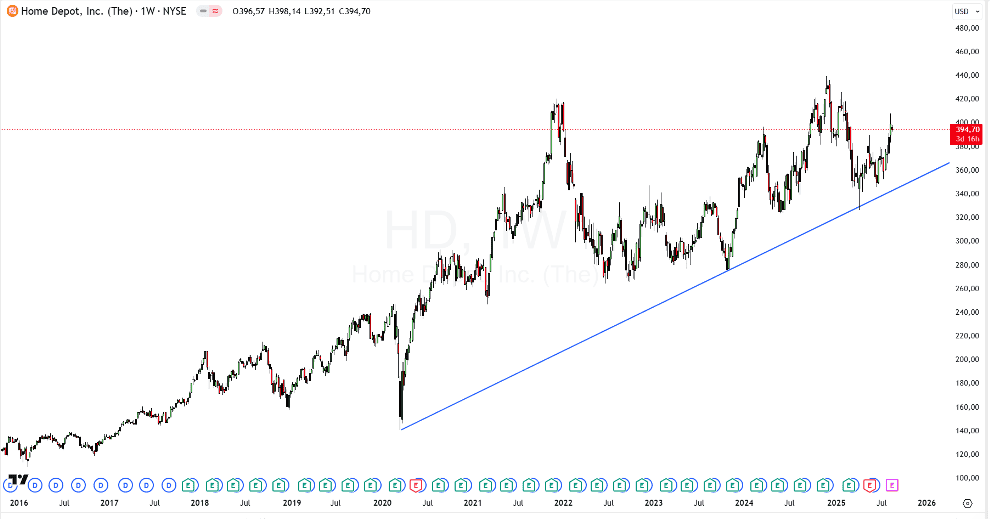

Home Depot (HD) shares are trading at around US$394 ahead of its second quarter earnings report today. Investors are paying attention to whether the company is able to regain same-store sales growth after a slight decline in the previous quarter. Pressure from the sluggish housing market and high interest rates have held back the performance of the home remodeling sector, but the Pro segment is still a bright spot with steady demand from contractors.

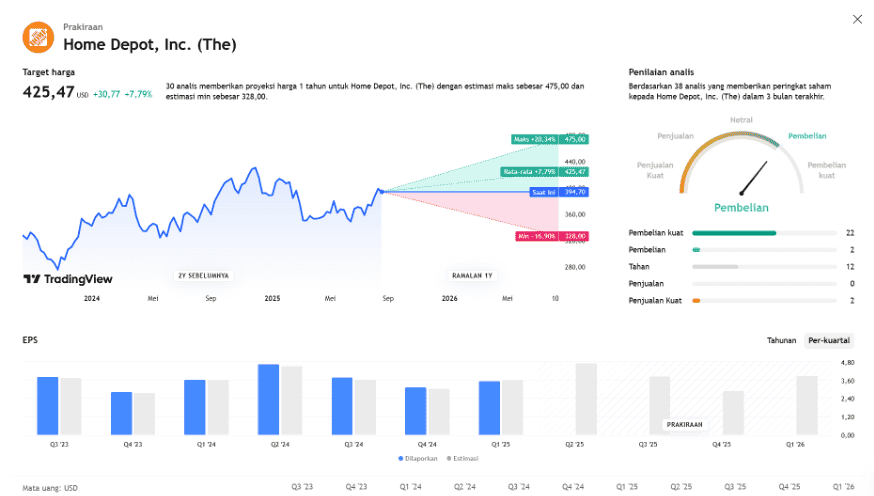

Although earnings this time is expected to show challenges, Wall Street remains optimistic for the long term. Major acquisitions such as GMS Inc. and SRS Distribution are expanding the distribution network, while analysts target a share price in the range of US$430-434, giving an upside potential of 7-9% from current levels. With a stable dividend and the prospect of a rebound if interest rates fall, Home Depot is still seen as an attractive defensive stock amid market uncertainty.

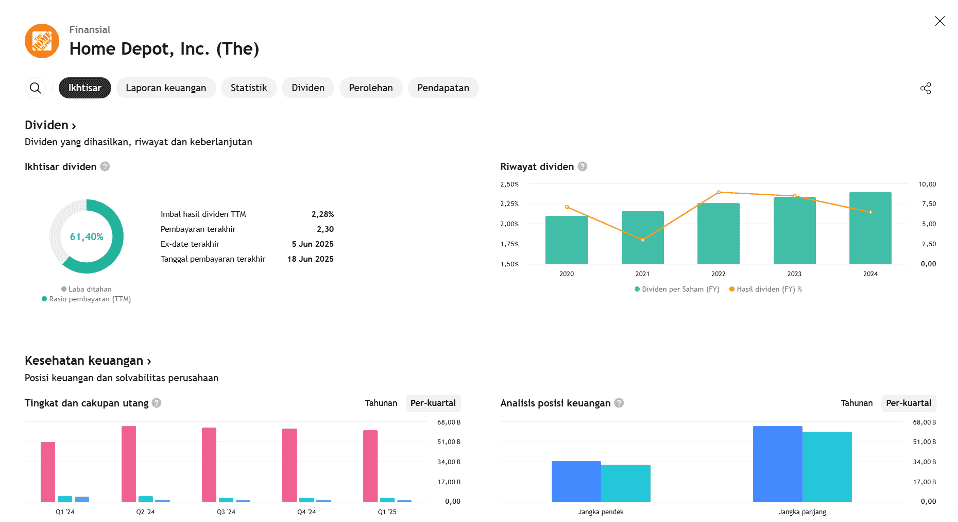

Analysts remain optimistic about the medium- and long-term outlook. The majority recommendation still leans towards “Buy”, with an average price target of around US$430-434, which translates to a potential upside of 7-9% from current levels. In addition, Home Depot is known as a company that consistently pays dividends, with a yield of around 2.3% and a record of 16 consecutive years of increasing payments to shareholders.

With a solid track record of growth, an aggressive expansion strategy, and the potential for a housing market rebound if interest rates begin to decline, Home Depot remains seen as one of the attractive defensive stocks for the long term. Short-term risks remain, but the fundamental outlook gives investors a strong reason to keep their eyes on HD.

PROJECTED FINANCIAL PERFORMANCE

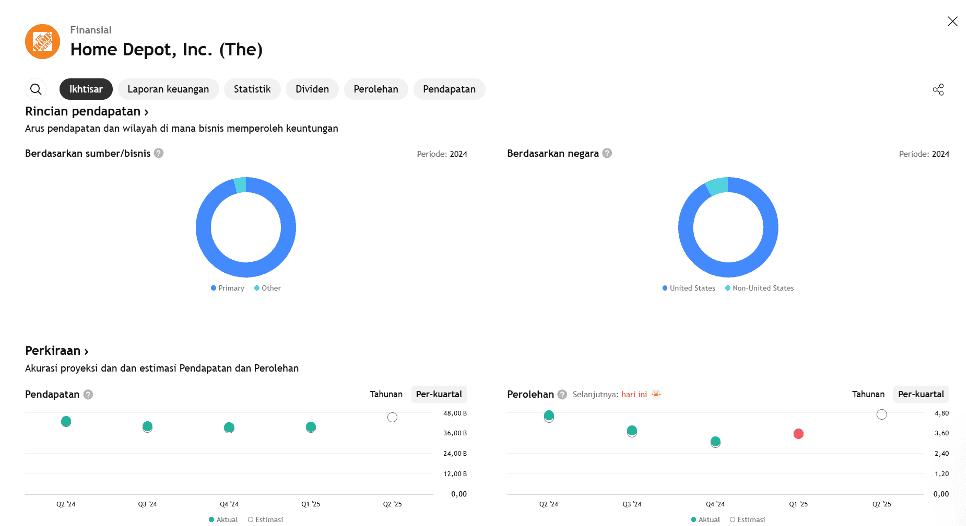

Home Depot will release its Q2 earnings on Tuesday before the market opens, focusing on same-store sales growth in the US and signs of a housing market recovery.

- Market Expectations:

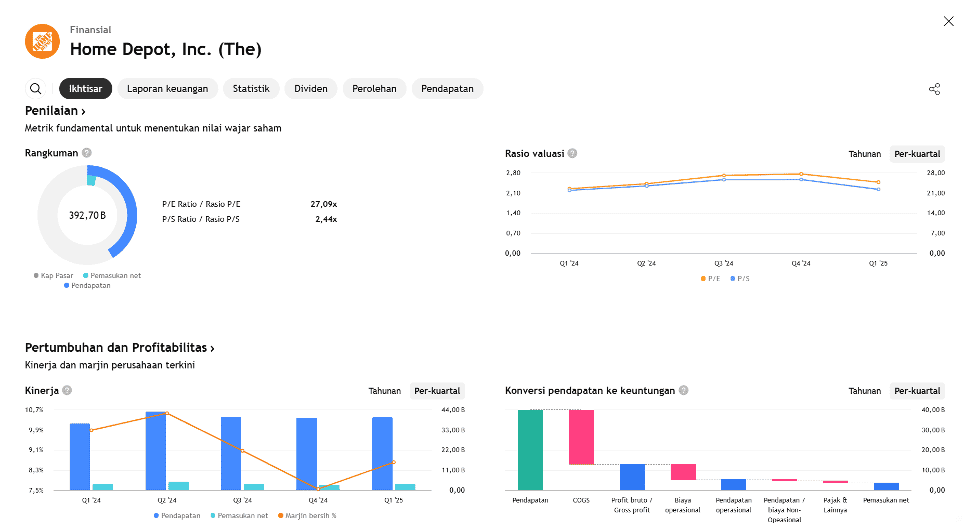

- Global same-store sales are projected to rise 1.4% (vs. down 0.3% in Q1).

- In the US, it is expected to rise 1.6%, becoming the third consecutive positive quarter – the first time since 2022.

- Revenue is expected to rise 5% YoY to $42.4 billion.

- Adjusted EPS is expected to be $4.72 (vs. $4.67 last year).

- Supporting Factors:

- Consumers are starting to return to large projects such as kitchen/bathroom remodeling.

- Home improvement demand is expected to improve despite high interest rates.

- Home Depot is focusing on supplier diversification to reduce tariff risk, with a target of no single country (other than US) accounting for >10% of purchases in the next 12 months.

- Outlook & Strategy:

- Annual targets remain: net sales growth of 2.8% and same-store sales +1%.

- Q2 is referred to as the “Super Bowl” season by management, with optimal availability levels.

- Strategy is not to raise prices, but to expand supplier sources.

- Stock Movements:

- Home Depot shares are up >10% in the past month on expectations of Fed rate cuts.

- Rival Lowe’s is up 15%.

- Bank of America analysts expect Home Depot to continue to capture market share, especially through its professional contractor business (pro segment).

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED