Key Highlights

- Goldman Sachs is set to announce its third-quarter (Q3) earnings report on Tuesday before the U.S. market opens.

- Analysts expect the firm’s year-over-year (YoY) revenue to grow by approximately 11.9% to around US$ 14.21 billion.

- Adjusted earnings per share (EPS) are projected to be around US$ 10.57.

- Historically, Goldman Sachs has a strong record of beating analyst expectations — over the past two years, the firm’s reported revenue has averaged 6.6% above consensus estimates.

- In the previous quarter, the company delivered a “stunning” performance, surpassing forecasts for both revenue and earnings.

- Over the past 30 days, there has been little change in analyst estimates, suggesting that the market expects steady and consistent performance from Goldman this quarter.

Recent Performance Review

Previous Quarter (Q3 & Q2 2025)

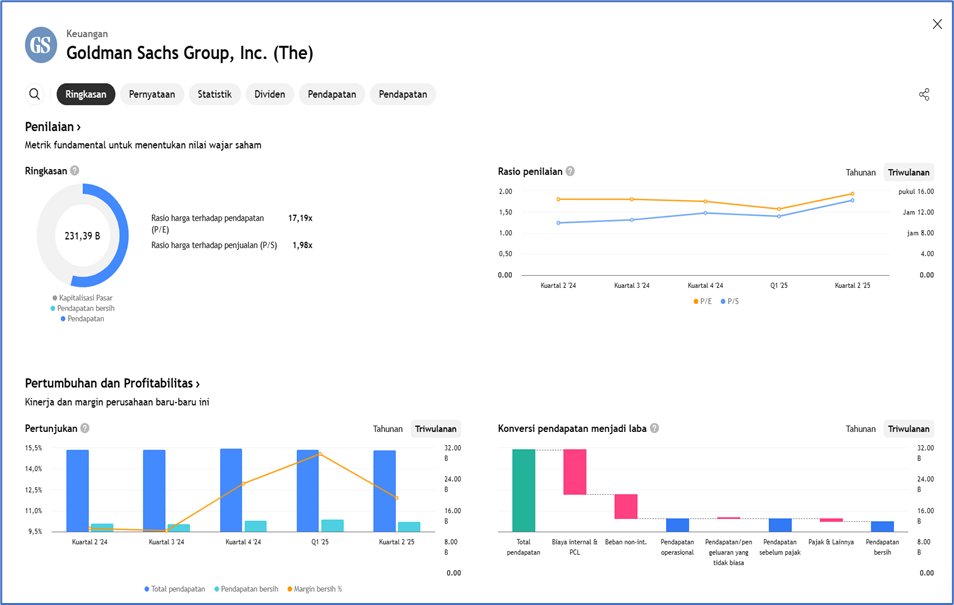

- In Q3 2024, Goldman reported revenue of US$ 12.70 billion and net income of US$ 2.99 billion, with EPS at US$ 8.40 and an annualized ROE of about 10.4%.

- In Q2 2025, profits surged 22% year-over-year, driven by explosive equity trading revenue amid market volatility and strong investment banking activity.

- Goldman has consistently outperformed analyst expectations, often beating both revenue and EPS projections in prior quarters.

- However, challenges remain:

- Asset and wealth management segments have shown signs of pressure, with declining revenue.

- Credit loss provisions require close monitoring, particularly within the credit card and loan portfolios.

Strengths & Risks

Strengths

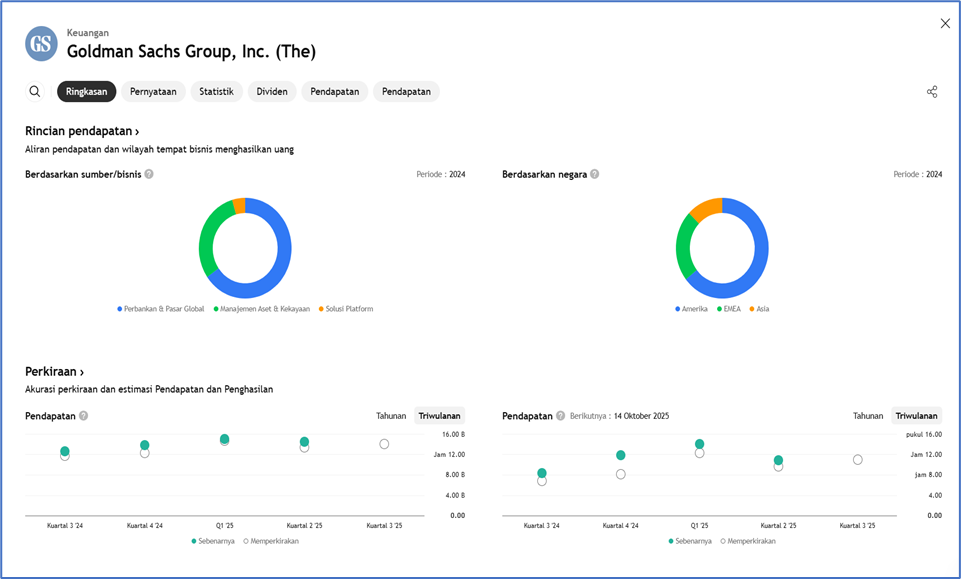

- Diversified revenue streams — Goldman does not rely on a single source of income; trading, investment banking, and asset management all contribute.

- Strong performance during market volatility — periods of uncertainty often benefit Goldman’s trading division.

- Proven record of exceeding forecasts, building investor confidence in Goldman’s ability to deliver positive surprises.

Risks

- Global macro and geopolitical conditions — trade wars, new tariffs, and U.S. policy uncertainty may dampen corporate and investment activity.

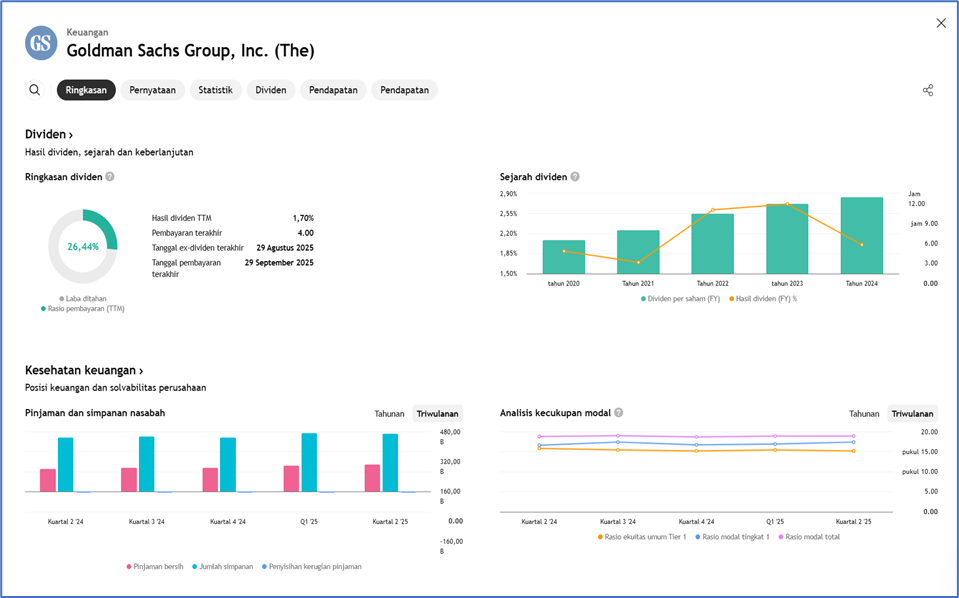

- Rising costs and credit provisions — potential credit deterioration could pressure profitability.

- Wealth and asset management growth challenges, particularly if equity and bond markets weaken.

- Overly optimistic analyst projections — aggressive assumptions could lead to downward revisions if results disappoint.

Earnings Outlook & Projections

Based on a combination of analyst consensus and historical performance, the following projections apply:

| Metric | Projection / Estimate |

|---|---|

| Annual EPS Growth | ~3–5% per year (based on analyst forecasts) |

| Return on Equity (ROE) | ~6–7% annually |

| 12-Month Share Price Target | Estimated to rise ~14–15% over the next three years |

| Consensus Rating | Average analyst target: US$ 663.8 (high: US$ 785, low: US$ 592) |

| Outlook Summary | Most analysts recommend “Buy”, with a few maintaining “Hold” due to macro and market risks |

Q3 2025 Projections (Upcoming)

- Revenue: Expected to grow ~11.9% YoY to approximately US$ 14.21 billion.

- Adjusted EPS: Forecast around US$ 10.57 per share.

- Some analysts are even more optimistic, projecting EPS up to US$ 10.93 per share.

- Key performance drivers will include trading activity and investment banking margins, especially if Goldman can maintain or expand profitability in these segments.

Conclusion & Market Implications

- Goldman Sachs remains well-positioned for continued growth, particularly if market volatility persists and M&A or IPO activity continues to recover.

- However, challenges persist — macroeconomic conditions, regulatory tightening, and credit risks remain key concerns.

- For investors, the upcoming Q3 report will be pivotal:

- A strong beat and optimistic management guidance could reignite bullish momentum in Goldman’s stock.

- Conversely, any signs of weakness in key segments could trigger downside revisions.

- Conservative investors should remain attentive to potential downside risks, especially if analyst expectations prove too optimistic.

Earning Projection Prediction

What Analysts Are Saying

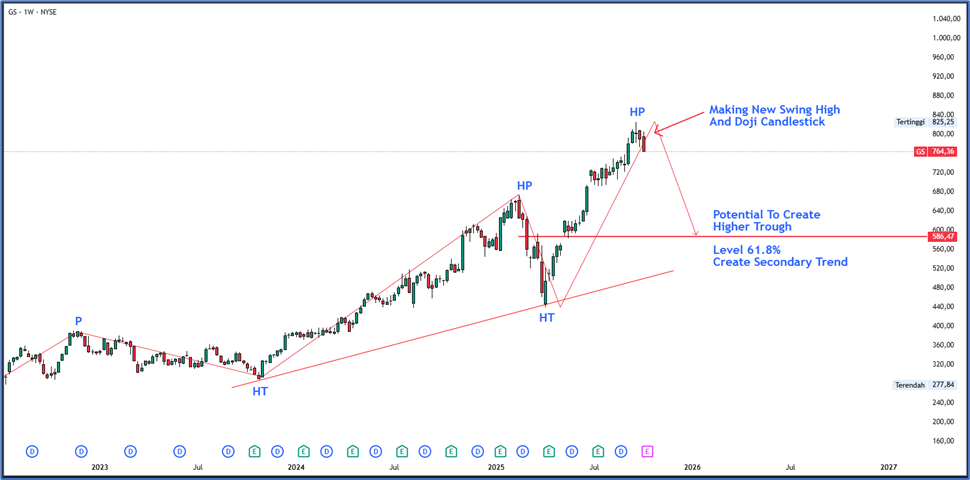

Short Term Projection