Jakarta — Maxco Futures | 2025

The year 2025 marks a powerful resurgence for the global gold market. After three consecutive years of net outflows, gold-backed exchange-traded funds (ETFs) are once again seeing massive inflows. According to the World Gold Council (WGC), total inflows during the first half of 2025 reached approximately US$38 billion, equivalent to around 397 tons of gold — the highest level since the 2020 pandemic.

This surge reaffirms gold’s status as the world’s premier safe-haven asset amid growing global economic uncertainty. “Investors are returning to gold as protection against geopolitical risks and a weakening U.S. dollar,” the WGC noted in its Gold ETF Flows 2025 report.

Fund Flows: From Outflows to a Sharp Rebound

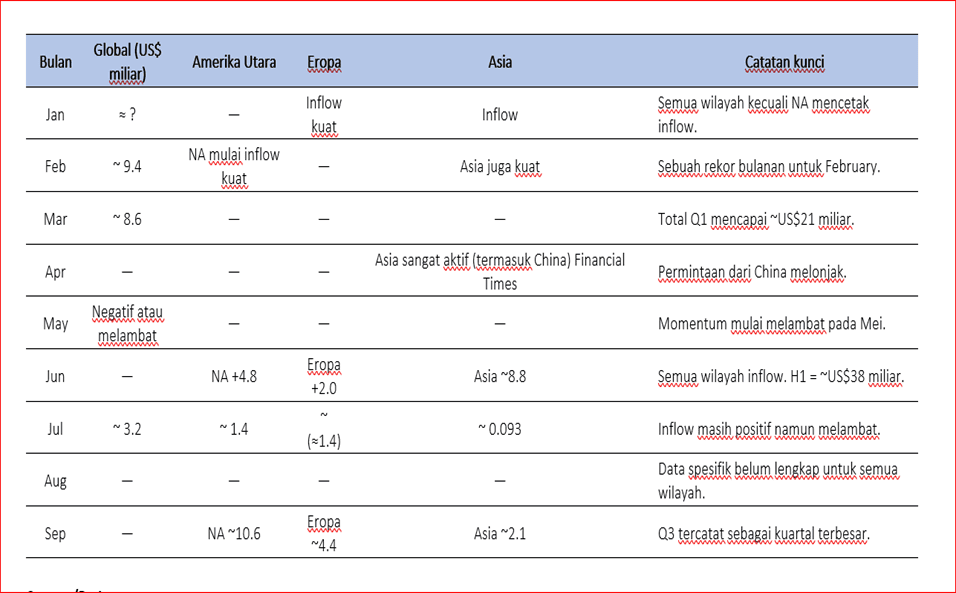

After ending 2023 in negative territory, gold ETFs began 2025 with impressive momentum. In the first quarter alone, inflows reached US$21.1 billion (about 226 tons), marking the strongest quarter in three years. The biggest surge occurred in February, when global gold ETFs attracted US$9.4 billion in new investments.

This euphoria was largely driven by rising expectations of Federal Reserve interest rate cuts, along with concerns over the economic outlook in China and Europe. As investors sought hedges against equity market volatility and geopolitical tensions, gold once again became the preferred refuge.

However, the WGC reported that momentum began to ease in May 2025, with US$1.8 billion in outflows — largely due to profit-taking after gold prices hit a record high above US$2,550 per troy ounce.

Regional Trends: U.S. Dominance and Asia’s Rising Role

Regionally, North America remained the largest contributor to the surge. U.S. institutional investors increased exposure to gold through major ETFs such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), amid uncertainty surrounding the Federal Reserve’s policy direction.

Meanwhile, Asia — particularly China — emerged as a powerful new driver. The Chinese market recorded a historic monthly inflow in April, reflecting growing domestic demand for precious metal-based assets. Gold ETFs in Shanghai and Hong Kong are now among the fastest-growing segments globally.

Europe, on the other hand, posted more moderate but steady inflows, with several funds in Switzerland and Germany maintaining consistent demand as a hedge against U.S. dollar fluctuations.

Three Key Drivers Behind the Inflows

- Global Geopolitical Tensions — From conflicts in the Middle East to renewed U.S.–China trade friction, investors are turning to safe-haven assets resilient to geopolitical shocks.

- Expectations of Lower Interest Rates — Markets anticipate aggressive rate cuts from the Fed toward year-end, weakening the U.S. dollar and enhancing gold’s appeal.

- Gold Price Momentum — The rally that pushed gold to new record highs spurred additional buying from both retail and institutional investors, triggering a “momentum buying” effect that further amplified inflows.

Global Market Implications

The massive inflows into gold ETFs underscore their role as a barometer of global risk sentiment. Total assets under management (AUM) in gold ETFs have now climbed back toward US$250 billion, with total physical holdings nearing 3,500 tons by the end of the first half of 2025.

Still, volatility remains a key concern. With fluctuating gold prices and uncertainty over future monetary policy, the WGC warns that ETF flows could quickly reverse. “Investors are now more tactical — they enter swiftly when risks rise, and exit just as quickly when prices rally,” the report said.

Note:

• For some months (including January, April, and August), full regional breakdowns were not publicly released by the WGC.

• “—” indicates data not available in public sources.

• “Asia” includes the broader Asia-Pacific region in WGC reports, with separate mentions for China, Japan, and India.

• Data in the accompanying table are estimates based on WGC publications and secondary sources.

Outlook: Stable Yet Cautious

Entering the fourth quarter of 2025, the outlook for gold ETFs hinges on two main factors: the Federal Reserve’s rate policy and global geopolitical stability. If macroeconomic fragility persists and U.S. bond yields continue to decline, fund inflows into gold are likely to remain positive into early 2026.

However, if the U.S. dollar strengthens on the back of faster economic recovery, some investors may shift to a defensive stance and lock in profits.

The WGC expects ETF-driven gold demand to remain solid through 2025, supported by a mix of macro hedging strategies and strong buying from Asia, particularly China and India.

Conclusion

The year 2025 marks the triumphant return of gold as a global capital magnet. From Wall Street to Shanghai, investors are flocking to the yellow metal as protection against economic and geopolitical storms. While volatility remains an ever-present risk, the massive inflows into gold ETFs underscore one enduring truth: confidence in gold as the ultimate safe-haven asset is not fading — it’s growing stronger.

Ade Yunus, ST, WPA

Global Market Strategies – Maxco Futures