Alphabet Inc., the parent company of Google, continues to reaffirm its ambition to dominate in cloud computing and artificial intelligence (AI). However, behind the rapid expansion of its cloud business—which has become a new engine of growth—lies a dilemma: balancing expansion with profitability. With tightening margins and soaring capital expenditures to build AI infrastructure, Alphabet faces the classic challenge of a mature tech giant — maintaining robust growth without sacrificing cash flow and profit efficiency.

Summary

Key Highlights

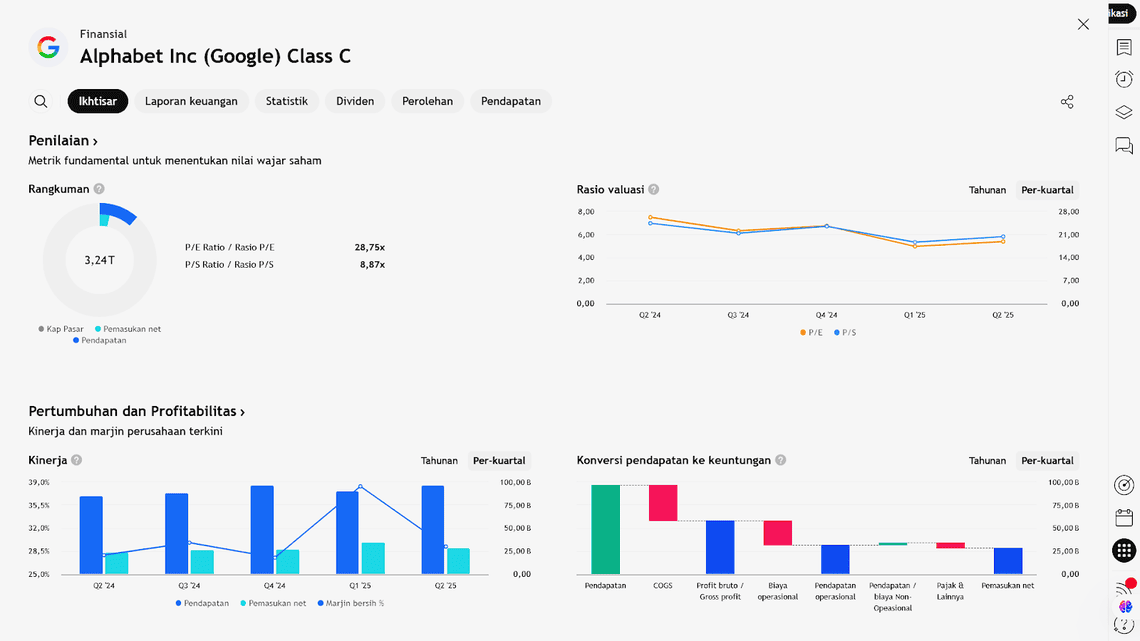

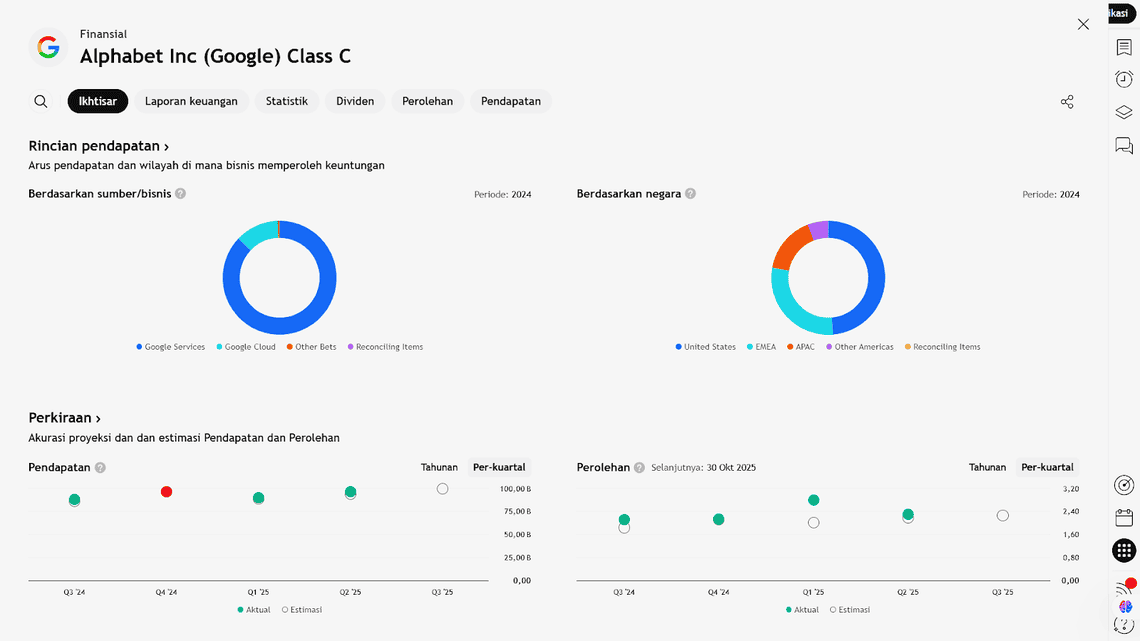

- Alphabet Inc. still derives about 85% of its revenue from its high-margin advertising and services business.

- Meanwhile, its cloud division — Google Cloud — continues to grow rapidly, with analysts projecting ~30% year-over-year growth for Q3 2025.

- However, Google Cloud’s profit margin (~19%) remains well below that of the advertising/services segment (~41%).

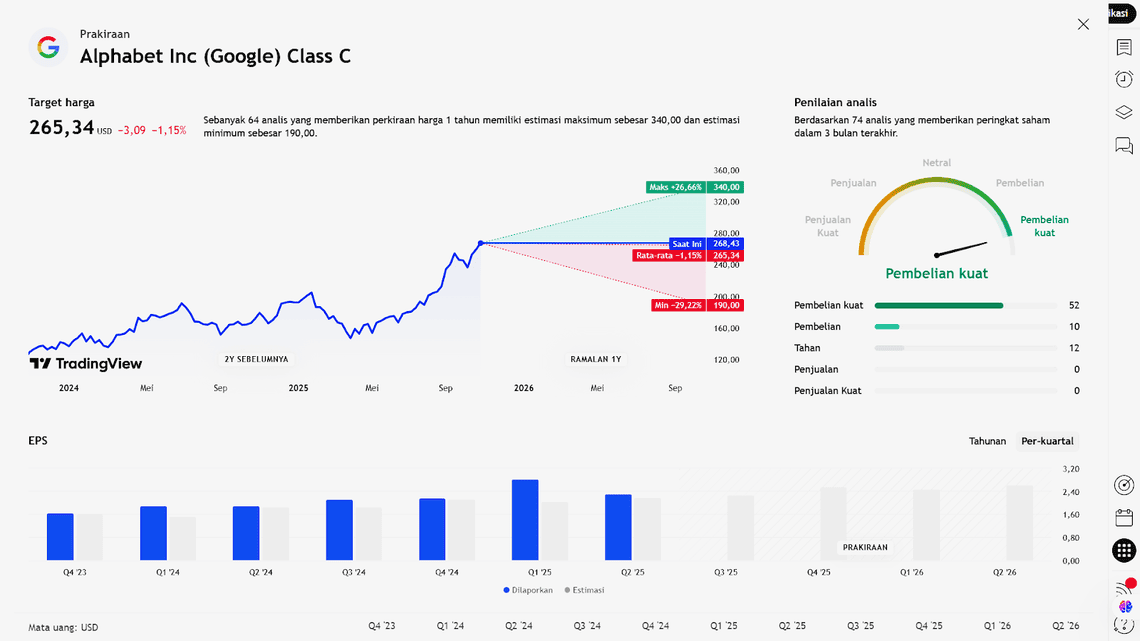

- Overall, Alphabet’s sales are expected to rise ~13%, while earnings per share (EPS) are projected to grow ~7%, reflecting a shift toward lower-margin businesses like cloud computing.

- Capital expenditure (CapEx) remains massive: US$53 billion in 2024, and projected to surge to US$85 billion in 2025 to support AI and data center infrastructure.

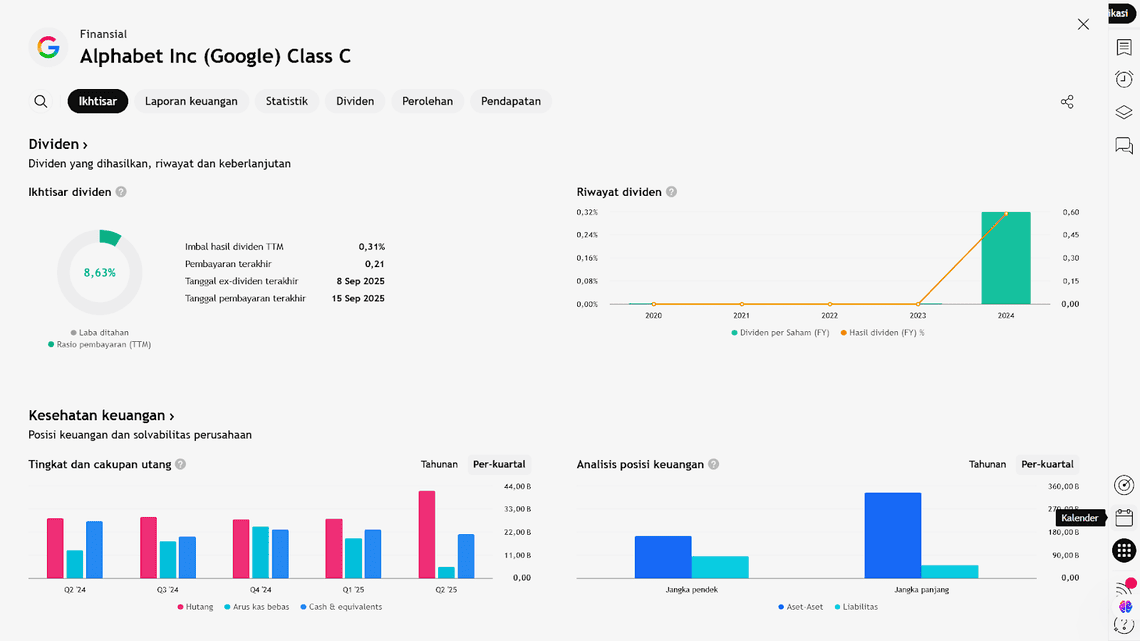

- Despite a strong operating cash flow (over US$130 billion in the past 12 months), free cash flow has declined ~20% due to heavy investment spending.

- The company maintains a robust cash position (~US$95 billion) and strong borrowing capacity — having issued US$12.5 billion in bonds in May 2025.

- Core advertising businesses (Search and YouTube) continue to grow at a double-digit rate, serving as the financial backbone amid Alphabet’s pivot toward AI and cloud services.

Implications & Takeaways

- The rapid growth of Google Cloud is positive in the medium to long term, signaling diversification away from the highly saturated ad business.

- However, lower cloud margins mean that even strong revenue growth may contribute less to net income compared to advertising.

- High capital spending poses risks — while essential for AI and infrastructure, shrinking free cash flow could disappoint investors focused on cash efficiency.

- Investors must assess how quickly cloud margins can improve and whether ad revenue remains resilient; a slowdown in ads could heavily pressure profit margins.

- In the AI race, Google Cloud faces formidable rivals such as Microsoft Azure and Amazon AWS, making speed and cost efficiency critical.

- From a macro and regulatory standpoint, Alphabet remains exposed to digital ad shifts, evolving AI regulations, and escalating investment costs.

Conclusion

Overall, Alphabet continues to post solid growth, particularly in cloud and AI-related services. Yet, it remains weighed down by thinner margins and aggressive capital spending. While top-line figures appear strong, the real question for investors is whether Alphabet’s massive AI and cloud investments will ultimately generate the level of profitability needed to justify their scale.

Earning Projection Prediction

WHAT THE ANALYST SAYS

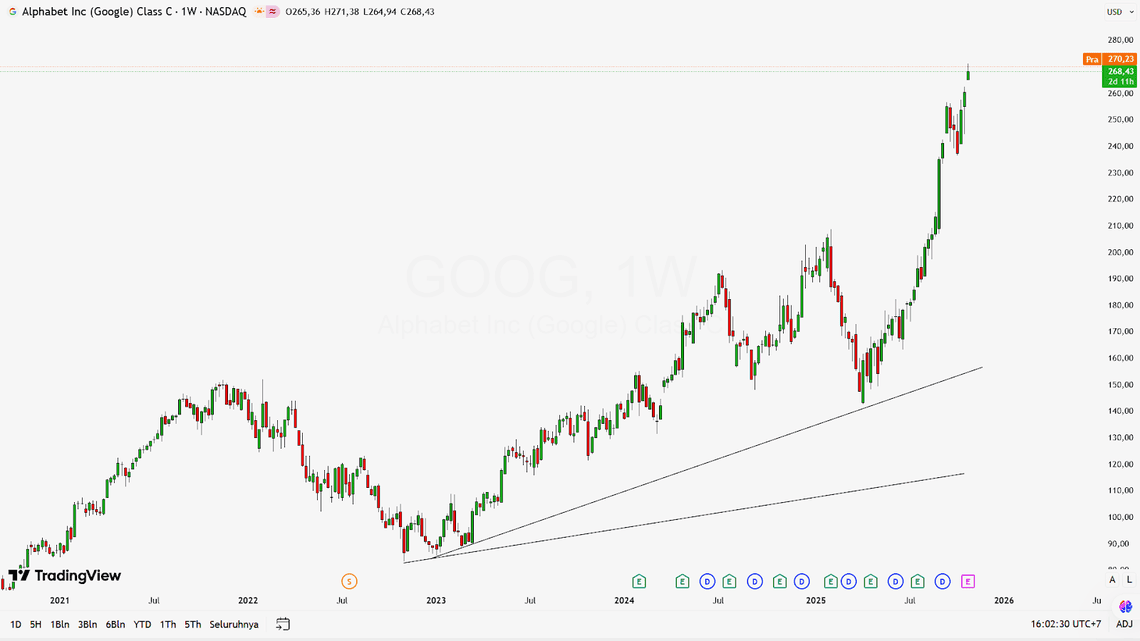

Short – Medium Term Projection

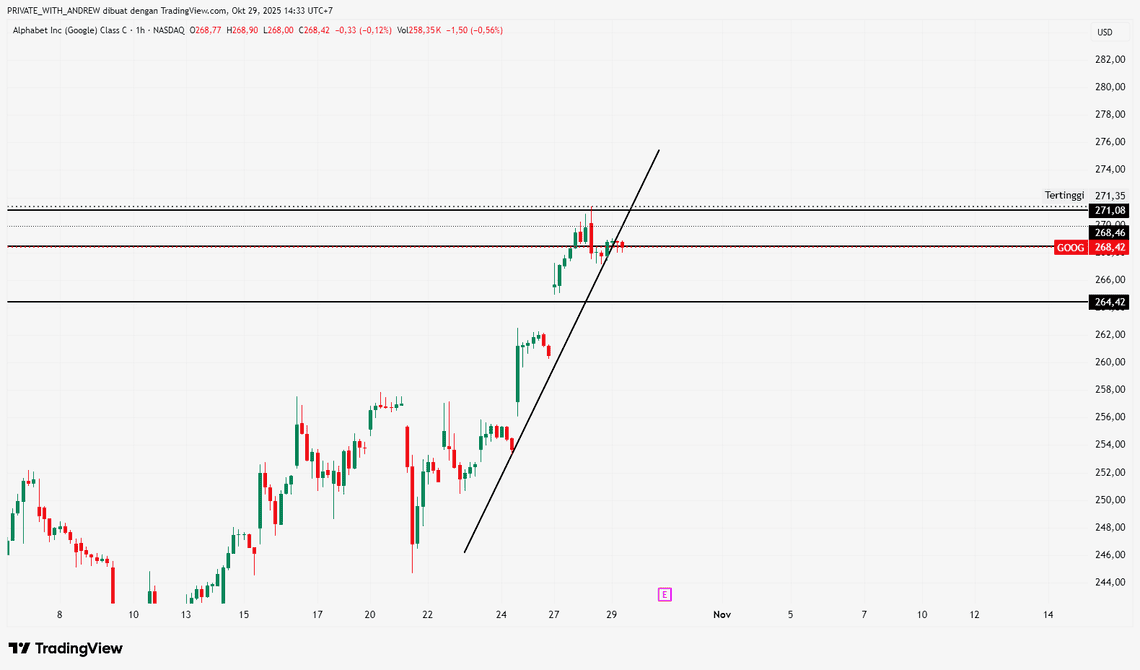

Strategy

| Sell GOOGLE | |

| Entry | 268.42 |

| Take Profit | 264.42 |

| Stoploss | 271.08 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst