IBM Set to Release Q3 Results

Key Highlights

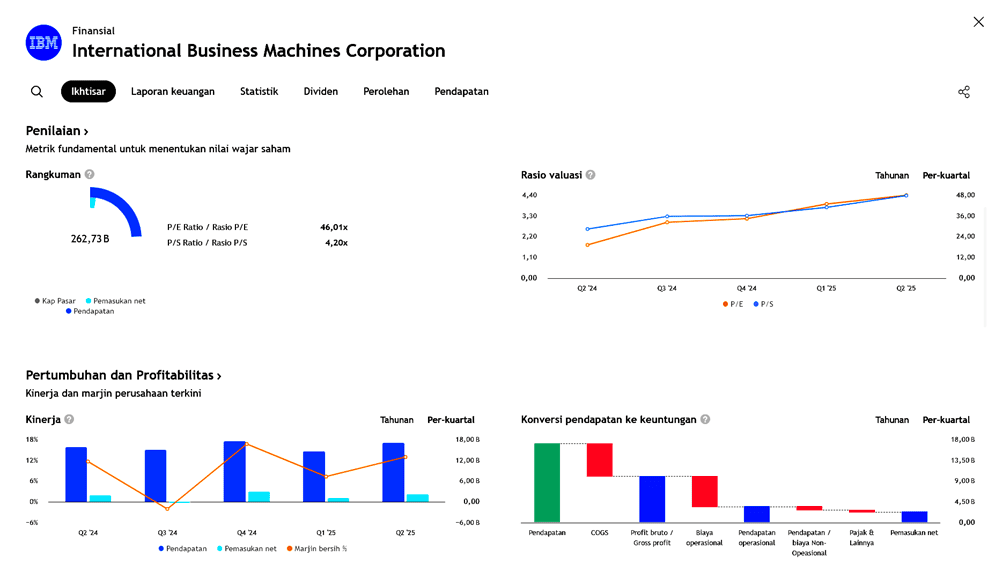

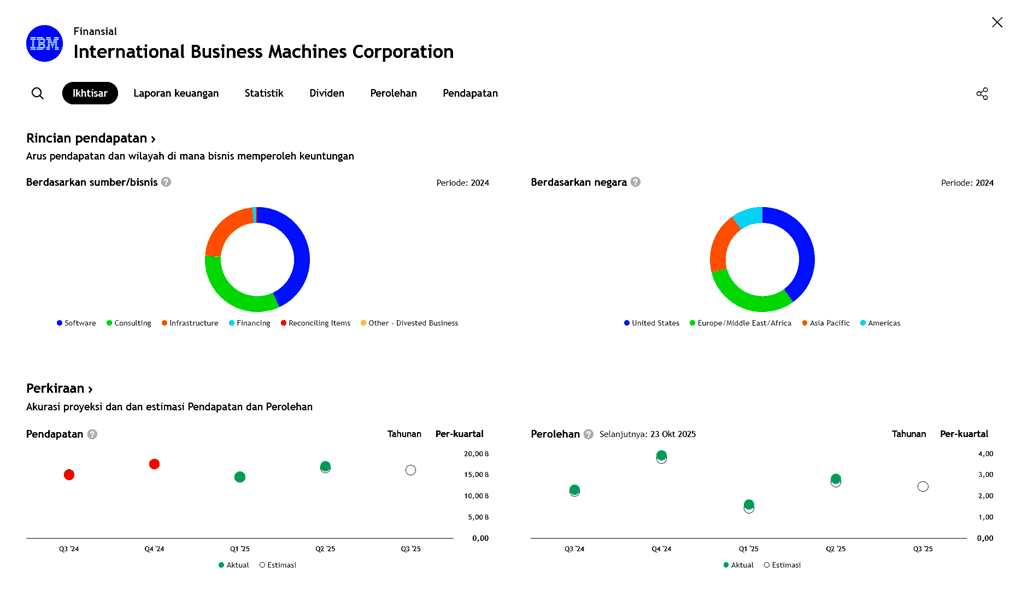

- IBM is expected to beat analysts’ expectations for Q3 FY2025, driven by strong demand for artificial intelligence (AI) and cloud/hybrid services.

- Consensus estimate: revenue of approximately US$16.1 billion, representing growth of around 6–8% year over year.

- Software business growth is viewed as a key indicator this quarter, following two consecutive quarters of underperformance in that segment.

- Other segments under the spotlight include Consulting and Infrastructure/Mainframe, where growth in consulting is expected to slow.

- IBM has reported significant expansion in its generative AI business, supported by a strong portfolio in AI and hybrid cloud, fueling optimism among analysts.

Why Analysts Are Optimistic

- IBM already has a large “book of business” in AI, indicating that enterprise clients are increasing their spending on AI-driven solutions.

- The company is also strengthening strategic partnerships in AI and open-source ecosystems, helping expand both its market reach and technical capabilities.

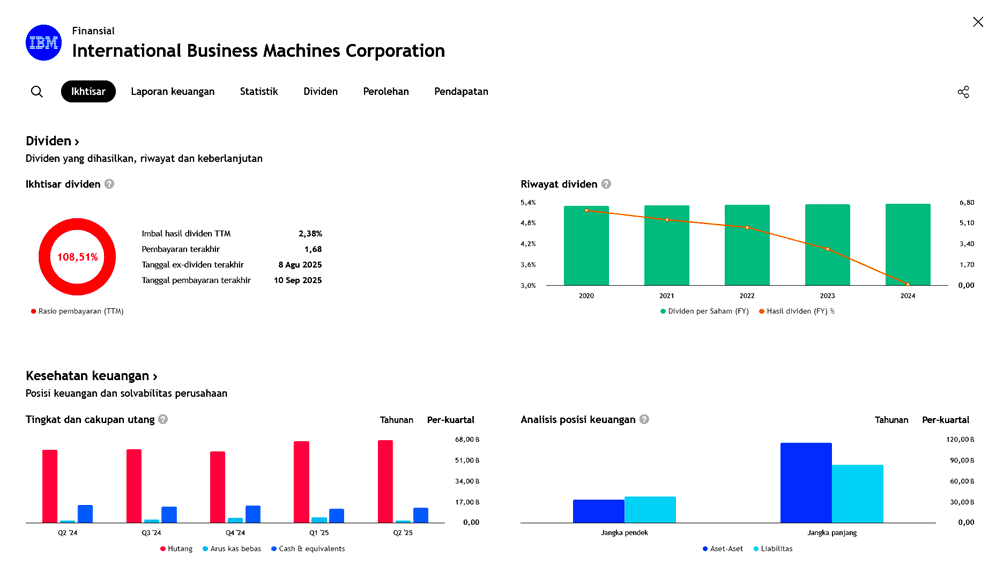

- The software segment carries higher margins compared to consulting or infrastructure, meaning stronger software growth could lead to a notable profit increase.

Risks and Watchpoints

- The Consulting segment faces headwinds — growth could be limited or even stagnant due to market challenges.

- The Infrastructure (including mainframe) business depends on hardware upgrade cycles, which may peak or enter a lull.

- Despite strong optimism, IBM’s business remains large and complex — sustaining long-term growth in software, AI, and cloud will be critical.

Conclusion

IBM enters this quarter with positive momentum, supported by strong performance in AI and hybrid cloud services. If its software and AI divisions deliver as expected, Q3 could mark a significant step forward in accelerating IBM’s transformation toward a growth-focused model. However, final results will depend on the company’s ability to reinvigorate slower segments and maintain healthy margins and sustainable growth moving forward.

Earning Projection Prediction

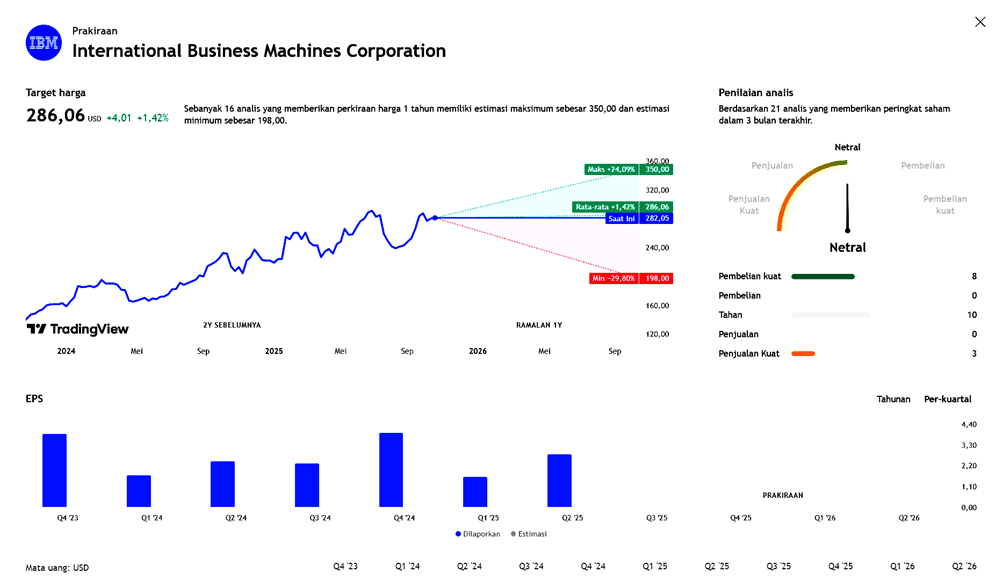

WHAT THE ANALYST SAYS

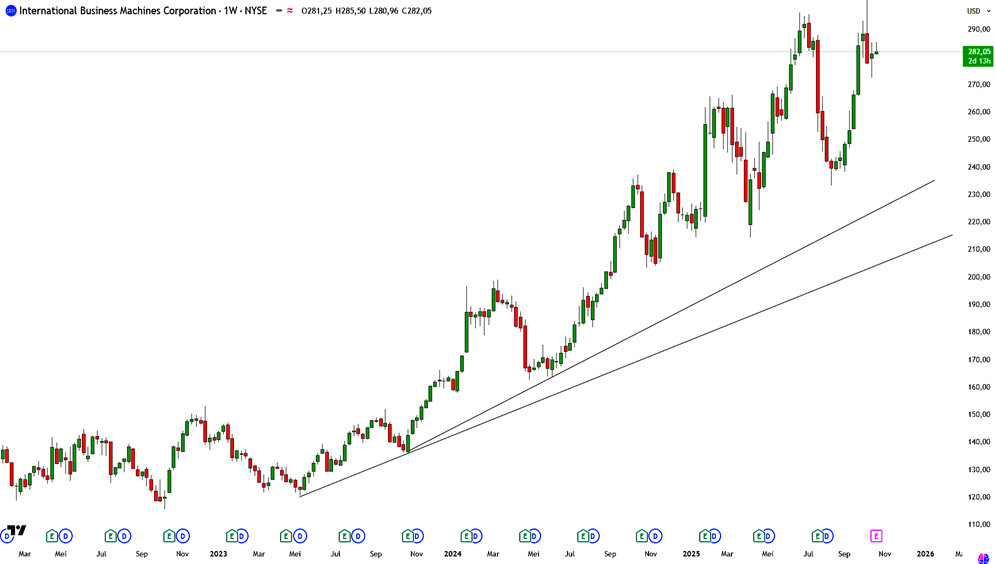

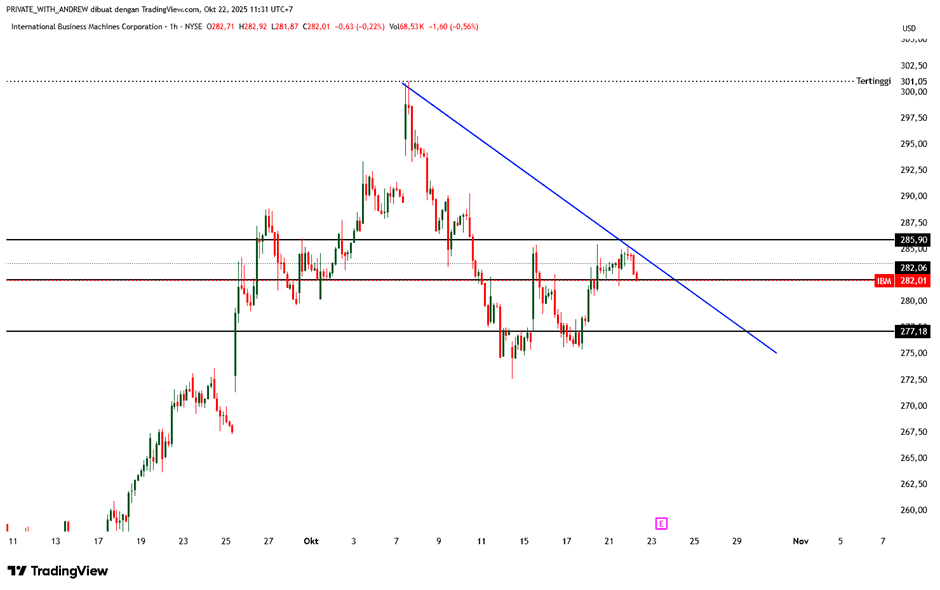

Short – Medium Term Projection

| Sell IBM | |

| Entry | 282.01 |

| Take Profit | 277.18 |

| Stoploss | 285.90 |

Disclaimer On