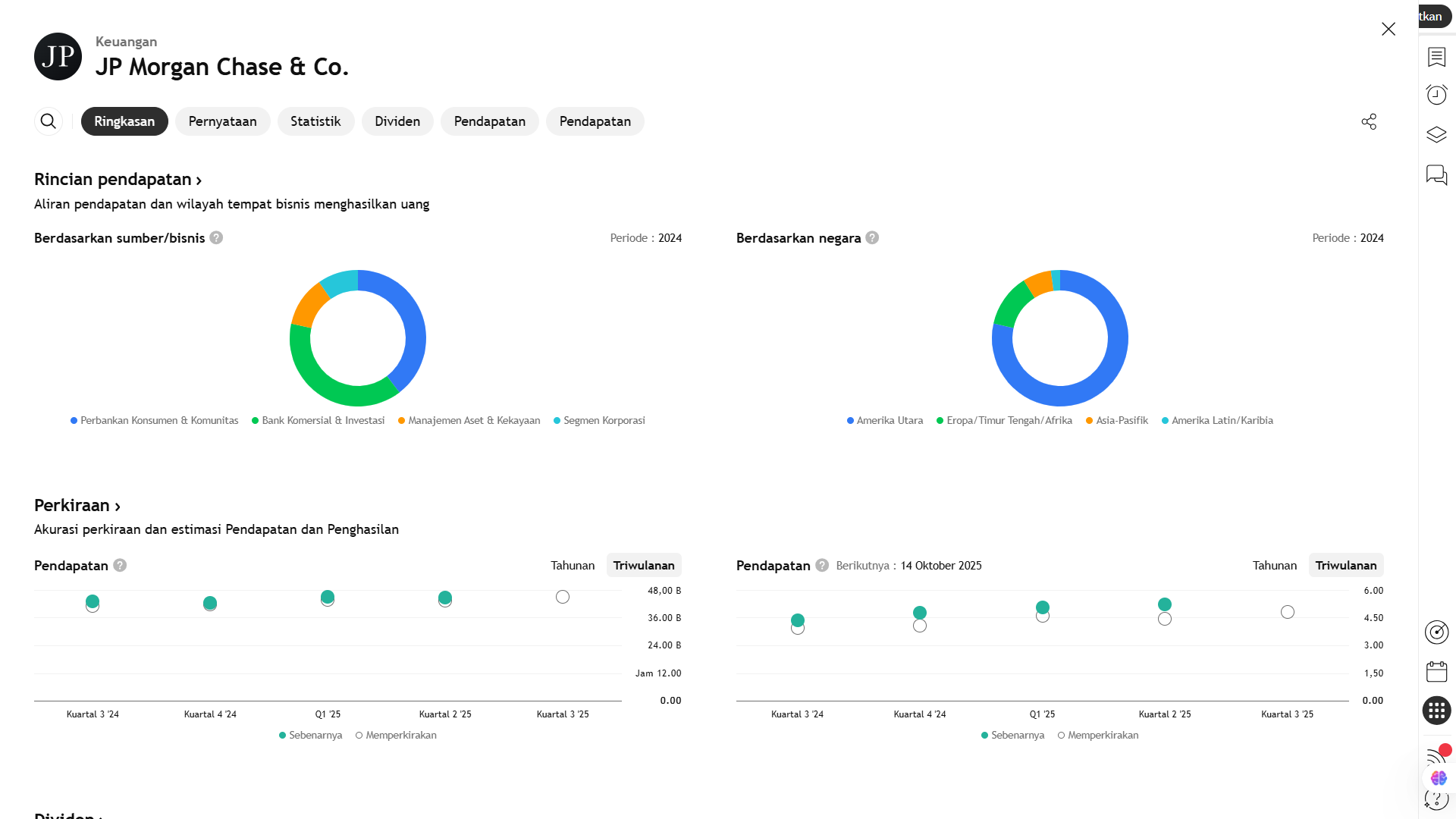

1. Upcoming Q3 Release

JPMorgan Chase is scheduled to release its third-quarter (Q3) earnings report on October 14, 2025, before the U.S. market opens.

2. Previous Quarter Performance

In the previous quarter, JPMorgan reported revenue of US$ 44.91 billion, a decline of about 10.5% year-over-year (YoY).

However, the figure still exceeded analysts’ expectations by roughly 2.9%.

On the other hand, net interest income (NII) came in slightly below projections.

3. Analysts’ Expectations for Q3 2025

- Revenue: Expected to grow 6.2% YoY to around US$ 45.28 billion.

- Adjusted Earnings per Share (EPS): Estimated at US$ 4.87 per share.

- Over the past 30 days, analysts’ forecasts have remained largely unchanged, indicating a steady outlook ahead of the earnings release.

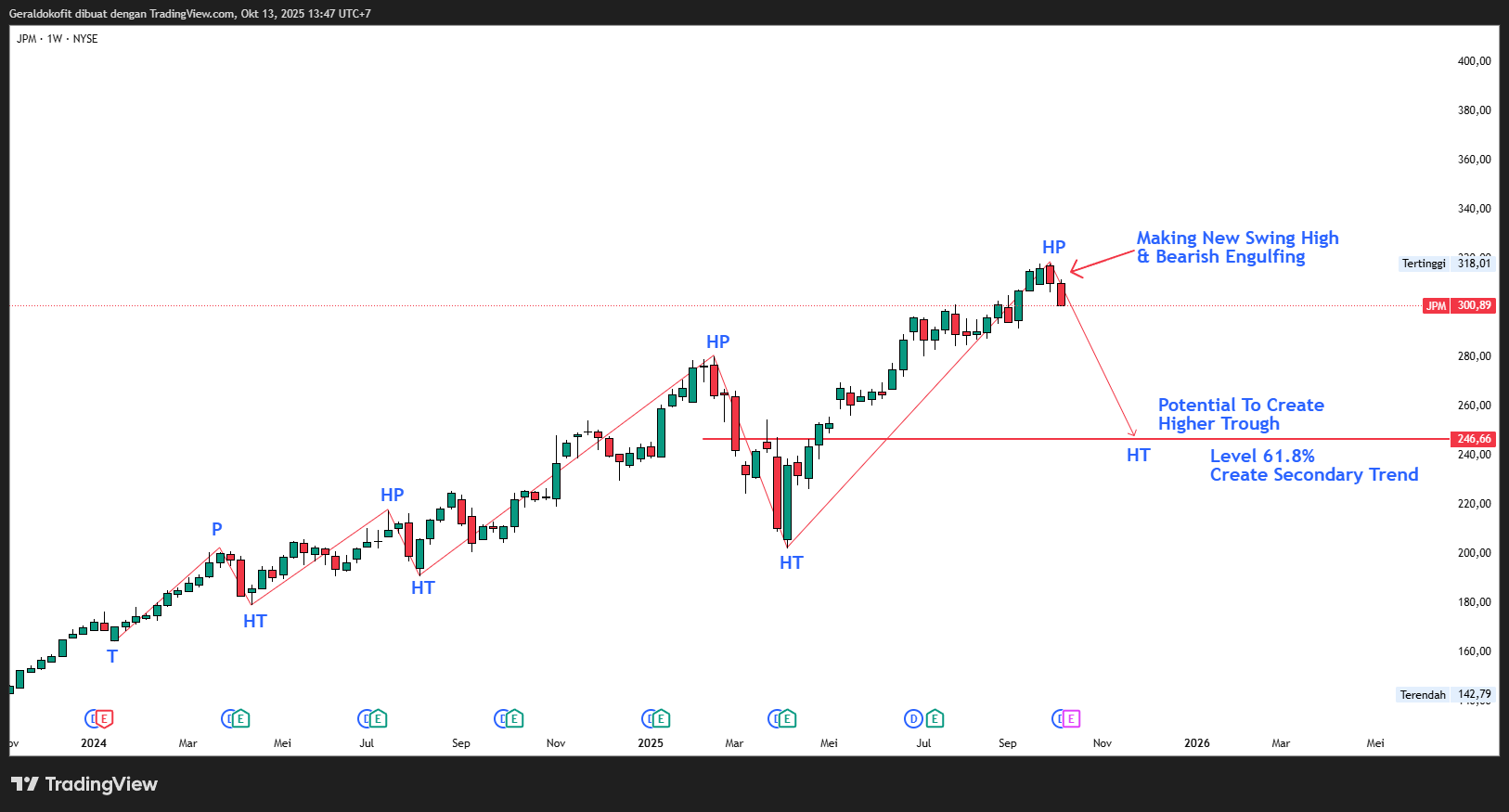

4. Market Performance and Sentiment

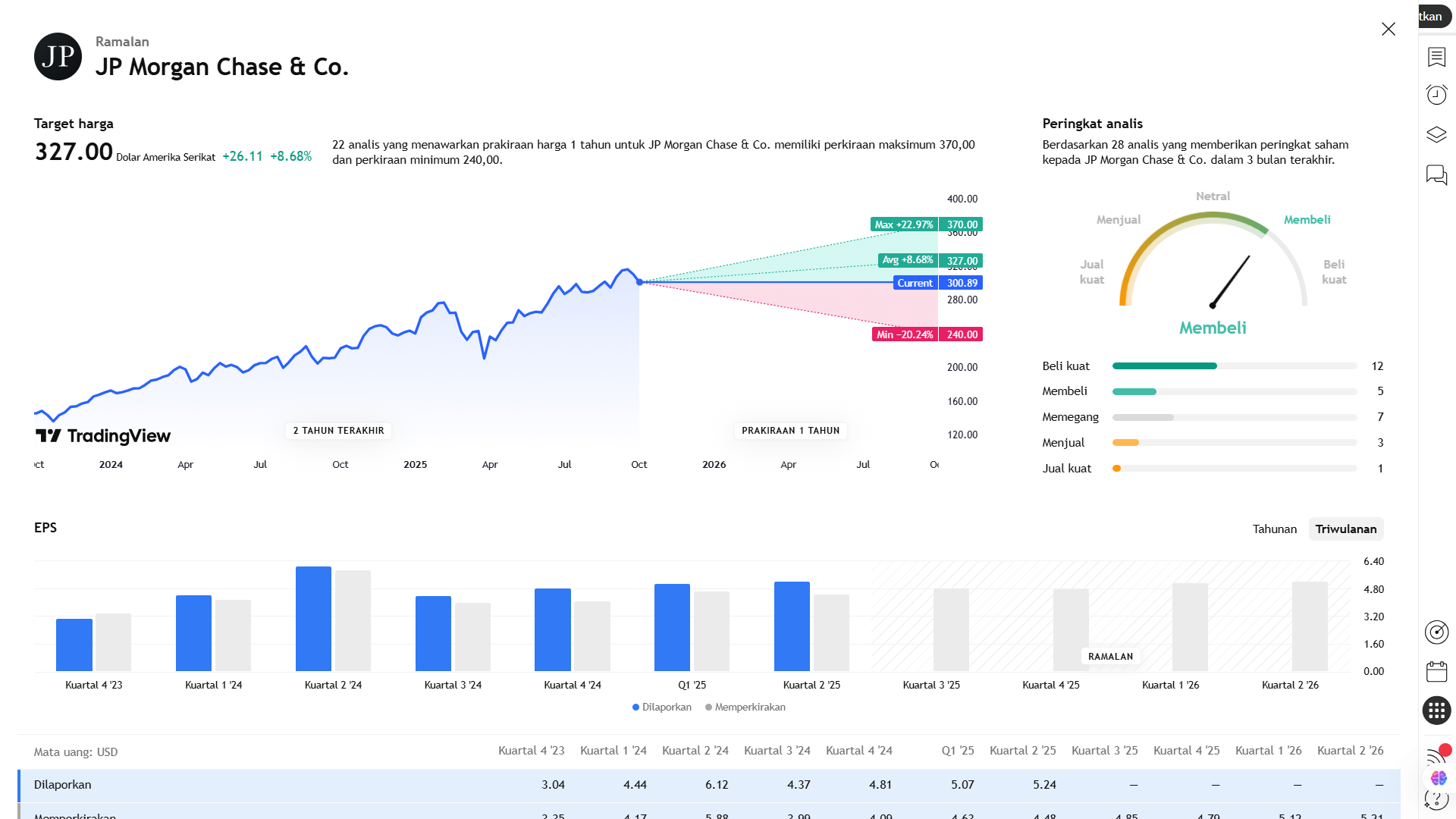

- JPMorgan has missed Wall Street revenue estimates only once in the past two years, and on average, has beaten expectations by around 2.3%.

- As the first major U.S. bank to report earnings this season, JPMorgan’s results often serve as a barometer for the broader banking sector.

- Over the past month, banking stocks have fallen about 6.1% on average, while JPM shares have declined roughly 2.8% over the same period.

- The average analyst price target for JPMorgan stands at US$ 322.09, compared to its current share price of around US$ 300.12.

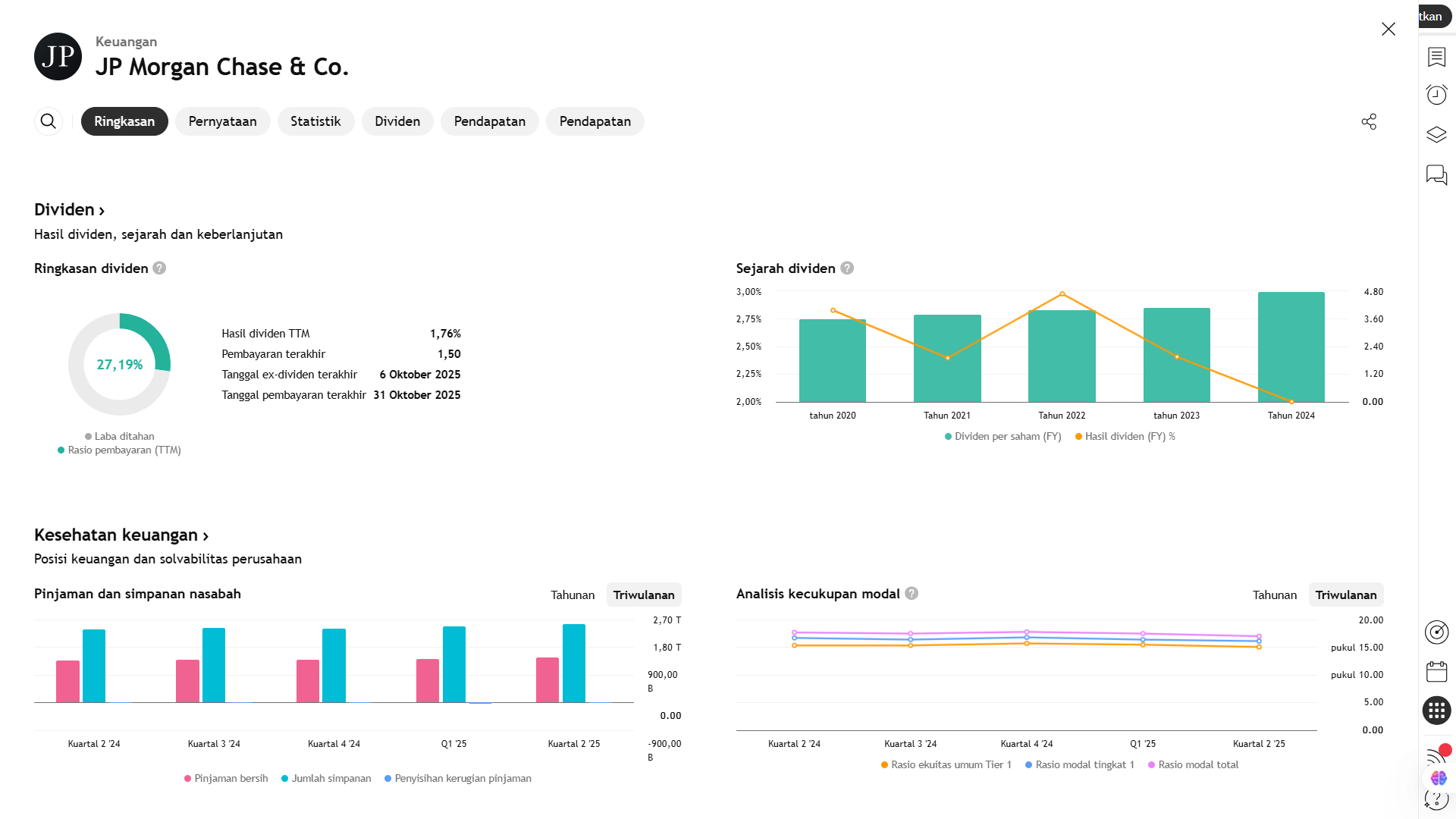

5. Projections & Expectations

- Earnings per Share (EPS): Expected at US$ 4.83, representing 10.5% YoY growth.

- Revenue: Projected at US$ 44.66 billion, up 4.7% YoY.

- Over the past 30 days, analysts have raised EPS estimates by approximately 0.79%.

6. Analysis & Risks

- The Earnings vs. Consensus model currently indicates a 0% variance, suggesting no significant earnings surprise based on recent revisions.

- However, JPMorgan has a strong track record of outperforming expectations:

- Last quarter: Estimated EPS = US$ 4.51, Actual = US$ 4.96 → Positive surprise of +9.98%.

- Over the past four quarters, JPMorgan has consistently exceeded consensus estimates.

7. Conclusion

Market reaction to JPMorgan’s upcoming report will likely depend not only on the quarterly numbers themselves but also on management’s commentary during the earnings call, particularly regarding economic outlook and strategic direction.

For investors, it’s not just about whether JPMorgan “beats” or “misses” expectations, but rather how the company outlines its forward guidance, including adjustments related to interest rate trends, credit growth, and global macroeconomic conditions.

Earnings Projection Prediction

What Analysts Are Saying

Short Term Projection