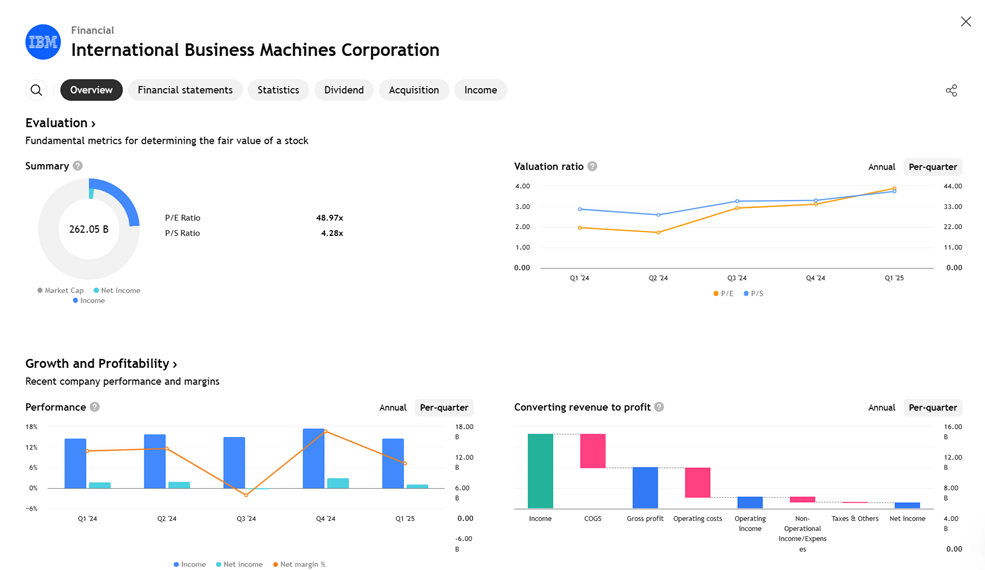

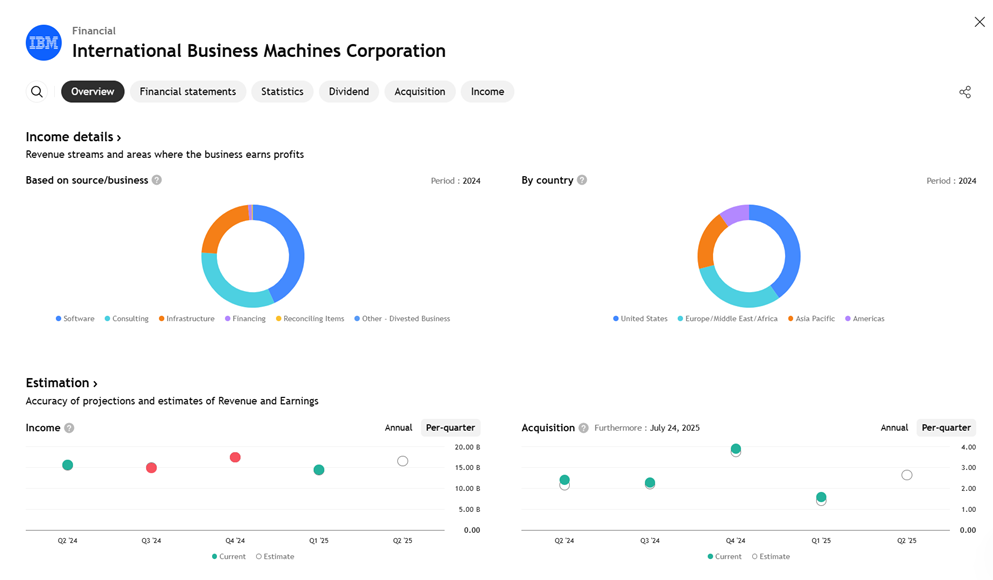

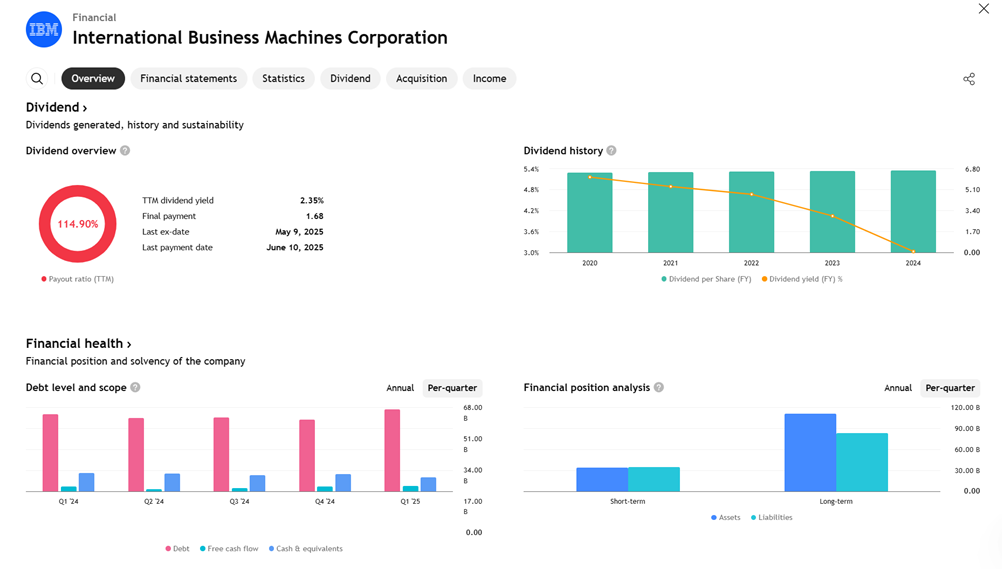

IBM has delivered solid financial performance in the second quarter of 2025, reinforcing a positive outlook for its stock price going forward. This report highlights several key factors supporting the favorable assessment of IBM shares.

Margin Expansion Amid Interest Rate Pressure

IBM posted a 3-basis-point expansion in its Net Interest Margin (NIM), reaching 4.49%. Amid rising interest rate pressures, this achievement demonstrates the company’s ability to maintain funding efficiency. The margin growth was driven by a $121.9 million increase in the loan portfolio since December 2024, particularly in the commercial and residential loan segments. This strategy helped the company reduce its cost of funds and maintain a healthy margin.

Unusual Insider Activity

Recent unusual insider trading activity in IBM shares often signals that management and insiders have a bullish view on the company’s near-term outlook. Such movements are typically interpreted as a strong indication of a potential price breakout.

Strengthening “Buy” Rating

IBM has been rated “Buy” since May 16. The latest quarterly report further justifies maintaining this rating. Robust demand for hybrid cloud solutions and artificial intelligence (AI), along with a recovery in the software and consulting units, suggests continued growth potential. IBM remains one of the most promising technology stocks for the medium to long term.

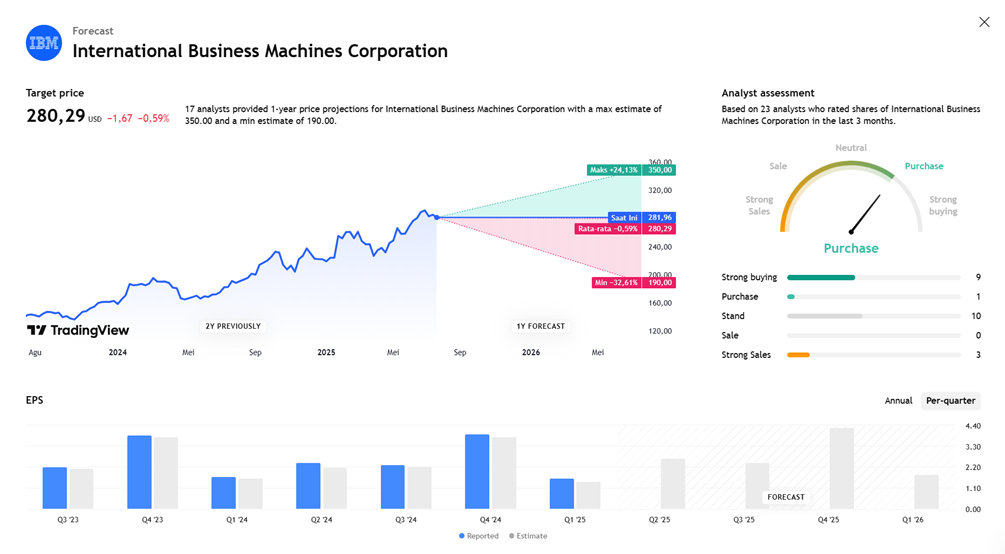

IBM Earnings Preview: What to Expect from This Quarter’s Report

IBM, the global technology and consulting giant, is set to release its quarterly earnings on Wednesday afternoon. Here are the key points to watch:

Last Quarter Performance

- Revenue: Reached $14.54 billion, beating analyst expectations by 1%, although flat year-on-year.

- Operating Income & EPS: Significantly exceeded analyst estimates, indicating strong operational efficiency.

This Quarter’s Expectations

- Revenue: Forecast to grow 5.1% YoY to $16.58 billion.

- Earnings per Share (EPS): Projected at $2.65.

- Analyst estimates have remained stable over the past 30 days, reflecting confidence in the company’s performance.

Peer Comparison

- From the same sector, only Accenture has reported its results so far:

- Revenue rose 7.7% YoY, beating expectations by 2.3%.

- However, its stock fell 3.6% following the report.

- Tech sector stocks have gained an average of 4.5% over the past month, while IBM stock has declined 1.4% over the same period.

Valuation and Market Sentiment

- IBM stock price: Currently at $285.21

- Average analyst target price: $273.36

- This indicates that IBM shares are currently trading above the consensus target price ahead of the earnings release.

Earning Projection Prediction

WHAT THE ANALYST STATED