IBM is set to report its first-quarter performance for fiscal year 2025, with several strategic topics expected to be in focus, including the impact of global tariffs, the Z mainframe refresh cycle, recent acquisitions, and developments in the Red Hat and Consulting divisions.

Impact of Global Tariffs

- Analysts will be watching the impact of tariffs on technology spending and customers’ digital transformation projects.

- IBM is considered resilient to tariffs, as most of its manufacturing is U.S.-based, with only about 2% in Mexico.

- IBM may only need to raise prices by 2%, significantly lower than competitors like Dell or Apple (up to 10%).

- Bank of America projects a demand drop of 5%, smaller than major competitors.

Z Mainframe Refresh Cycle

- IBM launched the z17 on June 18, with AI capabilities embedded in hardware, software, and system operations.

- Although the Z line contributes only ~10% of total revenue, it has a strong influence on other business lines like transaction processing, middleware, and storage.

- The previous z16 showed strong growth, which could be repeated with the z17.

- Related upcoming products: Spyre Accelerator, IBM Z Operation Unite (May 30), and z/OS 3.2 (Q3 2025).

Acquisitions and Technology Integration

- IBM has closed the acquisition of HashiCorp (Terraform) and begun integrating it, including into Z systems for hybrid cloud secret management.

- HashiCorp adds over $750 million in run-rate revenue, with the potential to accelerate past $800 million.

- Other acquisitions:

- DataStax (closing in Q2, contributing $100 million in run-rate revenue)

- StreamSets, Webmethods, Prescinto, and Kubecost – helping drive software growth by 2 percentage points over the next two quarters.

Red Hat Division – AI Growth Engine

- Red Hat has seen increased interest, particularly from Citrix and VMware customers seeking alternatives.

- Red Hat operations generate a $6.5 billion run-rate, with a strong reputation for cost-effective and efficient AI support.

- Products like RHEL AI and OpenShift AI contribute to $1 billion in AI software revenue and $4 billion in AI service bookings.

IBM Consulting – Key Player in GenAI

- IBM Consulting accounts for around 80% of IBM’s total $5 billion GenAI business so far.

- Recent acquisitions include:

- Hakkoda (Snowflake & AI)

- AST (Oracle)

- Previous acquisitions: Skyarch Networks (AWS) and Accelalpha (Oracle)

- The potential impact of federal contract cuts under a Trump administration is seen as minimal (<5% of IBM’s total sales come from federal sources).

Conclusion

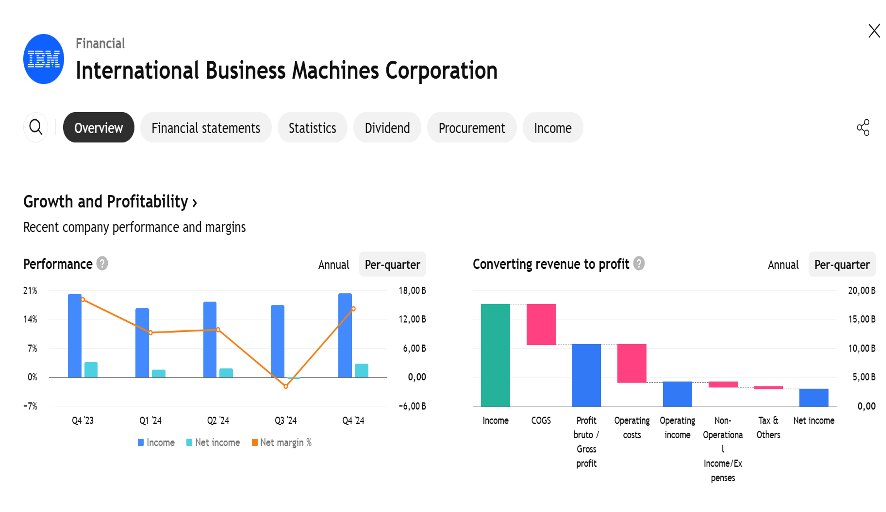

IBM is in a strong and strategic position, with:

- Resilience to global tariffs,

- New product launches in the infrastructure segment,

- Acquisitions that strengthen its AI and cloud portfolio,

- Strong growth in Red Hat and Consulting divisions.

Analysts and investors will be watching closely to see whether these strengths can drive IBM’s performance amid global economic challenges and geopolitical shifts.

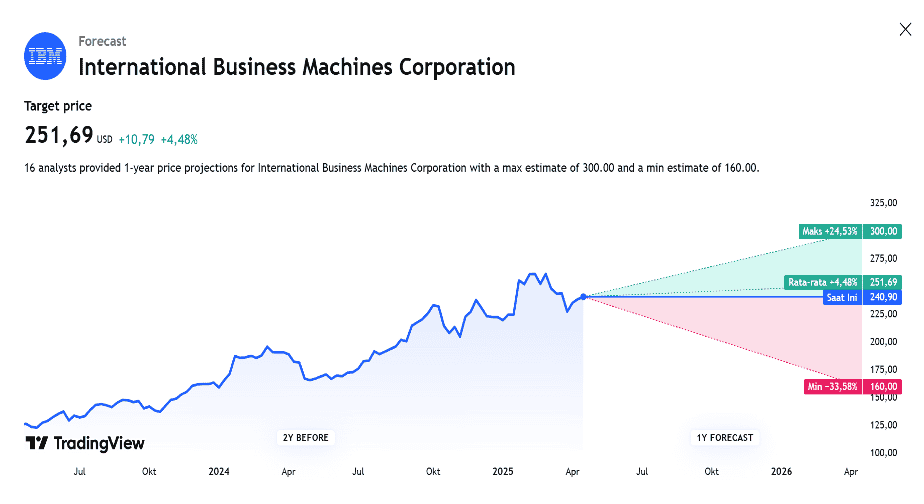

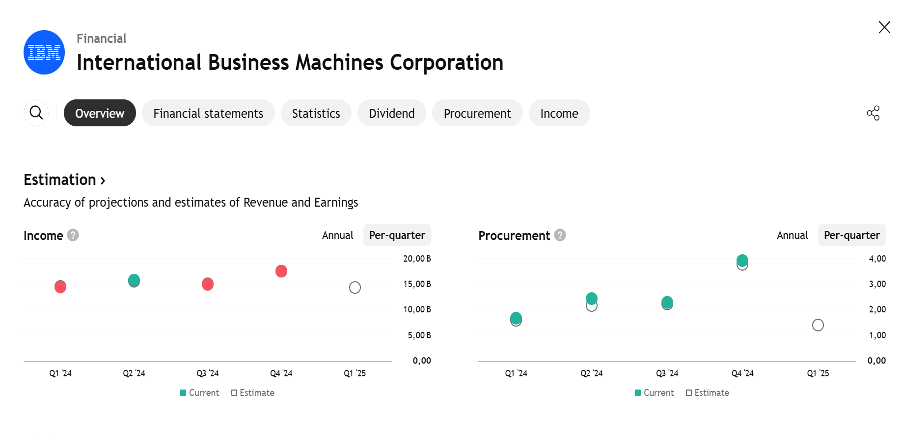

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED