In the world of trading, choosing the right time frame is often a challenge, especially for beginner traders. Many are still confused and wondering: “What time frame is most suitable for me? Is it 1 minute (1m), 15 minutes (15m), 1 hour (1h), daily (1D) or weekly (1W)?”

Before answering that question, it’s important to understand that the best time frame is highly dependent on the trading style and personal traits of each trader. Therefore, the first step is to identify the trading style that suits your circumstances and goals.

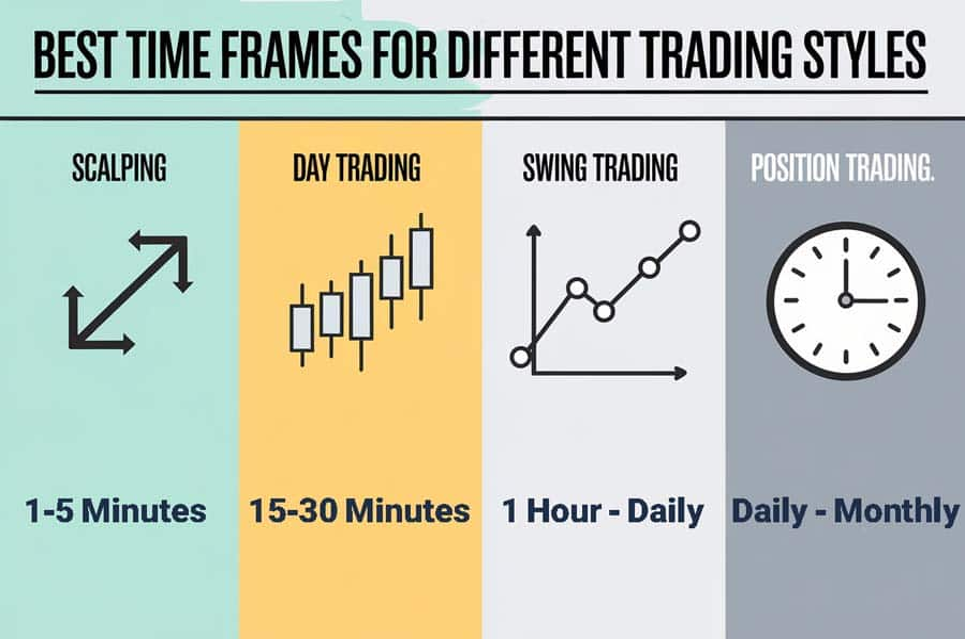

*This table shows the main differences between trading styles based on time frames and position duration.

Know Your Trading Style

Here are some types of trading styles and time frames that are commonly used:

- Scalping

A strategy of taking profits within minutes. It usually uses M15-M5 time frames. Positions are held for about 2-20 minutes. - Intraday

Open and close positions within one day. Typically uses H4-M15 time frames. Position duration ranges from 1-3 hours. - Swing Trading

Hold positions for several days to achieve a larger target. Time frames used are usually Daily-H4. Positions can last around 32-42 hours. - Position Trading

A long-term strategy of holding positions for weeks. Commonly used time frames are Daily-Weekly. Positions can last between 8-10 days or more.

Consider Time and Psychology

Besides understanding your trading style, you also need to consider your available time and mental readiness.

If you have limited time due to your main job or other activities, then strategies with large time frames such as swing or position trading will be more suitable. On the other hand, if you have more free time and can focus fully, scalping or intraday strategies with small time frames may be an option.

Keep in mind, the smaller the time frame used, the higher the psychological pressure and stress levels that may arise. If you tend to get easily distracted or feel uncomfortable with fast market movements, then a larger and more stable time frame is recommended.

Tips for Choosing the Right Time Frame

- Test several time frames through a demo account

This step is important so that you can understand the rhythm of each time frame before using real funds. - Evaluate your strategy

Make sure the strategy used is really suitable for the time frame of choice. Avoid forcing certain strategies on time frames that are not suitable. - Avoid the habit of changing time frames

Consistency is very important in trading. Switching time frames too often will only lead to confusion and lack of direction.

Common Mistakes that Happen

- Multi Time Frame Hopping

Frequently changing charts to find signals that “look good”. This makes you lose focus and direction. - Overtrading

Open positions too often on small time frames, while not being prepared with proper risk management.

There is no one time frame that works for everyone. Every trader has different conditions, needs, and characters. Therefore, choosing the right time frame should be tailored to your strategy, free time, and comfort in making decisions.

“What matters is not how often you trade, but how wisely you enter the market.”

Hopefully, this article can be a useful reference in your trading journey.

The best investment is an investment in knowledge. Start your journey to trading success with a Masterclass Trading Webinar every Friday. Join now!